So, you’re looking to put together a great Tax Preparer Resume, huh? It can feel like a lot to figure out, especially with all the different sections. But don’t worry, we’re going to break it all down. This guide will walk you through each part of your resume, from your contact information to your work history, and even those extra bits like certifications and projects. The goal is to help you build a resume that really stands out and gets noticed by employers in 2025.

Key Takeaways

- Make sure your Tax Preparer Resume is clear and easy to read.

- Highlight your specific experience with tax preparation.

- Include any relevant certifications you have.

- Showcase your skills that are useful for tax work.

- Always check your resume for any mistakes before sending it out.

1. Summary

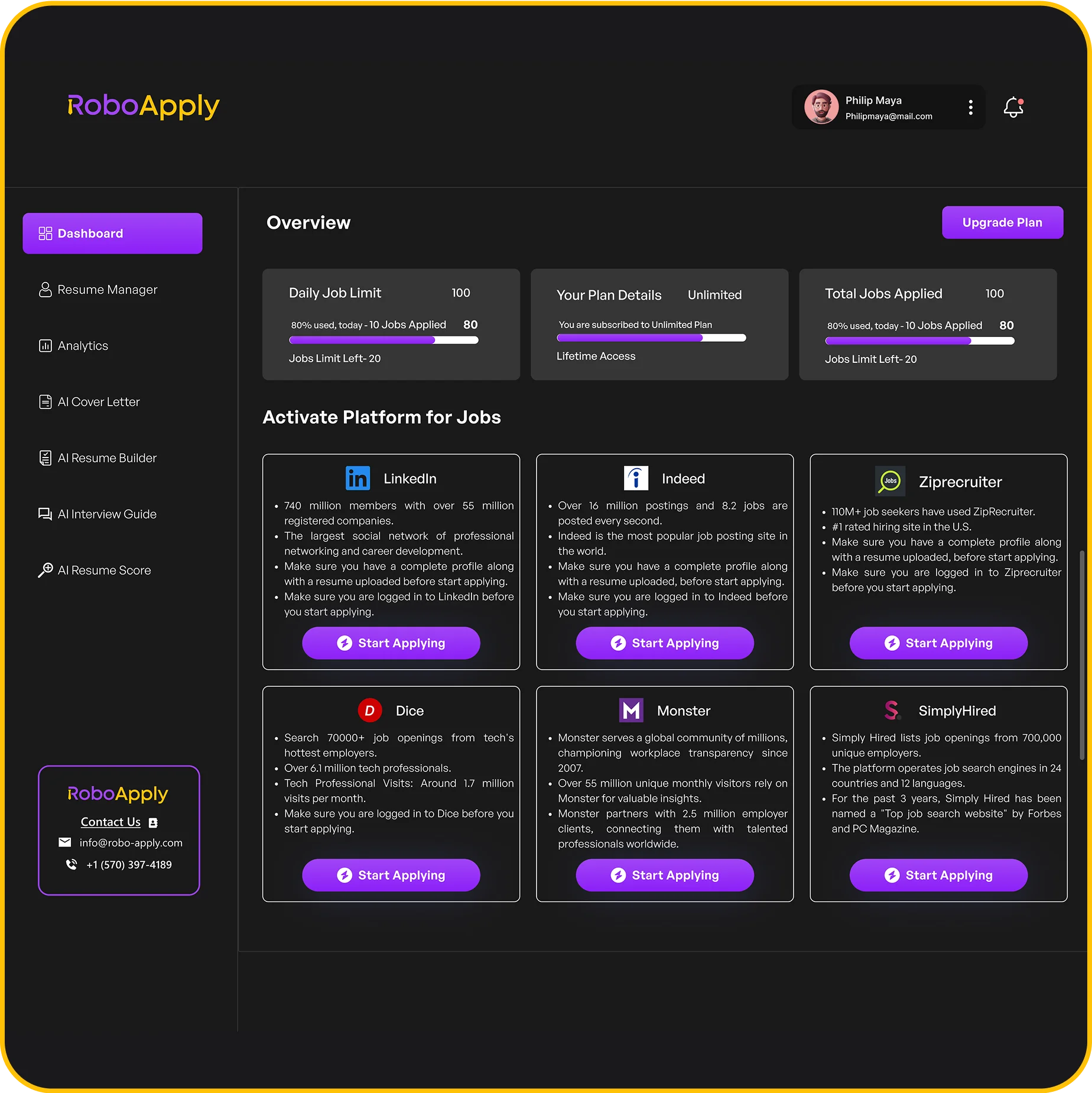

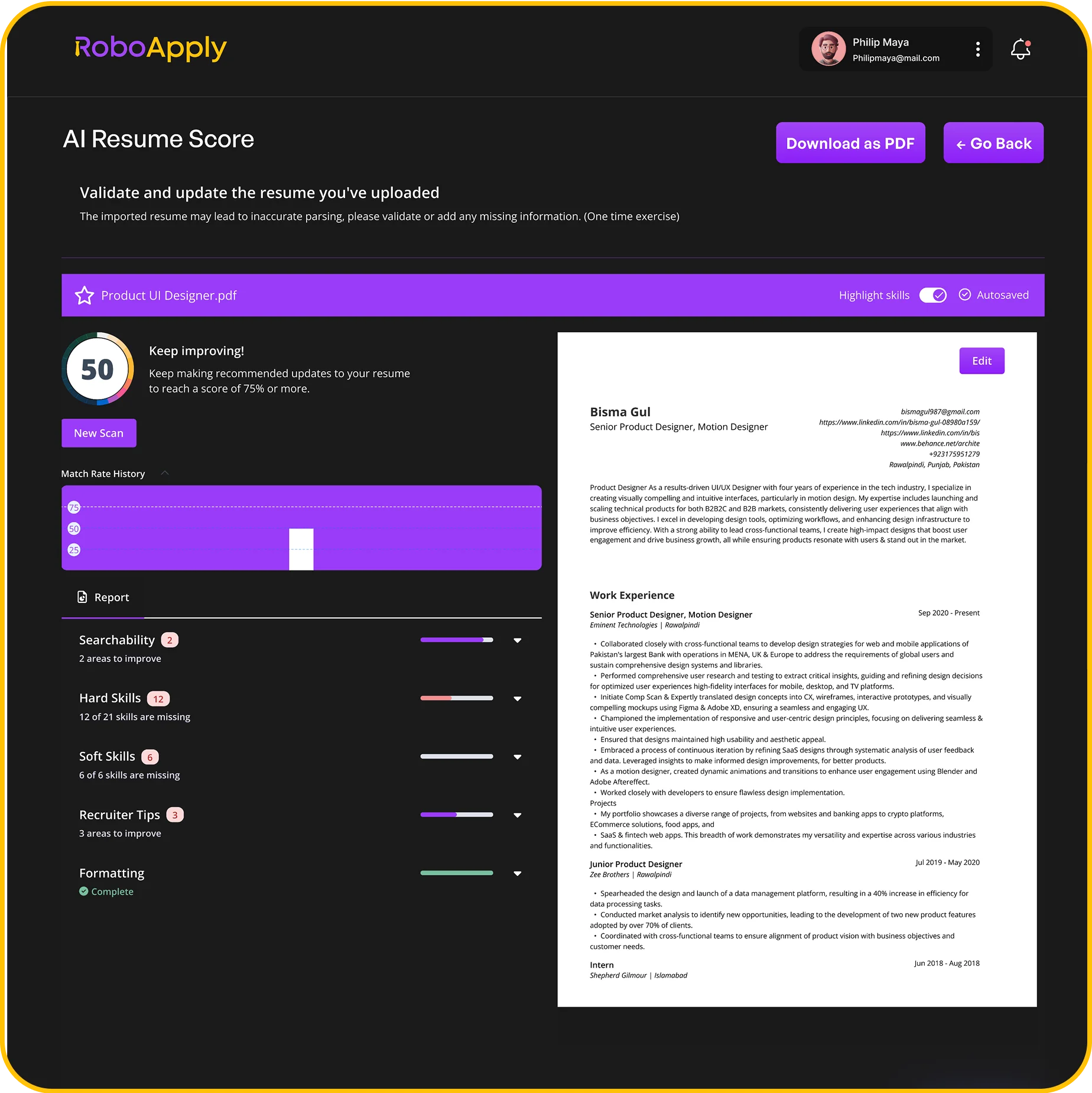

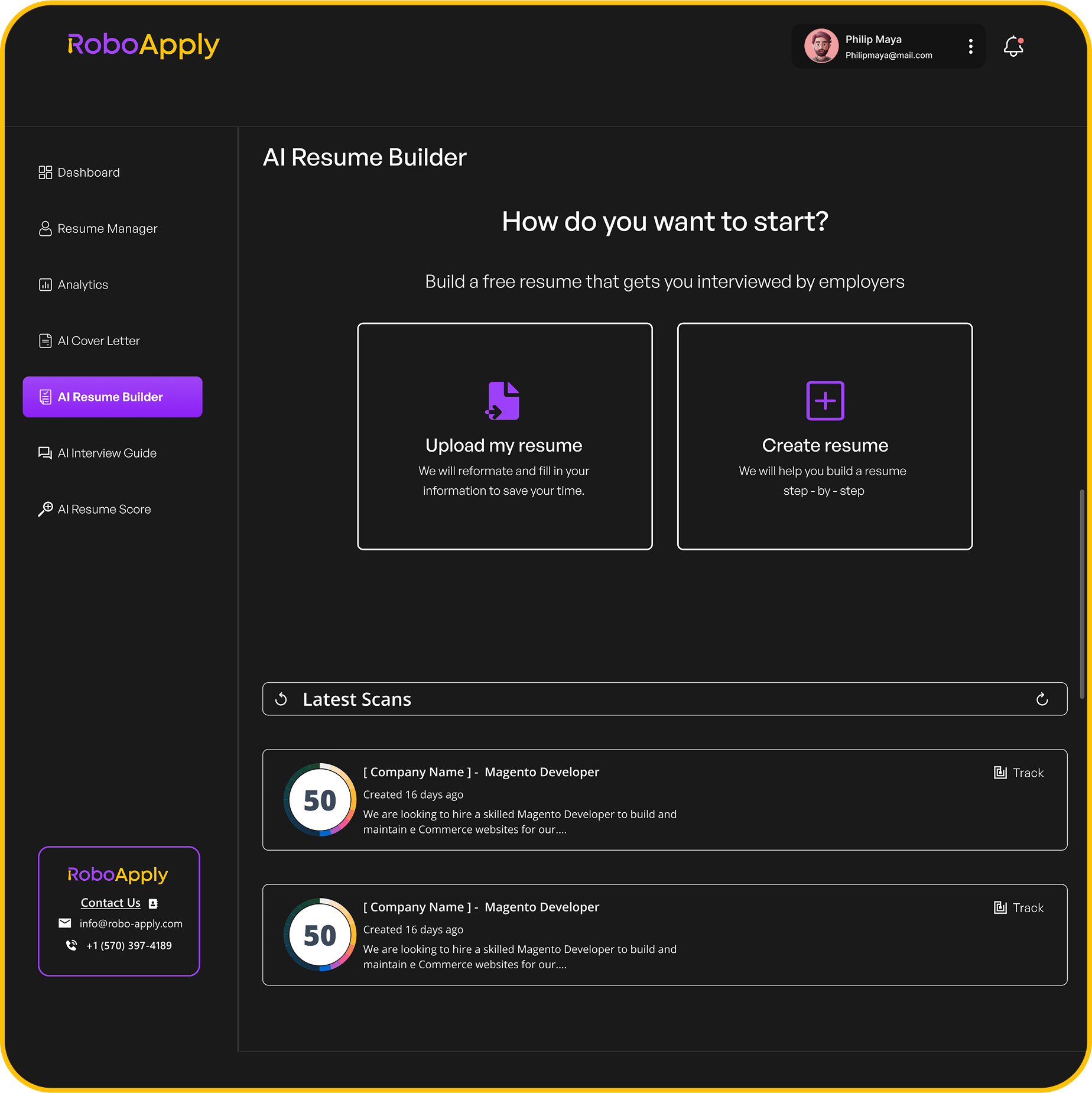

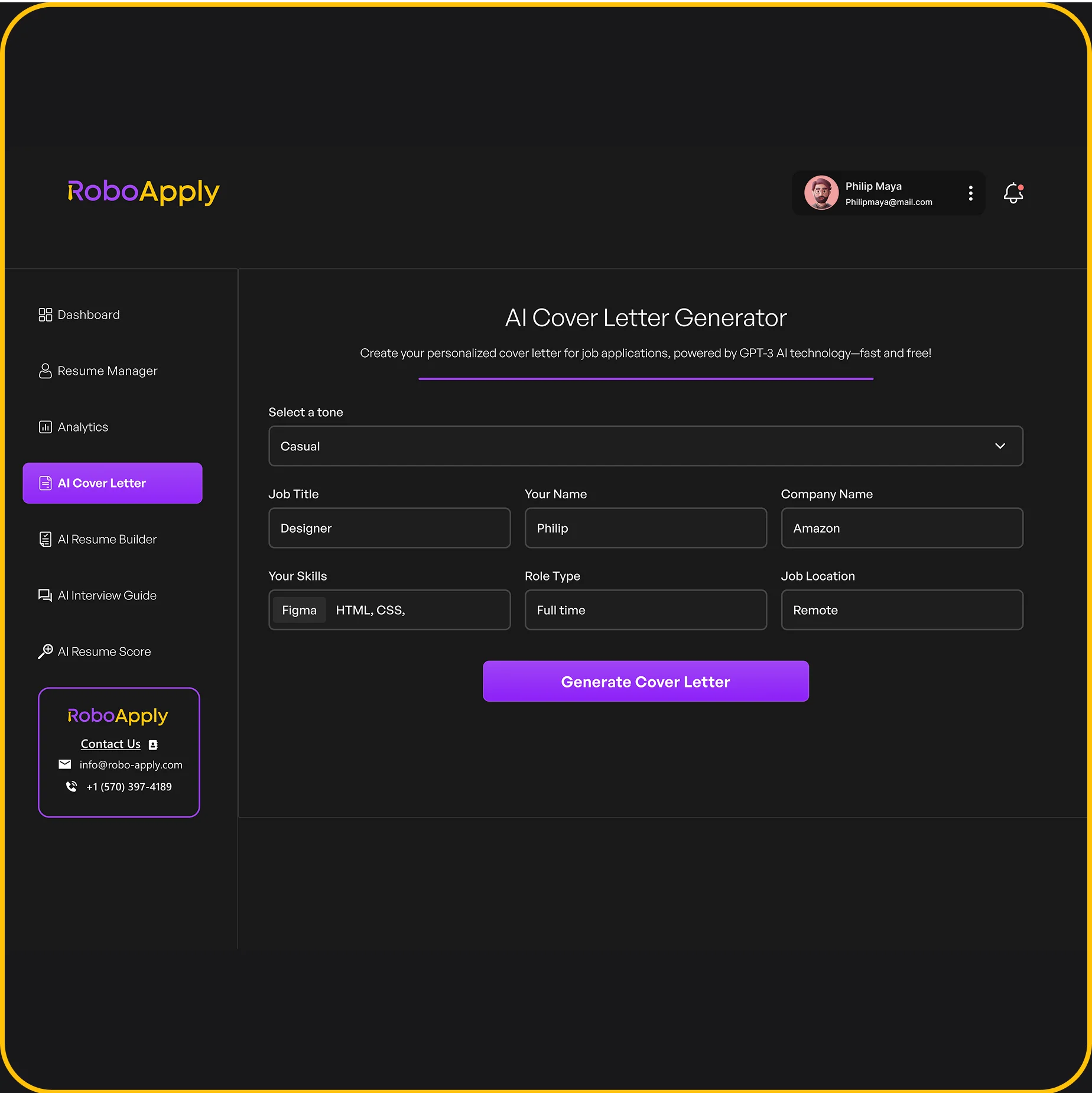

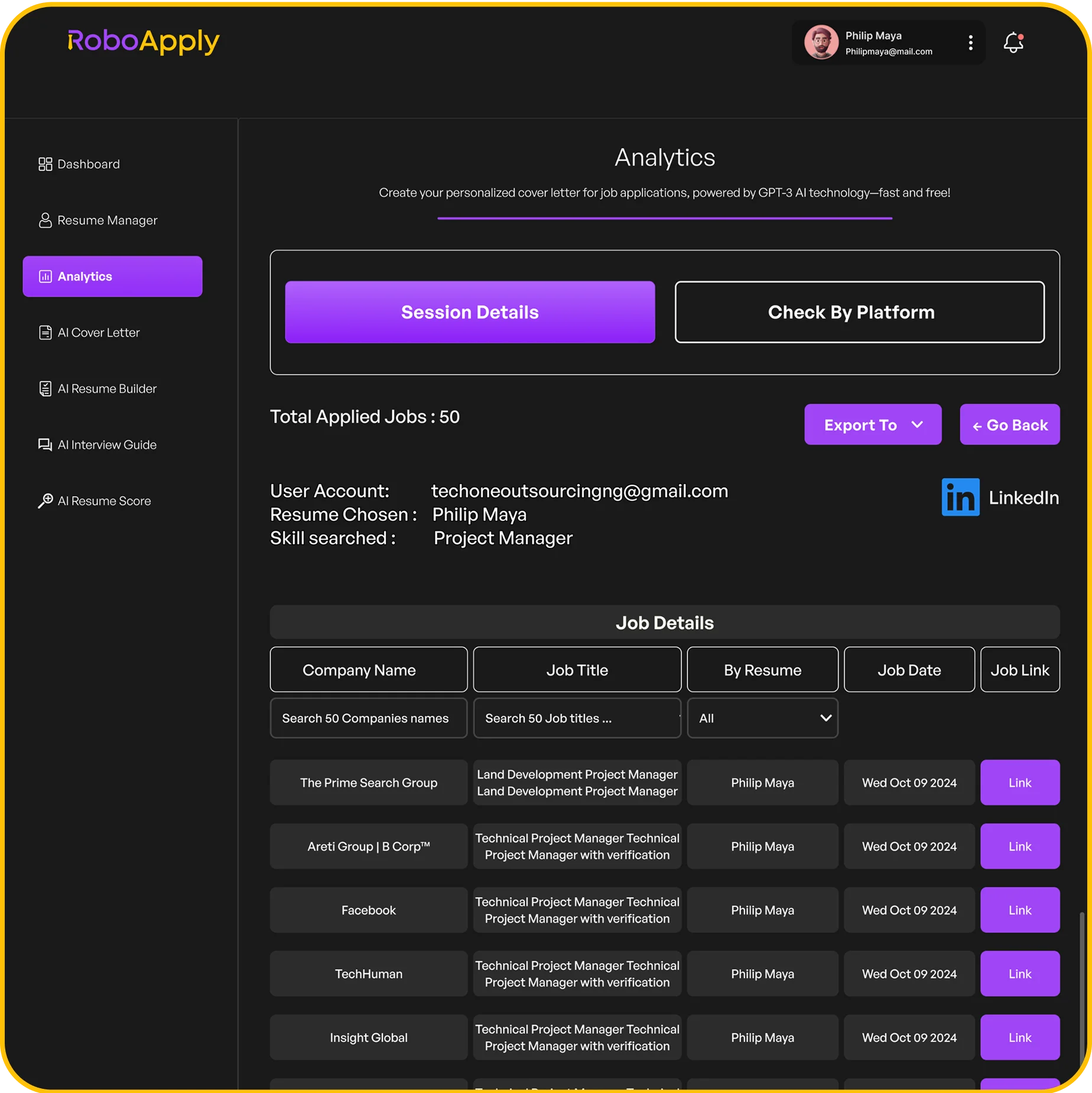

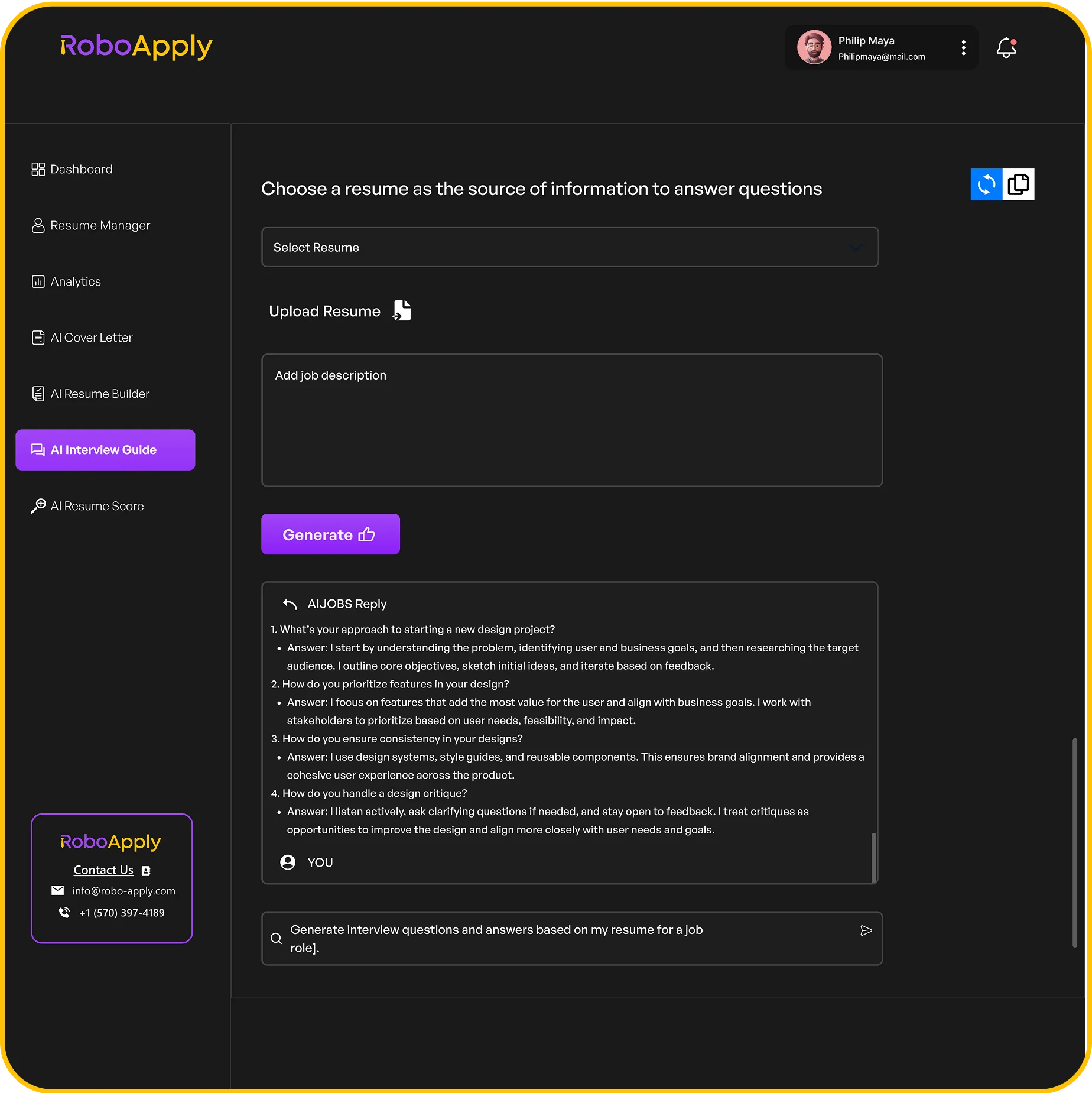

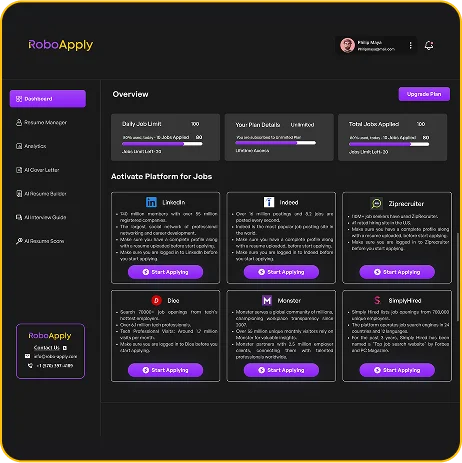

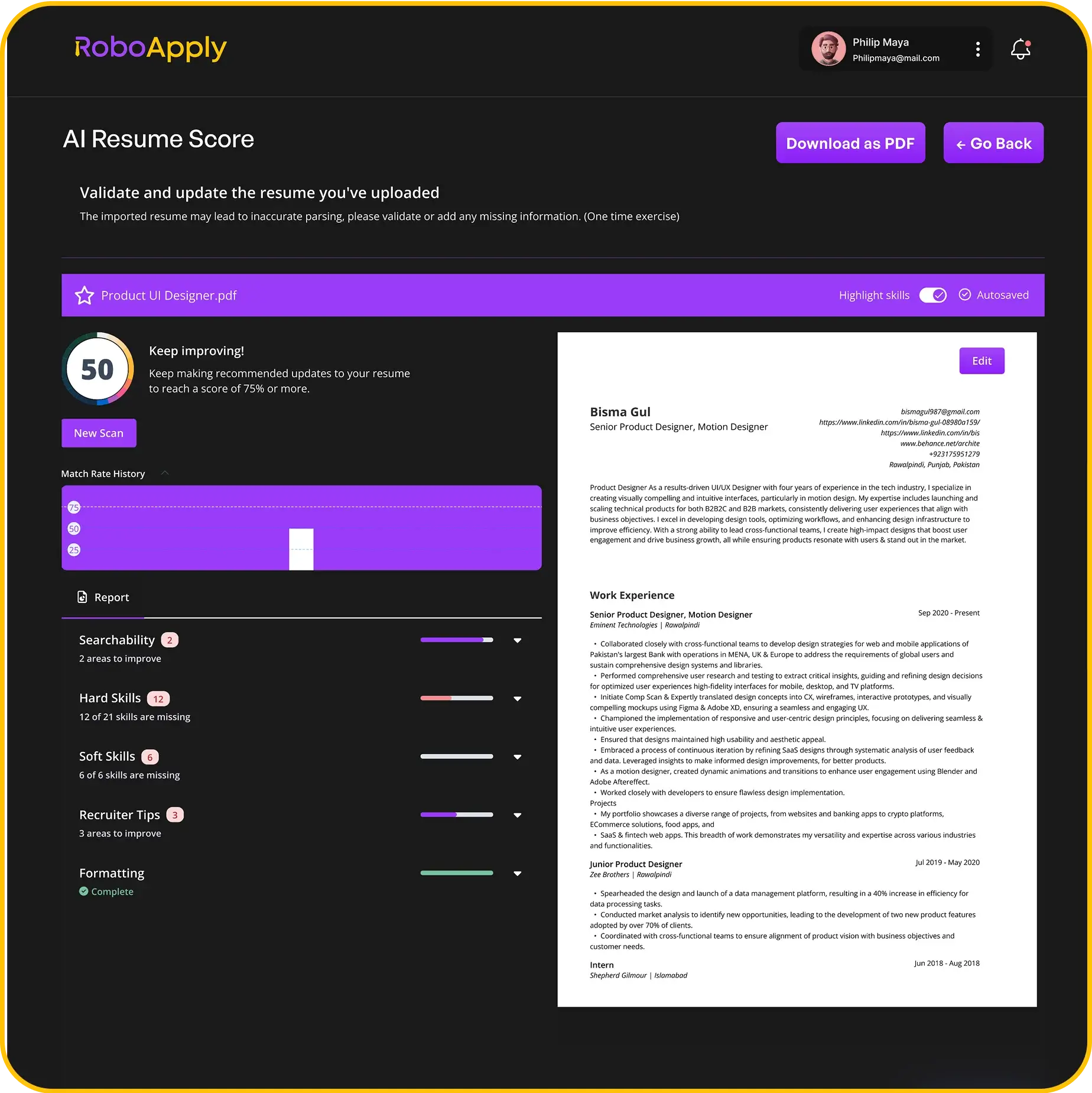

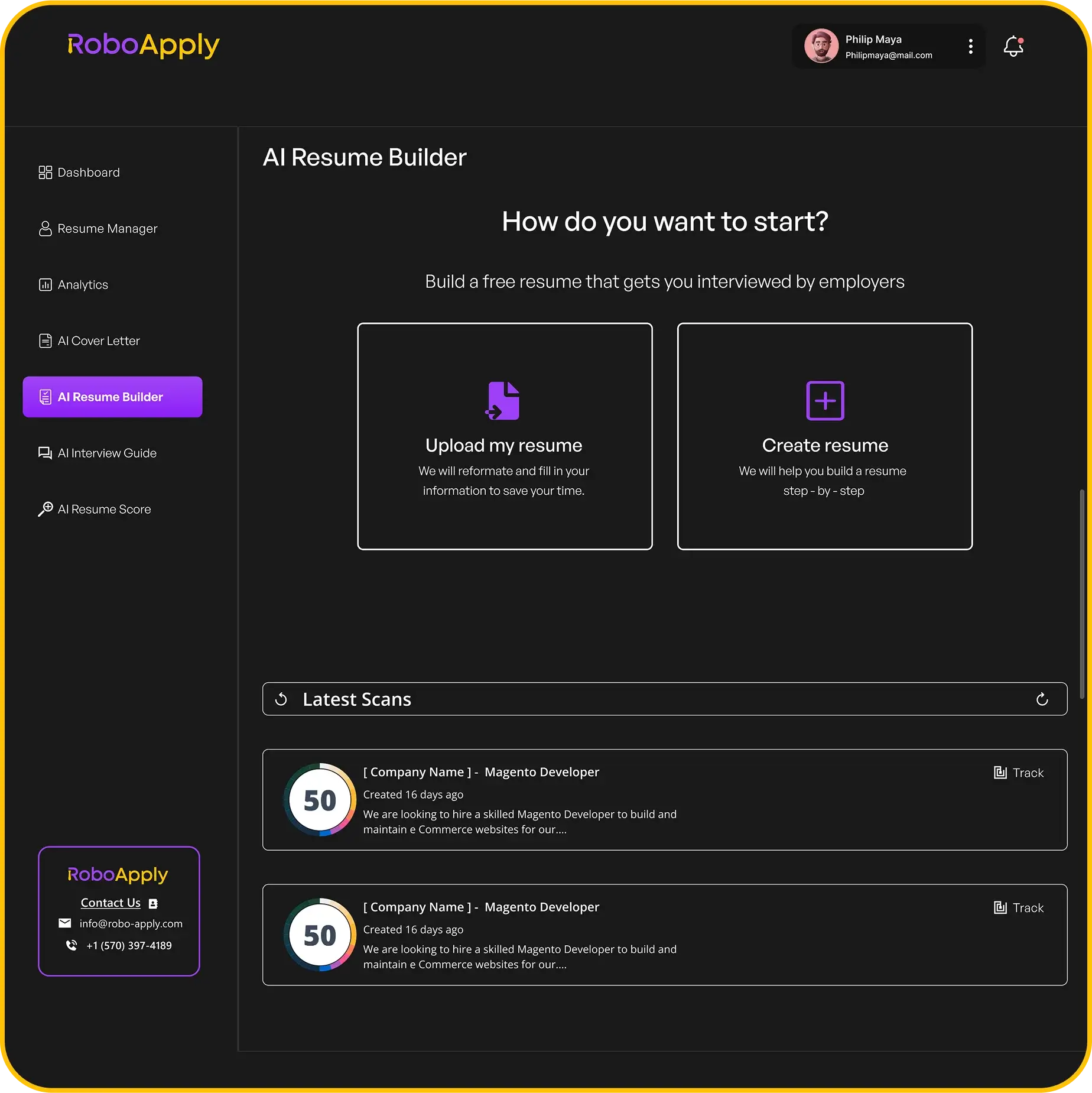

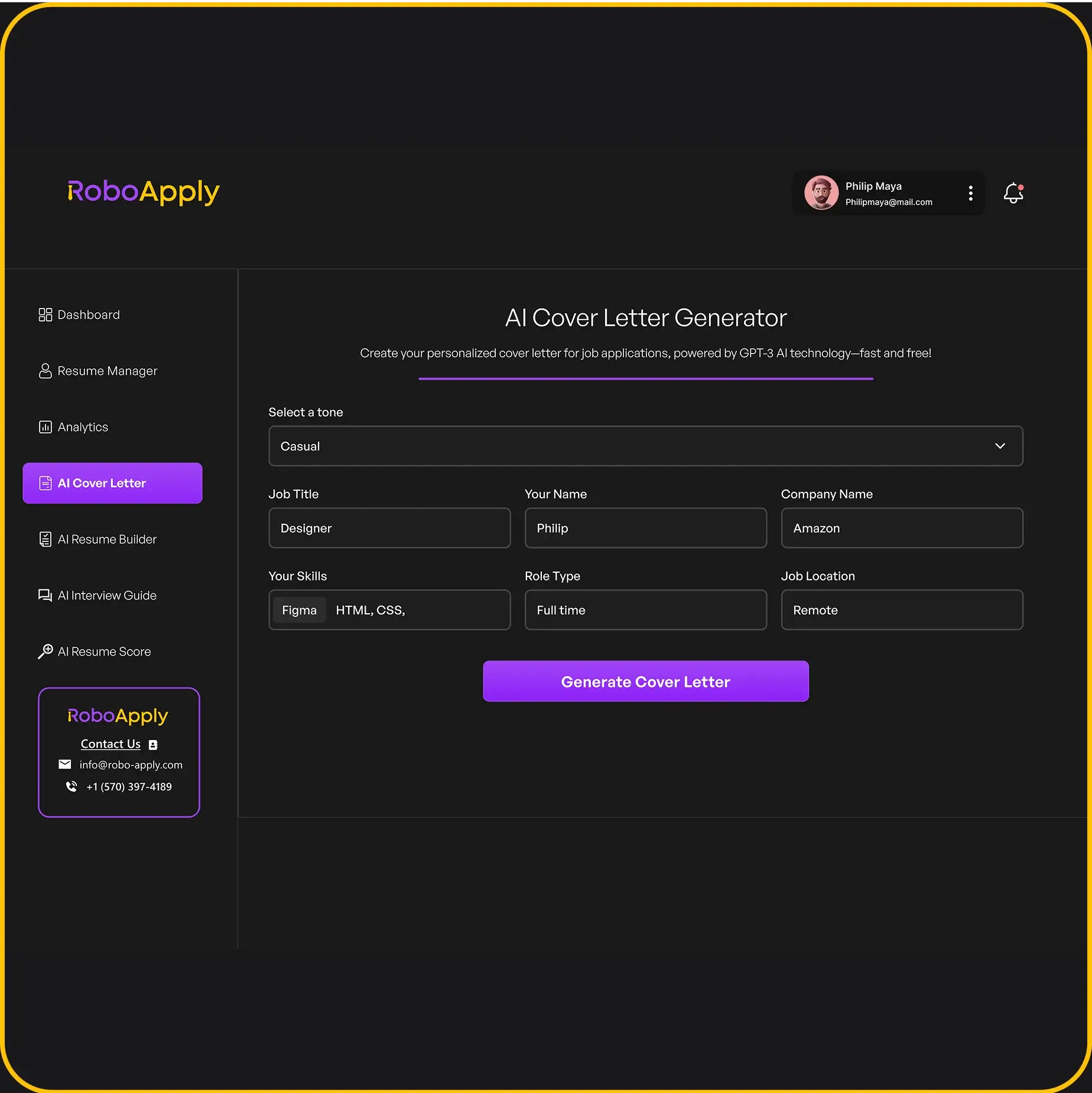

Your resume summary is like a movie trailer – it needs to grab the hiring manager’s attention fast. It’s a short paragraph at the top of your resume that highlights your key skills and experience. Think of it as your elevator pitch. RoboApply can help you tailor this section to each job, making sure you emphasize the skills that are most relevant to the specific role.

A strong summary can make or break your chances of getting an interview. It’s the first thing they see, so make it count. Don’t just list your skills; show how you’ve used them to achieve results. Quantify your accomplishments whenever possible. For example, instead of saying "Managed tax preparation," say "Managed tax preparation for over 100 clients, ensuring 100% compliance and increasing client satisfaction by 15%."

Here’s an example of a good summary:

"Highly motivated and detail-oriented Tax Preparer with 5+ years of experience in preparing and filing individual and corporate tax returns. Proven ability to identify and resolve complex tax issues, ensuring compliance with all applicable laws and regulations. Seeking to leverage my expertise and skills to contribute to the success of a dynamic and growing firm."

Here are some tips for writing a killer summary:

- Keep it short and sweet – aim for 3-4 sentences.

- Focus on your most relevant skills and experience.

- Quantify your accomplishments whenever possible.

- Tailor it to each job you’re applying for.

- Use strong action verbs.

Think of your summary as a way to showcase your accountant resume examples and make a strong first impression. It’s your chance to tell the hiring manager why you’re the perfect candidate for the job. Make it count!

2. Contact Information

Your contact information section is super important. It’s how recruiters will reach out, so make sure it’s clear and professional. You want to make it as easy as possible for them to get in touch. RoboApply can help ensure your contact details are correctly formatted and prominently displayed.

- Full Name: Use your full, formal name. No nicknames here!

- Professional Email: Ditch the old high school email address. Create a professional-sounding email, preferably with your name in it.

- Phone Number: Make sure your voicemail is set up and professional. You don’t want to miss a call because your voicemail is full or has a silly greeting.

- LinkedIn Profile: Include a link to your LinkedIn profile. Make sure it’s up-to-date and reflects the information on your resume. This is a great way for recruiters to learn more about your experience. You can find tax services resume examples to see how others have done it.

- Location: List your city and state. You don’t need to include your full street address for privacy reasons.

Keep this section concise and easy to read. Recruiters often scan resumes quickly, so make sure your contact information stands out. Double-check for typos! A mistake here could mean missing out on an opportunity.

Here’s an example:

John Doe

johndoe@email.com

(555) 123-4567

LinkedIn.com/in/johndoe

Anytown, CA

It’s pretty straightforward, right? Just make sure everything is accurate and professional. This section is a key part of your work-from-home resume.

Also, here’s what not to include:

- Your full home address

- Your date of birth

- An unprofessional email address (like partyanimal@email.com)

- Irrelevant social media profiles

Keep it professional, keep it simple, and make it easy for recruiters to contact you. This is your first impression, so make it count! Remember to tailor your tax accountant resume to the specific job you’re applying for.

3. Work Experience

Your work experience section is where you really show what you’ve done. It’s not just about listing your jobs; it’s about showing how you’ve helped companies and clients. Use action verbs and numbers to make your accomplishments stand out. RoboApply can help you tailor this section to match the job description, making sure you highlight the most relevant experience.

Focus on quantifiable achievements to really grab attention.

Here’s how you can structure your work experience section:

- Job Title: Be clear and accurate.

- Company Name: Include the location.

- Dates of Employment: Use month and year.

- Responsibilities and Achievements: Use bullet points to list your accomplishments. Start each bullet point with a strong action verb.

Remember to tailor your resume to each job you apply for. Highlight the experiences and skills that are most relevant to the specific position. This shows the employer that you’re a good fit for the role.

Here’s an example:

Tax Preparer

ABC Tax Services, Anytown, USA

June 2020 – Present

- Prepared and filed over 300 individual and business tax returns annually.

- Reduced client tax liabilities by an average of 15% through effective tax planning strategies.

- Trained and mentored 5 junior tax preparers, improving team efficiency by 20%.

- Resolved over 50 complex tax issues with the IRS, resulting in favorable outcomes for clients.

- Maintained a 98% client satisfaction rate through excellent customer service.

Another example:

Senior Tax Associate

XYZ Accounting Firm, Sometown, USA

January 2018 – May 2020

- Managed a portfolio of 100+ high-net-worth clients, providing comprehensive tax services.

- Conducted thorough tax research and analysis to ensure compliance with federal and state regulations.

- Identified and implemented tax-saving opportunities, resulting in $500,000+ in client savings.

- Supervised a team of 3 tax associates, providing guidance and support on complex tax matters.

- Developed and presented tax planning seminars to clients, increasing client engagement and retention.

And one more:

Staff Accountant

123 Corporation, Bigcity, USA

August 2016 – December 2017

- Assisted with the preparation of corporate tax returns, ensuring accuracy and compliance.

- Reconciled general ledger accounts and prepared financial statements.

- Analyzed financial data and provided insights to management for decision-making.

- Implemented new accounting procedures, improving efficiency and accuracy.

- Supported the annual audit process, providing documentation and explanations as needed.

When describing your experience, use keywords from the job description. This helps your resume get past applicant tracking systems (ATS). Also, use numbers to quantify your achievements. For example, instead of saying "Improved client satisfaction," say "Improved client satisfaction by 25%."

RoboApply can help you identify the right keywords and quantify your achievements, making your work experience section more impactful. Remember to tailor your resume for each application to highlight the most relevant skills and experiences. This will significantly increase your chances of landing an interview. Make sure to highlight your tax knowledge and experience.

4. Education

Your education section is where you list your academic achievements. It’s pretty straightforward, but there are a few things to keep in mind to make it shine. Think of it as showing employers you have the foundational knowledge to do the job.

Education Details

- List your degrees in reverse chronological order. Start with your most recent degree and work your way back. This makes it easy for employers to see your highest level of education first.

- Include the full name of the institution, the degree you earned, and your graduation date (or expected graduation date). Don’t forget to mention your major and any relevant minors.

- If you have a high GPA (like, really high), you can include it. Otherwise, it’s generally best to leave it off. No need to draw attention to a less-than-stellar GPA.

Example

Here’s how you might format your education section:

Bachelor of Science in Accounting, May 2023

University of Example, Exampleville, USA

Tips for Tax Preparers

- If you have a degree in accounting, finance, or a related field, make sure it’s prominently displayed. This is a key qualification for tax preparers.

- If you’ve taken any relevant coursework, such as tax law or financial accounting, you can list those as well. This shows employers that you have specific knowledge related to the job. RoboApply can help you tailor your resume to highlight these specific skills for each application.

- If you’re still in school, you can list your expected graduation date. Just make sure to update your resume once you’ve graduated!

A well-crafted education section can significantly boost your resume. It shows employers that you have the necessary knowledge and skills to succeed in the role. Make sure it’s clear, concise, and easy to read.

Placement Matters

Where you put your education section can depend on your experience level. If you’re a recent graduate, it might make sense to put it near the top. If you have years of experience, it can go further down. Consider the impact of section placement on your resume.

5. Certifications

Having certifications on your tax preparer resume can really set you apart. It shows employers that you’ve gone the extra mile to gain specialized knowledge and skills. Plus, it gives clients confidence in your abilities. RoboApply can help you highlight these certifications effectively, making sure they catch the eye of potential employers.

Here are some common and valuable certifications for tax preparers:

- Certified Public Accountant (CPA): This is a big one. It’s a widely recognized credential for accounting professionals, and it involves passing a rigorous exam and meeting certain educational and experience requirements. CPAs can represent clients before the IRS.

- Enrolled Agent (EA): EAs are federally licensed tax practitioners who can also represent taxpayers before the IRS. They’ve either passed an IRS exam or have experience as an IRS employee. This is a solid choice if you want to focus specifically on tax.

- Certified Tax Preparer (CTP): This certification demonstrates competency in tax preparation. The requirements vary depending on the organization offering the certification, but it generally involves coursework and an exam. It’s a good way to show you’re serious about tax preparation.

Including your certifications is a must. Make sure to list the full name of the certification, the issuing organization, and the date you obtained it. If the certification requires renewal, include the expiration date as well.

It’s also a good idea to list any relevant continuing education courses you’ve taken. This shows that you’re committed to staying up-to-date with the latest tax laws and regulations. You can find free income tax courses to boost your resume.

6. Skills

When it comes to tax preparer resumes, skills are super important. It’s not just about knowing taxes; it’s about showing you can actually do the job. Here’s a breakdown of the kinds of skills you should think about including.

- Tax Law Knowledge: You absolutely need to know your stuff when it comes to tax laws and regulations. This isn’t just about knowing the basics; it’s about staying up-to-date with all the changes. For example, you might say, "Expert knowledge of federal and state tax regulations, including recent updates to the tax code." RoboApply can help you tailor this to specific job descriptions.

- Tax Preparation Software: Knowing how to use tax software is a must. It’s like being a chef who knows how to use all the kitchen gadgets. List the specific software you’re good at, like TurboTax, H&R Block, or Drake Tax. An example would be, "Proficient in using tax preparation software such as Lacerte, ProSeries, and UltraTax."

- Attention to Detail: Tax preparation is all about the details. One small mistake can cause big problems. Show that you’re meticulous and thorough. For instance, "Demonstrated ability to accurately review financial documents and identify discrepancies."

- Communication Skills: You need to be able to explain complex tax stuff to clients in a way they can understand. This means being a good listener and a clear communicator. A good example is, "Excellent communication skills, with the ability to explain complex tax concepts to clients in a clear and understandable manner."

- Problem-Solving Skills: Tax situations can be complicated, and you need to be able to think on your feet and find solutions. Show that you’re a problem-solver. For example, "Proven ability to analyze complex financial situations and develop effective tax strategies."

Having a solid set of skills on your resume is key to landing a tax preparer job. Make sure to highlight the ones that are most relevant to the specific job you’re applying for. Don’t just list them; show how you’ve used them in your previous roles. And remember, RoboApply can help you tailor your resume to match the job description, making sure your skills stand out.

Here’s a quick example of how you might list your skills:

- Tax Law Knowledge

- Tax Preparation Software (Lacerte, ProSeries, UltraTax)

- Attention to Detail

- Communication Skills

- Problem-Solving Skills

- Client Management

- Financial Analysis

Remember to tailor this list to the specific job you’re applying for. Good luck!

7. Awards

Awards can really make your resume pop, especially if they’re relevant to tax preparation. It shows you’re not just doing the job, but excelling at it. Think of it as extra proof that you’re good at what you do. RoboApply can help you tailor your resume to highlight these achievements, making sure they catch the eye of potential employers.

Here’s how to approach listing awards:

- Be Specific: Don’t just say "Employee of the Month." Explain why you got the award. What did you do that was so great?

- Relevance is Key: If you won a pie-eating contest, that’s awesome, but probably not relevant. Stick to awards that showcase your tax skills or professional abilities.

- Date and Context: Include the date you received the award and a brief explanation of the awarding organization. This adds credibility.

Awards demonstrate your commitment to excellence and can set you apart from other candidates. They provide tangible evidence of your skills and accomplishments.

Here are some examples of awards you might include:

- Employee of the Year (with a brief explanation of your contributions)

- Top Tax Preparer (based on client satisfaction or revenue generated)

- Volunteer of the Year (for tax-related volunteer work)

Remember, awards are a great way to showcase your achievements and make your resume stand out. Make sure to highlight them effectively using RoboApply to tailor your resume to the specific job requirements. If you’re looking for resume tips, there are plenty of resources available to help you craft a standout document.

If you’ve received recognition from reputable organizations, such as being recognized among the Top 200 CPA firms, be sure to include that information. This can significantly boost your credibility.

Awards can also include recognition for volunteer work, such as acting roles in community theater, if they demonstrate relevant skills like communication or attention to detail.

8. Volunteer Experience

Volunteer work can show you’re well-rounded and dedicated to helping others. It’s a great way to fill gaps in your resume or highlight skills you might not use in your paid work. Plus, it just looks good!

Including volunteer experience shows potential employers that you have a commitment to your community and are willing to give back. It can also demonstrate soft skills like teamwork, communication, and leadership.

Here’s how to make the most of your volunteer experience on your tax preparer resume. RoboApply can help you tailor this section to match the job description, making sure your efforts shine.

- Focus on relevant skills: Highlight volunteer roles where you used skills applicable to tax preparation, like attention to detail or working with numbers.

- Quantify your impact: Instead of just saying you "helped people," try to say you "prepared taxes for 50+ low-income families."

- Use action verbs: Start each bullet point with a strong action verb to describe your responsibilities and accomplishments.

Here’s an example:

Volunteer Tax Preparer

VITA (Volunteer Income Tax Assistance) Program | 2023 – Present

- Prepared and filed federal and state tax returns for over 75 low-income individuals and families.

- Provided tax counseling and education to clients, ensuring they understood their tax obligations and potential credits.

- Assisted in organizing and managing client intake, improving efficiency by 15%.

Another example:

Treasurer

Local Community Garden | 2022 – 2024

- Managed the organization’s finances, including budgeting, record-keeping, and financial reporting.

- Prepared monthly financial statements and presented them to the board of directors.

- Oversaw fundraising efforts, securing donations totaling $2,000 to support garden operations.

Even if your volunteer work isn’t directly related to tax preparation, you can still highlight transferable skills. For example, if you volunteered at a soup kitchen, you could emphasize your teamwork, communication, and problem-solving abilities. Think about how your volunteer experience demonstrates key skills that employers value.

If you have a lot of volunteer experience, you might consider creating a separate "Volunteer Experience" section. If you only have one or two experiences, you can include them in your "Work Experience" section or create a combined "Experience" section. Just make sure it’s clear and easy to read. For example, if you are an enthusiastic VITA volunteer, make sure to highlight that.

9. Professional Affiliations

Listing professional affiliations on your tax preparer resume can show employers that you’re serious about your career and stay updated on industry changes. It demonstrates a commitment to professional development and ethical standards. Plus, it can give you a leg up, especially if the affiliation is well-regarded in the field. RoboApply can help you tailor this section to match the specific requirements of each job you apply for.

Example of Professional Affiliations

Here’s how you might format this section:

- National Association of Tax Professionals (NATP)

- National Society of Accountants (NSA)

- Accreditation Council for Accountancy and Taxation (ACAT)

Why Include Professional Affiliations?

Including professional affiliations shows you’re dedicated to your field. It tells employers you’re not just doing a job; you’re invested in your profession. Professional organizations offer resources, training, and networking opportunities that can enhance your skills and knowledge. This can make you a more attractive candidate.

How to List Affiliations

- List the full name of the organization. Avoid abbreviations unless the abbreviation is more commonly known than the full name.

- Include any membership numbers or certifications you’ve obtained through the organization. This adds credibility.

- Mention any roles or positions you hold within the organization, such as committee member or chapter officer. This shows leadership and involvement.

Tips for Making This Section Stand Out

- Prioritize relevant affiliations. Only include affiliations that are directly related to tax preparation or accounting.

- Highlight achievements. If you’ve received any awards or recognition from the organization, mention it briefly.

- Keep it current. Make sure your affiliations are up-to-date. Remove any memberships you no longer hold.

Professional affiliations can significantly boost your resume by showcasing your commitment to the tax profession. They provide evidence of your ongoing learning and adherence to industry standards. This can set you apart from other candidates.

Common Professional Organizations for Tax Preparers

Here are some well-known organizations you might consider joining and listing on your resume. Being a member of the National Association of Tax Professionals can really boost your credibility.

- National Association of Tax Professionals (NATP): Offers education, resources, and advocacy for tax professionals.

- National Society of Accountants (NSA): Provides resources and support for accountants and tax professionals.

- Accreditation Council for Accountancy and Taxation (ACAT): Offers certifications for accounting and taxation professionals. They also provide top-tier tax education.

Maximizing the Impact of Your Affiliations

Think of this section as more than just a list. It’s a chance to show your dedication to the field. Make sure each affiliation is presented clearly and accurately. Consider adding a brief description of your involvement or any significant contributions you’ve made within the organization. This can turn a simple list into a powerful statement about your professional commitment.

10. Publications

Some tax preparers also write articles or books, or contribute to industry publications. If you’ve done this, it’s a great way to show your expertise and commitment to the field. It can really make your resume stand out, especially if the publication is well-known or respected. RoboApply can help you tailor your resume to highlight these achievements.

Listing publications shows you’re not just doing the job, but you’re also actively contributing to the knowledge base of the tax preparation profession. It demonstrates a deeper level of engagement and understanding.

Here’s how you might list publications on your resume:

- Title of Article/Book: "Tax Strategies for Small Businesses" (Published in Journal of Accountancy, 2024)

- Blog Post: "Understanding the Latest Tax Law Changes" (Featured on TaxPro Central, January 2025)

- Co-authored Chapter: "Estate Tax Planning" in "Advanced Tax Planning Techniques" (Publisher: Wiley, 2023)

Consider these points when adding publications:

- Relevance: Make sure the publications are relevant to the tax preparation field. A gardening article, while impressive, might not be the best fit.

- Citation Style: Use a consistent citation style (e.g., APA, MLA) for all your publications.

- Placement: Depending on the length and importance of your publication list, you can place it after your work experience or education sections. If you have many publications, consider creating a separate "Publications" section.

If you’re looking for resume examples to get started, there are many resources available online.

11. Languages

Knowing another language can really set you apart, especially in tax prep where you might deal with clients from diverse backgrounds. It shows you’re adaptable and can connect with a wider range of people. RoboApply can help you highlight these skills effectively.

It’s all about making your resume stand out.

Here’s how to list languages on your resume:

- List languages you speak: Include any languages you know, even if it’s just a little bit.

- Specify your proficiency level: Be honest about how well you speak each language (e.g., fluent, proficient, conversational, basic).

- Keep it consistent: Use the same format for all languages.

Being bilingual or multilingual can be a huge asset in the tax industry. It allows you to communicate directly with clients who might not be comfortable speaking English, building trust and rapport more easily. This can lead to better client relationships and a stronger reputation.

Here’s an example:

- English (Native)

- Spanish (Conversational)

- French (Basic)

Or, if you want to be more specific:

- English (Native)

- Spanish (Fluent – Reading, Writing, Speaking)

- Mandarin (Basic – Conversational)

Don’t overstate your abilities. It’s better to be honest and say "conversational" than to claim fluency and then struggle during an interview. You can also mention any relevant certifications Tax Associate role you have in a particular language, if applicable. RoboApply can help you tailor your language skills section to match the job description, making sure you highlight the most relevant languages for each application. Remember to tailor your accountant resumes to highlight the most relevant skills and experiences for each specific job.

12. Projects

Projects are a great way to show off your skills, especially if you’re light on work experience. They let you demonstrate what you can do in a practical way. Think of them as mini case studies that highlight your abilities.

Tax Return Analysis Project

This is where you show off your analytical skills. Did you take on a complex tax situation and untangle it? Did you find deductions others missed? Quantify the results if you can. For example:

- Analyzed and prepared individual income tax returns, identifying overlooked deductions that resulted in an average of $500 in additional refunds for clients.

- Developed a streamlined system for tracking client tax documents, reducing processing time by 15%.

- Conducted thorough reviews of prior-year tax returns, identifying and correcting errors that led to significant tax savings for clients. RoboApply can help you tailor this to different job descriptions.

Volunteer Tax Assistance Project

Volunteering is a fantastic way to gain experience and give back. If you’ve volunteered with a tax assistance program, definitely include it. It shows you’re not just about the money; you care about helping people too.

- Volunteered with the Volunteer Income Tax Assistance (VITA) program, providing free tax preparation services to low-income individuals and families.

- Assisted over 50 clients with their tax returns, ensuring accurate and timely filing.

- Educated clients on tax credits and deductions they were eligible for, helping them maximize their refunds. Remember to highlight your finance resume examples to showcase your skills.

Personal Finance Management Project

Even if it’s not directly tax-related, a personal finance project can show your understanding of financial principles. Did you create a budget that saved you a ton of money? Did you invest wisely and see great returns? Share it!

- Developed a personal budget and investment plan that resulted in a 20% increase in savings within one year.

- Researched and implemented tax-advantaged investment strategies, minimizing tax liabilities and maximizing returns.

- Created a spreadsheet to track expenses and income, identifying areas for improvement and achieving financial goals. Use these projects to enhance your tax accountant resume sample.

Projects are a great way to fill gaps in your resume. They show initiative and a willingness to learn. Don’t be afraid to get creative and think outside the box.

Data Analysis Project

Showcase your ability to analyze financial data. Did you use Excel or other tools to find trends or insights? Did you uncover errors or discrepancies? This is your chance to shine.

- Utilized Excel to analyze financial data, identifying discrepancies that resulted in recovering $10,000 in overpaid taxes. See how a tax preparer used Excel to achieve this.

- Developed a data visualization dashboard to track key tax metrics, providing insights for strategic decision-making.

- Conducted statistical analysis of tax data to identify trends and patterns, informing tax planning strategies.

13. References

When it comes to references, it’s pretty standard not to include them directly on your resume. Instead, it’s better to state that references are available upon request. This saves space and allows you to tailor your references to each specific job. RoboApply can help you keep track of who you’ve used as a reference for which job, so you’re always prepared.

Think of it this way:

- Listing "References available upon request" keeps your resume concise.

- It gives you control over who the employer contacts.

- It allows you to prepare your references beforehand.

Providing references only when asked shows you’re organized and respectful of your references’ time. It also gives you a chance to inform your references about the job you’re applying for, so they can provide relevant and impactful feedback.

It’s a small detail, but it shows professionalism. Make sure you have a list of people ready to go, with their contact information and a brief description of your relationship with them. This way, when an employer asks, you’re ready to send it over without delay. You can use resume skills to highlight your abilities.

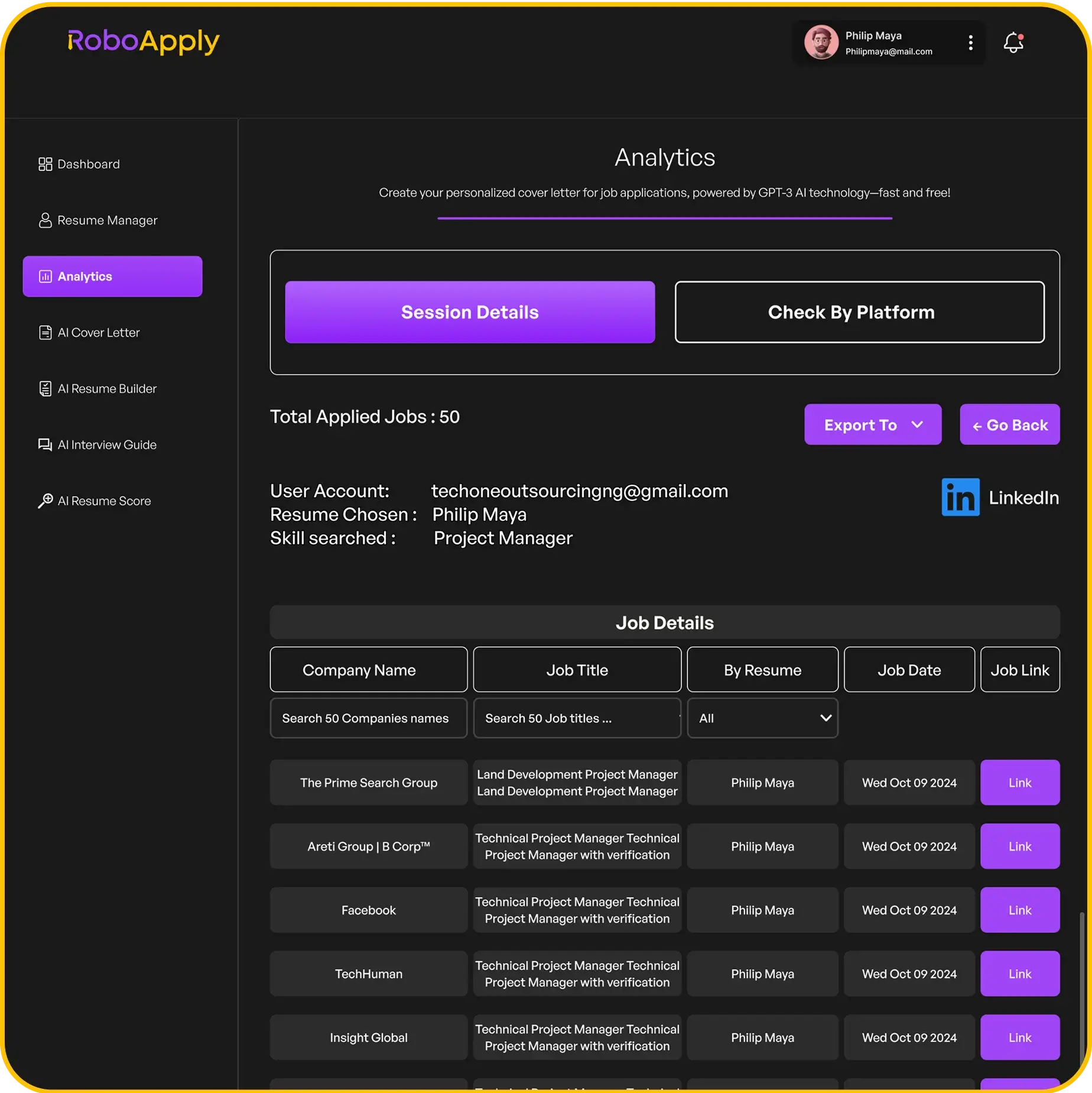

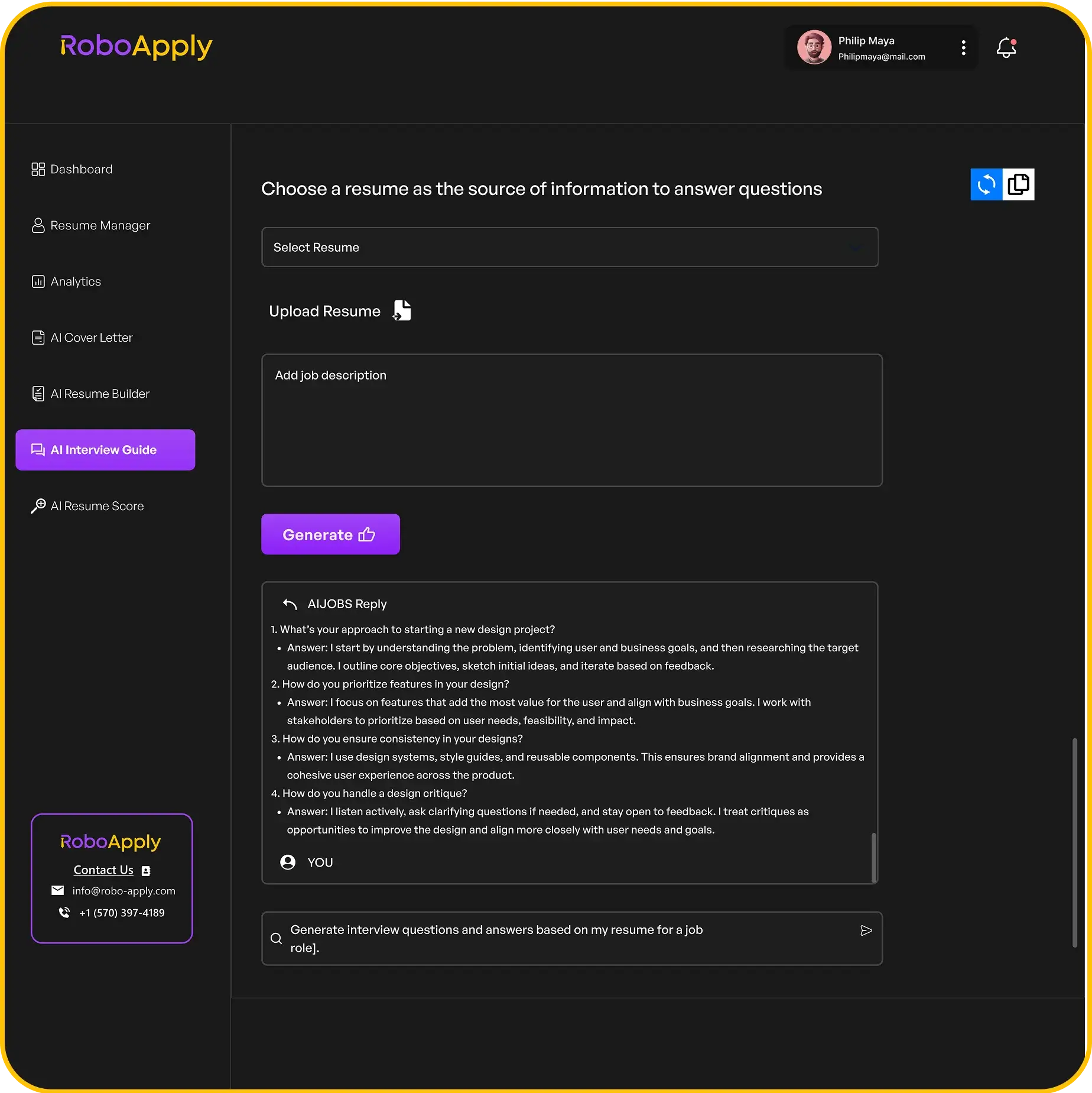

Want to make job hunting easier? Our tool, RoboApply, can help you apply for jobs super fast. It even helps with your resume and cover letter. Check out our website to see how RoboApply can help you land your dream job.

Wrapping Things Up

So, there you have it. Getting your resume just right for a tax preparer job in 2025 doesn’t have to be a huge headache. It’s really about showing what you can do, making sure it’s easy to read, and hitting those key things employers are looking for. Think about what makes you good at this kind of work and put that front and center. A little effort here can really make a difference in getting your foot in the door for that next big opportunity. You’ve got this.

Frequently Asked Questions

What exactly does a tax preparer do?

A tax preparer helps people and businesses get their taxes ready and filed correctly with the government. They make sure you follow all the rules and often help you find ways to pay less tax legally.

What kind of schooling or training do I need to be a tax preparer?

To become a tax preparer, you usually need a good understanding of numbers and tax laws. Many start with a degree in accounting or finance. You might also need special certifications, like being an Enrolled Agent (EA), to do more complex tax work.

Where do tax preparers typically find jobs?

Many tax preparers work for accounting firms, tax preparation companies, or even for themselves. Some also find jobs in the finance departments of big companies.

What are some important skills for a tax preparer to have?

It really helps to be good with numbers, pay close attention to details, and be able to explain complicated tax stuff in a simple way. Being trustworthy and keeping client information private are super important too.

How much money can a tax preparer expect to make?

The pay for tax preparers can change a lot based on where they work, how much experience they have, and if they have special licenses. Generally, more experience and certifications mean you can earn more.

Do tax preparers need to keep learning new things?

Yes, tax laws often change. So, tax preparers need to keep learning and stay updated on new rules and changes every year to do their job well.

How can I make my tax preparer resume look really good?

You can make your resume stand out by showing off any special tax software you know, highlighting times you saved clients money, and mentioning any advanced tax courses or certifications you have.

What are some general tips for writing a great resume?

It’s a good idea to put your most impressive achievements and skills at the top, use clear and simple language, and make sure there are no mistakes. Also, tailor your resume for each job you apply for.