So, you want to show off your budgeting smarts on your resume, huh? Good idea! In today’s job market, being good with money isn’t just for accountants anymore. Companies everywhere want to see that you can handle finances, no matter what role you’re going for. This article will walk you through the top budgeting skills that hiring managers are looking for in 2025 and give you some solid examples to help your resume stand out.

Key Takeaways

- Make sure to use numbers and facts to show what you’ve done. For example, instead of saying ‘managed budgets,’ say ‘managed a $2 million budget and cut costs by 15%.’

- Always change your resume for each job you apply for. Look at the job description and use words from it to describe your budgeting skills.

- Don’t forget about ‘soft skills’ like talking to people and solving problems. These are just as important as the technical stuff when it comes to budgeting.

1. Budget Planning

Budget planning is where it all starts. It’s not just about guessing numbers; it’s about creating a roadmap for your finances. Think of it as setting the stage for everything else you do with your money. It involves forecasting income, estimating expenses, and allocating resources to achieve specific goals. It’s a skill that’s valuable in pretty much any job, from managing a household budget to overseeing a multi-million dollar corporate budget.

Budget planning is more than just crunching numbers; it’s about understanding the financial landscape and making informed decisions. It’s about setting priorities and making sure your money is working for you, not the other way around.

Here’s the thing: budget planning isn’t a one-time thing. It’s an ongoing process that requires regular review and adjustment. Life happens, things change, and your budget needs to adapt. That’s why it’s so important to have a solid foundation in budget planning principles.

Budget planning is the cornerstone of financial management. It provides a framework for making informed decisions about resource allocation and helps ensure that financial goals are achieved.

Here are some key aspects of budget planning:

- Forecasting: Predicting future income and expenses.

- Resource Allocation: Deciding how to distribute funds to different areas.

- Goal Setting: Defining specific, measurable, achievable, relevant, and time-bound (SMART) financial objectives.

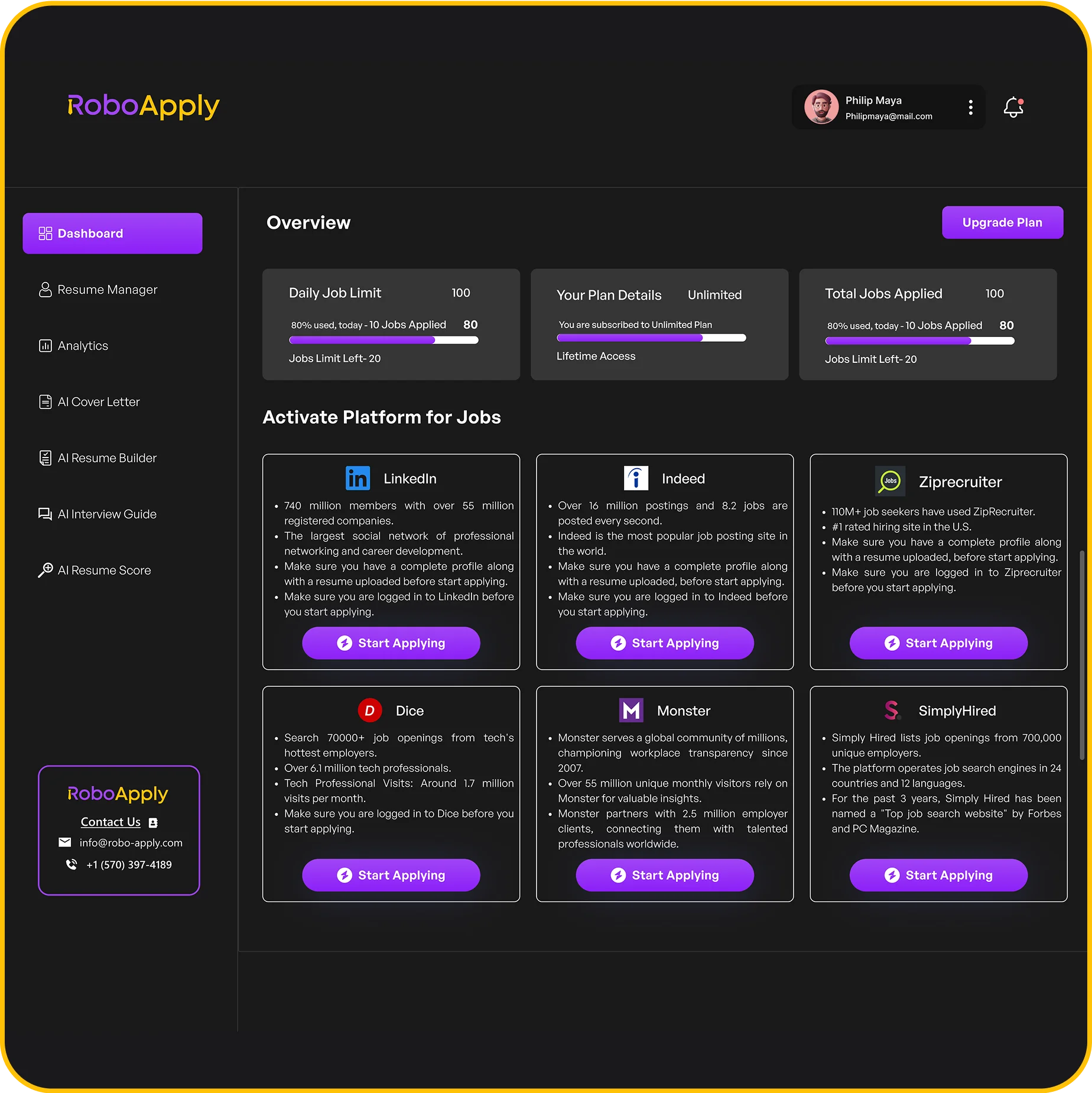

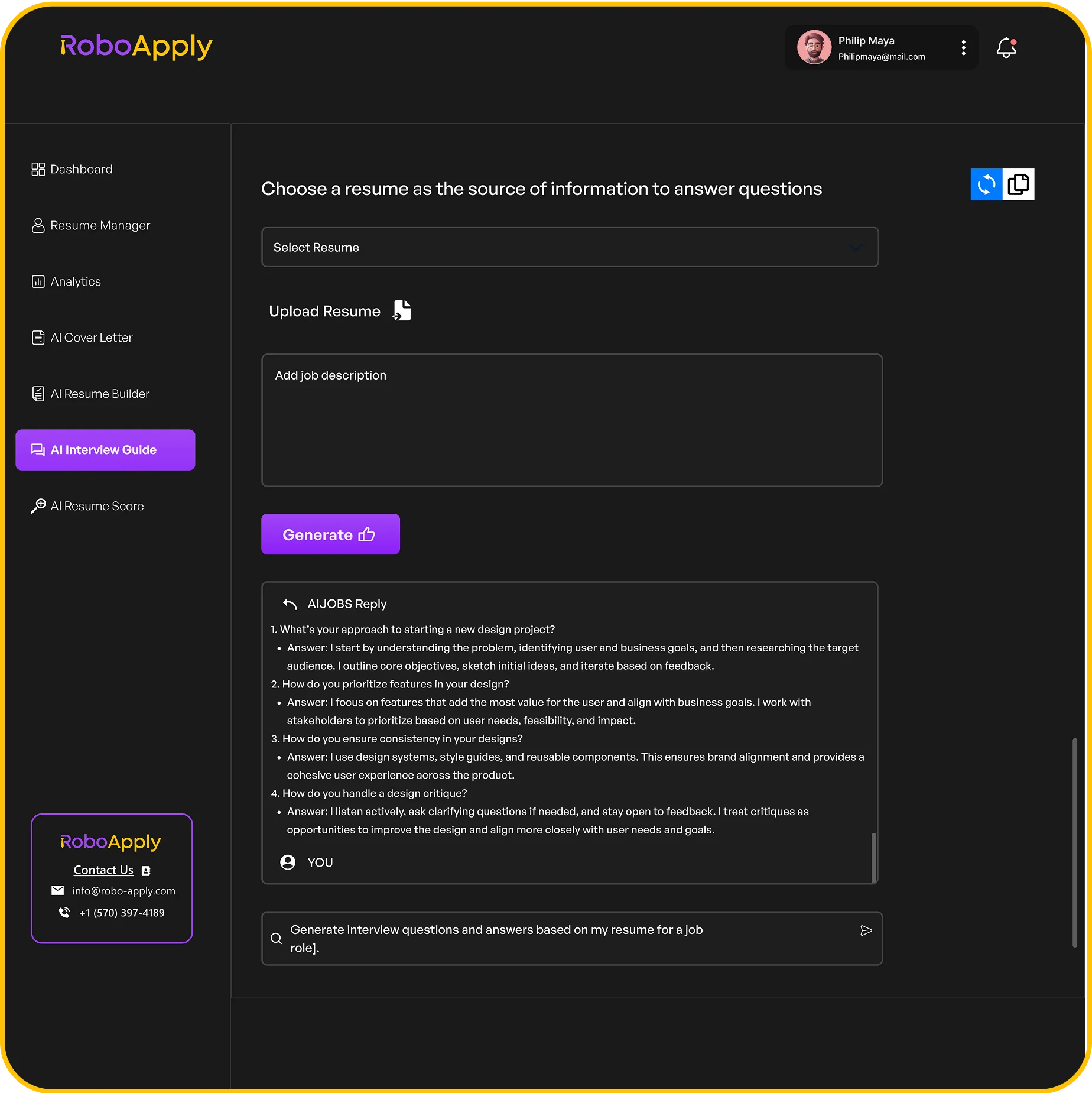

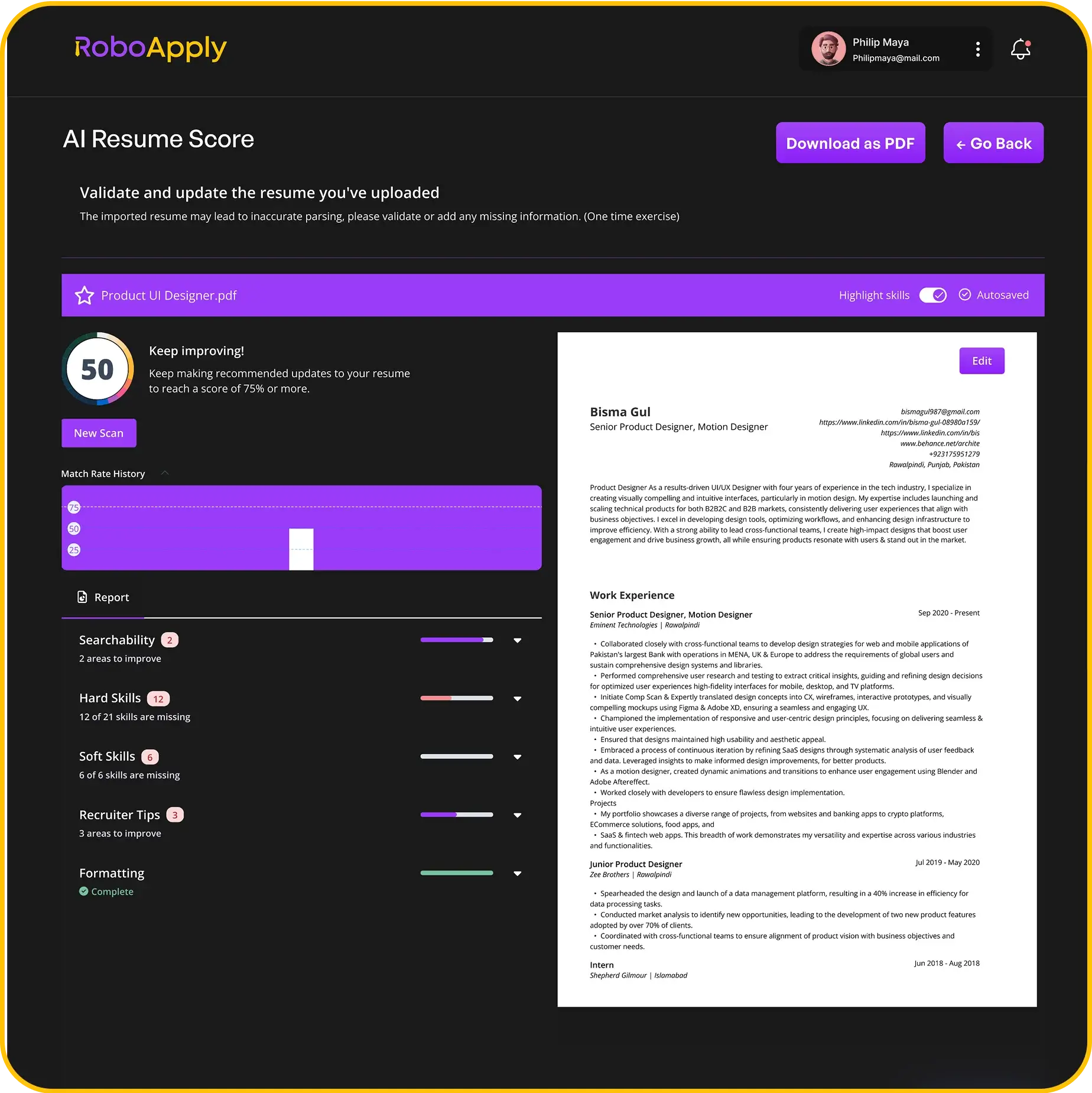

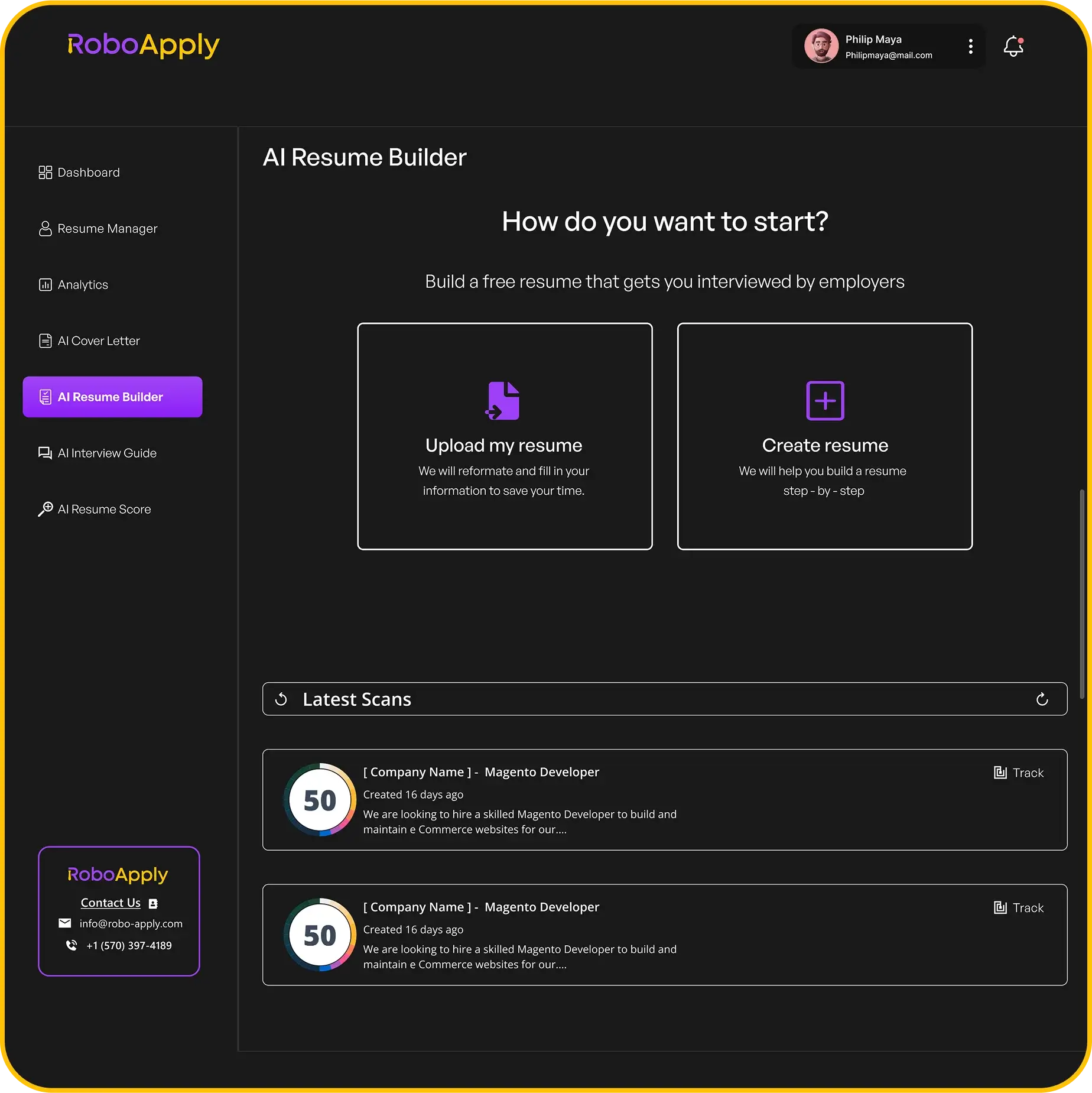

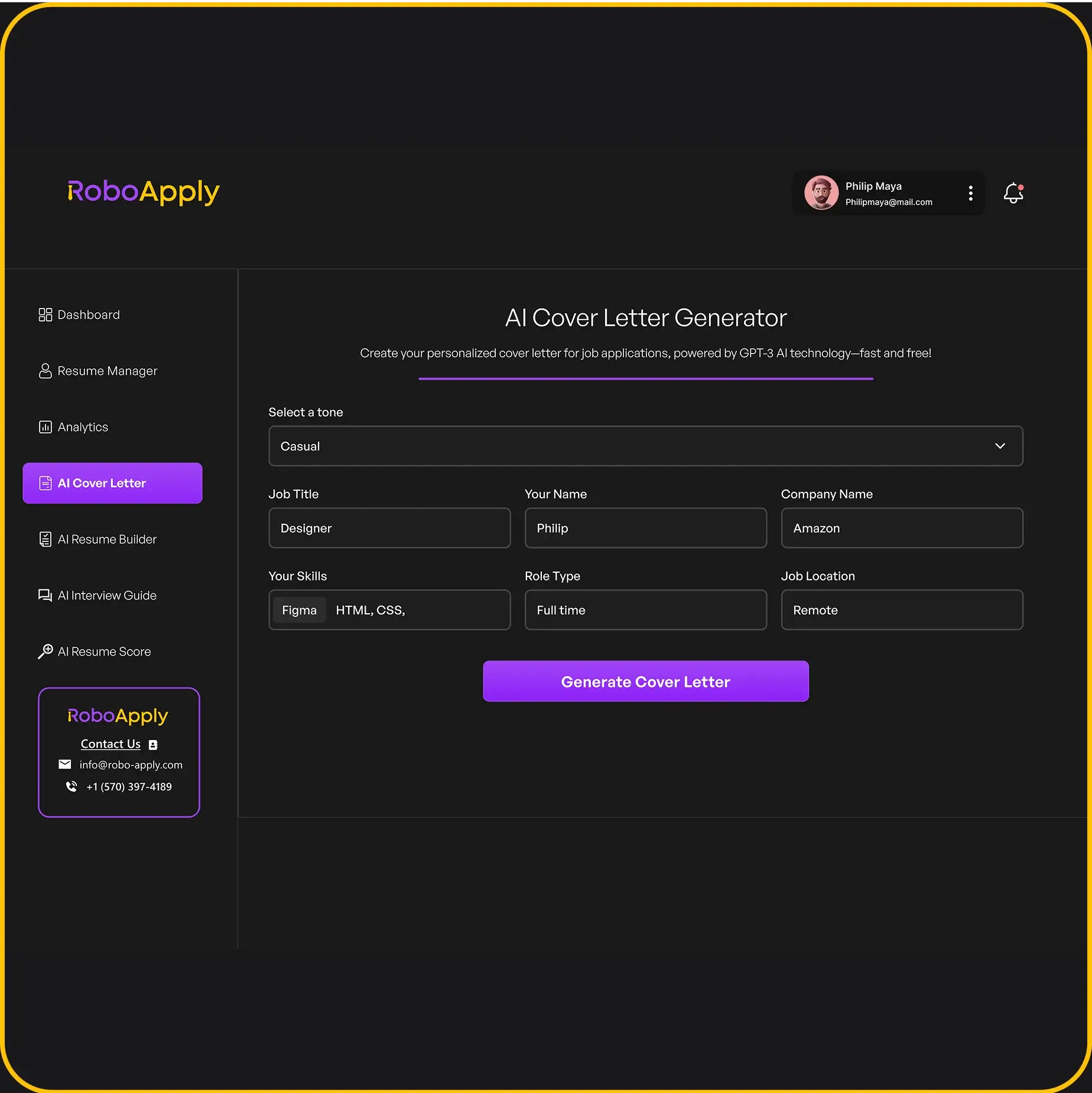

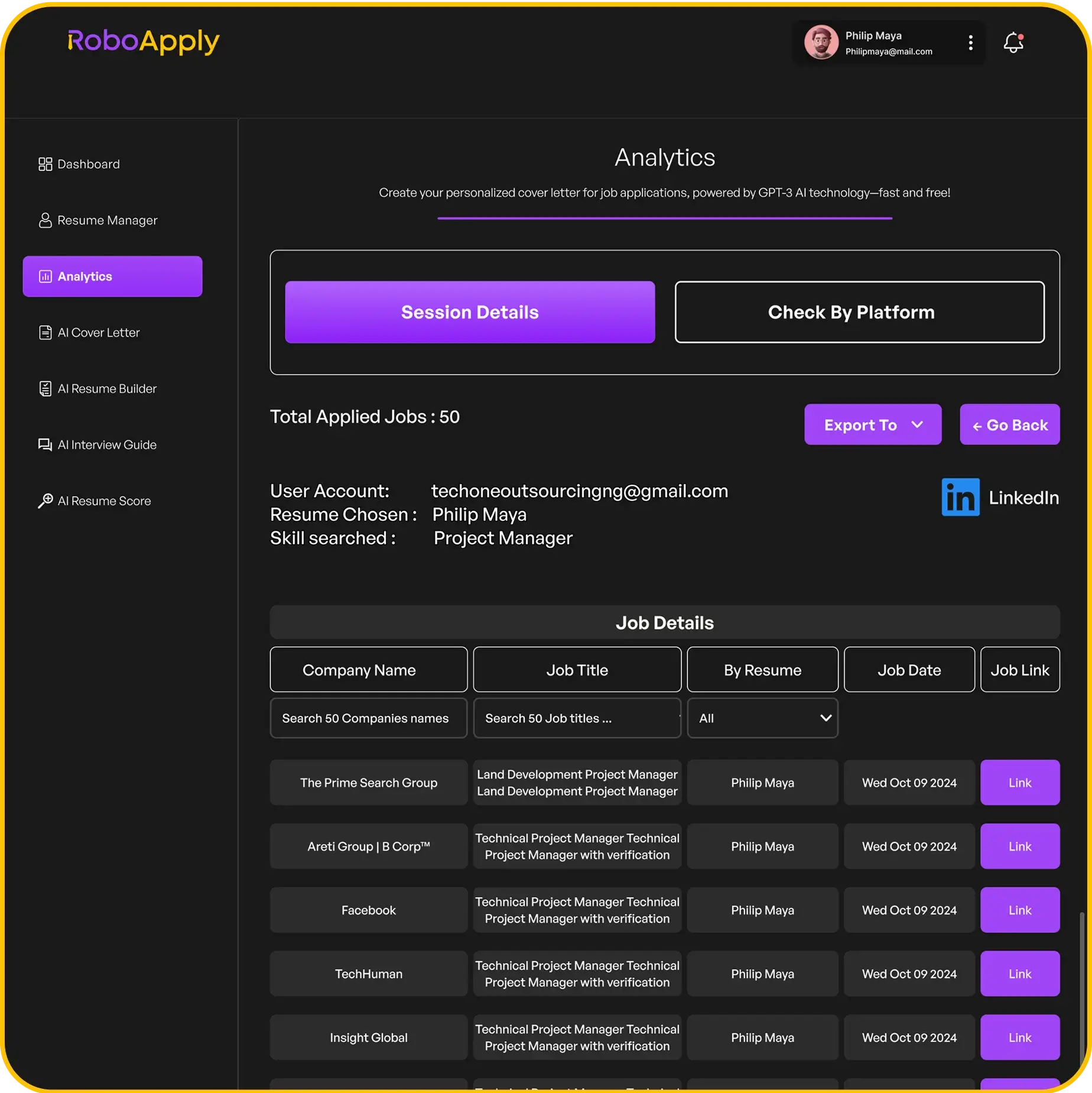

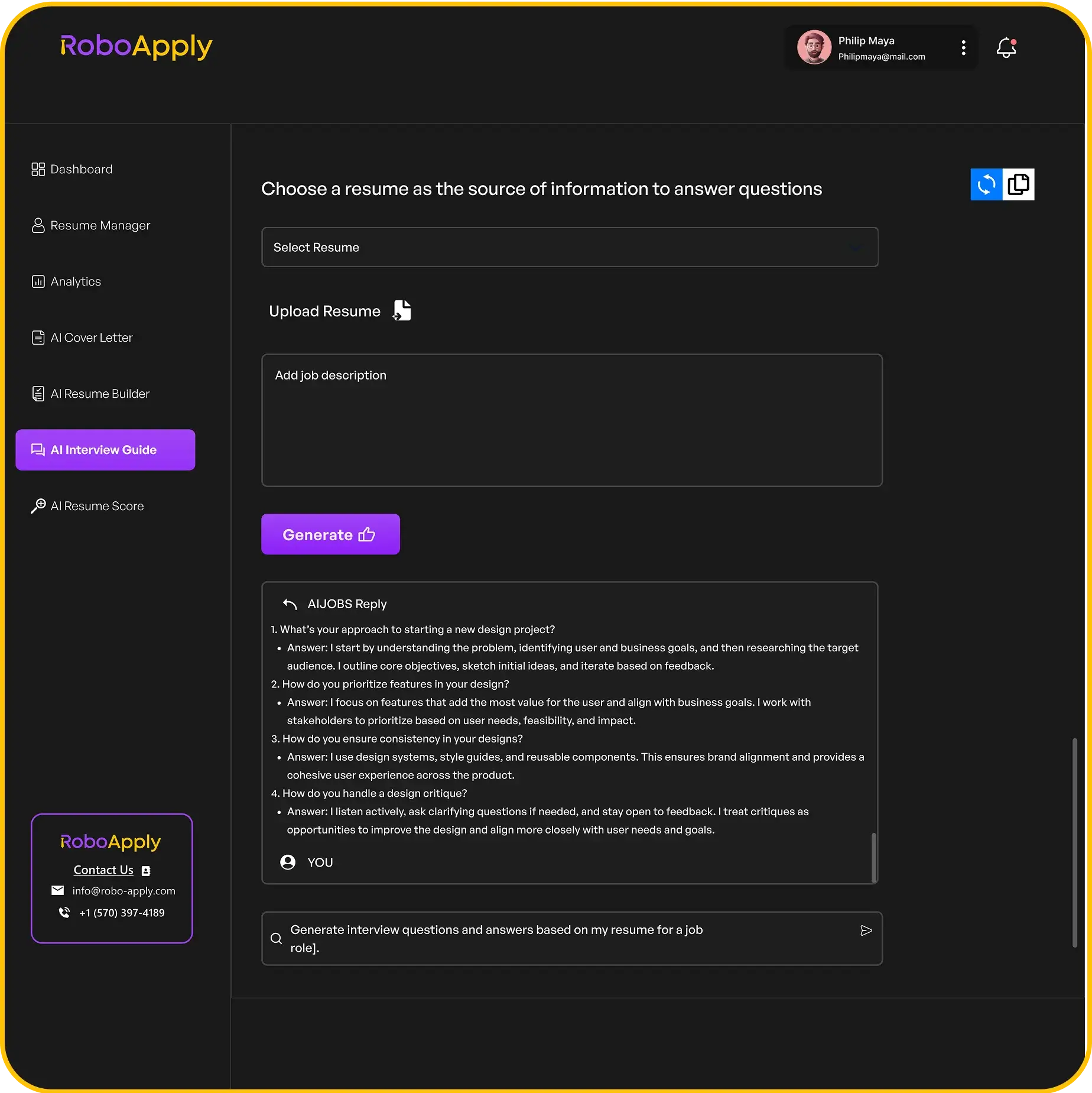

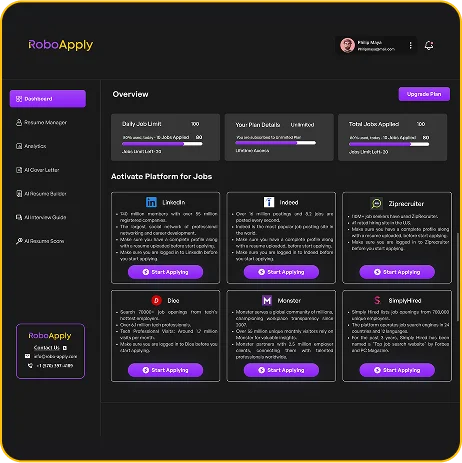

And remember, RoboApply can help you tailor your resume to highlight your budget planning skills, making you a more attractive candidate. For example, you can show how you’ve used budget analyst resume skills to improve financial outcomes in previous roles.

2. Cost Analysis

Cost analysis is all about figuring out the real cost of things – resources, products, services – so you can see if they’re actually worth it. It’s not just about looking at the price tag; it’s about digging deeper to understand all the direct and indirect costs involved. Think of it as detective work for your budget. You need to show you can handle financial data with ease.

I remember one time at my old job, we were trying to decide whether to keep using our old software or switch to a new one. The new software had a hefty price tag, but after doing a thorough cost analysis, we realized the old software was costing us even more in terms of maintenance, downtime, and lost productivity. It was a real eye-opener!

Here are some things that are important to cost analysis:

- Identifying all costs: This includes direct costs like materials and labor, as well as indirect costs like overhead and utilities.

- Comparing alternatives: Evaluating the costs of different options to make informed decisions.

- Finding inefficiencies: Spotting areas where costs can be reduced or eliminated.

Cost analysis is not just about cutting costs; it’s about making smart decisions that improve efficiency and profitability. It’s about understanding the true cost of doing business and making sure you’re getting the most bang for your buck.

RoboApply can help you showcase your cost analysis skills by highlighting specific achievements and quantifying your impact on cost savings. For example, you could say you reduced unnecessary expenditures by 25% by developing cost-benefit analysis templates. When crafting your resume as a budget analyst, focus on specific hard skills that show you can handle financial data with ease. Here’s a list to get you started:

- Financial modeling

- Data analysis

- Cost analysis

- Budget forecasting

- Excel

- Financial reporting

- Variance analysis

It’s a skill that can really make you stand out, especially if you can show how you’ve used it to save a company money. Recruiters look for your ability to be comfortable with managing budgets and financials. Try to highlight how you stayed on budget, allocated budgets or saved your employer costs. You can also show evidence of your analytical skills. Analytical skills involve your ability to break down a problem and come up with effective solutions. On Budget Analyst resumes, hiring managers want to see evidence of how you analyzed quantitative or qualitative data. Make sure to use a custom resume template to help you succeed in job interviews.

Here’s a simple table to illustrate a cost analysis example:

| Item | Cost (Old System) | Cost (New System) | Savings |

|---|---|---|---|

| Maintenance | $5,000 | $1,000 | $4,000 |

| Downtime | $3,000 | $500 | $2,500 |

| Labor | $2,000 | $1,500 | $500 |

| Total | $10,000 | $3,000 | $7,000 |

3. Financial Modeling

Financial modeling is all about building an abstract representation of a real-world financial situation. Think of it as creating a simplified version of a company’s financials to forecast future performance or evaluate different scenarios. It’s a core skill for anyone in finance, allowing you to make informed decisions based on data-driven projections.

I remember when I first started learning about financial modeling, it seemed super intimidating. Spreadsheets full of formulas? No thanks! But once I got the hang of it, I realized how powerful it could be. It’s not just about crunching numbers; it’s about understanding the underlying business and translating that into a model that can help you see the future. You can practice financial modeling skills by helping colleagues with financial statement analysis.

Financial models are used for all sorts of things, from valuing a company to deciding whether to invest in a new project. They help you understand the potential risks and rewards of different decisions.

Here’s what I’ve learned about financial modeling over the years:

- It’s an iterative process. You build a model, test it, refine it, and repeat.

- Assumptions are key. The accuracy of your model depends on the quality of your assumptions.

- Sensitivity analysis is your friend. See how your model changes when you tweak different inputs.

Financial modeling is a skill that can really set you apart. And with tools like RoboApply, you can make sure your resume highlights your financial modeling abilities effectively, increasing your chances of landing that dream job. To create an effective financial modeling resume, make sure to include all relevant skills.

4. Budget Control

Budget control is all about keeping a close eye on spending and making sure everything stays within the allocated budget. It’s not just about saying ‘no’ to expenses; it’s about proactively managing resources and making smart decisions to avoid overspending. Think of it as the financial steering wheel, guiding the organization toward its goals without crashing the bank.

Budget control involves regularly monitoring expenditures, comparing them against the budget, and taking corrective actions when necessary. It’s a continuous process, not a one-time event.

Effective budget control requires a combination of skills and tools. You need to be able to track expenses, analyze variances, and communicate effectively with different departments. Plus, knowing your way around budgeting software can make the whole process a lot smoother. RoboApply can help you tailor your resume to highlight these skills, making sure potential employers see you as a master of budget management.

Here’s a simple example. Imagine a project with a budget of $10,000. Throughout the month, you track all expenses related to the project. If you notice that spending is exceeding the planned amount, you need to investigate why and take steps to get back on track. This might involve cutting costs in other areas, renegotiating contracts, or even seeking additional funding.

Here are some key aspects of budget control:

- Monitoring Expenses: Regularly tracking all expenditures to ensure they align with the budget.

- Variance Analysis: Identifying and analyzing differences between budgeted and actual amounts.

- Corrective Actions: Implementing measures to address overspending or underspending.

- Communication: Keeping stakeholders informed about the budget status and any potential issues.

Good budget control can lead to significant cost savings and improved financial performance. It also helps to ensure that resources are used efficiently and effectively. By showcasing your budget control skills on your resume, you’re telling employers that you’re a responsible and reliable financial manager. You can also use RoboApply to optimize your resume for specific job requirements, ensuring that your budget control skills are front and center.

5. Account Reconciliation

Account reconciliation is basically making sure your bank statements and your accounting records match up. It’s like double-checking your work to catch any mistakes or weird stuff happening. Think of it as a detective game for your finances. It’s not the most glamorous task, but it’s super important for keeping things accurate and spotting fraud early. RoboApply can help you highlight your experience with account reconciliation, showing employers you’re detail-oriented and reliable.

6. Variance Analysis

Variance analysis? It’s basically digging into why your actual financial results don’t match what you thought they’d be. It’s not just about finding the differences, but understanding why they happened. Was it a change in market conditions, or did someone just mess up? Knowing this helps you adjust your future budgets and strategies. RoboApply can help you highlight your variance analysis skills on your resume, showing employers you can not only spot problems but also figure out how to fix them.

Think of it like this: you budgeted $1,000 for marketing, but you spent $1,200. Variance analysis is figuring out where that extra $200 went. Did you run more ads? Did the cost per click go up? Did someone approve an expense without checking the budget? You need to know!

Here’s a simple example:

| Category | Budgeted | Actual | Variance | Explanation |

|---|---|---|---|---|

| Marketing | $1,000 | $1,200 | $200 (Unfavorable) | Increased ad spend due to a new campaign. |

| Sales | $10,000 | $9,000 | $1,000 (Unfavorable) | Lower than expected sales in June. |

| Raw Materials | $5,000 | $4,500 | $500 (Favorable) | Negotiated better pricing with suppliers. |

Variance analysis isn’t just about finding problems; it’s about finding opportunities for improvement. By understanding why variances occur, you can make better decisions and improve your financial performance.

Here are some key aspects of variance analysis:

- Identifying Variances: Spotting the differences between budgeted and actual figures.

- Investigating Causes: Figuring out why those differences happened.

- Taking Corrective Action: Adjusting your plans to get back on track.

- Reporting: Communicating your findings to management.

Variance analysis is a key skill for any budget analyst. Make sure to highlight your experience with financial reporting and analysis on your resume.

7. Forecasting

Forecasting is all about predicting future financial outcomes based on past and present data. It’s not just guessing; it’s using data and trends to make informed projections. Think of it as looking into a crystal ball, but instead of magic, you’re using numbers and analysis. It’s a critical skill for anyone involved in budgeting because it helps in planning for potential scenarios and making proactive decisions. RoboApply can help you highlight your forecasting skills by tailoring your resume to match job descriptions that emphasize this ability.

Forecasting isn’t about being 100% accurate; it’s about reducing uncertainty and making the best possible decisions with the information available.

Here are some things to keep in mind:

- Accuracy is key, but adaptability is crucial. Markets change, so your forecasts need to be flexible.

- Use a variety of methods. Don’t rely on just one forecasting technique. Combine different approaches for a more robust prediction.

- Regularly review and update your forecasts. The world doesn’t stand still, and neither should your financial projections.

Good forecasting can save a company a lot of money and help it make better strategic decisions. For example, accurately predicting sales trends can help a company optimize its inventory and staffing levels. This skill is essential for budget planning.

8. Financial Reporting

Financial reporting is all about taking the numbers and turning them into something people can actually understand. It’s not just about crunching data; it’s about telling a story with that data. Think of it as translating financial jargon into plain English. It’s about showing where the money is coming from, where it’s going, and how well the company is doing overall. Good financial reports help managers make better decisions and keep everyone on the same page. RoboApply can help you tailor your resume to highlight your experience with financial reporting tools and techniques, making sure your skills really shine.

Here’s the thing, it’s not just about spitting out numbers. It’s about making sure those numbers are accurate, reliable, and presented in a way that makes sense to the people who need to use them. It’s a crucial skill, especially if you’re aiming for a role where you need to communicate financial performance to stakeholders.

Financial reporting is a critical skill that involves preparing and presenting financial data in a clear, concise, and understandable format. It’s essential for making informed decisions and ensuring transparency within an organization.

Here are some key aspects of financial reporting:

- Accuracy is key. You need to make sure the numbers are right. No one wants to make decisions based on bad data.

- Clarity is important. Reports should be easy to read and understand, even for people who aren’t financial experts.

- Timeliness matters. Reports need to be available when they’re needed, so decisions can be made promptly.

9. Expense Management

Expense management is all about controlling costs. It’s not just about cutting back; it’s about making sure money is spent wisely and efficiently. Think of it as getting the most bang for your buck. It’s a key skill for anyone involved in budgeting, as it directly impacts the bottom line. RoboApply can help you highlight your expense management skills on your resume, making you a more attractive candidate.

Expense Tracking

Keeping tabs on where the money goes is the first step. You can’t manage what you don’t measure. This involves recording all expenses, categorizing them, and regularly reviewing the data. It’s about having a clear picture of spending patterns. For example, I once used a simple spreadsheet to track my personal expenses for a month. It was eye-opening to see how much I was spending on coffee! Accurate tracking is the foundation of effective expense management.

Cost Reduction Strategies

This is where you find ways to lower expenses without sacrificing quality or productivity. It could involve negotiating better deals with suppliers, finding cheaper alternatives, or streamlining processes to eliminate waste. The goal is to identify areas where costs can be cut without negatively impacting operations. I remember when my company switched to a different internet provider and saved a ton of money each month. It was a simple change, but it made a big difference.

Policy Implementation

Having clear expense policies is crucial for controlling spending. These policies should outline what expenses are allowed, how they should be documented, and the approval process. It ensures everyone is on the same page and helps prevent unauthorized spending. Think of it as setting the rules of the game. A well-defined policy can prevent a lot of headaches down the road. For example, a clear travel expense policy can avoid confusion and disputes.

Vendor Negotiation

Getting the best possible prices from vendors is a key part of expense management. This involves researching different vendors, comparing prices, and negotiating favorable terms. It’s about being a savvy shopper and getting the most value for your money. I once negotiated a lower price with a supplier by simply asking for a discount. You’d be surprised how often it works! Effective management requires transferable skills like negotiation.

Budget Compliance

Making sure expenses stay within the allocated budget is essential. This involves monitoring spending, identifying variances, and taking corrective action when necessary. It’s about staying on track and avoiding overspending. I always compare my actual expenses to my budget each month to see if I’m on target. If not, I make adjustments to my spending habits. Here’s an example of how to show budget compliance on your resume:

- Consistently adhered to departmental budgets, minimizing overspending.

- Implemented cost-saving measures that resulted in a 10% reduction in expenses.

- Proactively identified and addressed potential budget variances.

Reporting and Analysis

Regularly reporting on expenses and analyzing spending patterns is important for identifying trends and making informed decisions. This involves creating reports, analyzing data, and presenting findings to management. It’s about turning raw data into actionable insights. I use charts and graphs to visualize my spending data and make it easier to understand. This helps me identify areas where I can improve my expense management. A strong delivery manager resume will highlight reporting skills.

Expense management is not just about cutting costs; it’s about optimizing spending to achieve the best possible results. It requires a combination of skills, including tracking, analysis, negotiation, and policy implementation. By mastering these skills, you can help your organization save money and improve its financial performance.

10. Return On Investment

Return on Investment (ROI) is a big deal in budgeting. Basically, it’s figuring out how much bang you get for your buck. It helps you decide if a project or investment is actually worth the money. You need to know how to calculate it, analyze the results, and then use that info to make smart decisions. RoboApply can help you tailor your resume to show off your ROI skills, making you a more attractive candidate.

Understanding ROI is key to making informed financial decisions.

Here’s the thing, ROI isn’t just a number; it’s a way to compare different opportunities and see which ones give you the best return. It’s about being strategic with your resources.

ROI is a critical metric for evaluating the efficiency of investments and guiding resource allocation decisions.

Here’s a simple breakdown:

- Calculate ROI: Know the formula (ROI = (Net Profit / Cost of Investment) x 100).

- Analyze Results: Understand what a good ROI looks like for your industry.

- Apply Insights: Use ROI data to prioritize projects and investments.

Think of it like this: you’re deciding between two projects. Project A costs $10,000 and is expected to bring in $15,000 in revenue. Project B costs $20,000 and is expected to bring in $30,000. Which one is better? Let’s calculate the ROI:

- Project A: (($15,000 – $10,000) / $10,000) x 100 = 50% ROI

- Project B: (($30,000 – $20,000) / $20,000) x 100 = 50% ROI

In this case, both projects have the same ROI. But what if Project B was expected to bring in $40,000?

- Project B: (($40,000 – $20,000) / $20,000) x 100 = 100% ROI

Now, Project B is the clear winner. Being able to show that you can analyze these scenarios and make the right call is a huge plus. Make sure to highlight your investment analysis skills on your resume. You can use this guide to find finance resume examples.

Thinking about what you get back for what you put in? It’s a big deal, especially when it comes to your career. Our tool helps you land that dream job faster, meaning you start earning sooner. Want to see how much time and effort you can save? Check out our website to learn more!

Wrapping It Up: Your Budgeting Skills Matter

So, there you have it. Getting your budgeting skills down on your resume in a clear way can really make a difference. It’s not just about listing what you can do; it’s about showing how those skills have helped in real situations. Think about the numbers, the projects, and the ways you’ve made things better. When you put your resume together, remember to pick out the skills that fit the job you want. A good resume isn’t just a list; it tells a story about what you can bring to the table. Keep practicing those skills, and keep updating your resume to show off your latest wins. You’ve got this.

Frequently Asked Questions

How often should I update the budget skills on my resume?

You should update your resume any time you learn new budgeting skills or have new achievements related to money management. Make sure each update is important and fits the jobs you want.

Should I include budget-related side projects or volunteer work on my resume?

Yes! If you’ve managed money for a club, a charity, or even your own side business, those experiences show you’re good with budgets. Pick the best examples and explain how they prepared you for a job.

How should I present budget side projects or volunteer work on my resume?

To show off your budget side projects or volunteer work, create a special section called “Relevant Experience.” For each project, say what you did, what skills you used, and any big successes. If you don’t have much space, just pick the most impressive ones.