Looking for a job as a credit analyst? It can feel like a big deal to make your resume stand out. You need to show off your skills in finance, risk assessment, and how you handle numbers. This guide has ten Credit Analyst Resume Examples to help you put together a great resume for 2025. We’ll give you some ideas and tips to help you get noticed by hiring managers.

Key Takeaways

- Make sure your resume clearly shows your skills in financial analysis and risk assessment.

- Use numbers to show what you’ve achieved, like how much money you saved or helped make.

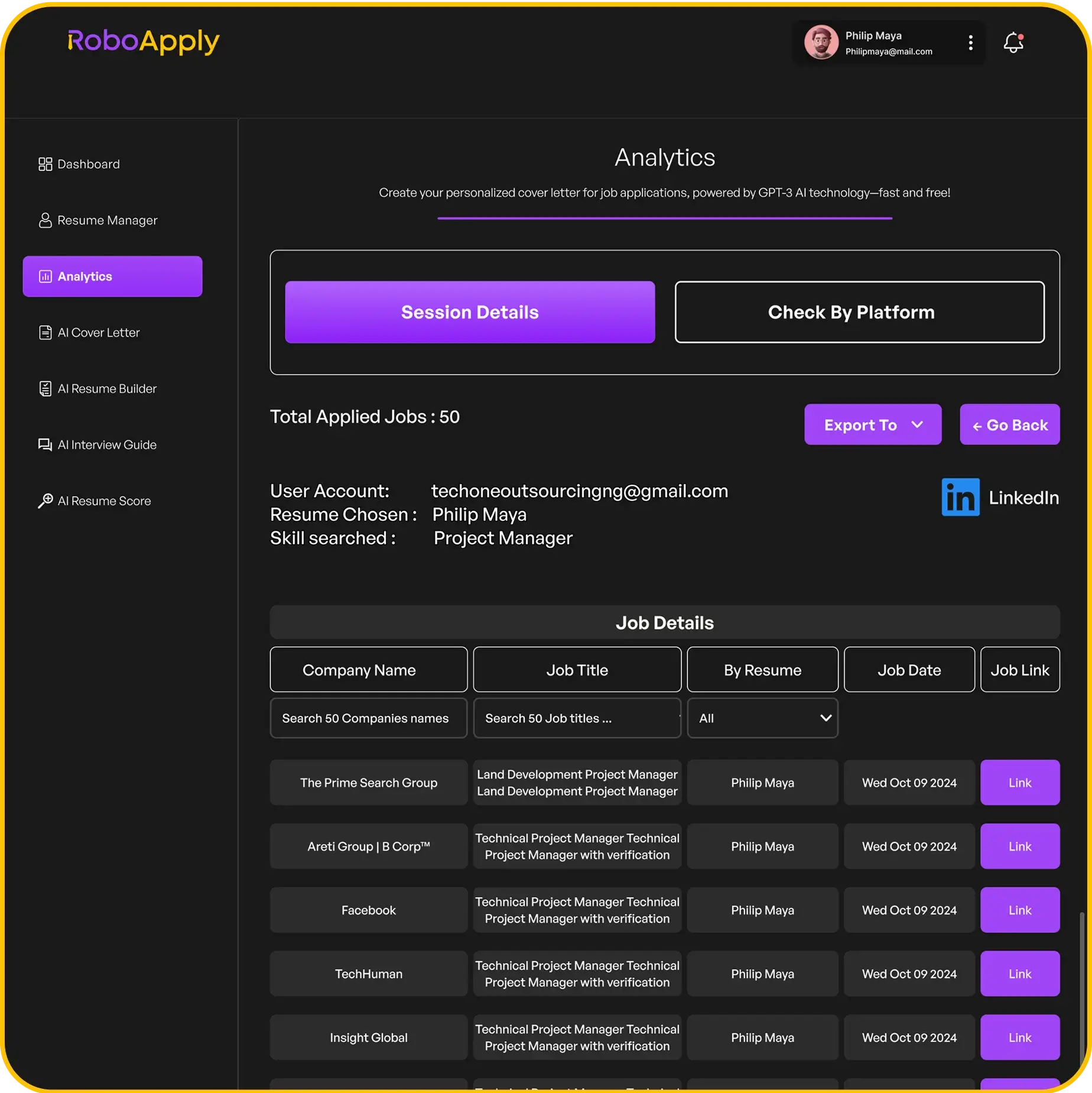

- Tailor your resume for each job application, matching your skills to what they’re looking for.

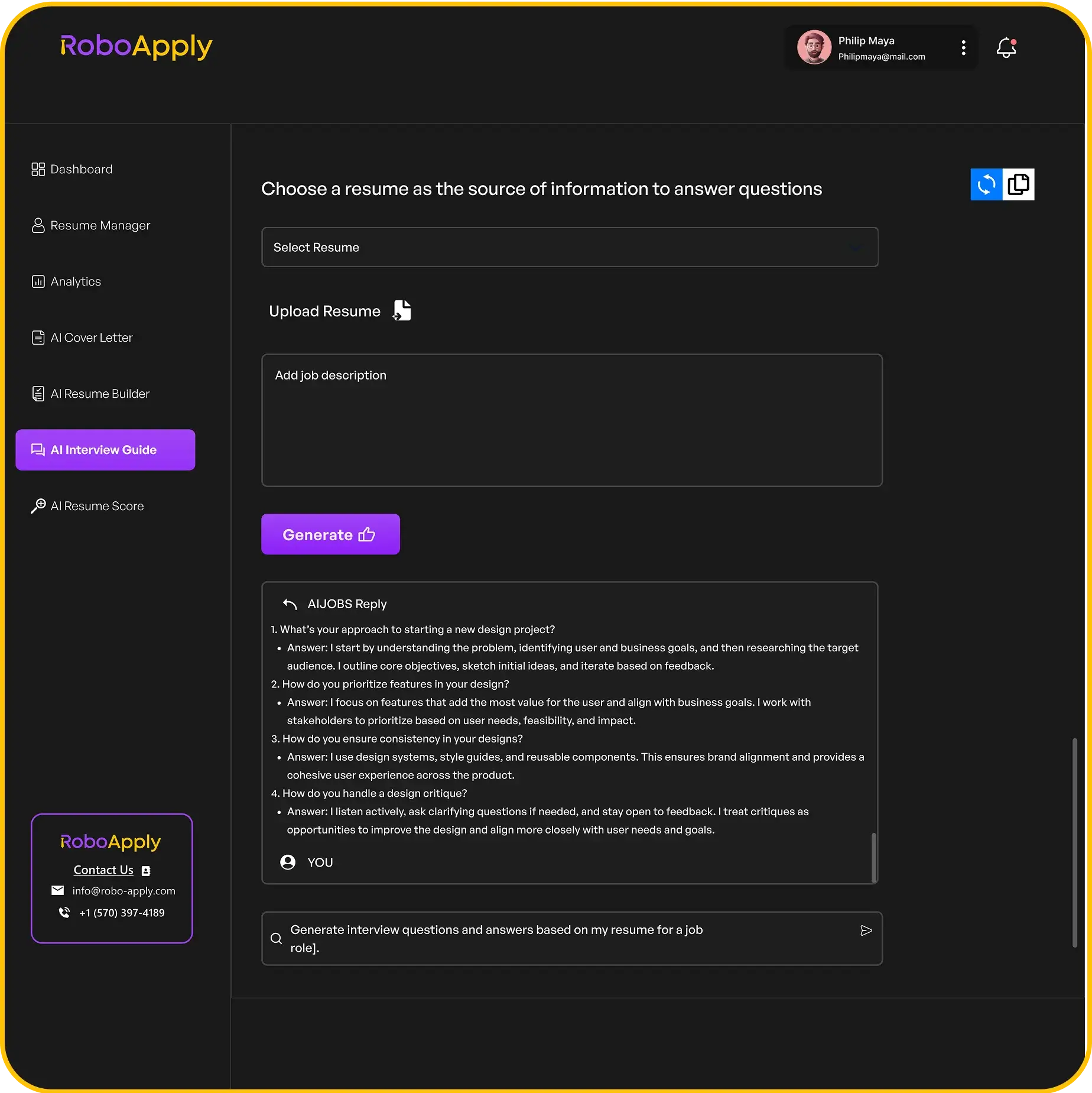

- Include any special certifications or software you know that are important for credit analysis.

- Proofread your resume carefully to avoid any mistakes; a clean resume makes a good impression.

1. Private Risk Credit Analyst Resume

Private risk credit analysts focus on evaluating the creditworthiness of individuals or entities with substantial assets, often involving complex financial situations. Your resume needs to demonstrate your ability to assess risk in these unique scenarios. It’s about showing you understand the nuances of private wealth and investment.

Here’s what to keep in mind:

- Highlight experience with high-net-worth individuals or private equity.

- Showcase your skills in financial modeling and risk assessment.

- Quantify your achievements whenever possible (e.g., “Reduced portfolio risk by 15%”).

When describing your experience, focus on the specific challenges and solutions you encountered in private credit risk. What unique factors did you consider? How did you mitigate potential losses?

Consider this example:

- Analyzed and monitored credit risk for a $200M loan portfolio, resulting in a 15% decrease in non-performing assets through strategic risk mitigation efforts.

- Streamlined the due diligence process using advanced Excel macros and financial modeling, reducing the analysis time by 30% while maintaining accuracy.

- Led a team of 5 junior analysts, enhancing departmental productivity by 20% and improving report quality through effective mentorship and training in analytical tools like Moody’s Analytics.

Remember to tailor your resume to each specific job application, emphasizing the skills and experiences that are most relevant to the position. You can also create a resume that highlights your analytical skills.

2. Commercial Credit Analyst Resume

Commercial credit analysts focus on evaluating the creditworthiness of businesses rather than individuals. This role requires a strong understanding of B2B transactions and corporate finance. You’ll be analyzing financial statements, liabilities, and annual reports to determine a company’s ability to repay loans. Tailoring your resume to highlight your experience in this area is key.

Here’s what to keep in mind:

- Highlight B2B Experience: Emphasize any experience you have working with businesses, such as analyzing their financial health or managing commercial accounts. This shows you understand the specific challenges and opportunities in the commercial lending world.

- Showcase Financial Analysis Skills: Commercial credit analysis relies heavily on financial analysis. Make sure to showcase your skills in financial modeling, ratio analysis, and cash flow forecasting. Mention any specific software or tools you’re proficient in.

- Quantify Your Achievements: Whenever possible, quantify your achievements with numbers and metrics. For example, you could mention how you improved loan portfolio performance or reduced risk exposure. This helps demonstrate the impact of your work.

A strong commercial credit analyst resume demonstrates a clear understanding of business finance and risk assessment. It should highlight your ability to analyze complex financial data and make sound lending decisions.

- Financial Analysis: Ability to interpret financial statements and assess financial health.

- Risk Management: Skills in identifying and mitigating potential credit risks.

- Industry Knowledge: Familiarity with various industries and their specific financial characteristics.

Remember to tailor your resume to each specific job application, highlighting the skills and experience that are most relevant to the position. A well-crafted resume can significantly increase your chances of landing an interview and securing your dream job as a commercial credit analyst. Make sure to highlight your analytical skills to stand out.

3. Senior Credit Analyst Resume

When you’re aiming for a senior role, your resume needs to shout experience and results. It’s not just about listing what you did, but showing how you made a difference. Think quantifiable achievements and leadership examples.

Here’s what a senior credit analyst resume might look like:

Your Name

Senior Credit Analyst

City, Country • (123) 456-789 • [email protected] • linkedin.com/in/your-profile

EXPERIENCE

Senior Credit Analyst

Company A July 2013 – December 2016

Evaluated credit risk for corporate loan applications, approving $100 million in new loans while maintaining an NPL ratio below 1.5%

Developed a credit monitoring system that early-flagged potential defaults, leading to a 10% decrease in overdue accounts

Collaborated with underwriting and sales teams to refine credit policies, resulting in a 15% increase in loan approval rates and a 12% rise in client retention

Senior Credit Analyst

Company B May 2017 – July 2020

Conducted in-depth financial statement analysis for a portfolio of 50+ high-value corporate accounts, which contributed to a 5% revenue increase for the bank.

Played a key role in developing risk assessment policies that reduced loan defaults by 12%, utilizing insights from Argus software for commercial real estate projections.

Successfully trained and integrated two new credit analysis software platforms, RiskCalc and CLOs, which improved productivity and analytical depth for the entire credit analysis team.

Focus on showcasing your analytical skills and your ability to make sound credit decisions. Highlight any leadership roles or contributions to process improvements. Remember, it’s about demonstrating your impact on the organization’s financial health.

Here are some key things to include:

- Quantifiable Achievements: Instead of just saying you

4. Entry-Level Credit Analyst Resume

Landing that first credit analyst job can feel like a huge hurdle. You might think, “How can I prove I’m capable without tons of experience?” The trick is to highlight your potential, skills, and education effectively. Let’s look at how to craft an entry-level resume that gets noticed.

Beginner Credit Risk Analyst Resume Sample

When you’re just starting out, your resume needs to shout, “I’m eager to learn and ready to contribute!” Focus on your academic achievements, relevant coursework, and any internships or projects that showcase your analytical abilities. Don’t underestimate the power of a well-crafted objective statement to grab the reader’s attention.

Recent finance graduate with strong analytical skills and a passion for credit analysis. Eager to leverage academic knowledge and internship experience to contribute as an Entry-Level Credit Analyst. Adept at financial analysis, data interpretation, and supporting senior analysts in credit assessments.

Here’s what you might include in your experience section, even if it’s just internships:

- Credit Analyst Intern

- Bank of America, Charlotte, NC

- June 2023 – August 2023

- Assisted in reviewing credit applications and analyzing financial statements.

- Supported the credit risk assessment process by preparing preliminary reports.

- Collaborated with the team to evaluate creditworthiness and monitor portfolio performance.

- Finance Intern

- Barclays, Charlotte, NC

- June 2022 – August 2022

- Provided analytical support for financial projects and research.

- Assisted in data collection and analysis for financial reports and presentations.

- Developed financial models to forecast investment performance.

Also, make sure to include a skills section. Some skills to highlight are:

- Financial Modeling

- Data Analysis

- Risk Assessment

- Financial Reporting

- Decision-Making

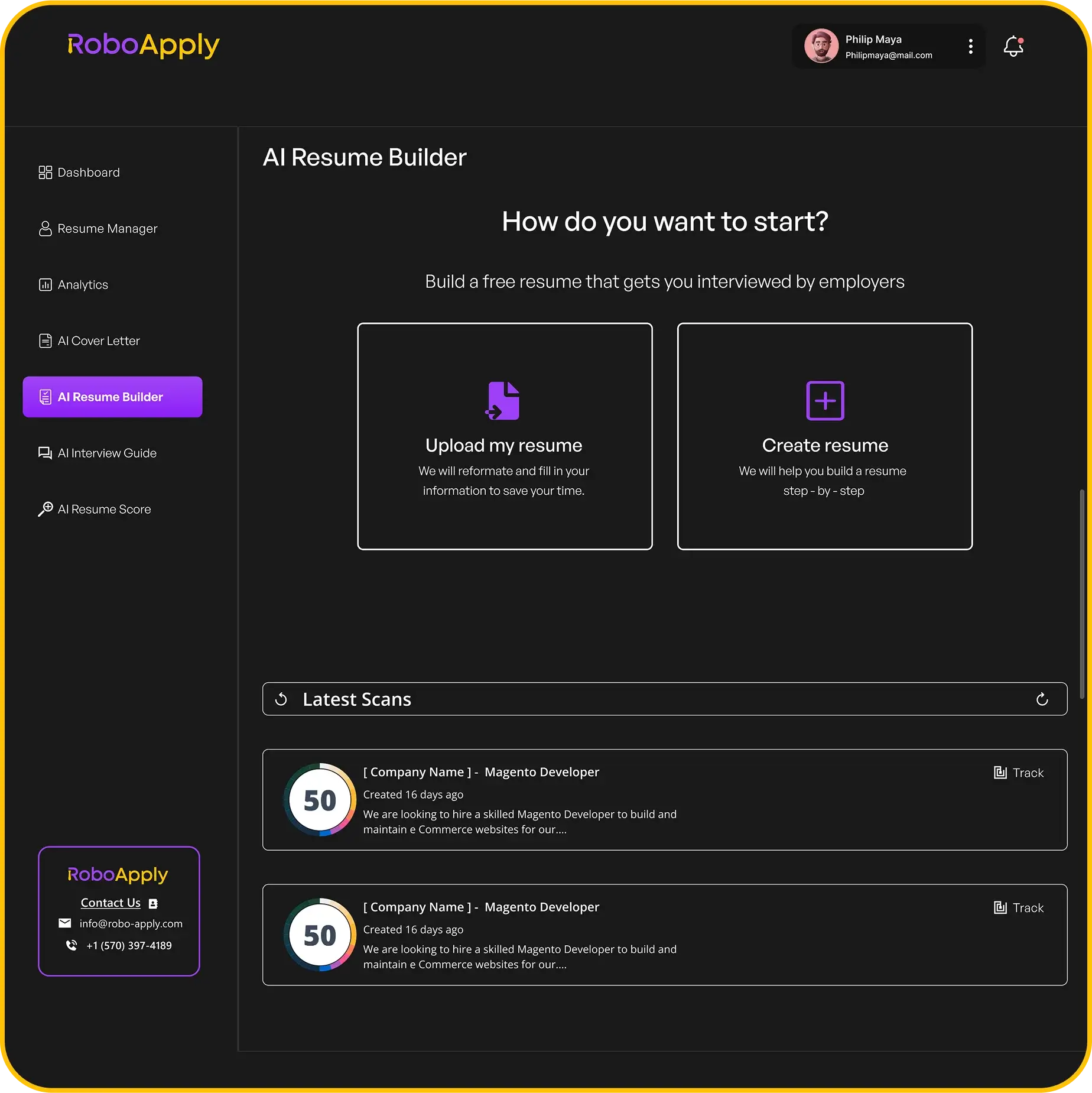

Remember to tailor your resume to each specific job application. Research the company and the role, and then adjust your resume to match their needs. A well-targeted resume shows that you’re genuinely interested and have taken the time to understand what they’re looking for. You can also use an AI resume builder to help you get started.

Education First, or Experience?

If you’re a recent grad, put your education section at the top. This highlights your academic background in finance, economics, or business. If you have some relevant work experience, lead with that instead. Your professional experience shows how you can apply your knowledge in real-world situations.

5. Bank Credit Analyst Resume

Bank credit analysts play a vital role in assessing the creditworthiness of individuals and businesses seeking loans from a bank. Your resume needs to highlight your understanding of banking practices and risk management. Let’s look at how to make your resume stand out.

To make sure your resume is up to par, consider these points:

- Showcase your experience with financial statement analysis. Banks want to see that you can dig into the numbers and understand a company’s financial health.

- Highlight any experience you have with loan documentation and compliance. Banks operate under strict regulations, so experience in this area is a plus.

- Quantify your achievements whenever possible. For example, mention the size of the loan portfolios you’ve managed or the percentage of loan defaults you helped reduce.

A strong bank credit analyst resume demonstrates not only your analytical skills but also your understanding of the banking industry’s specific needs and regulations. Tailor your resume to each specific bank you’re applying to, highlighting the skills and experiences that are most relevant to their operations. Make sure to include resume examples to help guide you.

Remember to tailor your resume to the specific bank and position you’re applying for. Research the bank’s values and the specific requirements of the role, and then highlight the skills and experiences that align with those needs. A well-crafted resume will significantly increase your chances of landing an interview. Also, remember to highlight your attention to detail.

For example, you might include something like this in your experience section:

- Analyzed financial statements and credit reports to assess the creditworthiness of loan applicants.

- Prepared loan presentations and recommendations for senior management.

- Monitored loan portfolios to identify and mitigate potential risks.

- Ensured compliance with all relevant banking regulations and policies.

By following these tips, you can create a bank credit analyst resume that showcases your skills and experience and helps you land your dream job. Don’t forget to check out bank teller resume examples for additional inspiration.

6. Mortgage Credit Analyst Resume

Mortgage credit analysts play a vital role in the home-buying process. They assess the creditworthiness of applicants to determine the risk associated with lending them money for a mortgage. Your resume needs to showcase your ability to analyze financial data, understand lending regulations, and make sound judgments.

A strong mortgage credit analyst resume highlights your analytical skills, attention to detail, and knowledge of mortgage lending practices. It should also demonstrate your ability to communicate effectively with both internal teams and external clients.

- Detail-oriented: Mortgage analysis requires meticulous attention to detail to ensure accuracy and compliance.

- Analytical skills: You must be able to analyze financial statements, credit reports, and other relevant data to assess risk.

- Communication skills: Clear and concise communication is essential for explaining your findings and recommendations to stakeholders.

To really stand out, quantify your achievements whenever possible. For example, mention how you improved loan processing times or reduced default rates. Let’s get into it!

7. Consumer Credit Analyst Resume

Consumer credit analysts focus on evaluating the creditworthiness of individual consumers. This role is common in banks, credit card companies, and other lending institutions that provide credit to individuals. Your resume should highlight your ability to assess risk, analyze credit reports, and make sound lending decisions.

Example

Let’s say you helped reduce loan defaults by implementing a new scoring model. That’s something to highlight! Or maybe you streamlined the application process, leading to more approvals. Quantify these achievements whenever possible.

Key Skills to Highlight

- Credit Scoring Models: Expertise in using and interpreting credit scoring models (e.g., FICO, VantageScore). Show that you understand how these models work and how to use them effectively.

- Credit Report Analysis: Ability to thoroughly analyze credit reports to identify potential risks and red flags. This includes understanding credit history, payment patterns, and debt levels.

- Regulatory Compliance: Knowledge of relevant regulations and laws related to consumer lending (e.g., Fair Credit Reporting Act, Truth in Lending Act). Staying compliant is super important.

- Communication Skills: Clear and effective communication skills to explain credit decisions to applicants and internal stakeholders. You need to be able to explain complex stuff simply.

- Data Analysis: Proficiency in using data analysis tools and techniques to identify trends and patterns in consumer credit data. Being able to spot trends is a huge plus.

Resume Summary Example

Consumer Credit Analyst with 5+ years of experience in the banking industry. Proven ability to assess credit risk, analyze financial data, and make informed lending decisions. Implemented a new credit scoring model that reduced loan defaults by 15%. Strong knowledge of regulatory compliance and consumer lending practices.

Tailoring Your Resume

Make sure to tailor your resume to each specific job application. Highlight the skills and experiences that are most relevant to the position. Use keywords from the job description to help your resume get noticed by applicant tracking systems (ATS). Consider using a resume example to help you get started. Also, remember to proofread carefully before submitting your application. A well-crafted resume can significantly increase your chances of landing an interview. If you’re also applying for tax positions, make sure to check out some tax accountant resume examples too!

8. Government Credit Analyst Resume

Government credit analysts play a vital role in assessing the financial stability and creditworthiness of entities seeking government funding or support. They ensure taxpayer money is used responsibly and that risks are minimized. Your resume should highlight your understanding of government regulations, financial analysis skills, and ability to make sound recommendations.

- Demonstrate experience with governmental accounting standards and financial reporting requirements.

- Showcase your ability to interpret and apply relevant laws and regulations.

- Quantify your impact by mentioning successful projects or recommendations that saved taxpayer money or improved financial outcomes.

When crafting your government credit analyst resume, emphasize your commitment to public service and your understanding of the unique challenges and opportunities within the government sector. Tailor your resume to match the specific requirements of the agency or department you are applying to.

For example, you might include a section detailing your experience with specific government programs or initiatives. You could also highlight any certifications or training related to government financial management. Remember to use clear and concise language, avoiding jargon that may not be familiar to all readers. If you need to create a resume that will capture attention, make sure to follow these tips.

9. Credit Analyst Resume Templates

Finding the right template can really make your resume stand out. It’s not just about aesthetics; it’s about presenting your information in a way that’s easy for recruiters to digest. Think of it as packaging your skills and experience in the most appealing way possible. There are tons of options out there, from minimalist designs to more elaborate layouts, so take your time and find one that fits your personal brand and the type of role you’re targeting.

When choosing a template, consider the following:

- Readability: Is the font easy to read? Is there enough white space?

- Relevance: Does the template suit the credit analyst role? Avoid overly creative templates for more conservative industries.

- ATS Compatibility: Can applicant tracking systems easily parse the information? Some fancy templates can cause issues.

Using a well-structured template can significantly improve your chances of getting noticed. It shows you pay attention to detail and understand professional presentation.

Remember to tailor the template to your specific experience and the job description. Don’t just fill in the blanks; make it your own. A generic resume won’t cut it in today’s competitive job market. Make sure to highlight your analytical skills and experience effectively.

There are many resources online where you can find templates. Some popular options include:

- Microsoft Word: Offers a variety of basic resume templates that can be customized.

- Canva: Provides a wide range of visually appealing templates, some of which are free.

- Resume.com: Features templates specifically designed for different industries and job titles.

Pro Tip: Always save your resume as a PDF to ensure the formatting stays consistent across different devices and operating systems. This prevents any unexpected changes when the hiring manager opens your resume.

Don’t underestimate the power of a good template. It can be the difference between your resume getting a second look or ending up in the rejection pile. Take the time to find one that works for you, and then customize it to showcase your unique skills and experience. Remember to focus on crafting an effective resume to increase your chances of landing an interview.

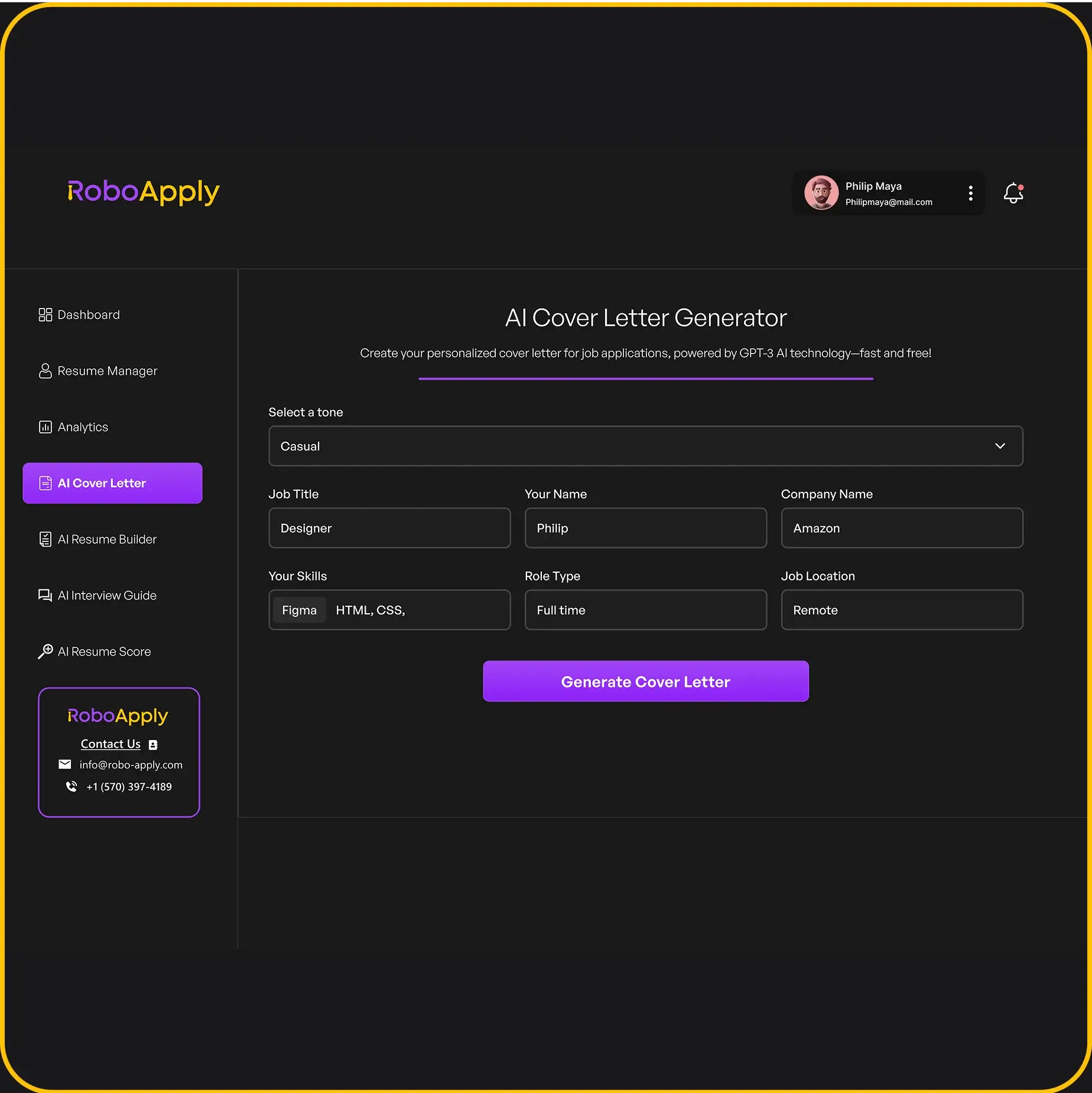

10. Credit Analyst Cover Letter

A cover letter is your chance to make a strong first impression. It’s a formal document you send with your resume, giving you space to explain your background and why you’re a good fit for the job. Think of it as your personal sales pitch, highlighting your skills and enthusiasm.

Key Elements of a Strong Cover Letter

A good cover letter should include:

- A compelling opening: Grab the reader’s attention right away. Mention the specific position you’re applying for and how you found the opening. Show your excitement and make them want to keep reading. For example, you might start with something like, “I am writing to express my keen interest in the Credit Analyst position at [Company Name], as advertised on [Platform].”

- Highlight relevant skills and experience: Don’t just repeat your resume. Instead, expand on your most relevant skills and experiences. Explain how they align with the job requirements and provide specific examples of your accomplishments. Use action verbs and quantify your achievements whenever possible. Think about how your tasks you performed in previous roles can translate to success in this new opportunity.

- Tailor it to the specific job: Generic cover letters are a big no-no. Take the time to research the company and the specific role. Show that you understand their needs and explain how you can contribute to their success. Mention specific projects or initiatives that resonate with you and explain why. This shows you’ve done your homework and are genuinely interested in the opportunity.

- Showcase your personality: Let your personality shine through. Be professional but also be authentic. Let the hiring manager get a sense of who you are as a person. This can help you stand out from other candidates with similar qualifications. A well-crafted cover letter can really set you apart.

- Proofread carefully: Typos and grammatical errors are a major turnoff. Proofread your cover letter carefully before submitting it. Ask a friend or colleague to review it as well. A polished cover letter shows attention to detail and professionalism.

A cover letter is more than just a formality; it’s an opportunity to connect with the hiring manager on a personal level and demonstrate your passion for the role. It allows you to tell your story and explain why you’re the best candidate for the job.

Example Snippet

Here’s a short example of how you might structure a paragraph highlighting your skills:

“In my previous role as a Credit Analyst at [Previous Company], I was responsible for analyzing financial statements, assessing credit risk, and making lending recommendations. I consistently exceeded expectations, achieving a [quantifiable achievement, e.g., 15%] reduction in loan defaults within my first year. My banking cover letter demonstrates my ability to quickly learn new systems and adapt to changing market conditions.”

Want to land that credit analyst job? A great cover letter can make all the difference. It’s your chance to show off your skills and why you’re the perfect fit. Don’t miss out on our tips to make your letter shine. Check out our website for more help on your job search!

Wrapping Up Your Credit Analyst Resume

So, there you have it. Getting your credit analyst resume just right can feel like a big job, but it’s really about showing what you can do clearly and simply. Think about the examples we looked at and the tips we talked about. Make sure your resume tells a good story about your skills and what you’ve achieved. A well-made resume can definitely help you get noticed by hiring managers. Take your time, check everything, and good luck with your job search!

Frequently Asked Questions

What does a credit analyst do?

A credit analyst looks at how risky it is to lend money to people or businesses. They check financial papers and past payment habits to decide if someone can pay back a loan. This helps banks and companies avoid losing money.

What education do I need to be a credit analyst?

To become a credit analyst, you usually need a degree in finance, accounting, economics, or a related field. Some jobs might ask for a master’s degree or special certifications like the CFA (Chartered Financial Analyst).

What skills are important for a credit analyst?

Credit analysts need to be good with numbers, pay close attention to details, and be able to think critically. They also need to know how to use financial software and understand economic trends. Good communication skills are important too.

Can I get a credit analyst job with no experience?

Yes, many entry-level jobs are available for credit analysts. These roles often involve learning the basics of financial analysis and risk assessment under the guidance of more experienced team members.

What should I put on my credit analyst resume?

A credit analyst resume should highlight your skills in financial analysis, risk management, and using financial tools. Include any projects where you helped improve lending processes or reduced financial risks. Use strong action words to describe your achievements.

How can I make my credit analyst resume better?

You can make your resume stand out by showing specific results. For example, instead of saying “analyzed data,” say “analyzed data, which led to a 15% reduction in bad loans.” Also, tailor your resume to each job you apply for.

How long does it take to find a credit analyst job?

The time it takes to find a job can vary, but having a strong resume and networking can speed things up. Many people find jobs within a few months, especially if they are actively looking and applying to many places.

Are credit analysts in high demand?

Yes, credit analysts are in demand because businesses always need to manage financial risks. As the economy changes, the need for skilled analysts who can make smart lending decisions remains strong.