So, you’re looking to put together a great Collections Specialist Resume? Good idea! It can feel a bit tricky to make your resume stand out, especially when you want to show off your skills in getting payments and keeping customers happy. This guide is here to help you do just that. We’ll go over some examples and tips to make sure your resume looks good and gets noticed. It’s all about showing what you can do, plain and simple. Collections Specialist Resume | Powered by RoboApply.

Key Takeaways

- Make sure to highlight your negotiation skills and how you handle customer accounts. These are super important for a Collections Specialist.

- Include examples of how you’ve helped companies get payments back. Numbers and real situations make your resume stronger.

- Don’t forget to mention any special software you know or any awards you’ve gotten. Little details can make a big difference.

1. Collections Specialist

Collections specialists are vital for maintaining a company’s financial stability by ensuring they receive owed payments. This role demands excellent interpersonal skills, as it involves discussing sensitive financial matters with individuals and companies. A strong understanding of debt collection regulations and laws is also essential.

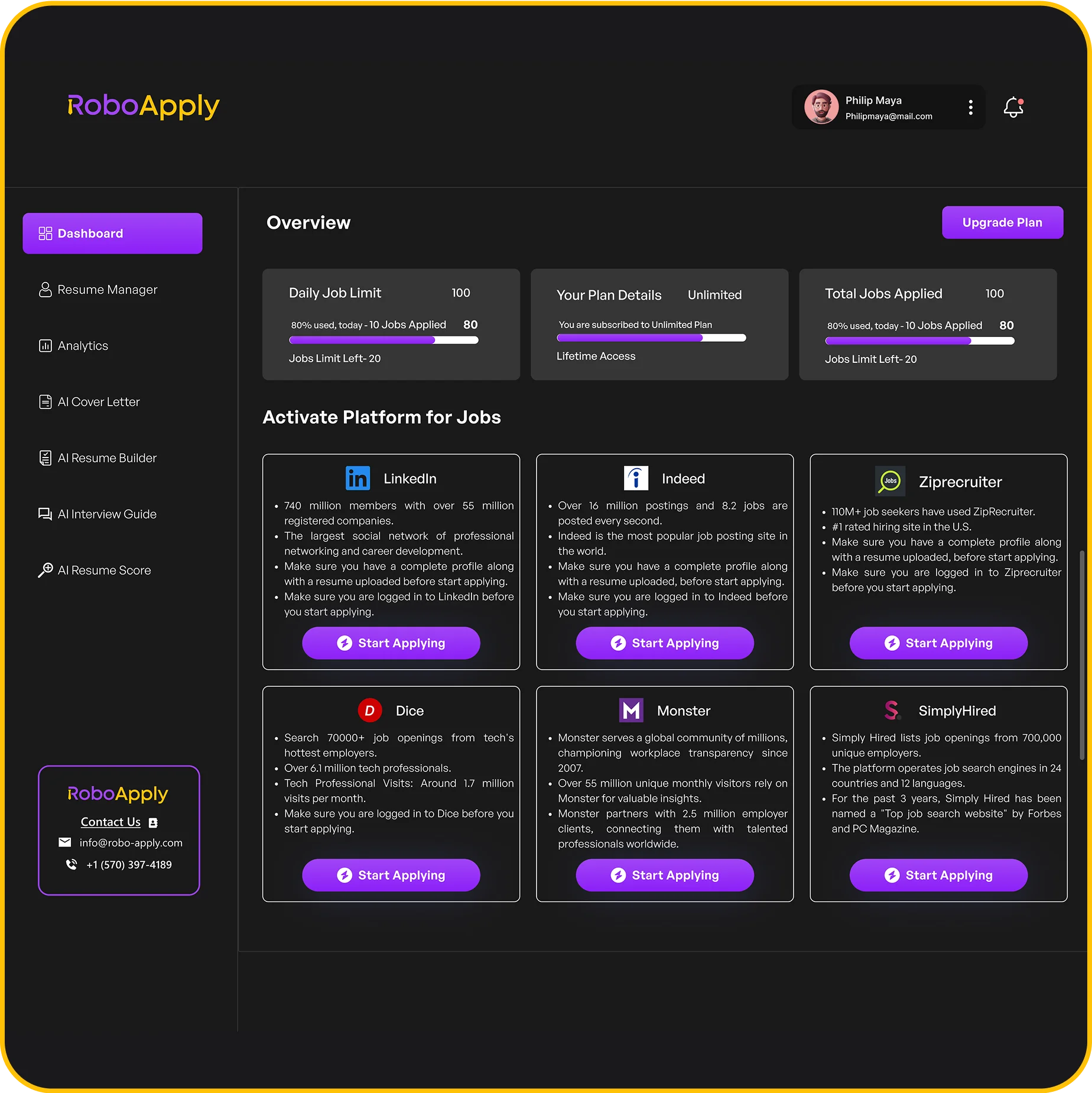

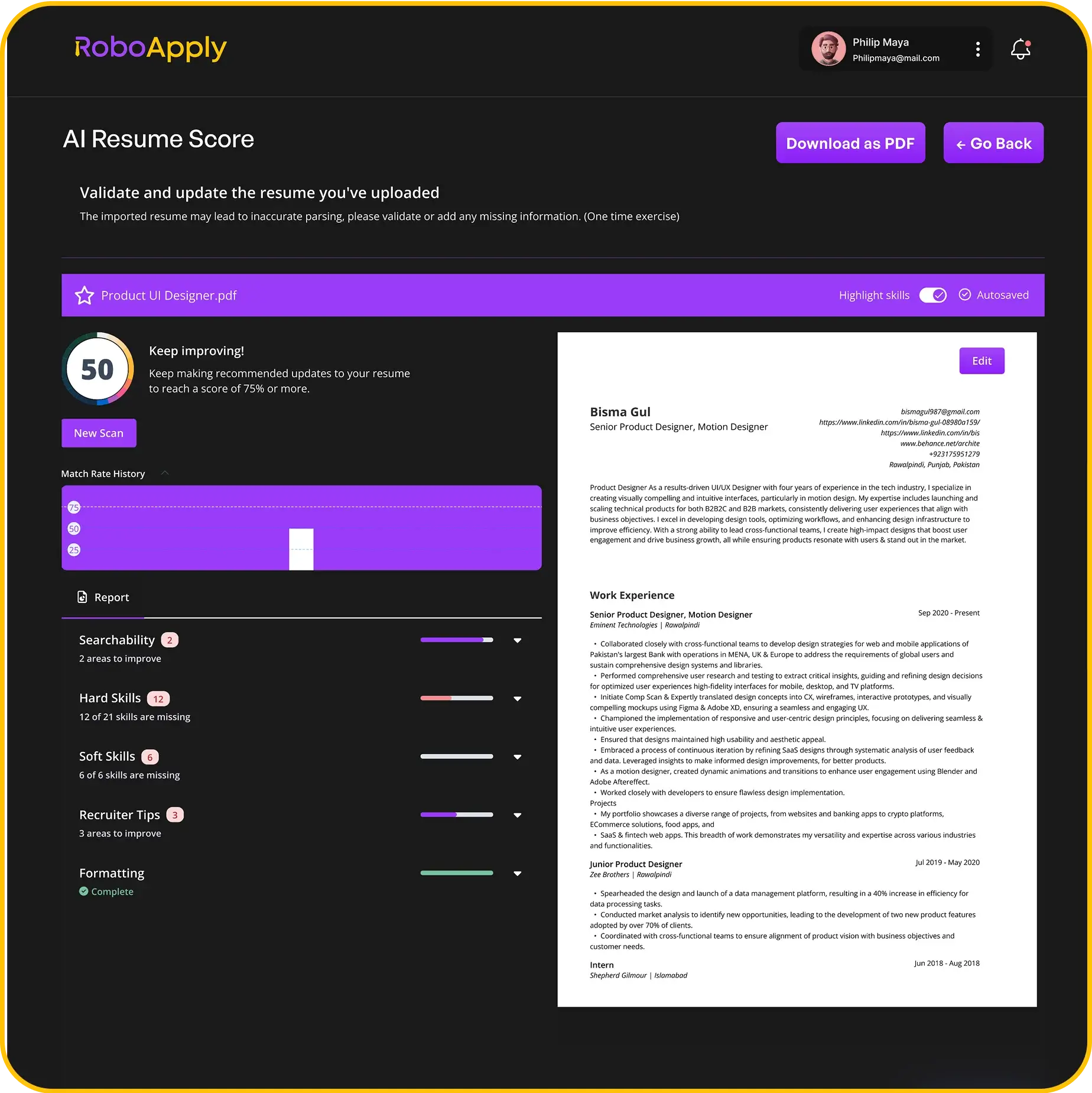

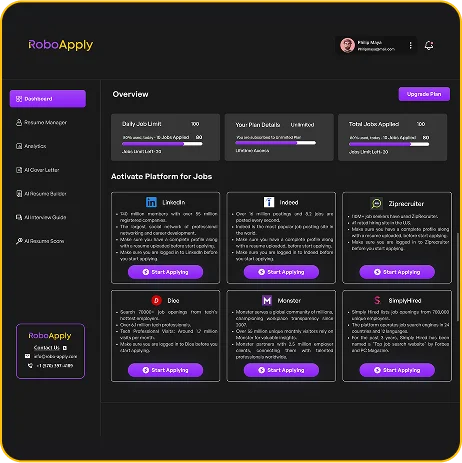

There are over 100,000 collections specialists in America, with women holding just under 70% of these positions. While over 70% have further degrees, about 24% have only high school diplomas, suggesting relatively accessible entry requirements, at least education-wise. Recruiters prioritize candidates who demonstrate regulatory knowledge, proficiency in relevant tools, and a proven track record of achievements in the field. Using RoboApply to build resumes can help highlight these qualifications effectively.

A Collections Specialist is responsible for locating debtors, informing them of overdue payments, and creating reports related to collection activities. Effective communication is key in this role.

To succeed as a collections specialist, consider the following:

- Communication: Clearly and professionally communicate with debtors regarding outstanding balances.

- Negotiation: Develop and implement repayment plans that are mutually beneficial.

- Record Keeping: Maintain accurate and detailed records of all collection activities.

Here’s an example of responsibilities:

- Send notices to taxpayers when accounts are delinquent.

- Confer with taxpayers or their representatives to discuss issues, laws, and regulations involved in returns, and to resolve problems with returns.

- Notify taxpayers of any overpayment or underpayment, and either issue a refund or request further payment.

- Maintain records for each case, including contacts, telephone numbers, and actions taken.

2. Debt Collection Specialist

Debt Collection Specialists are all about recovering money owed to a company. They’re the ones who identify outstanding debts, create strategies for debt recovery, and work out repayment plans with customers. Your resume needs to highlight your experience in debt collection and billing, and it’s super important to show off your strong communication skills.

A successful Debt Collection Specialist resume showcases a proven track record in recovering outstanding debts and effectively negotiating payment plans.

Here’s what you might include in your resume:

- Experience in debt collection processes.

- Strong negotiation skills to create payment plans.

- Familiarity with accounts receivable and billing procedures.

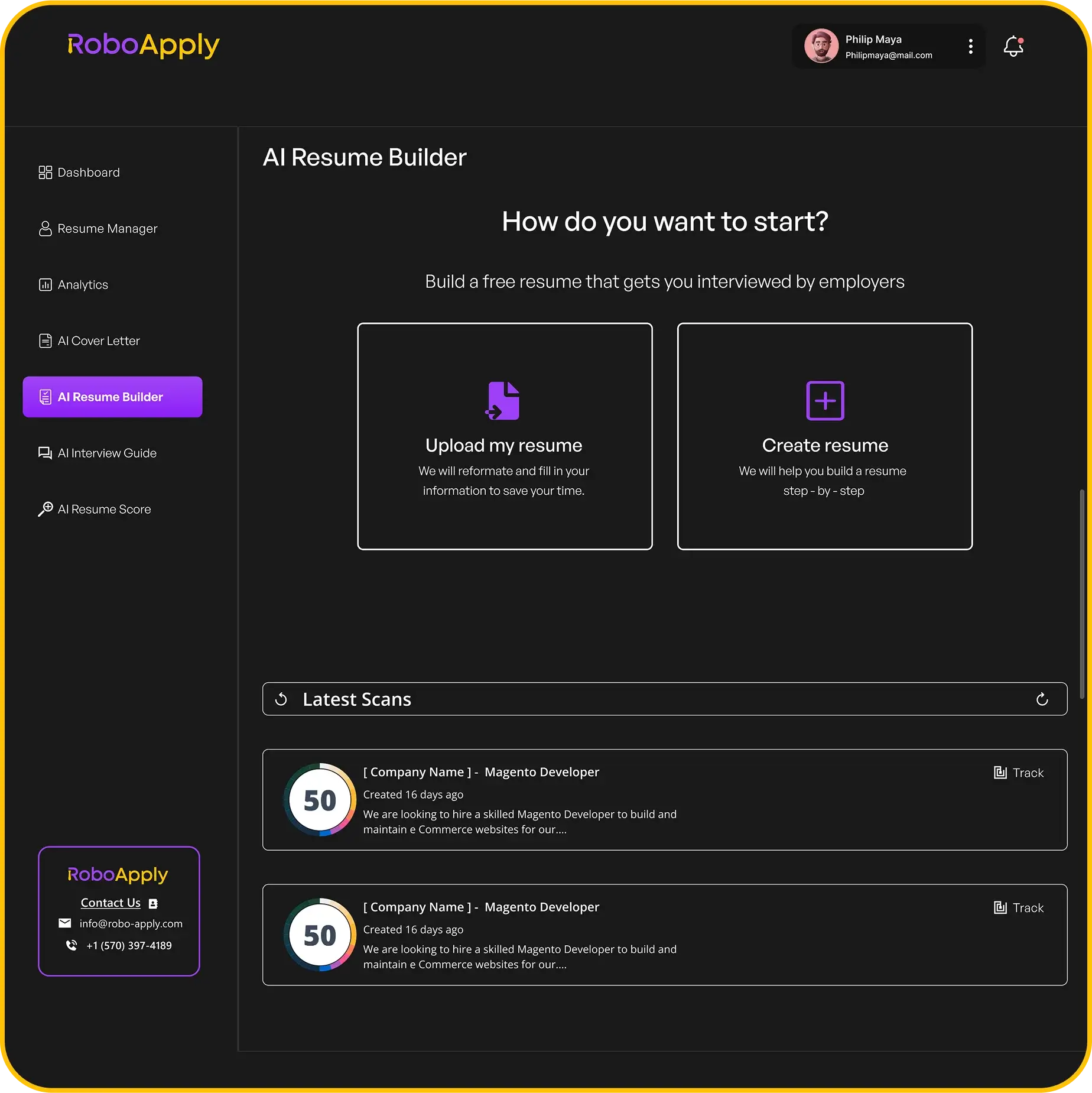

RoboApply can help you tailor your resume to emphasize these key areas, making sure you stand out to potential employers.

3. Collection Agent

Collection agents are the folks on the front lines, directly engaging with clients to recover outstanding debts. They use a variety of methods, from setting up payment plans to negotiating settlements. It’s a role that demands excellent communication skills and a solid understanding of debt collection laws. Let’s look at how to highlight these skills on your resume.

RoboApply can help you tailor your resume to showcase your strengths as a collection agent, ensuring you highlight the skills and experiences that matter most to employers.

Here’s what a Collection Agent resume might look like:

- Objective: To obtain a challenging position as a Collection Agent where I can utilize my skills in negotiation, communication, and problem-solving to maximize debt recovery and contribute to the financial success of the organization.

- Experience:

- Skills: Negotiation, Communication, Debt Recovery, Skip Tracing, Conflict Resolution, Customer Service, Compliance, Data Entry, Account Management, Problem-Solving.

A strong Collection Agent resume emphasizes not only your ability to collect debts but also your commitment to ethical and compliant practices. Highlighting your knowledge of relevant laws and regulations can set you apart from other candidates.

Here are some key skills you might want to include on your debt collection specialist resume:

- Sales

- Banking

- Customer Service

- Credit Analysis

- Data Collection

4. Header

Your resume header is prime real estate. It’s the first thing recruiters see, so make it count! It needs to be clear, concise, and easy to read. Think of it as your professional introduction.

It should include:

- Your full name

- Phone number

- Email address

- LinkedIn profile (optional, but recommended)

- Location (city, state)

Make sure your email address sounds professional. No partyanimal85@email.com! Use a variation of your name. Also, double-check that everything is accurate. A typo in your phone number means missed opportunities.

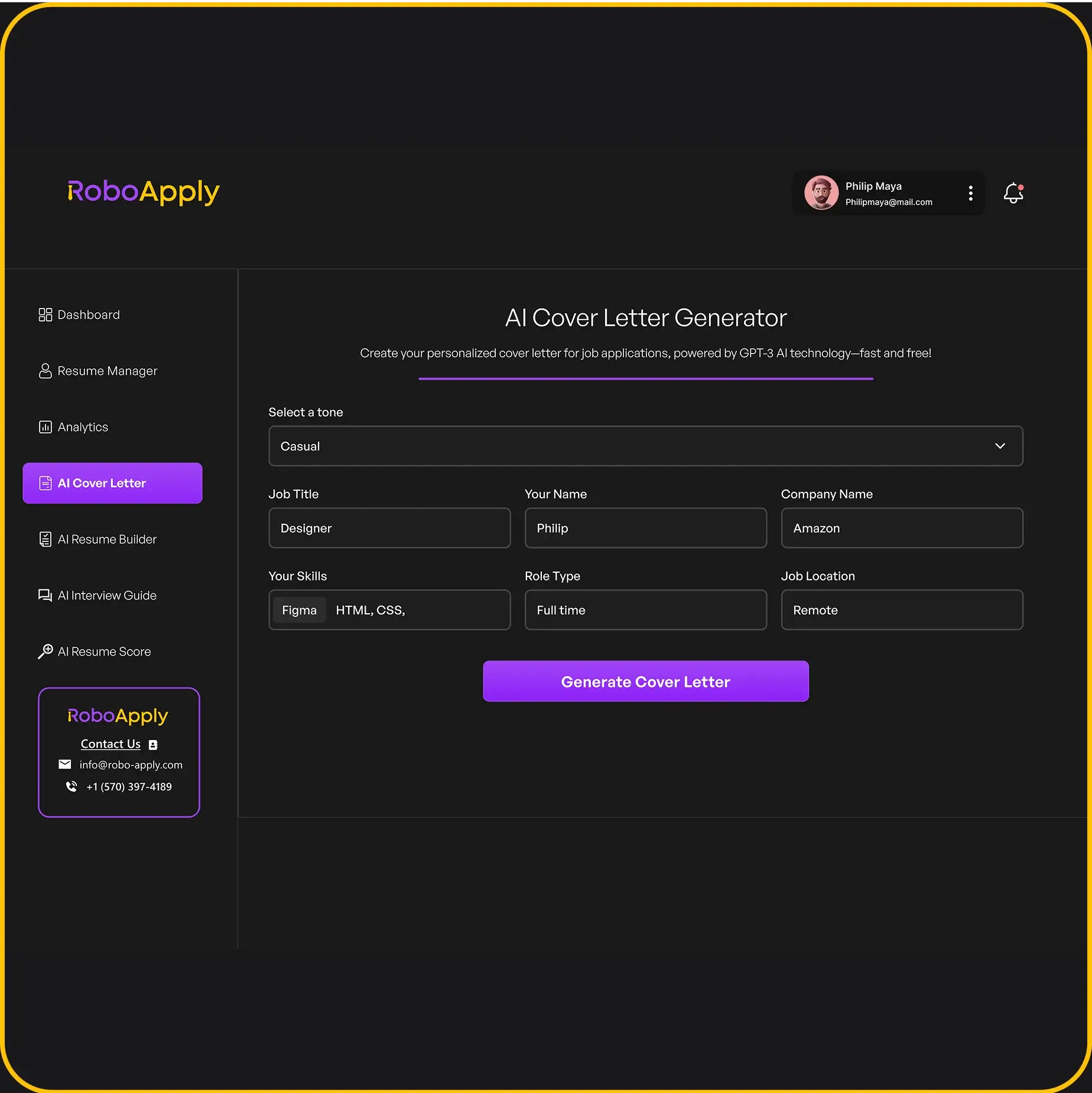

Using a tool like RoboApply can help you ensure your header is formatted correctly and includes all the necessary information. It’s a simple way to make a strong first impression. You can also check out some resume templates to get an idea of how to format your header.

5. Summary

The summary section of your collections specialist resume is your chance to make a strong first impression. It’s a brief overview of your skills, experience, and what you bring to the table. Think of it as your elevator pitch – a quick snapshot that grabs the reader’s attention and makes them want to learn more. RoboApply can help you tailor this section to match specific job descriptions, ensuring your most relevant qualifications shine.

A well-crafted summary can significantly increase your chances of landing an interview.

Here’s how to make it count:

- Keep it concise: Aim for 3-5 sentences.

- Highlight key skills: Mention skills that match the job description.

- Quantify achievements: Use numbers to show your impact (e.g., "Reduced delinquency rates by 15%").

A strong summary should immediately tell the hiring manager why you’re a great fit for the role. It’s not just about listing your experience; it’s about showcasing your value.

Let’s look at an example:

Dedicated collections specialist with 5+ years of experience in debt recovery and customer service. Proven ability to negotiate payment plans and resolve disputes effectively. Consistently exceeded monthly collection goals by 20%. Seeking a challenging role where I can leverage my skills to improve cash flow and reduce outstanding debt. This is a great way to showcase your accounts receivable management skills.

6. Experience

Okay, so the Experience section is where you really show what you’ve done. It’s not just about listing jobs; it’s about showing how you kicked butt in those roles. Think accomplishments, not just duties. Let’s get into it.

Here’s an example of how you might structure your experience section:

Work Experience

Collections Specialist

XYZ Financial Services

2013-2017

* Managed a portfolio of 500+ delinquent accounts through outbound calls and emails, consistently achieving a monthly target of $100,000 in collections.

* Negotiated payment plans with debtors, resulting in a 15% increase in successful debt recovery.

* Provided financial counseling to individuals facing debt-related issues, helping them develop personalized repayment plans.

* Managed a caseload of 100+ clients, ensuring compliance with regulatory requirements and maintaining accurate documentation.

Quantify your achievements whenever possible. Instead of saying "Improved collection rates," say "Improved collection rates by 15% in Q3 2024." Numbers speak volumes.

If you’re new to the field, don’t sweat it. You can still build a solid experience section. Think about volunteer work, internships, or even relevant coursework. Did you manage a club’s finances in college? That counts! Did you help a local charity with their fundraising? That’s relevant too. Frame these experiences to highlight skills like communication, negotiation, and problem-solving – all crucial for a collections specialist. RoboApply can help you tailor your resume to highlight these transferable skills, making your application stand out even without direct experience. For example, you can use RoboApply to refine your resume for various research positions.

Here are some ideas for those with limited experience:

- Volunteer Roles: Community involvement often equips you with valuable interpersonal skills, and sometimes even technical ones, relevant to the job.

- Freelance Work: Even small freelance gigs can demonstrate your ability to manage tasks, meet deadlines, and communicate with clients.

- Academic Projects: Relevant coursework or projects can showcase your understanding of financial principles or customer service techniques.

Remember, it’s all about how you present your experience. Make it clear, concise, and focused on what you can bring to the table. Tailor each description to match the specific requirements of the job you’re applying for. Think about using action verbs to start each bullet point. For example, instead of "Responsible for managing accounts," try "Managed a portfolio of accounts…" It sounds more active and impactful. Also, make sure to include the company name, your job title, and the dates of employment for each position. This helps provide context and credibility to your experience. If you’re looking for more examples, check out this AAA-rated collector resume.

7. Education

Okay, so let’s talk about the education section of your collections specialist resume. It’s pretty straightforward, but you want to make sure you get it right. Basically, you’re showing employers that you have the necessary background to do the job. RoboApply can help you format this section to make it look professional and easy to read.

Here’s how it usually goes:

- List your degrees in reverse chronological order. Start with your most recent degree and work your way back.

- Include the full name of the degree (e.g., Bachelor of Science in Finance), the name of the institution, and the graduation date (or expected graduation date).

- If you have any relevant certifications, like in debt collection practices, include those too.

If you don’t have a ton of work experience, you can add some relevant coursework or academic achievements to beef up this section. But keep it brief and only include things that directly relate to the job.

Let’s look at an example:

Example:

Master of Business Administration

DePaul University, Chicago, IL

Graduated: June 2023

Bachelor of Science in Finance

University of Illinois, Urbana-Champaign, IL

Graduated: May 2021

It’s clean, it’s simple, and it gives the employer the information they need. You might want to highlight your financial education if it’s relevant to the role.

8. Skills and Keywords

It’s super important to show off the right skills on your collections specialist resume. Think of it as highlighting what you’re good at and what the job needs. You want to make it easy for the hiring manager to see you’ve got what it takes. RoboApply can help you tailor your resume to match specific job descriptions, making sure you include the most relevant skills and keywords.

Hard Skills

These are the technical abilities you’ve picked up over time. Collections software is a big one. Knowing your way around tools like CollectMax or Debtmaster can really set you apart. Also, don’t forget accounting tools like QuickBooks or Sage 50cloud. Being good with customer relationship management (CRM) systems like Salesforce or HubSpot CRM is another plus. These are all things you can learn, but having them already is a major advantage.

Soft Skills

Soft skills are just as important as hard skills. These are your people skills and how you handle different situations. Communication is huge – you need to be able to talk to people clearly and effectively. Negotiation skills are also key, since you’ll often be working to find solutions with debtors. And don’t underestimate the importance of empathy; understanding where people are coming from can help you reach a resolution. These skills show you’re not just a robot following a script.

Key Skills to Include

Here’s a list of skills you should consider adding to your resume:

- Collections

- Cash Collection

- Customer Service

- Financial Analysis

- Data Analysis

It’s a good idea to create a dedicated skills section on your resume. You can also weave these skills into your experience descriptions, showing how you’ve used them in past roles. This helps demonstrate your abilities in a real-world context.

Skills Word Cloud

Think of a word cloud as a visual representation of the most important keywords in the collections specialist field. The bigger the word, the more often it shows up in job descriptions. This can give you a clue about what skills employers are really looking for. For example, you might see "communication," "negotiation," and "problem-solving" as large words, indicating their importance. Make sure to include effective strategies in your resume.

Tools and Software

Knowing specific software and tools can give you a leg up. Here are a few examples:

- Financial Tools: SAP ERP, QuickBooks, Oracle Financial Services

- Techniques: Credit Risk Assessment, Debt Recovery Strategies, Financial Analysis

- Software & Platforms: SQL, Tableau, Power BI, CRM Tools

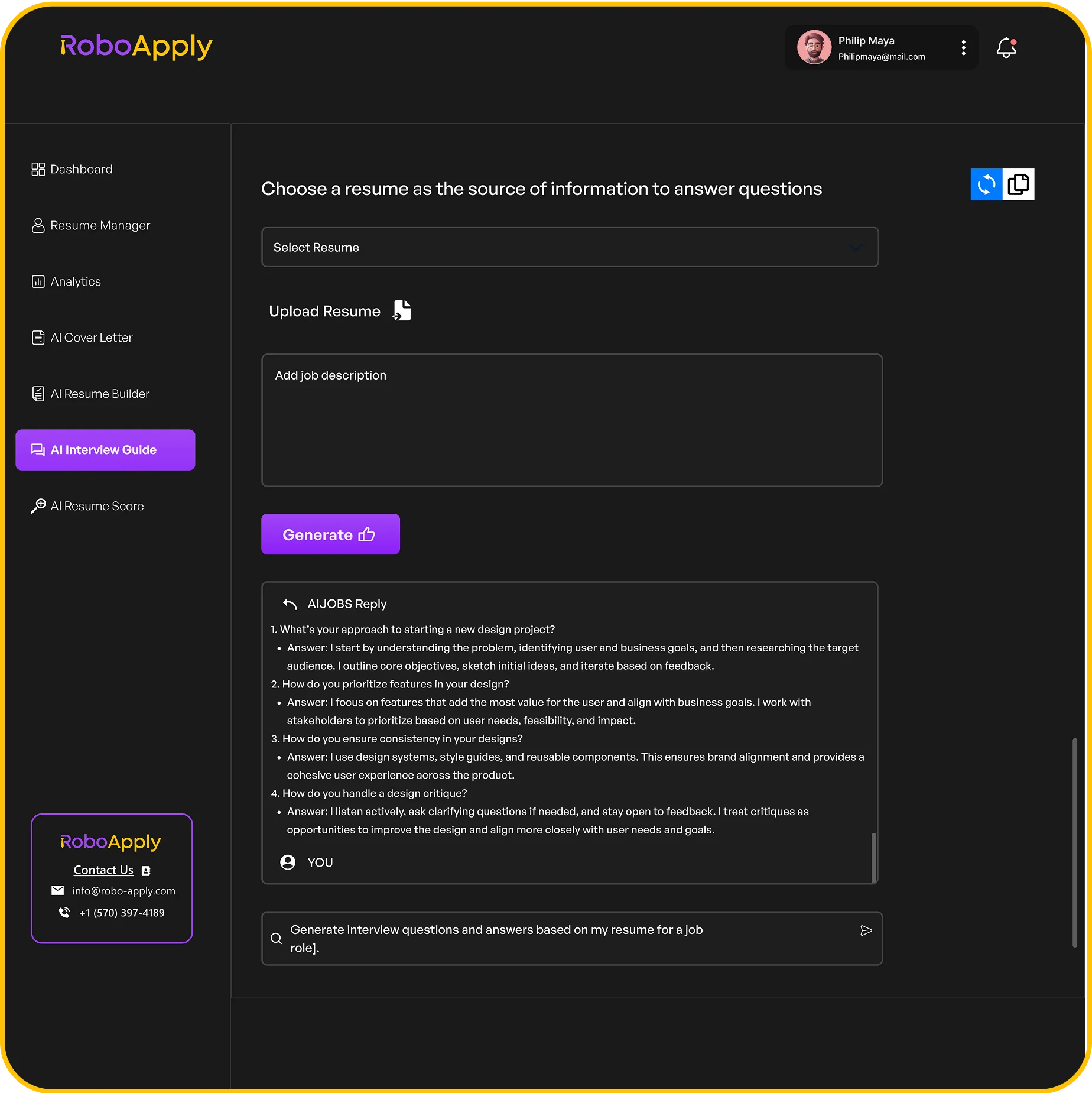

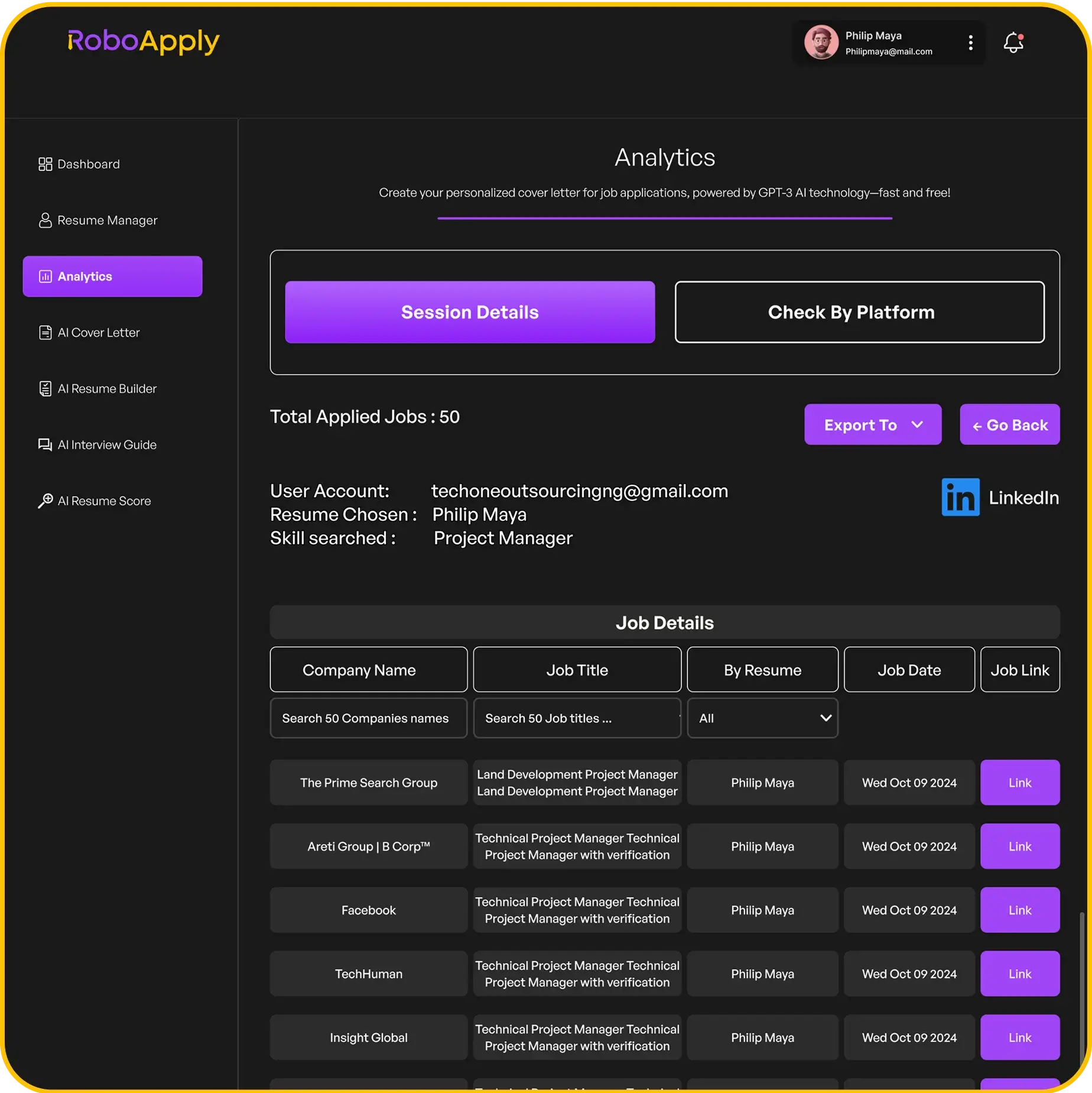

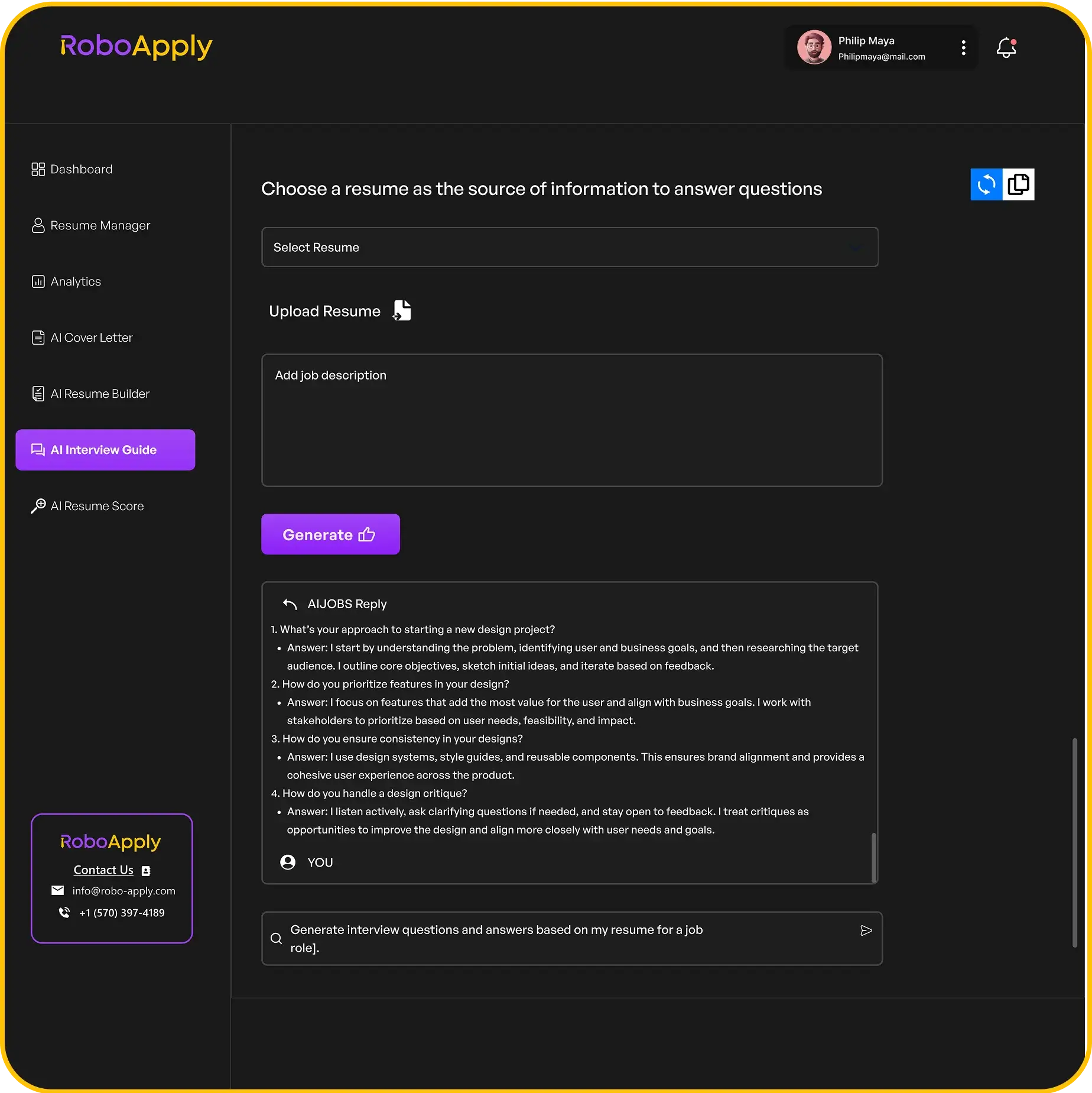

Want to make sure your resume stands out? Knowing the right skills and keywords can make all the difference. Our special tool helps you find the best words to use so your application gets noticed. Check out RoboApply today and give your job search a real boost!

Wrapping Things Up: Your Collections Specialist Resume

So, there you have it. Putting together a good collections specialist resume means showing off your skills in a clear way. Remember to focus on what you’ve actually done, like how much money you helped recover or how you improved payment times. Make sure your resume is easy to read and gets straight to the point. With a bit of effort, you can create a resume that really stands out to hiring managers.

Frequently Asked Questions

What should a strong collections specialist resume include?

A good collections specialist resume should clearly show how you’ve helped companies get back money they were owed. It needs to highlight your skills in talking to people, working out payment plans, and keeping good records. Make sure to include any special computer programs you know how to use and how good you are at solving problems. Also, if you can, mention how much money you helped collect or how much faster payments came in because of your work.

How can I make my collections specialist resume stand out?

To make your resume stand out, focus on your achievements, not just your duties. For example, instead of saying, “Managed overdue accounts,” say something like, “Helped collect 20% more overdue payments by talking to customers and setting up new payment plans.” Use numbers whenever you can to show your success. Also, tailor your resume for each job you apply for by using words from the job description.

Should I include a cover letter with my collections specialist resume?

Yes, it’s a good idea to include a cover letter. A cover letter lets you tell a short story about why you’re a great fit for the job and the company. You can explain how your skills and past experiences match what they’re looking for. It’s also a chance to show your personality and enthusiasm for the role, which a resume alone can’t always do.