A well-organized loan processor resume can make a strong impact on job applications, especially in a competitive job market. Knowing how to present skills and experience clearly helps candidates stand out to hiring managers.

This article introduces 15 real-world loan processor resume examples and a practical guide for 2025. It aims to help readers create resumes that highlight their strengths and meet current industry standards.

1) Contact Information Placement

Contact information should always go at the very top of a loan processor resume. This helps hiring managers find the applicant’s name, phone number, and email quickly. It saves time and looks professional.

The best resumes start with the full name in a larger font, followed by the phone number, a professional email address, and the city and state. Some people also add their LinkedIn URL if their profile is up-to-date.

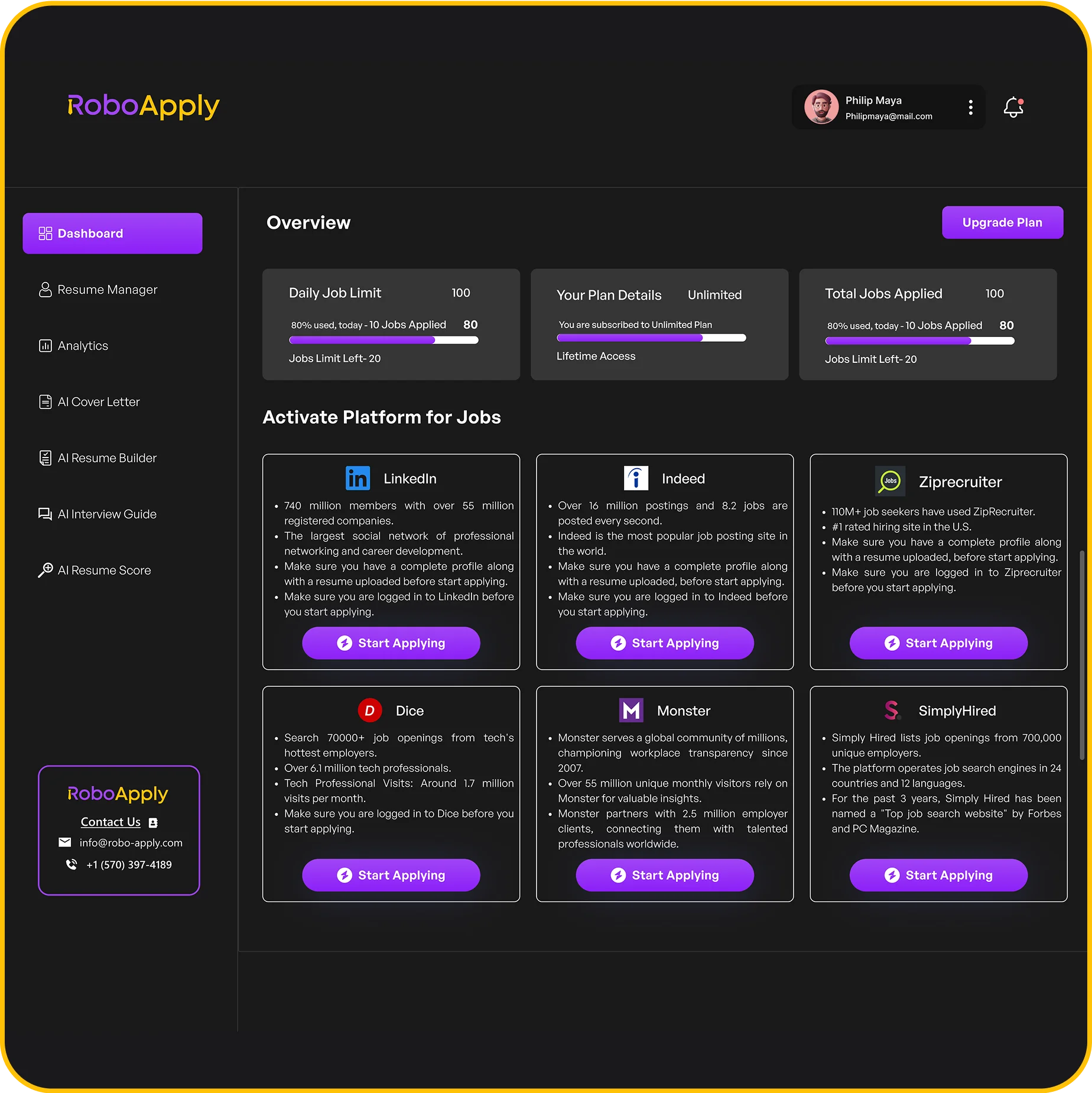

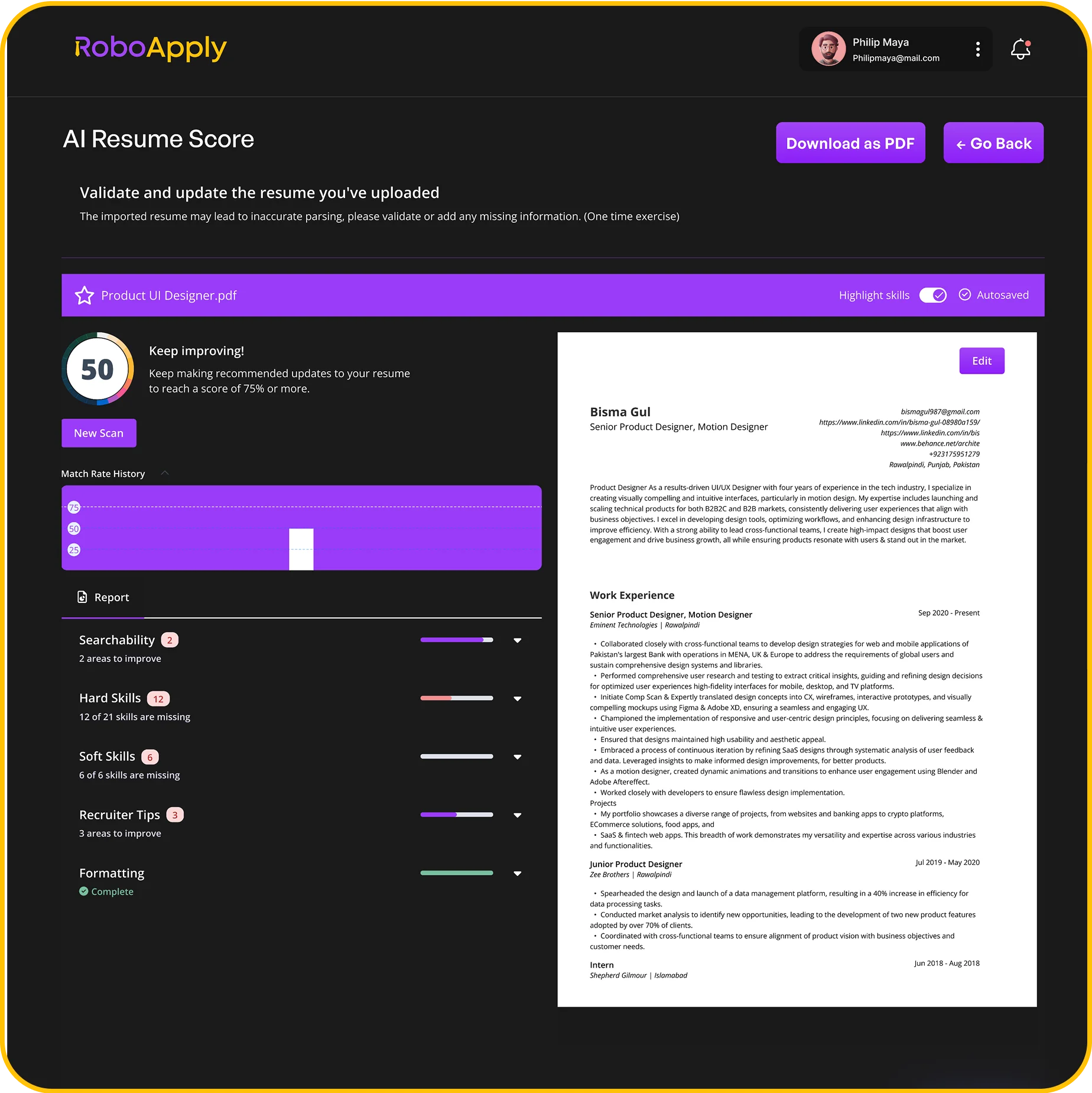

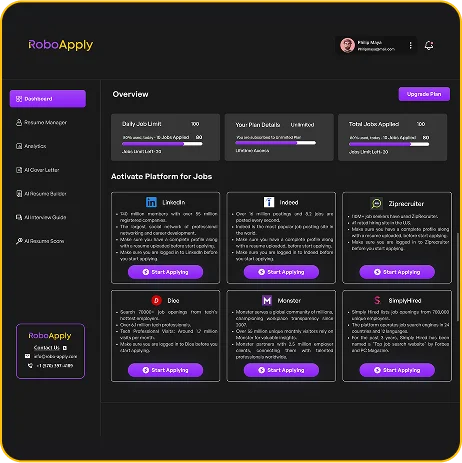

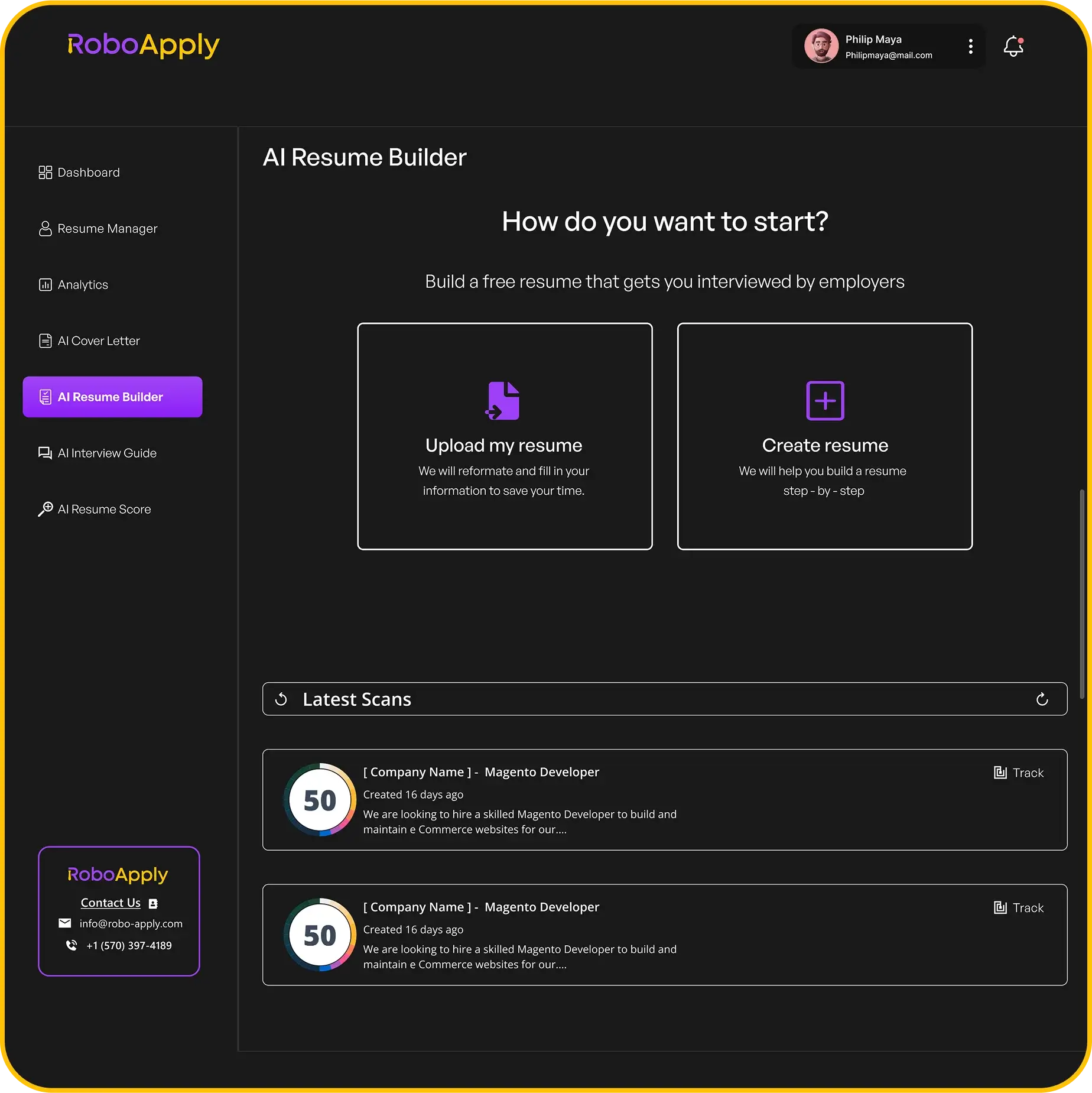

Avoid putting contact details in the header or footer, as some hiring systems may not read them there. Tools like RoboApply make it easy to format your resume correctly and ensure all important details are in view for both humans and resume scanners.

Here is an example of how to structure contact information at the top of a loan processor resume:

John Smith

(555) 123-4567

john.smith@email.com

Denver, CO

linkedin.com/in/johnsmith

Keeping the contact section clear and simple ensures that recruiters know how to reach out. This basic step is crucial for every loan processor resume.

2) Resume Summary Examples

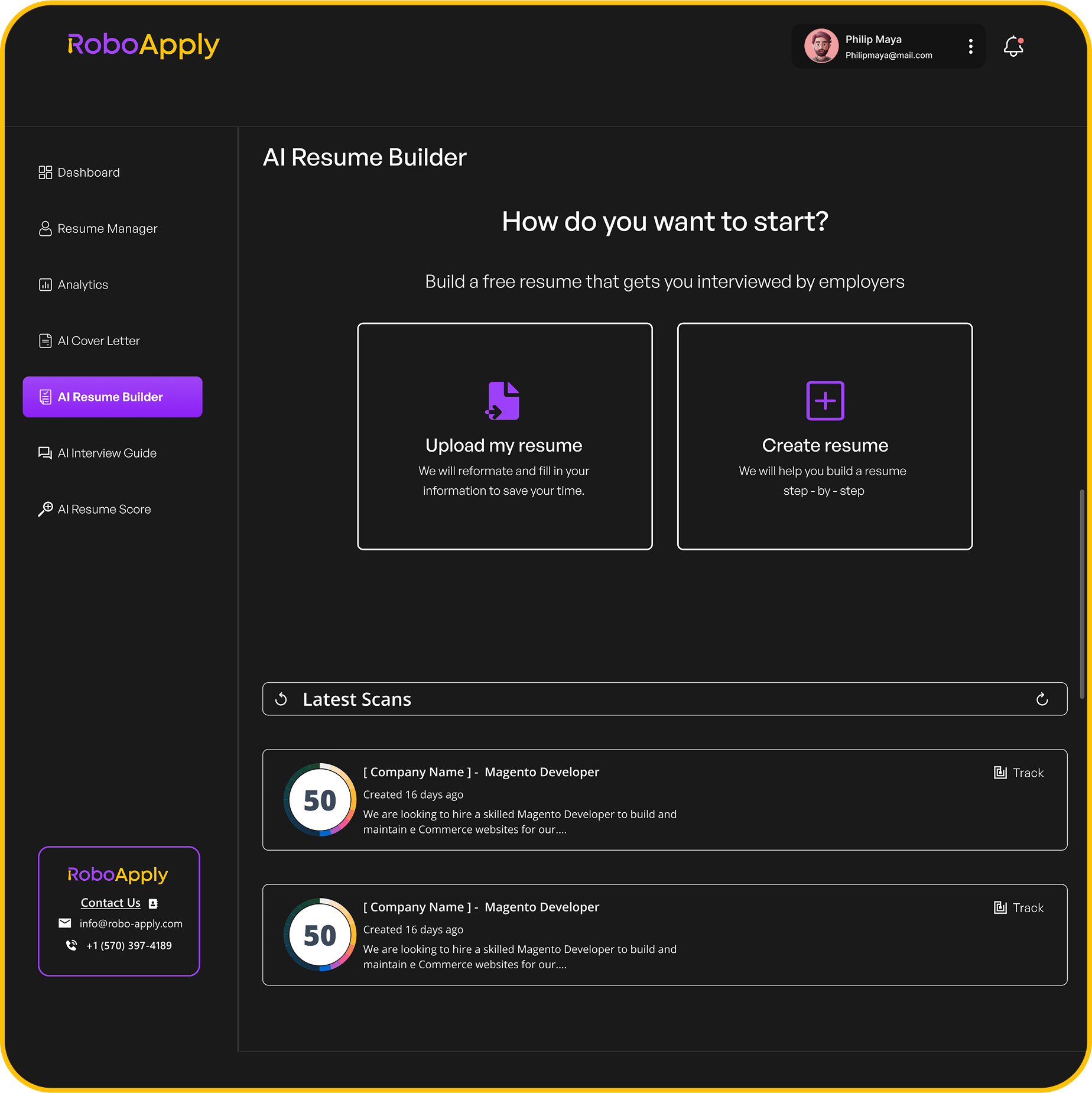

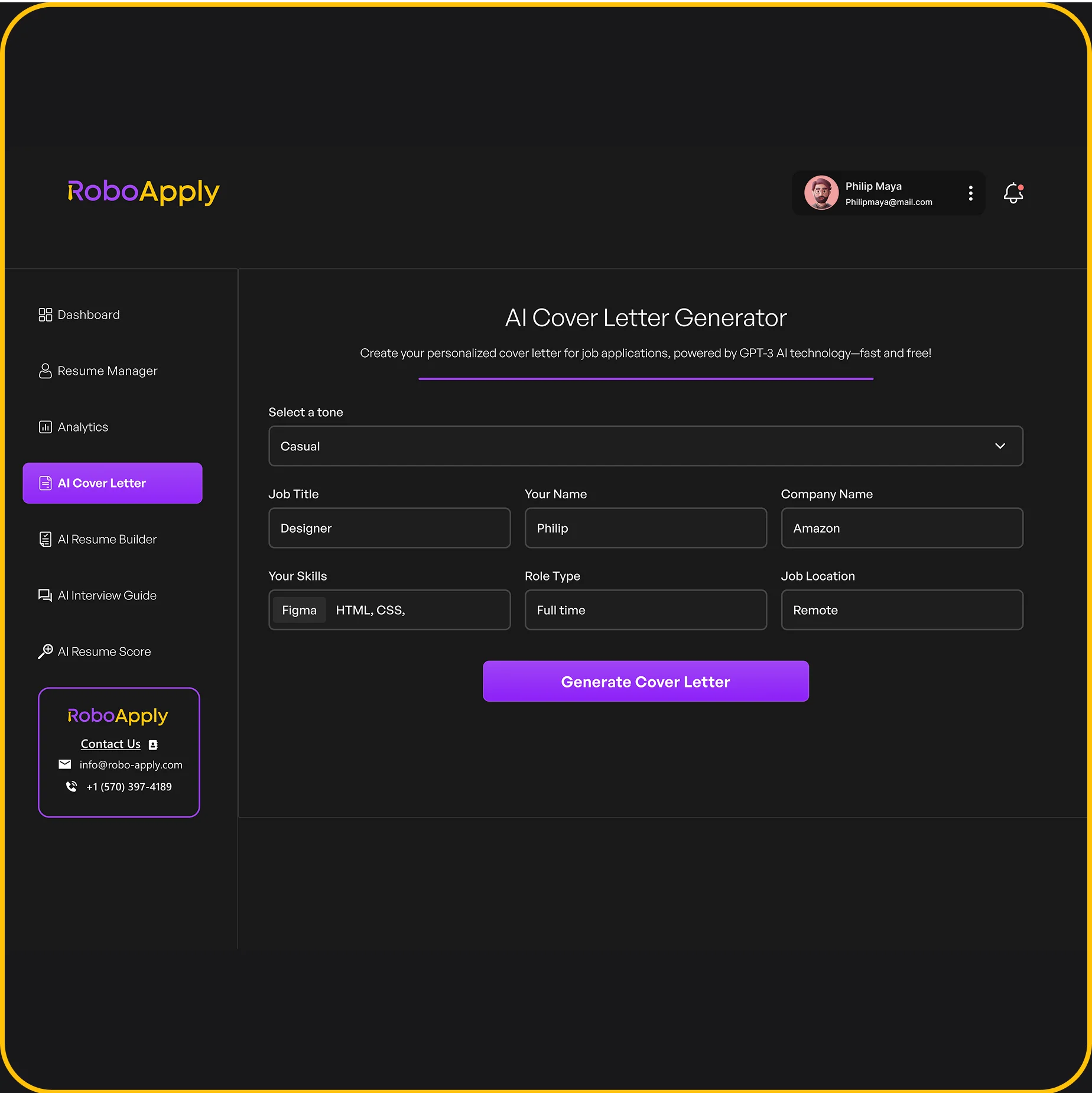

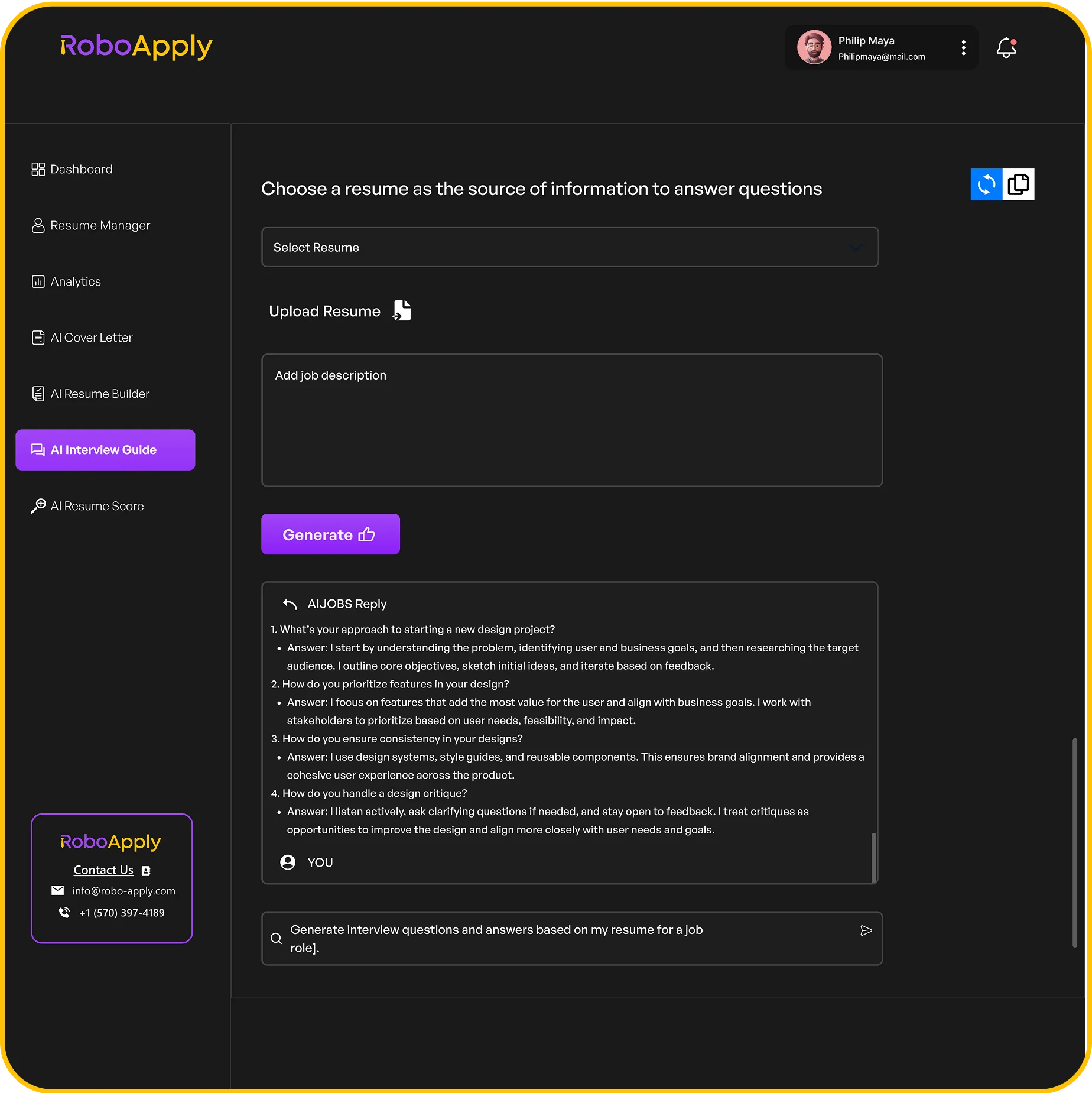

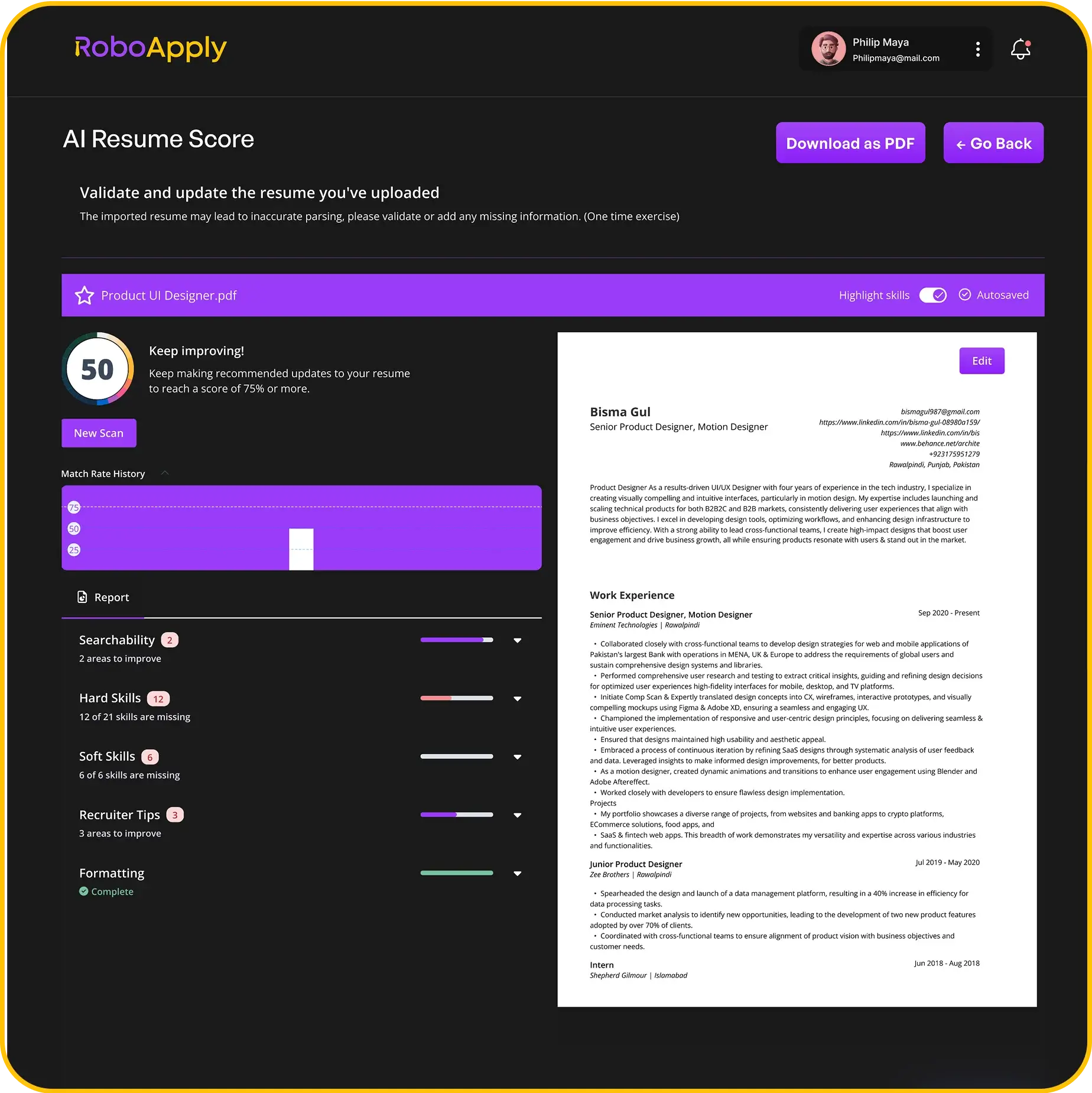

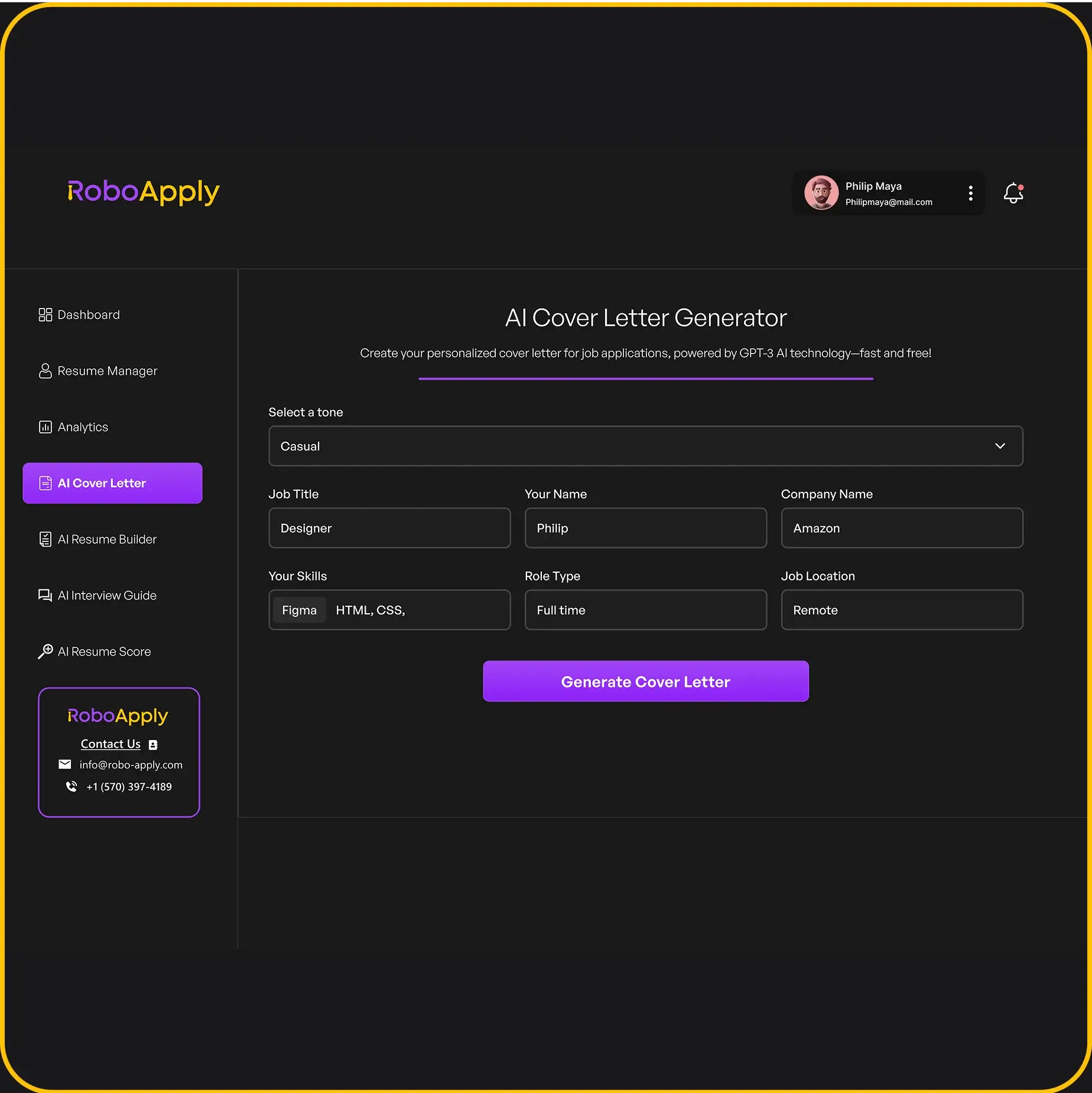

A resume summary is a short paragraph at the top of a resume that quickly highlights experience, skills, and achievements. It helps employers see right away why a candidate is a good fit. RoboApply offers smart tools like its AI resume builder and resume grammar checker to help make writing these summaries easier and more effective.

Loan processors should use their summary to emphasize attention to detail, knowledge of lending rules, and software skills. Using keywords from the job post can also help get past company screening systems. These examples are ready to use or tweak for real job applications.

Example 1:

Detail-oriented loan processor with 4+ years of experience handling documentation, verifying applicant information, and meeting strict deadlines in fast-paced banking environments. Skilled in loan origination software, compliance checks, and collaborating with underwriters. Known for excellent communication and organizational skills. Ready to streamline loan processing for ABC Bank using proven accuracy and efficiency.

Example 2:

Experienced loan processor with a strong record of supporting mortgage and consumer loan applications from submission to closing. Proficient in document review, customer communication, and staying current with federal lending guidelines. Highly organized and able to juggle multiple files at once while maintaining accuracy. Seeks to add value to Dynamic Lending Co. with reliable processing support.

Example 3:

Efficient and thorough loan processor with three years in financial services environments. Well-versed in mortgage document tracking, data entry, and client service. Adept at using loan processing platforms and ensuring files comply with industry regulations. Excited to help XYZ Financial complete more loans with fewer errors and fast turnaround times.

Bringing in tools like RoboApply early in the writing process saves time and improves summary quality. RoboApply can check summaries for grammar, help with keyword suggestions, and make sure the content is ATS-optimized for better job search results.

3) Highlighting Loan Processing Experience

Hiring managers want to see real loan processing experience listed clearly. RoboApply recommends using job titles, specific achievements, and metrics where possible. This helps employers recognize relevant industry skills right away. Listing software experience and knowledge of loan documentation practices is also important for 2025 roles.

For those needing an example, here is a plain-text resume section ready to use or customize:

Work Experience

Loan Processor

First National Bank, Dallas, TX

March 2022 – April 2025

- Reviewed and processed up to 50 mortgage loan applications weekly while maintaining 98% accuracy rate.

- Collaborated with underwriters to resolve document issues and support on-time closings.

- Managed digital files and tracked deadlines using Encompass and DocuSign.

- Consistently met monthly funding targets and passed all internal compliance audits.

It’s smart to use action verbs like “processed,” “managed,” and “collaborated” to describe duties and achievements. RoboApply’s AI resume and cover letter builder can help job seekers write and format strong bullet points like these. Including quantifiable results, such as accuracy rate and number of applications processed, makes your experience stand out at a glance.

Don’t forget to list key loan processing software and compliance knowledge. Skills like loan documentation, regulatory compliance, and digital systems are essential for today’s loan processor roles. For more tips and resume insights, review loan processor resume examples for 2025.

4) Key Loan Processor Skills

Loan processors need strong document management skills. Every day, they handle and organize loan files, ensuring that paperwork is complete and compliant. Being detail-oriented helps them spot errors and avoid costly delays.

Knowledge of underwriting guidelines is essential. Loan processors must understand how loans are evaluated and approved. Staying current with these rules helps reduce rejections and speed up applications.

Technology skills play a big role. They should be comfortable with loan processing software, spreadsheets, and office tools. RoboApply’s resume builder can highlight software proficiency and make these skills stand out.

Communication is another key skill. Loan processors often act as a bridge between clients, loan officers, and underwriters. Clear, prompt responses prevent confusion and keep applications moving forward.

Multitasking is important for handling multiple files at once. Loan processors benefit from strong organization and time management so that no loan falls through the cracks.

Compliance and accuracy matter in every task. Keeping up with financial regulations and double-checking data can prevent audit issues or loan denials. For guidance, sites like JobHero’s loan processor resume guide offer more on compliance in daily duties.

Problem-solving helps with unusual cases. When an application is missing information or has errors, loan processors find and fix these problems quickly. This keeps the process on schedule and the customer informed.

Customer service skills also make a difference. Explaining terms, answering questions, and staying patient with worried applicants can improve the loan experience.

For resume writers, RoboApply’s AI resume builder, ATS optimizer, and grammar checker can help highlight each of these areas, making a loan processor’s skills clear and professional to employers.

5) Using Action Verbs Effectively

Action verbs make a loan processor resume stronger and easier to understand. These words help showcase actual results and make each bullet point clear and direct. Instead of using vague terms, strong action verbs like “analyzed,” “processed,” or “coordinated” tell hiring managers exactly what was accomplished. For users looking to streamline phrasing and maximize impact, RoboApply’s AI resume builder can suggest the best verbs and optimize bullet points in real time.

Use action verbs at the start of each work experience bullet point. This makes the resume more dynamic and helps statements stand out in Applicant Tracking Systems (ATS). The right verbs quickly show a hiring manager the scope of each task.

Here are a few action verbs to use in a loan processor resume: reviewed, verified, processed, negotiated, communicated, coordinated, resolved, documented, and assessed. These verbs match common duties in loan processing roles and can help your accomplishments look clear and professional.

Example bullet point using action verbs: Reviewed and verified all applicant documents to ensure accuracy, compliance, and timely loan approval.

For additional ideas, visit this list of action verbs for loan processor resumes. RoboApply makes it easy to test, improve, and refine your bullet points with built-in resume grammar checks and ATS optimization features, helping users craft a strong, professional resume every time.

6) Detailing Multi-tasking Abilities

Loan processors must handle many tasks at the same time, such as gathering documents, communicating with clients, and working with underwriters. Showing strong multi-tasking skills on a resume makes it clear that the applicant can manage busy workloads and tight deadlines.

A good way to highlight multi-tasking is by listing concrete examples. Instead of just saying “multi-tasker,” describe how tasks were juggled during a typical workday or loan process.

For example:

“Managed documentation for over 40 loan applications at once, ensured timely communication with clients and lenders, and coordinated with underwriters to meet closing deadlines. Used tracking tools to organize files, monitor progress, and quickly address issues as they arose.”

Including real numbers and daily tasks helps recruiters understand the candidate’s abilities.

Using tools like RoboApply’s resume builder, applicants can quickly add and enhance multi-tasking achievements. RoboApply’s AI can suggest skills and bullet points that fit real job descriptions, saving time and improving the overall strength of the resume.

When listing these skills, focus on clarity and results. Use bullet points such as:

• Processed 25+ loans simultaneously without missing a deadline

• Balanced communication between clients, title companies, and underwriters daily

• Organized digital and paper files to streamline document retrieval

Job seekers can also use RoboApply’s ATS resume score optimizer to make sure multi-tasking keywords are highlighted. This increases their chances of passing automated screenings and getting noticed by hiring managers.

7) Including Financial Services Background

A strong financial services background can make a loan processor resume stand out. This experience shows employers that the candidate understands banking rules, loan products, and industry standards. It also shows they can work with sensitive information and stay accurate with details.

Job seekers should list past roles in banks, credit unions, mortgage companies, or related financial businesses. Add job titles, company names, and a few bullet points about job tasks. Each item should prove real experience with finances, customer service, and loan paperwork.

Including specific systems and software, such as loan origination platforms or CRM tools, is important. RoboApply’s AI resume builder helps candidates highlight technical and practical financial skills that employers look for. Listing these skills makes resumes more competitive in today’s market.

Work history from finance jobs should connect to loan processing. For example, handling loan documentation, checking credit reports, or answering customer questions about loan terms fits well. These examples show hiring managers that the candidate already knows the basics of lending.

Here’s a plain-text example for this section of a resume:

Work Experience

Banking Specialist

First National Bank, Chicago, IL

March 2022 – April 2024

- Processed new loan applications and reviewed financial documents for accuracy

- Worked with underwriters to collect missing paperwork and confirm eligibility

- Explained loan options, terms, and account details to customers in person and over the phone

- Used MeridianLink and Salesforce to organize records and track applications

8) Formatting Work Experience

Listing work experience clearly makes a loan processor resume easy to read. Use reverse chronological order, which means listing the most recent job first. Each job entry should have the job title, company name, location, and the dates worked.

Bullet points are best for describing job duties and achievements. Keep each bullet clear and direct, starting with a strong action verb—for example: “Processed loan applications using automated software, ensuring 98% accuracy.” Using numbers helps show impact.

Consistency in formatting is critical. Use the same style for each job, including bold for job titles and regular text for company names. This keeps the section neat and professional.

RoboApply’s AI resume builder makes formatting work experience easy by offering built-in templates and quick, step-by-step guidance for section layout. Users can check their formatting with RoboApply’s resume grammar checker to avoid any errors or inconsistencies.

Here is a plain-text, formatted example of a work experience entry for a loan processor:

Loan Processor

First National Bank, Dallas, TX

March 2022 – May 2025

- Processed an average of 40 mortgage applications weekly using industry-standard loan processing software.

- Verified applicant information, including income and credit history, to satisfy underwriting guidelines.

- Communicated with clients, realtors, and underwriters to resolve document issues and speed up closings.

- Achieved a 99% loan file accuracy rate, reducing delays and rework.

Using this clear structure helps recruiters quickly see key skills and results. Adding 2–4 bullet points per job is ideal, and aligning dates and titles ensures strong readability. For even faster formatting, RoboApply users can auto-format work history with a single click.

For more details on how to structure resumes and what to include in each section, see these loan processor resume tips and examples.

9) Showcasing Customer Support Skills

Highlighting customer support skills on a loan processor resume can help candidates stand out. Employers look for strong communication, patience, and the ability to resolve issues quickly. Showing these skills proves that the applicant can handle client questions and guide borrowers through complex processes.

When adding customer support experience, it is best to use clear job duties and results. Mention ways you have helped clients, how you managed difficult situations, or how you explained loan details simply. You can also include specific achievements or praise received from customers.

Here is a plain-text example of how to list customer support skills on your loan processor resume:

Customer Support Experience

Answered an average of 40+ client calls daily, addressing questions about loan terms and helping borrowers complete documents correctly.

Explained complex loan requirements in clear terms, reducing customer confusion and improving application completion rates by 15%.

Received positive feedback from clients and managers for patience and problem-solving abilities.

Worked with underwriters and loan officers to quickly resolve application issues and meet tight deadlines.

Resume platforms like RoboApply make it easy to highlight these skills. RoboApply’s AI builder helps users word their customer support experience clearly and suggests improvements for better results. Users can also use the resume grammar checker and ATS score optimizer to match job postings and catch hiring manager attention.

For more tips, check out this guide on loan processor resume examples. It includes more ideas for describing customer support experience.

10) Certifications for Loan Processors

Earning certifications can help a loan processor stand out in the job market. Certifications show employers that the candidate is committed to learning and following industry standards. Many hiring managers look for this extra credential on resumes.

One respected certification is the Certified Loan Processor (CLP) from the National Association of Mortgage Processors. This credential covers federal lending laws, mortgage documentation, and processing best practices. It is ideal for anyone wanting a straightforward way to prove their expertise.

Another useful credential is the Certified Mortgage Processor (NAMP-CMP). This certification focuses on skills that directly help in daily loan processing, like detecting red flags on applications and reviewing key documents quickly. Many professionals use NAMP-CMP to boost their careers.

The Mortgage Bankers Association offers the Certified Mortgage Banker (CMB) program. Although this certification is advanced, it can separate experienced loan processors from their peers. A CMB on a resume signals significant industry experience and dedication.

RoboApply recommends that job seekers highlight certifications in the resume’s education or credentials section for best impact. RoboApply’s AI resume builder can even optimize where and how these credentials appear, helping the job seeker get more interviews.

Continuing education units (CEUs) are another path. They show a candidate stays updated on industry changes. Many loan processors complete short online CEU courses and list the hours on their resume to prove ongoing learning.

When listing certifications, candidates should include the full name, issuing organization, and the year earned. For example: Certified Loan Processor (CLP), National Association of Mortgage Processors, 2023

RoboApply also offers a built-in resume grammar checker to ensure these details are error-free. This kind of polish is essential for certification listings.

For professionals new to the field, entry-level certifications like the Loan Officer Assistant Certification from NAMP can be helpful. These show readiness and a strong foundation, even before on-the-job experience.

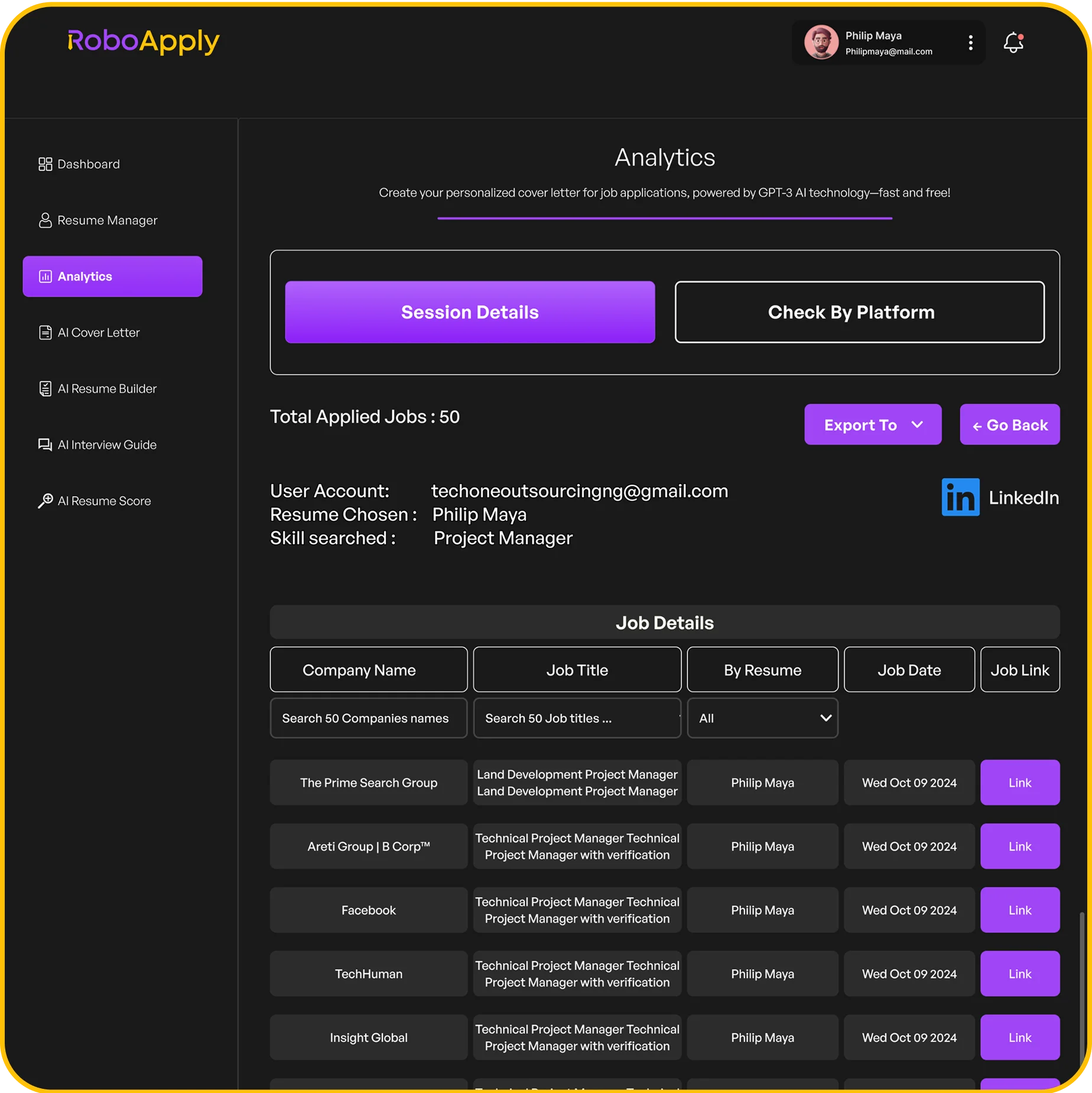

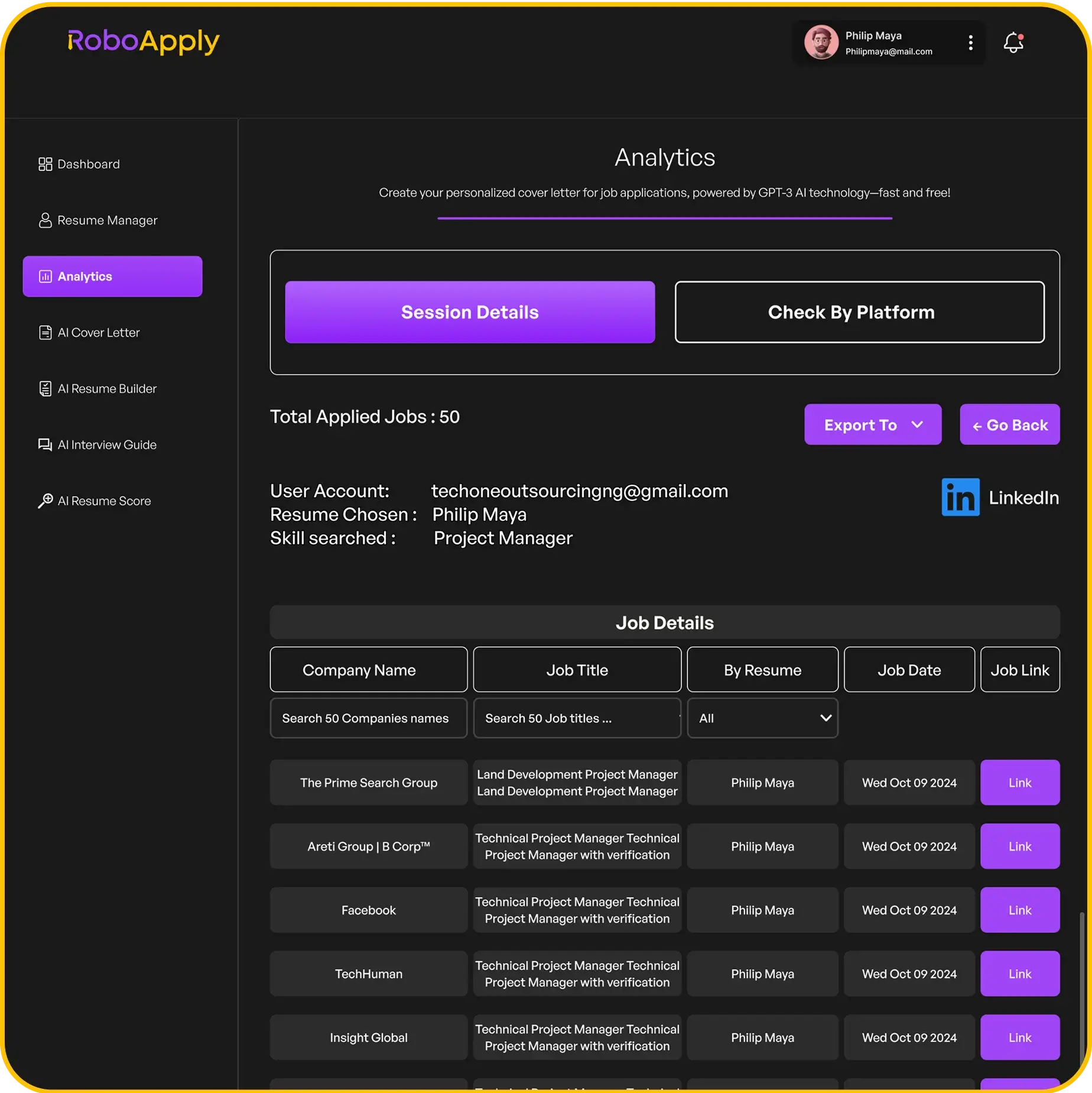

Including certifications gives a loan processor resume a competitive edge, especially when paired with RoboApply’s ATS resume optimizer and job tracking dashboard.

11) Education Section Best Practices

A clear, well-organized education section is important on a loan processor resume. List degrees in reverse chronological order, starting with the most recent. Include the degree name, school, location, and graduation year.

Adding relevant certifications or coursework, like courses in finance or accounting, can make a candidate’s resume stand out to employers. RoboApply’s AI resume builder helps format education details to match current industry standards and keeps this section tidy and easy to read.

Always avoid listing elementary or middle school information. If the applicant has some college but no degree, it is best to mention completed credits or ongoing programs.

Use consistent formatting throughout. Employers expect to see education sections that are neat and simple.

Here’s a full example of an education section for a loan processor resume:

Education

Bachelor of Science in Finance

Northern State University, Aberdeen, SD

Graduated: May 2022

Certificate: Mortgage Loan Processing, Online Course, Completed 2023

Relevant Coursework: Financial Accounting, Real Estate Finance, Risk Management

RoboApply can auto-format this section and make sure it fits with the rest of the resume. This can save time and help applicants avoid common errors.

12) Demonstrating Attention to Detail

Showing strong attention to detail is important for any loan processor. Lenders need people who can catch small mistakes, organize files, and follow step-by-step rules. Recruiters look for evidence of this skill in every job application.

Applicants should give examples of how they double-check paperwork, spot errors, and correct missing information. Add results whenever possible, such as completing hundreds of files error-free or improving document accuracy in a past role.

Here’s a plain-text resume snippet that clearly demonstrates attention to detail:

Loan Processor

ABC Mortgage Solutions, Houston, TX

February 2022 – May 2025

- Reviewed an average of 30 loan applications per week, catching and correcting data errors or missing documents before submission.

- Maintained a 99.5% accuracy rate in file processing by using detailed checklists and verifying information with borrowers and teammates.

- Improved document turnaround time by 15% by reorganizing the filing process and flagging incomplete files for immediate follow-up.

- Trained two new team members on company procedures for compliance and quality checks.

Job seekers can make this step faster by using RoboApply’s AI resume builder, which highlights attention to detail and double-checks job descriptions for matching skills. Manual proofing takes time, but RoboApply’s resume grammar checker can help find missed errors before sending out an application.

13) Quantifying Achievements

Many recruiters look for clear, measurable achievements on resumes. Quantifying achievements means using numbers to show the impact of your work. For loan processors, this can include loans closed, error rates reduced, or processing speed improvements.

Adding numbers makes your resume more convincing. It helps hiring managers see your value at a glance. RoboApply’s resume builder makes it easy to add and format these achievements so they stand out.

Use action words and back them up with data. For example, instead of saying “processed loan applications,” state “processed 60+ loan applications weekly with 98% accuracy.” This approach shows your productivity and attention to detail.

Numbers also make it easier to compare your skills to other candidates. Focus on key areas like turnaround time, approval rates, or customer satisfaction scores. RoboApply can help you brainstorm metrics for your experience.

Here is an example of a bullet point using quantifiable results:

- Processed an average of 75 residential and commercial loan files per month, reducing the overall closing time by 25% and achieving a client satisfaction rating of 97%.

Review more examples and tips on using numbers by visiting this loan processor resume guide. Using numbers can make your resume much stronger and more appealing to employers.

14) Customizing Resume for Job Description

Tailoring a loan processor resume to fit a specific job description is key to standing out to hiring managers. Start by reviewing the job posting and noting the main skills and qualifications listed. Then, match relevant skills, such as proficiency with loan processing software or knowledge of underwriting guidelines, directly in your resume. Tools like RoboApply make this step faster by scanning job ads and recommending the most relevant keywords.

Replace generic responsibilities with ones that reflect the exact requirements mentioned in the job post. For example, if a company emphasizes attention to accuracy and compliance, adjust your experience points to highlight these skills.

It’s important to be specific. Instead of a broad statement like “Processed loan documents,” write “Collected and reviewed borrower documents for FHA and VA loans, ensuring 100% compliance with company and federal guidelines.”

Using RoboApply’s AI resume and cover letter builder saves time while helping applicants optimize their resumes for Applicant Tracking Systems (ATS). This makes the resume more likely to be noticed by recruiters.

For more on what hiring managers look for, read expert guides on how to match your resume to the job description and see more example-driven advice. Tailoring each section increases your chances of landing an interview and getting noticed quickly.

15) Common Loan Processor Resume Mistakes

Leaving out important software skills is a frequent mistake. Loan processors should include experience with industry programs such as LOS, CRM systems, and other tools used to track documents and communication. Using RoboApply can help highlight these skills and check if anything critical is missing.

Failing to use numbers or data is another classic problem. When listing past successes, it is much better to mention how many loans were processed per month or the approval percentage achieved. For example: “Processed over 80 loan files monthly with a 99% accuracy rate.”

Writing a resume with vague job duties makes it hard for hiring managers to see the impact made. Entries like “Reviewed loans” are too simple. Instead, write specific actions such as “Reviewed applicant documents for compliance with FHA guidelines.”

Using a generic or cookie-cutter resume template can make the application forgettable. Customizing each section and using RoboApply’s ATS resume score optimizer ensures a unique, stronger fit for loan processor roles.

Not mentioning experience with underwriting guidelines is another oversight. Clearly state familiarity with Fannie Mae, Freddie Mac, or FHA rules as needed. For example: “Coordinated files to meet Fannie Mae and Freddie Mac underwriting conditions.”

Omitting document management skills reduces credibility. Loan processors manage sensitive paperwork daily. An example line: “Managed digital and paper loan files, ensuring secure handling and quick retrieval for audits.”

Skipping over teamwork and communication can hurt the resume. Hiring managers want to see proof of working with loan officers, underwriters, and clients. Example: “Collaborated with loan officers and underwriters to resolve file discrepancies, speeding up approval times by 15%.”

Submitting a resume with grammar or spelling errors is a red flag. RoboApply’s resume grammar checker tool can review content and suggest improvements before hitting submit.

Failing to show growth in previous roles may suggest a lack of ambition or results. Use language that highlights promotions or new responsibilities. For example: “Promoted to Senior Loan Processor within one year due to strong performance and attention to detail.”

Leaving out industry keywords can cause automated systems to filter out the resume. Use phrases like “mortgage processing,” “pre-underwriting,” and “loan documentation” to increase ATS compatibility, which RoboApply helps check and optimize.

Listing irrelevant work experience, such as jobs not related to finance or administration, can distract from key skills. Keep all entries focused on banking, lending, or office coordination.

Making the resume too long or including every job ever held can overwhelm recruiters. One or two pages are best, focusing on jobs from the last 10 years that relate most closely to loan processing.

Not addressing gaps in employment may raise questions. Add a short explanation if time was taken off for school, family, or professional training.

Forgetting to update contact information can cost job opportunities. Double-check that the email and phone number are current and professional.

Using “one-size-fits-all” cover letters weakens the application. Tools like RoboApply can create custom cover letters that address the needs of each employer instead.

Not following the application instructions or missing required documents can disqualify candidates. Always review each submission and use tools like RoboApply’s Chrome auto-apply and job tracking dashboard to make sure everything is in order. For more tips on creating a strong loan processor resume, check out these loan processor resume examples and guides for 2025.

Frequently Asked Questions

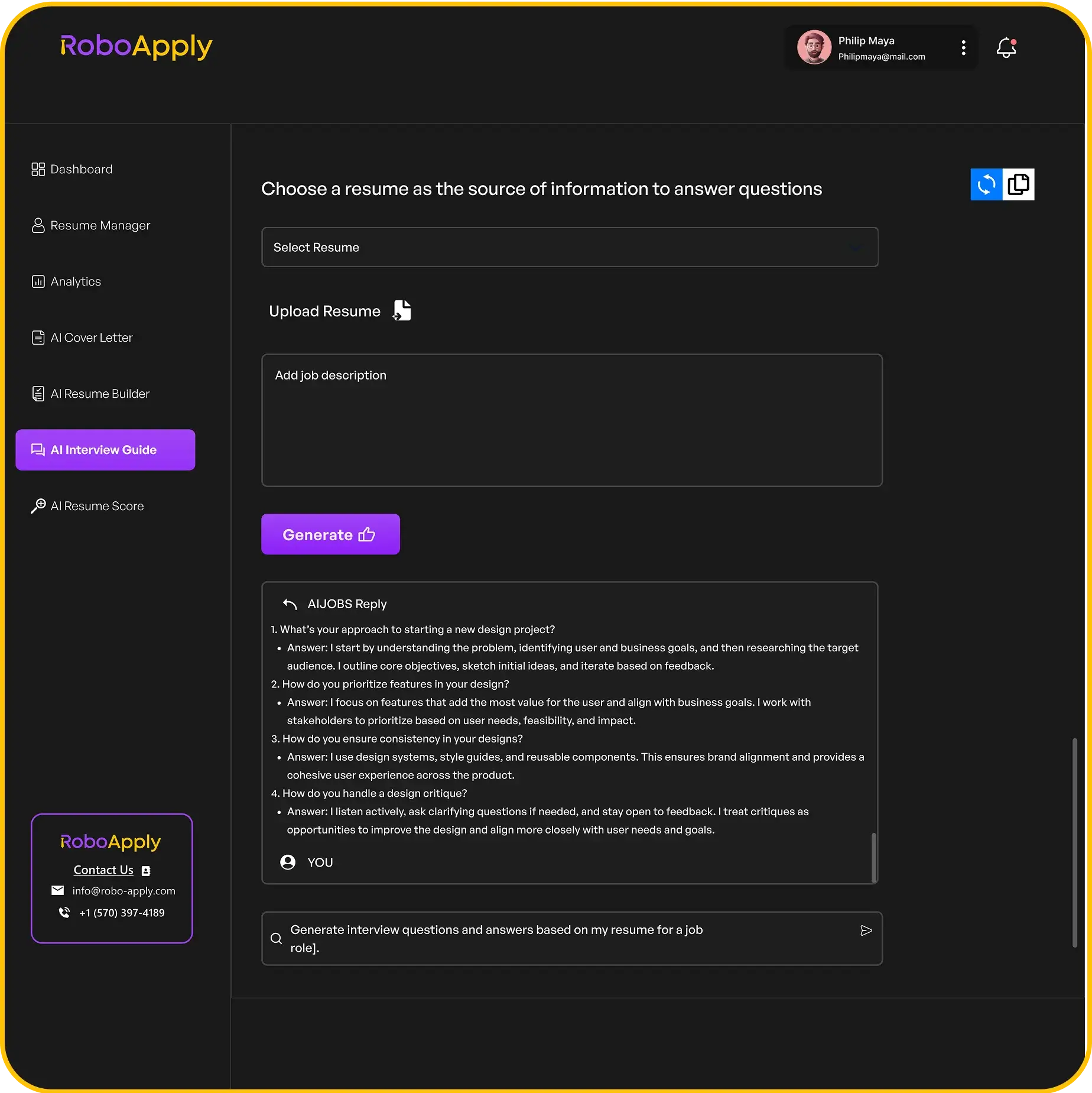

A strong loan processor resume in 2025 needs more than just listing past jobs. Key skills, the right document sections, and targeted tools like RoboApply can help job seekers stand out and get results fast.

What skills should be highlighted in a loan processor resume for 2025?

Applicants should showcase proficiency in document management, knowledge of underwriting guidelines, and experience with loan processing software. Attention to detail, organizational abilities, and communication skills are also vital. RoboApply’s AI resume builder helps users add these critical skills in summary and skills sections for maximum clarity.

How can someone with no experience create an effective loan processor resume?

Those new to lending should focus on transferable skills like customer service, data entry, and time management. They can include internships, coursework, or volunteer roles that show responsibility and reliability. RoboApply offers templates and bullet point suggestions tailored to entry-level applicants, making it easier to build a strong starting resume.

Where can I find senior mortgage loan processor resume samples?

Job seekers looking for senior-level resume examples can use RoboApply to browse targeted templates and keyword suggestions suited for advanced roles. This helps highlight leadership, compliance, and supervisory experience in the resume. Samples are regularly updated for hiring trends and expectations.

What sections are essential to include in a loan processor resume?

Every loan processor resume should feature clear contact information, a short summary, detailed work experience, relevant skills, and education. Including certifications or technical skills related to banking or finance can give an added edge. RoboApply automatically formats all of these sections for the user, making sure no key information is missing.

How can I obtain a loan processor resume guide for 2025?

Guides for writing modern loan processor resumes are found on reputable job search blogs and resume sites. RoboApply provides a dedicated resume guide with step-by-step instructions, expert tips, and live examples designed specifically for 2025, updated as hiring practices change.

In which format should I download loan processor resume examples for the most impact?

The PDF format is most widely accepted and keeps the formatting intact when submitted online or printed. RoboApply allows users to export their resumes as PDFs with optimized layouts, ensuring resumes look professional and are easily readable by applicant tracking systems.