Landing a financial accounting job in 2025 means having a resume that stands out. Employers look for candidates who can show relevant skills and real-world achievements in their applications. This article gives you clear examples and a practical guide to building a financial accounting resume that matches today’s job market.

Readers will find helpful information to make their resumes more effective and easier to read. With these strategies and examples, anyone can improve their chances of getting noticed for a financial accounting position.

1) Highlight proficiency in accounting software like QuickBooks and SAP

Listing skills in accounting software such as QuickBooks and SAP is a crucial part of an effective financial accounting resume. Employers want to see that candidates can handle the modern tools used in daily accounting work. Including these well-known programs shows that the applicant can manage digital records and understand automated workflows. Many recruiters actually scan resumes for mentions of these specific platforms.

Job seekers should be direct and clear about their abilities. Place any software skills in the skills or experience section using concrete language. It’s also helpful to mention how the software was used, like for daily bookkeeping, generating reports, or managing payroll.

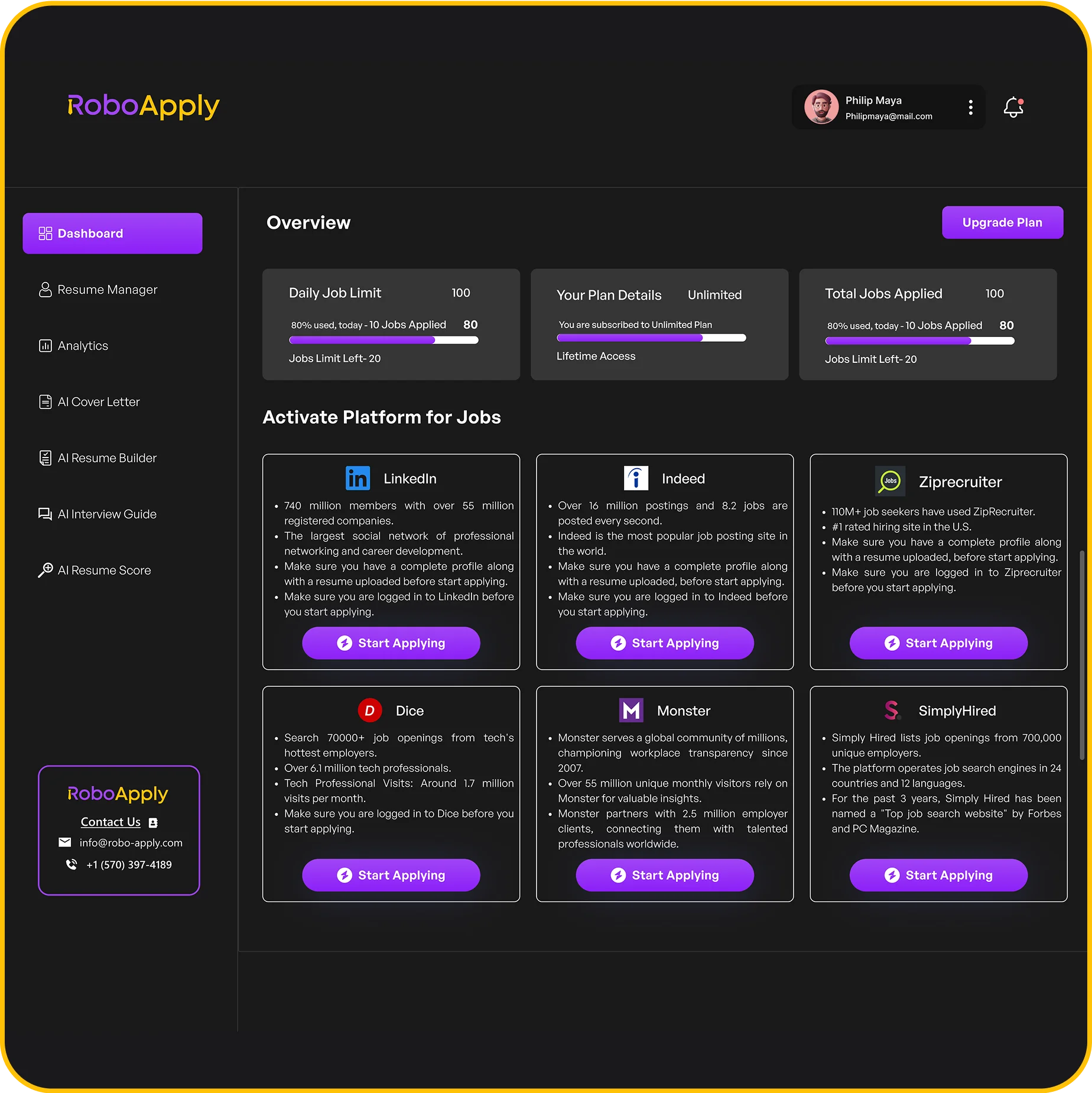

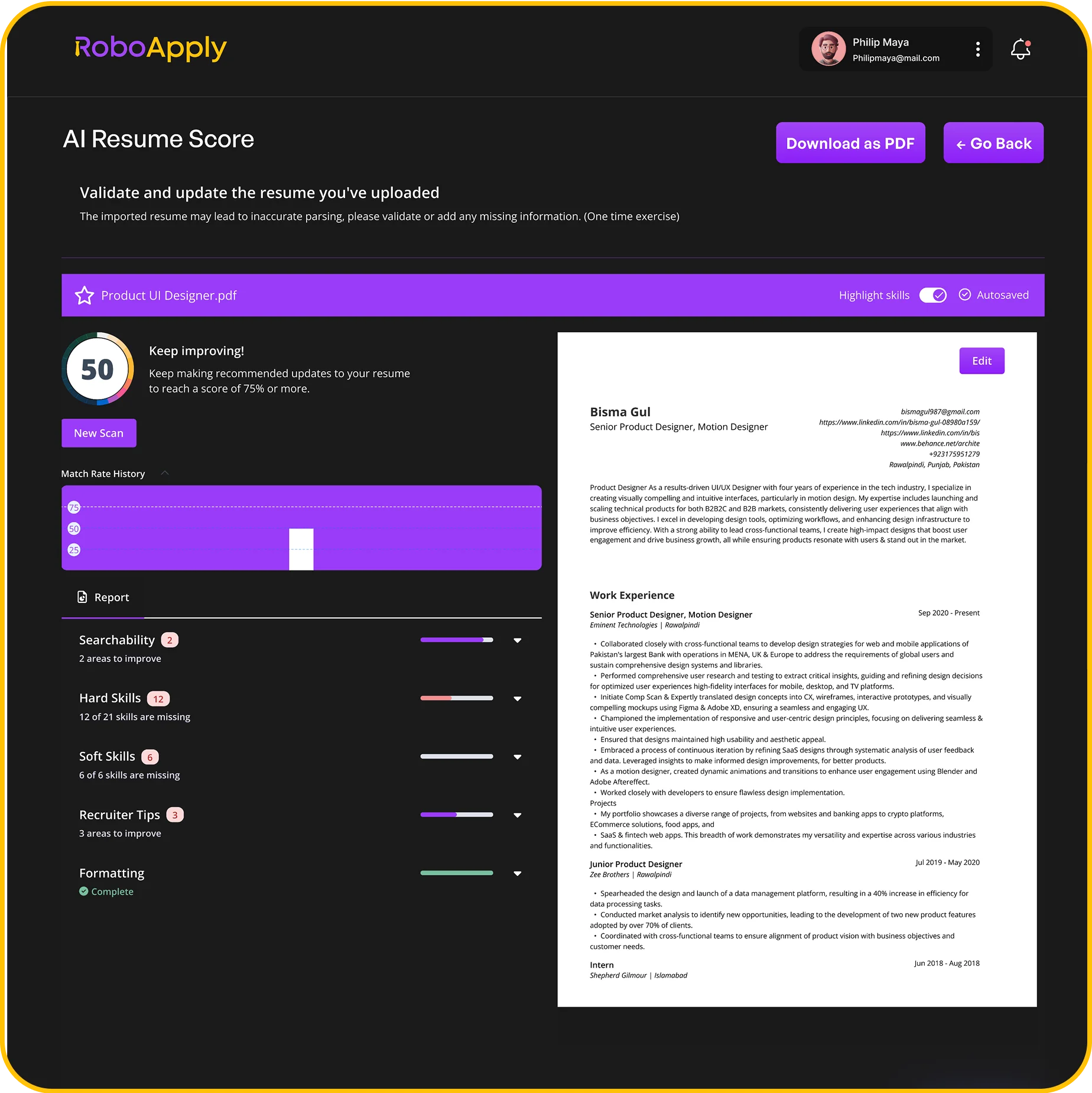

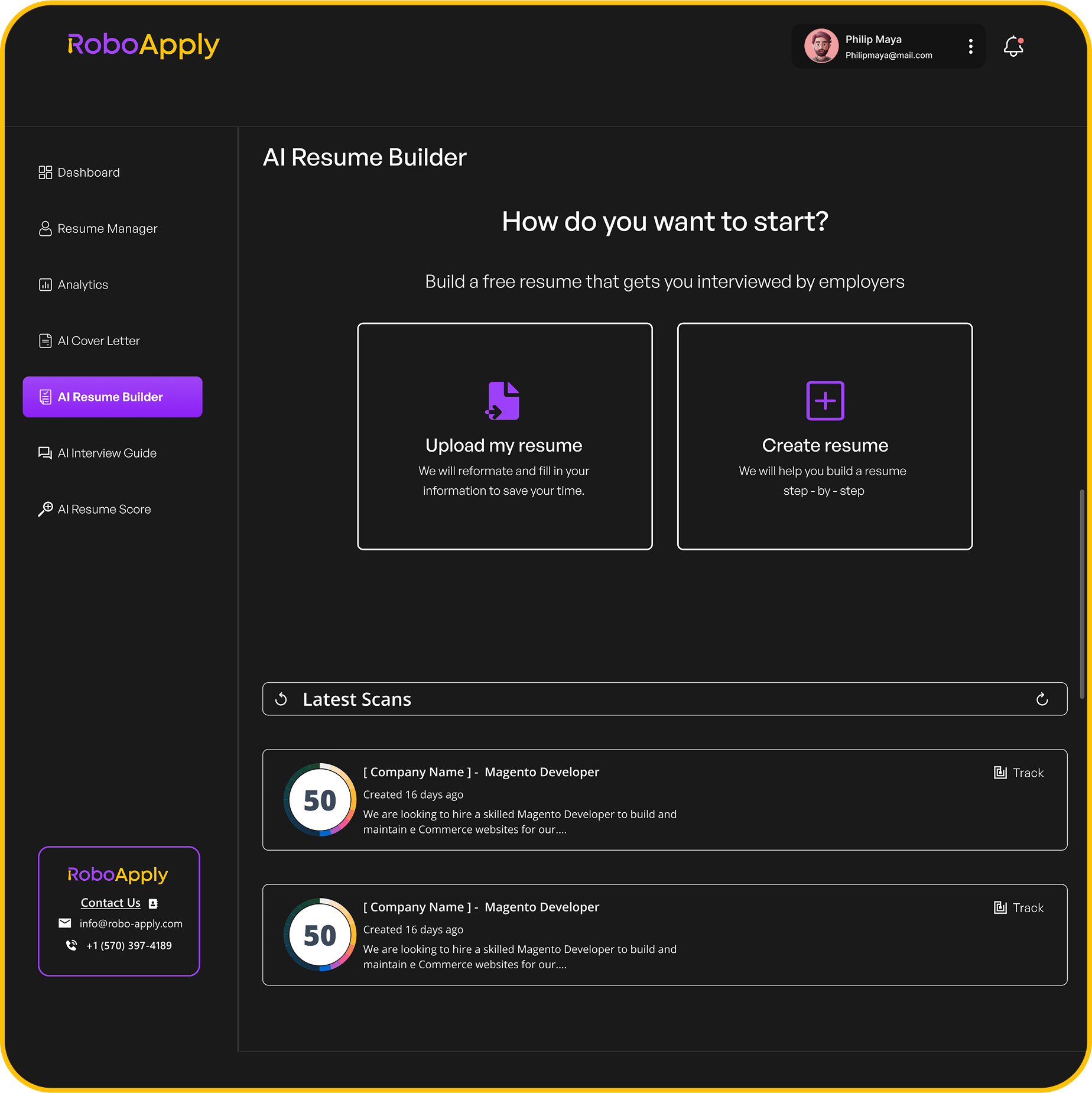

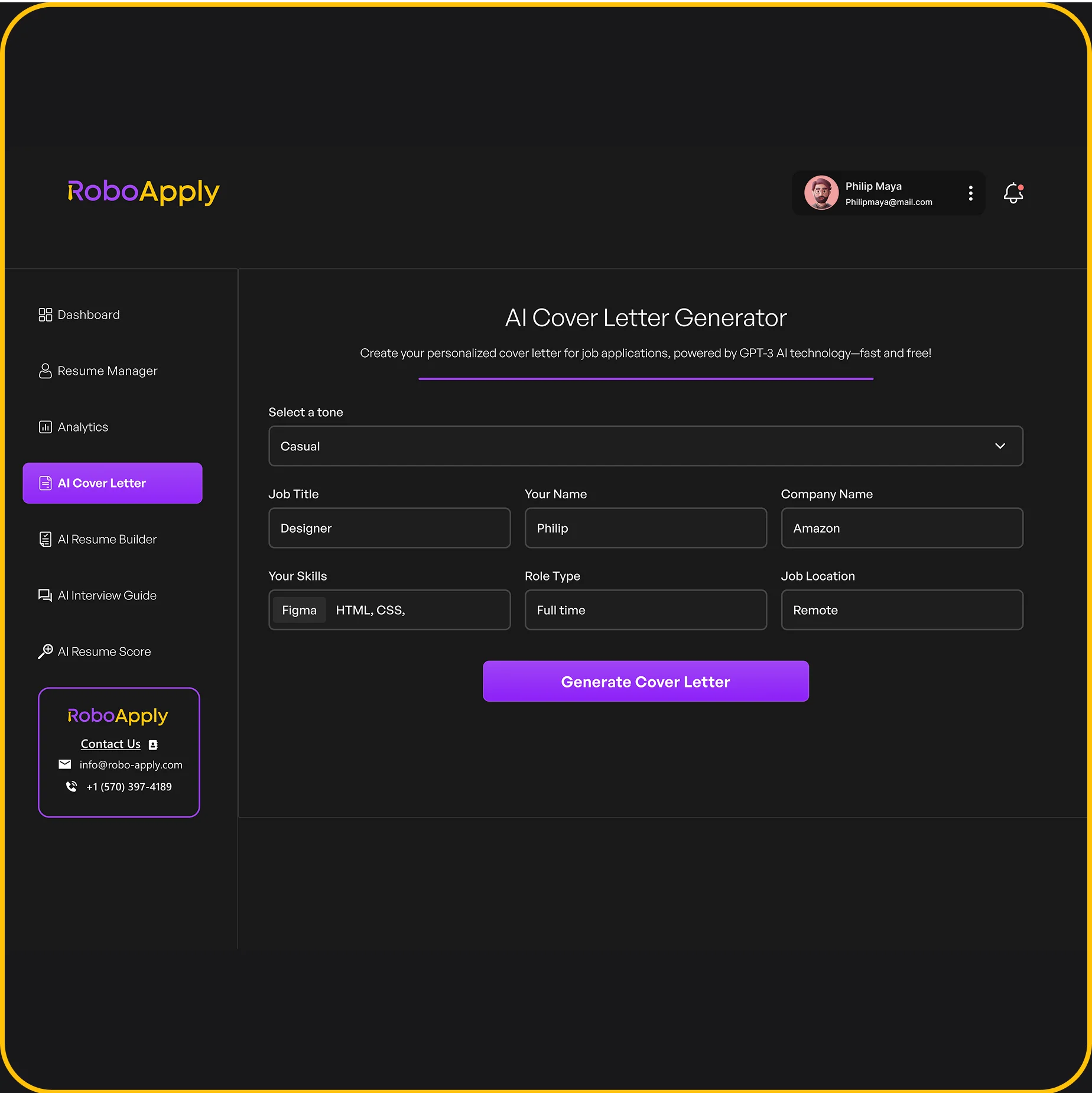

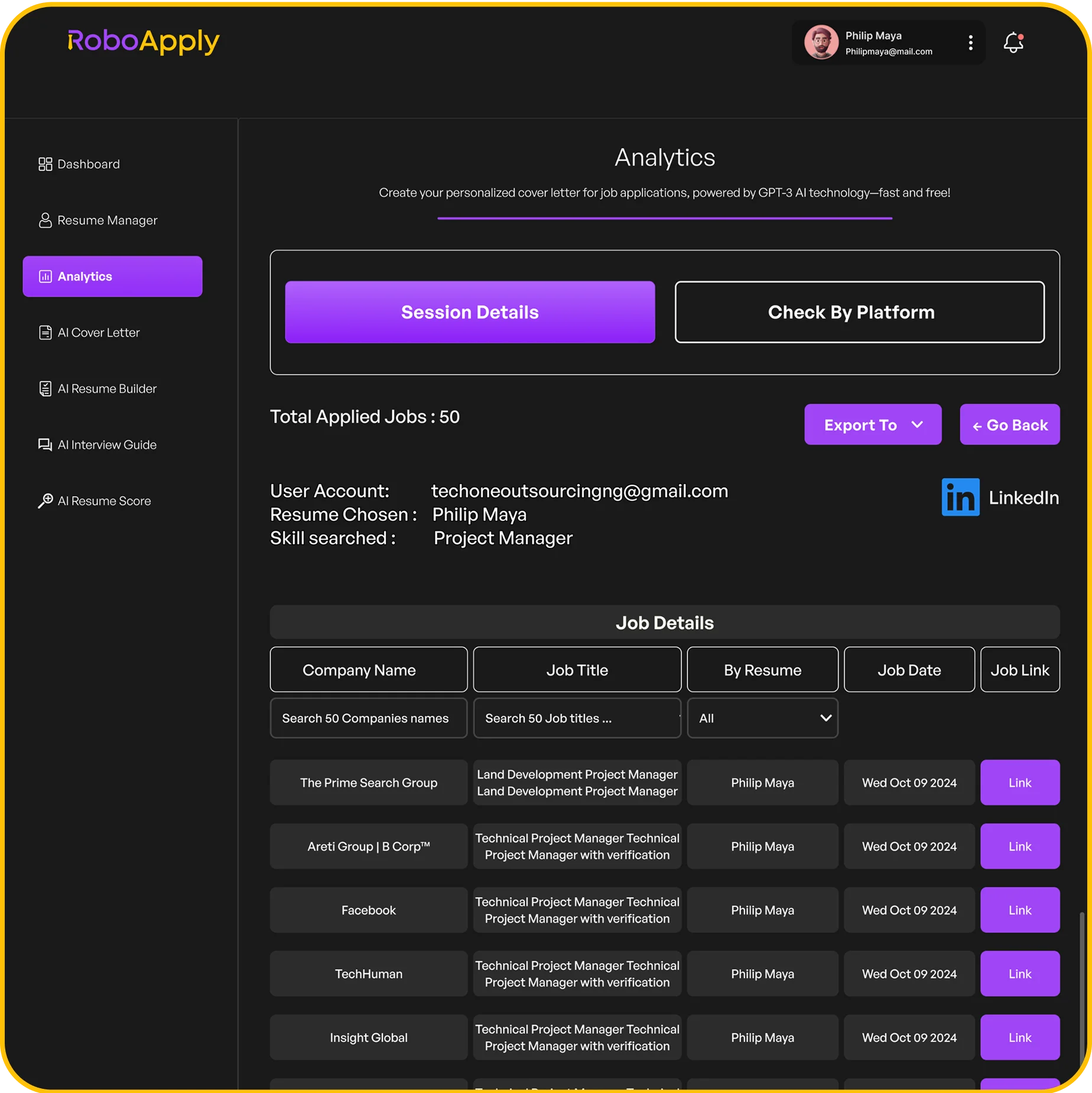

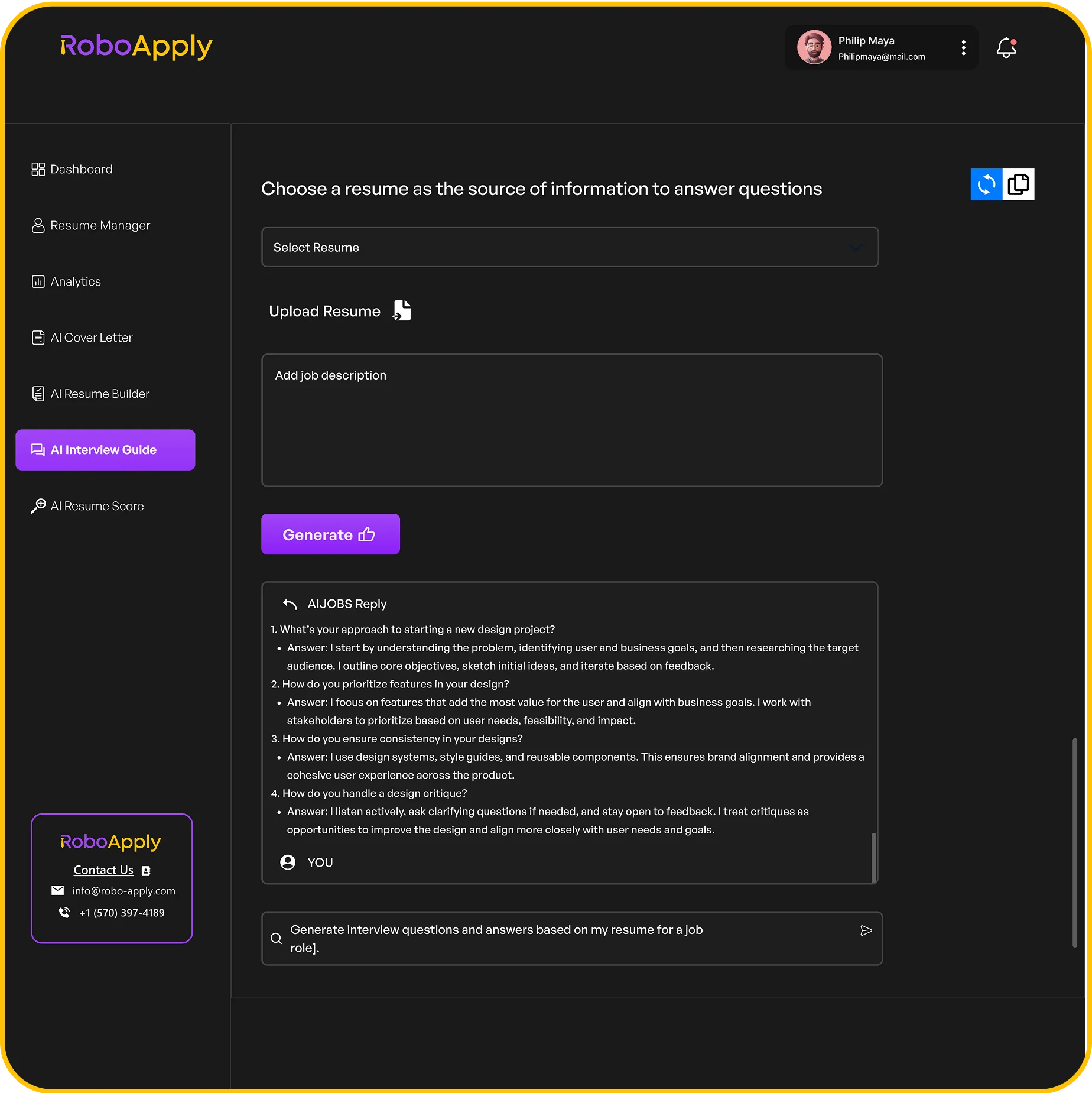

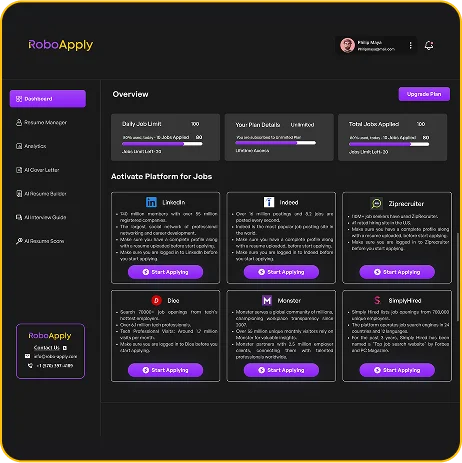

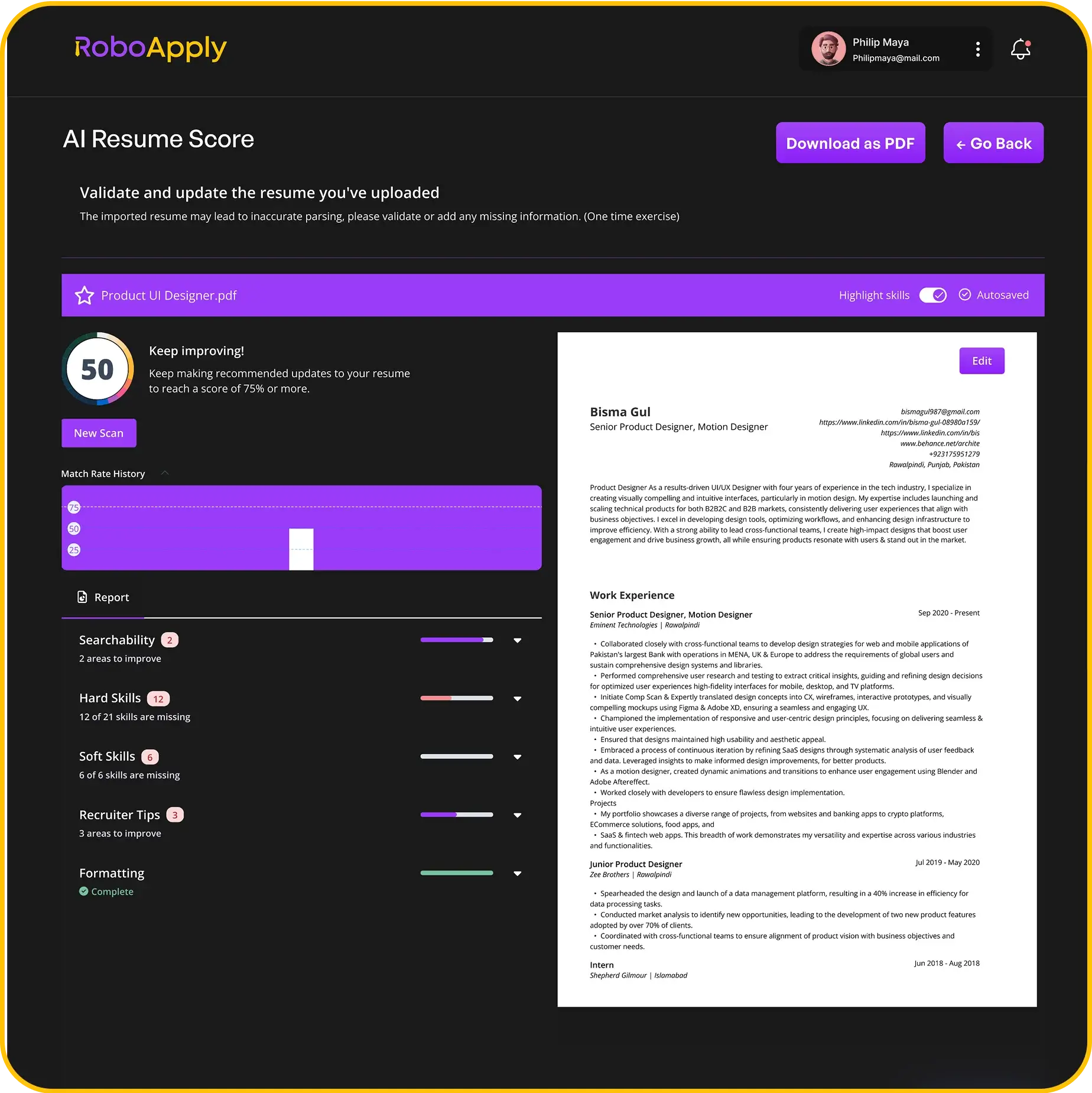

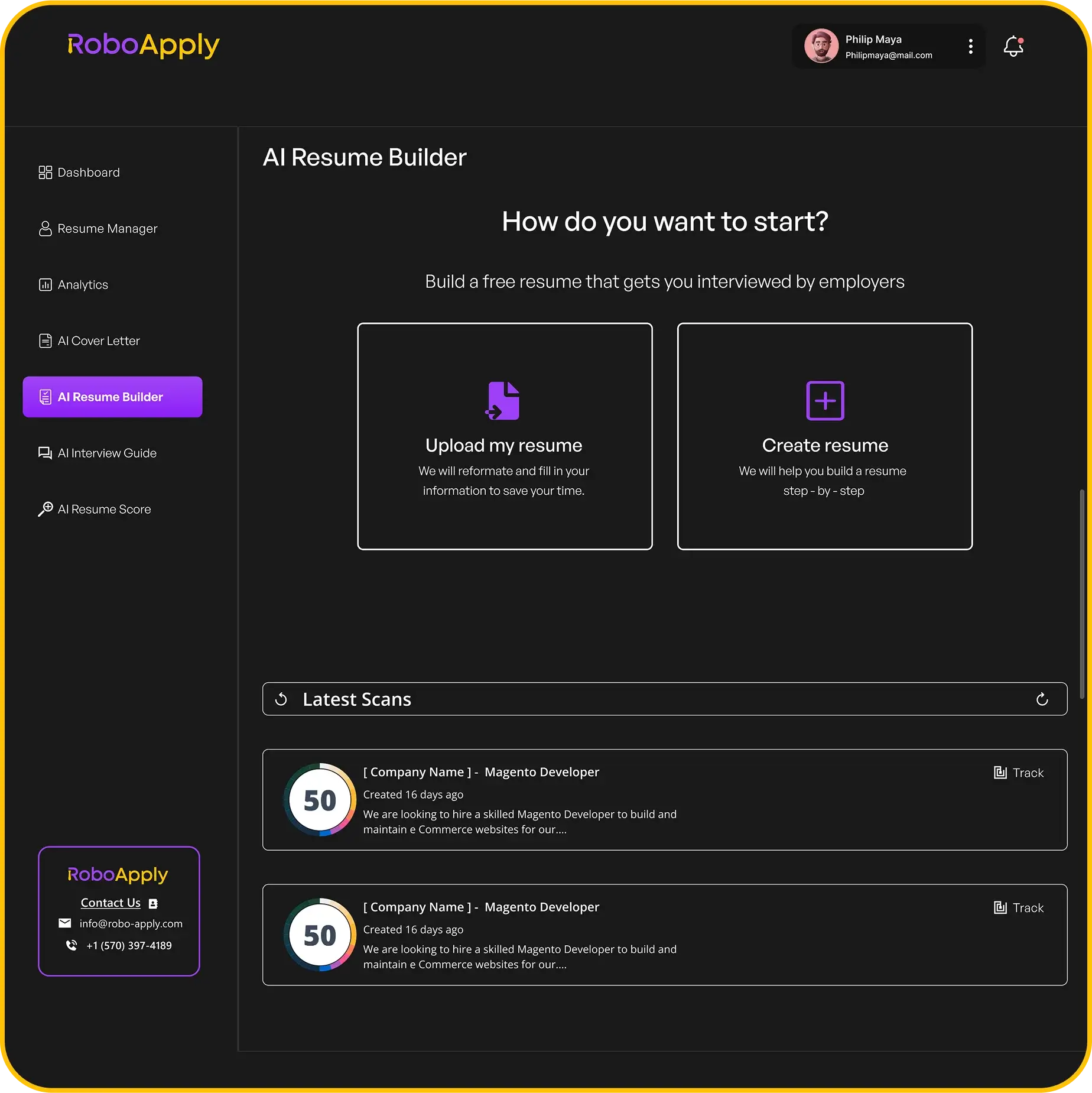

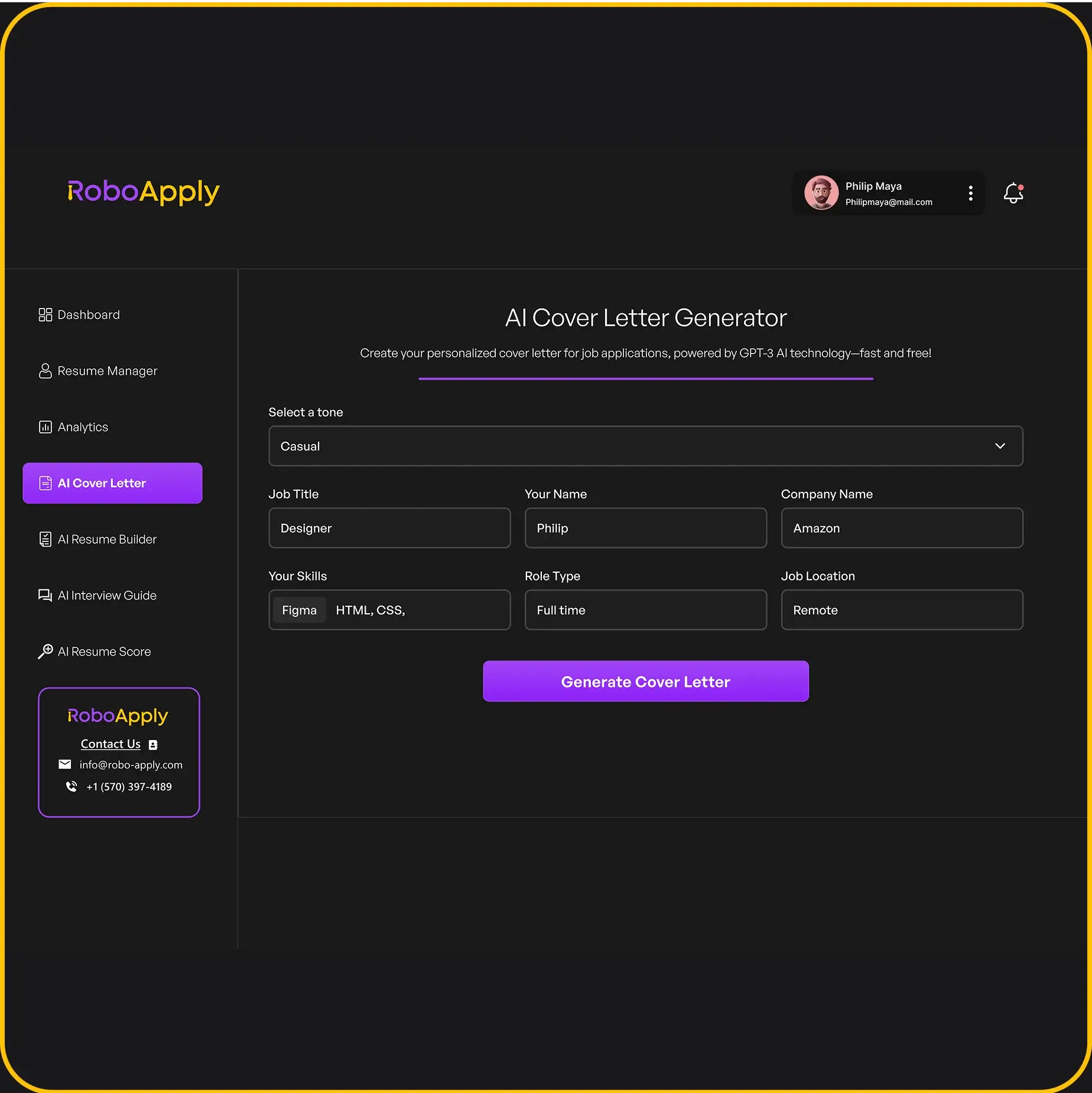

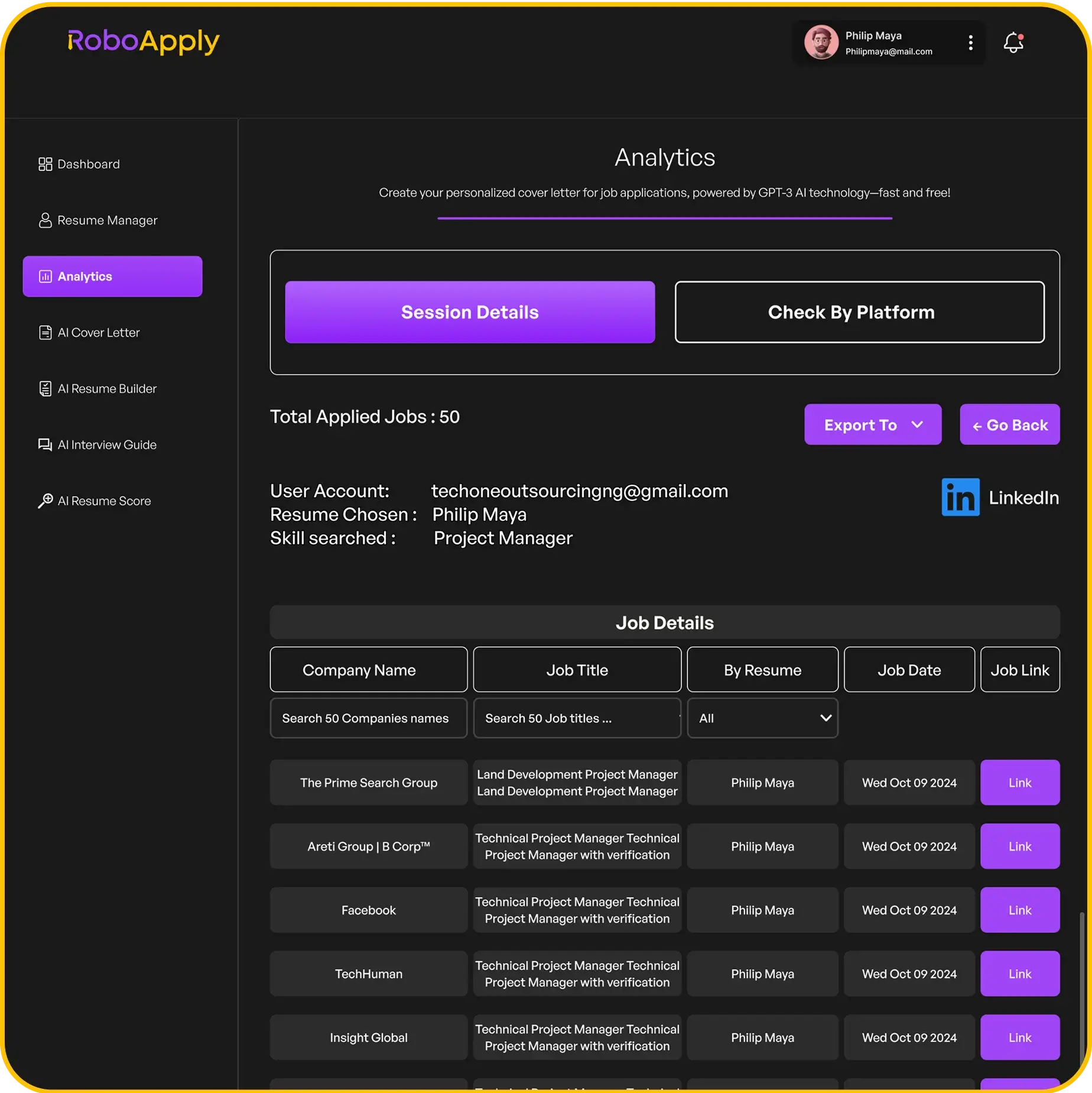

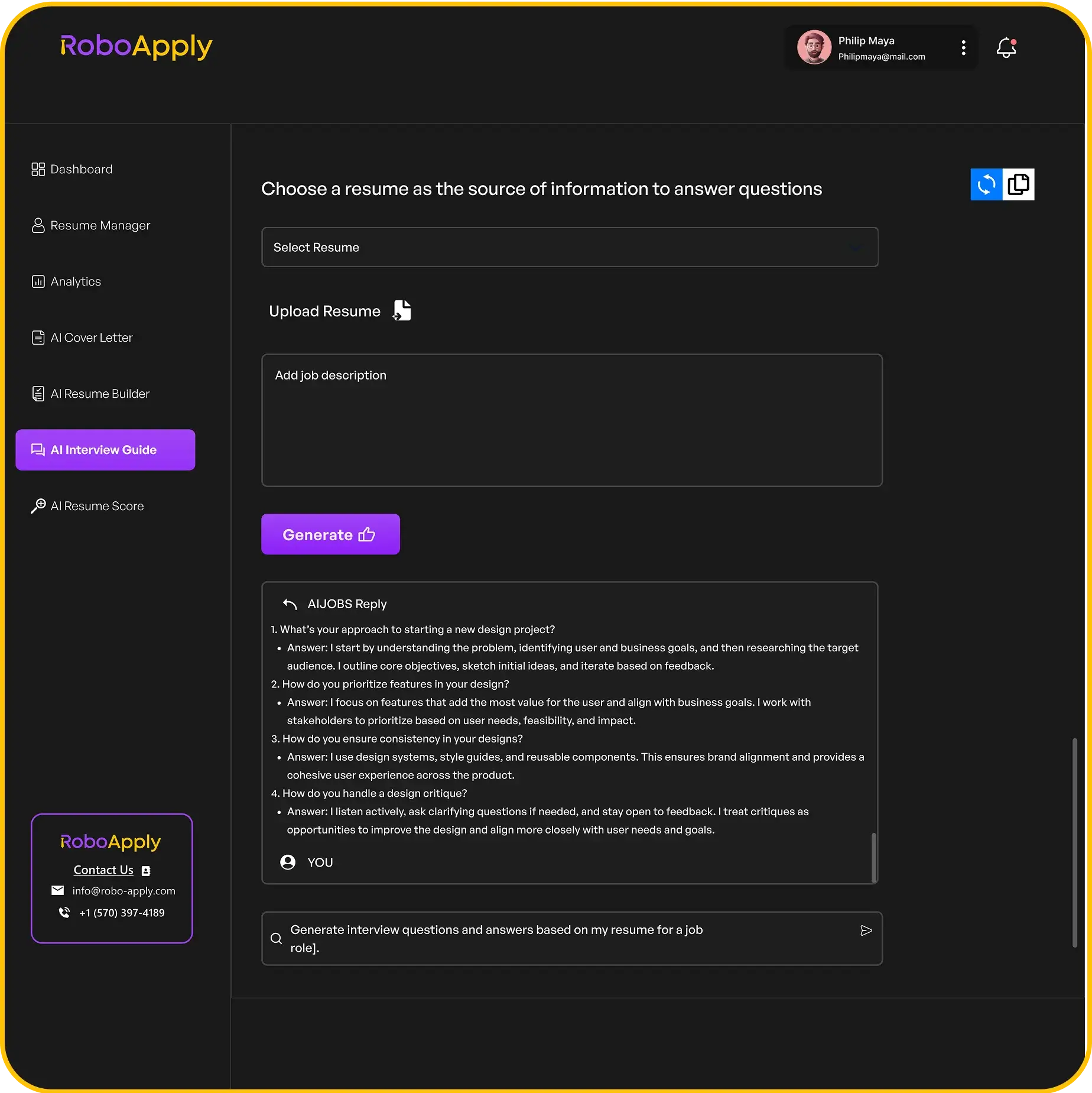

RoboApply makes this process fast and straightforward. Its AI resume builder can suggest the right keywords and perfectly phrase experience with accounting tools. It also offers a resume grammar checker to polish language and an ATS score optimizer to ensure software skills get noticed by screening systems.

Here’s an example of how to include accounting software proficiency on a resume:

Experience

Staff Accountant

ABC Manufacturing, Chicago, IL

June 2021 – May 2024

- Managed daily bookkeeping and reconciled accounts using QuickBooks.

- Generated monthly and quarterly financial statements in QuickBooks and SAP.

- Streamlined payroll processing by automating workflows in SAP.

- Provided training to team members on software best practices.

- Reduced time spent on monthly closing by 20% through automation.

Apply this approach to any accounting role, and tailor the descriptions using the RoboApply resume builder for the best results. For more tips on how to highlight accounting software skills, focus on clear descriptions and measurable achievements.

2) Emphasize experience with financial statement preparation and analysis

Employers want candidates who have solid experience preparing and analyzing financial statements. Listing this on a resume signals an understanding of key accounting duties and industry standards. Be clear about which statements were prepared, such as balance sheets, income statements, or cash flow statements, and describe the results achieved.

Use direct wording and bullet points to make these skills stand out. Focus on results and tools, like accounting software, used during the process. RoboApply’s AI resume builder helps highlight these points, ensuring ATS systems pick up on relevant keywords.

Here is a full-length example of an experience section showing how to highlight this skill:

Financial Accountant

ABC Manufacturing, New York, NY

June 2022 – May 2025

- Prepared monthly, quarterly, and annual financial statements, including balance sheets, income statements, and cash flow reports.

- Analyzed financial data to identify trends, variances, and root causes, helping management make informed decisions.

- Coordinated with team leads to ensure all statements followed GAAP standards and deadlines.

- Used QuickBooks and SAP for data entry, statement generation, and reconciliations.

- Improved financial statement accuracy by 12% through enhanced review procedures.

By focusing on clear results and naming specific tasks and tools, candidates can show true expertise in financial statement preparation and analysis. RoboApply makes formatting and keyword optimization of these skills quick and efficient. For more advice, find tips on financial accounting resume examples and how to highlight these experiences.

3) Include certifications such as CPA or ACCA

Financial accounting employers look for certifications like CPA (Certified Public Accountant) or ACCA (Association of Chartered Certified Accountants) on resumes. Having these shows an applicant’s commitment to learning and professional standards. Including certifications makes a candidate stand out and proves they meet industry requirements.

Place certifications in a dedicated section. Write the full name of the certification, the issuing body, and the year obtained. It’s best to list them right after your education or in a separate “Certifications” section. RoboApply’s AI resume builder can help organize this section properly and check your resume for grammar and keywords.

Here’s a practical example for your resume:

Certifications

Certified Public Accountant (CPA), New York State Board of Public Accountancy, 2023

Association of Chartered Certified Accountants (ACCA), ACCA Global, 2022

Mentioning certifications like these can boost your chances of passing applicant tracking systems and catching a hiring manager’s attention. For more tips on adding credentials, read through other accountant resume examples tailored for 2025.

4) Showcase achievements in financial reporting accuracy and timeliness

When writing a financial accounting resume, it is important to highlight clear achievements with numbers and results. Recruiters want to see proof of how you improved accuracy or speed in financial reporting. Using specifics and data makes your impact easy to understand.

For example, you could use a statement like:

Prepared monthly and quarterly financial reports with 100% on-time delivery for two straight years, increasing reporting accuracy by 15% by automating data verification.

RoboApply can help users identify and word these achievements more effectively. Its AI resume builder provides suggestions that focus on real results and helps optimize for applicant tracking systems.

If you’ve improved a team’s speed or reduced errors, mention the percentage. You might write:

Reduced monthly financial closing process by 3 days through process streamlining, resulting in faster data availability for management and a 10% decrease in reporting errors.

Specific, result-driven statements catch an employer’s attention. This approach is recommended by many resume guides, such as those found on Resumebuilder.com’s accountant resumes, which highlight quantifiable achievements in reporting accuracy.

5) Detail knowledge of regulatory standards like GAAP or IFRS

Employers want to see clear evidence that an accountant follows important financial regulations, like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). Listing these on a resume shows that the candidate can handle complex reporting and stay compliant with laws. This is especially important for roles that perform audits, reconciliations, or prepare financial statements.

Candidates should name specific standards they use and describe how they apply them in everyday work. For example, mentioning GAAP or IFRS in the skills section or in bullet points under work experience is a strong way to highlight this knowledge. This kind of detail helps resumes stand out in ATS filters and makes it easier for hiring managers to find qualified candidates. Using RoboApply’s AI resume builder can help users spotlight their regulatory knowledge with built-in guidance and relevant keywords.

Here is a copy-ready example of how to include this in a work history section:

Staff Accountant

ABC Corporation, New York, NY

June 2022 – May 2025

- Prepared quarterly and annual financial statements in strict compliance with GAAP

- Ensured all reporting met updated IFRS requirements for international divisions

- Led training sessions on regulatory changes, resulting in 100% staff compliance

- Completed regular audits to identify and fix discrepancies according to industry standards

Adding details like these on a resume proves the candidate’s value fast. For more tips and tools to optimize for regulatory keywords, users can try RoboApply’s resume score optimizer to check if their resume meets screening standards.

Including specific regulatory experience helps employers trust that the applicant understands and follows the rules that matter in finance. To see more ways to highlight regulatory knowledge and accounting skills, review top financial accounting resume examples for up-to-date best practices.

6) Demonstrate ability to analyze and interpret complex financial data

Employers value candidates who can break down complicated financial numbers and explain what they mean. Listing this skill on a resume shows that a candidate can do more than just basic calculations or follow instructions. They can find trends, make sense of large datasets, and help a company make smart decisions.

Use short, direct bullet points to describe real experiences handling financial data. Focus on what was done, how it was done, and the outcome. This helps recruiters see the practical impact of these skills.

Here is a concrete example you can use or adapt for your own resume:

Financial Analyst – Apex Manufacturing

January 2023 – April 2025

- Analyzed monthly, quarterly, and annual financial statements to identify cost-saving opportunities, resulting in a 12% reduction in non-essential expenses.

- Used advanced Excel and financial modeling to support forecasting, budgeting, and cash flow analysis.

- Interpreted large datasets to present management with key performance trends, enabling faster decision-making on investments and new product launches.

When listing these skills, try using numbers to show impact. Mention tools used, like Excel or Power BI, and explain how the analysis benefited the company.

AI tools like RoboApply can help improve bullet points and check for grammar errors. RoboApply also offers an ATS resume score optimizer to ensure resumes get noticed. For more real-world examples and tips on financial accounting resumes, visit this collection of accountant resume examples.

7) Mention experience with budgeting and forecasting processes

Hiring managers in financial accounting look for real experience with budgeting and forecasting. Adding this to a resume shows a candidate can plan, monitor, and adjust company finances. It proves they are able to make sound financial decisions and help the business stay on track.

Applicants should be specific about their role in budgeting and forecasting. List the kinds of budgets managed, tools or software used, and the impact of the work. This helps the resume stand out and shows direct value to employers. Online tools like RoboApply can help highlight these skills in a way that is clear, organized, and ready for applicant tracking systems.

Example:

Budgeting & Forecasting Experience

Managed annual budgets of up to $2M for three business units. Created detailed monthly and quarterly forecasts using Microsoft Excel and QuickBooks. Provided variance reports to department heads, identifying key trends and recommending adjustments. Improved forecast accuracy by 15% through analysis of historical data and proactive cost control. Participated in quarterly budget review meetings and contributed key recommendations that led to more efficient spending.

Frequently Asked Questions

A strong financial accounting resume in 2025 should show proficiency in widely used software, highlight detailed financial analysis skills, and include relevant certifications. Clear structure and specific achievements can help candidates, whether experienced professionals or recent graduates, stand out in a competitive market.

How can I showcase my 25 years of financial accounting experience on a resume?

It is important to focus on leadership roles, key achievements, and advanced technical skills gained from long-term experience. Highlighting expertise with financial statement preparation, regulatory compliance, and improvements in reporting accuracy can make a strong impact. RoboApply’s AI resume builder helps organize long careers into a concise, tailored format, ensuring each accomplishment connects with the job requirements.

What are the key elements to include in a financial accounting resume in 2025?

Key sections should cover up-to-date technical skills with accounting software such as QuickBooks and SAP, recent certifications like CPA or ACCA, and in-depth experience with financial statements. Achievements related to financial reporting accuracy and solid knowledge of standards like GAAP or IFRS are important to include. Action verbs and specific numbers demonstrate the impact of your work. Learn more about what to include by reviewing these financial accounting resume examples.

Which format is recommended for a financial accounting resume to stand out to employers?

A chronological format remains preferred in 2025 because it clearly shows growth and experience over time. This style is particularly effective for those with stable work histories. RoboApply recommends using their resume templates that keep formatting neat and ATS-friendly, which increases the chance of passing resume scans performed by employers.

How should recent graduates structure their junior accountant resumes?

Recent graduates should list their education first, followed by internships or project experience, technical skills, and any certifications. Emphasis should be placed on familiarity with modern accounting software and coursework relevant to financial processes. RoboApply’s templates help junior applicants create clear, professional resumes even with limited work backgrounds, guiding them on what to prioritize.

What should be highlighted in an accounting and finance resume summary?

A strong summary should mention the number of years of experience, primary areas of expertise (such as financial reporting or regulatory compliance), and the key software tools used. Adding one or two notable achievements, such as improvements in reporting timeliness, helps set the tone for the rest of the resume. RoboApply’s resume summary generator crafts concise and tailored summaries that can make the resume stand out.

What are effective strategies for optimizing a financial accounting resume for applicant tracking systems?

Resumes should use appropriate keywords from the job description, standard section headings, and minimal graphics. Highlighting skills and certifications in easy-to-read lists helps ATS systems recognize your qualifications. RoboApply’s ATS resume score optimizer reviews resumes and suggests targeted improvements, ensuring your financial accounting resume is more visible to recruiters searching through large applicant pools.