Finding the right format and examples for a tax accountant resume can make the difference when applying for jobs in 2025. A strong resume helps candidates highlight their tax knowledge, software skills, and updated experience to stand out to employers.

This article will guide readers through seven useful tax accountant resume examples and tips, offering a straightforward path to building a professional resume for today’s job market. Readers can use these strategies and templates to present their qualifications clearly and effectively.

1) Highlight expertise in tax preparation and compliance

Tax accountants need to show strong skills in tax preparation and compliance on their resumes. Employers look for candidates who can handle tax returns, stay up to date on regulations, and ensure clients follow all tax laws. Mentioning these skills in clear language makes a resume stand out to hiring managers.

Use direct statements to prove knowledge in areas like tax code research, preparing federal and state returns, and keeping records accurate. It helps to give examples with specific numbers or tasks to show the impact of your work. This allows hiring managers to picture your contribution right away.

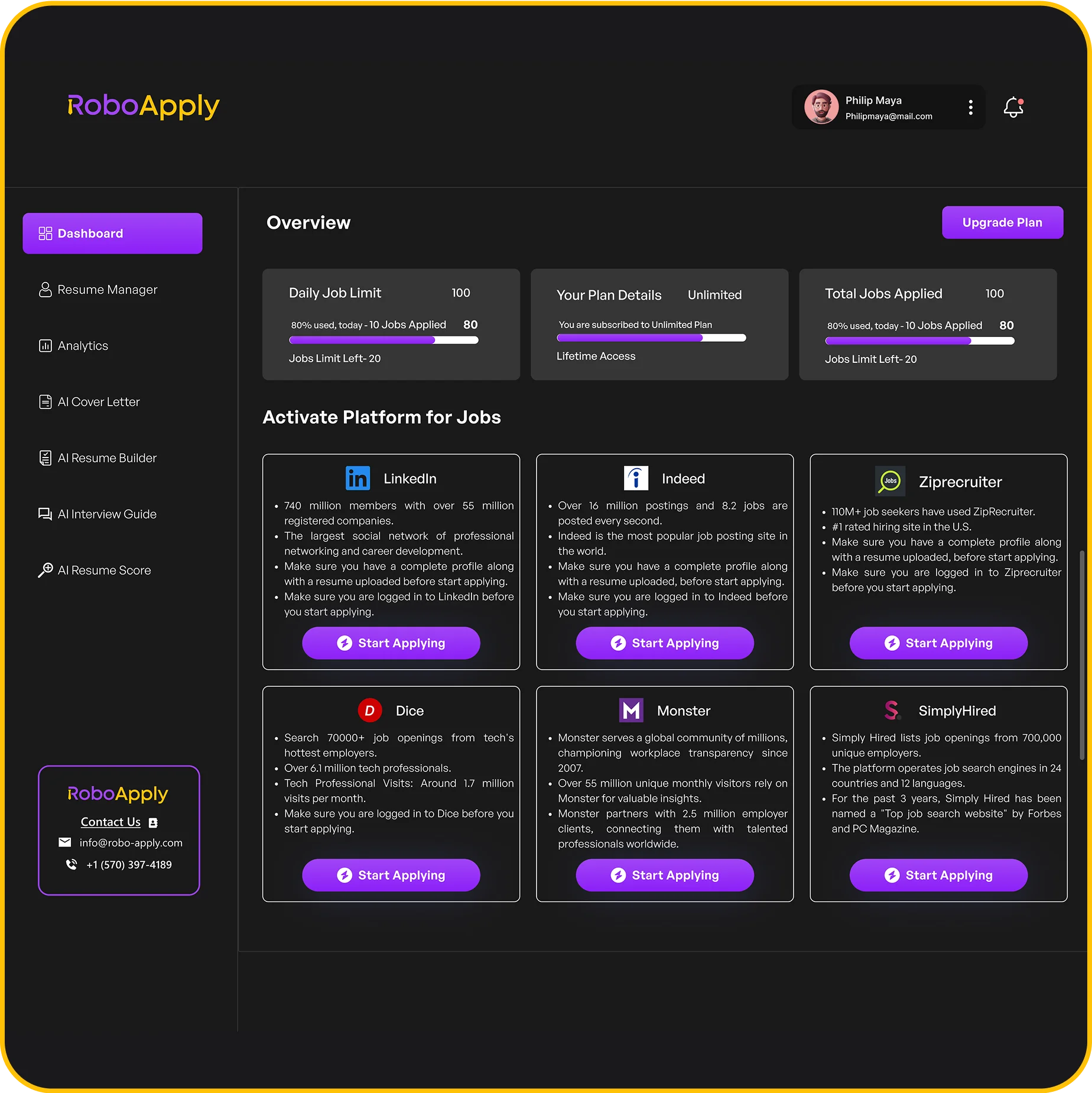

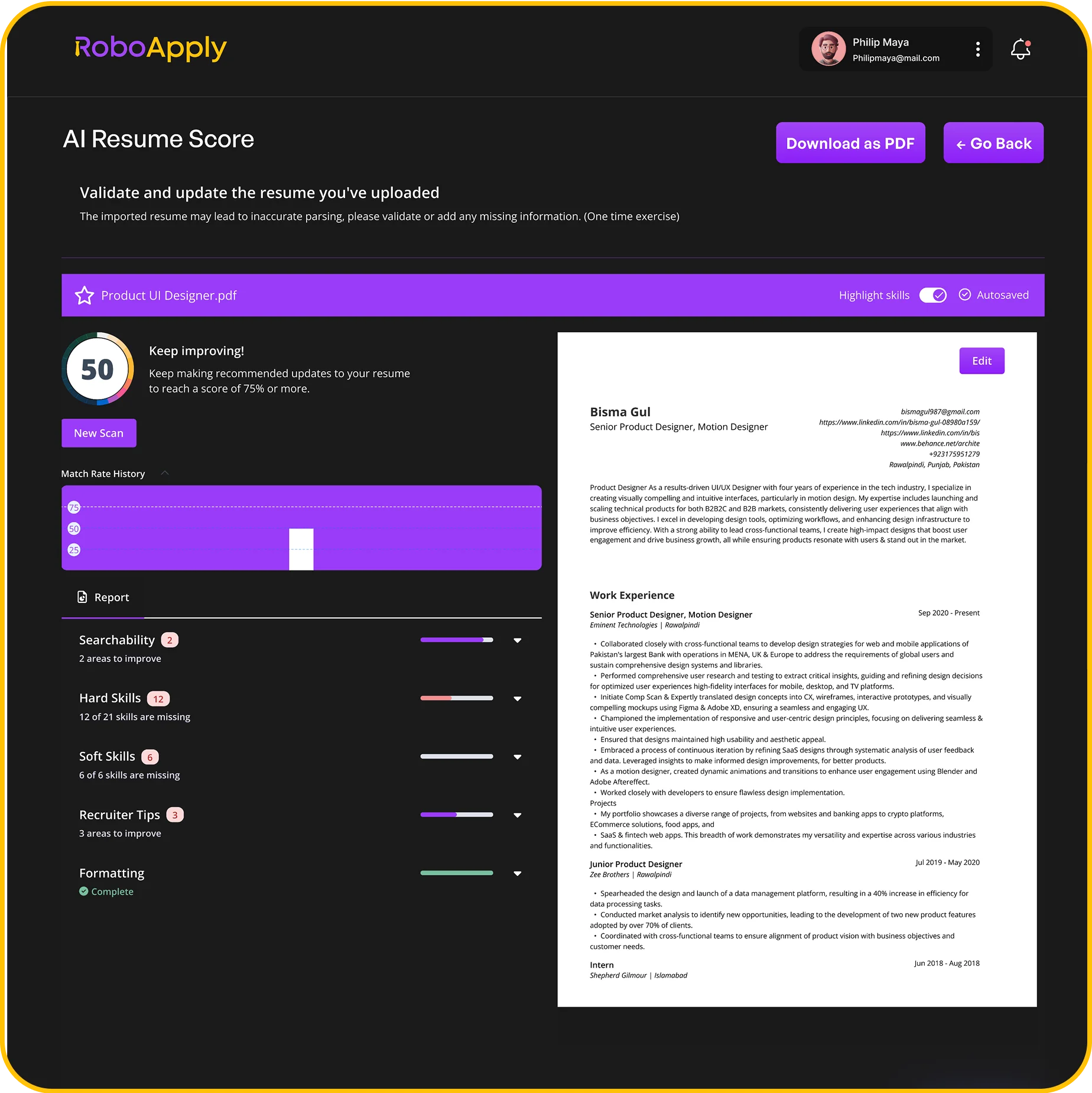

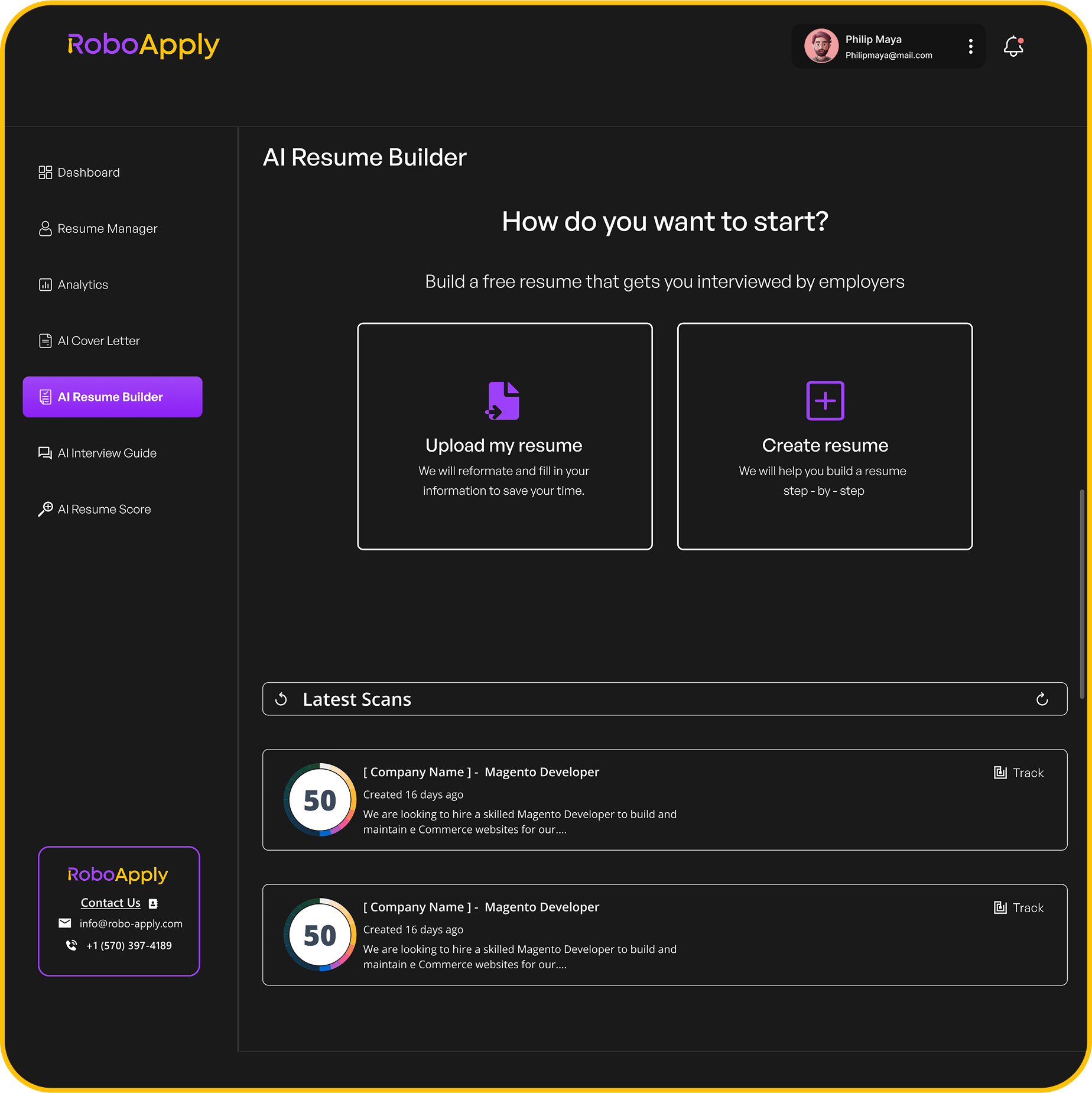

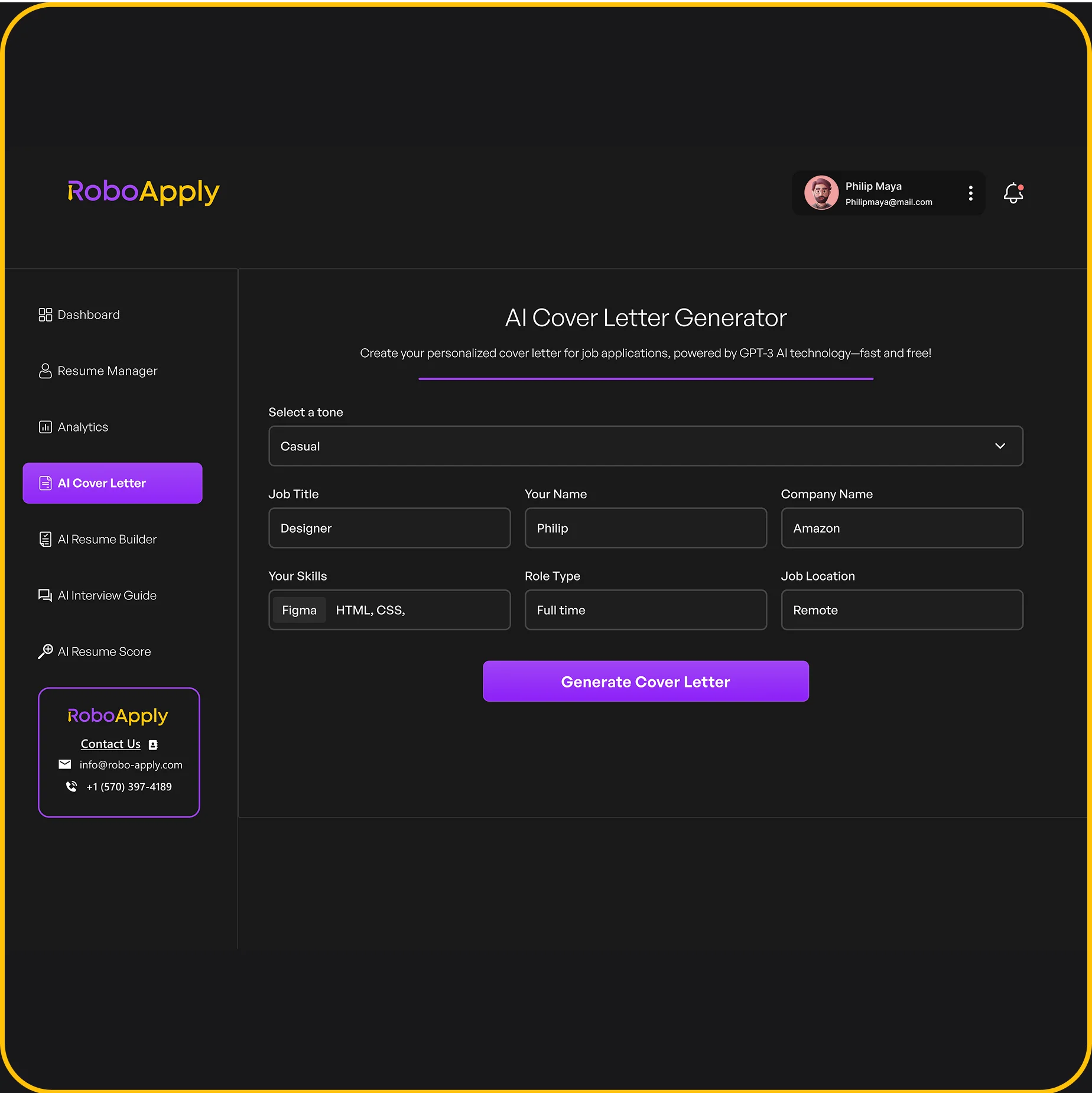

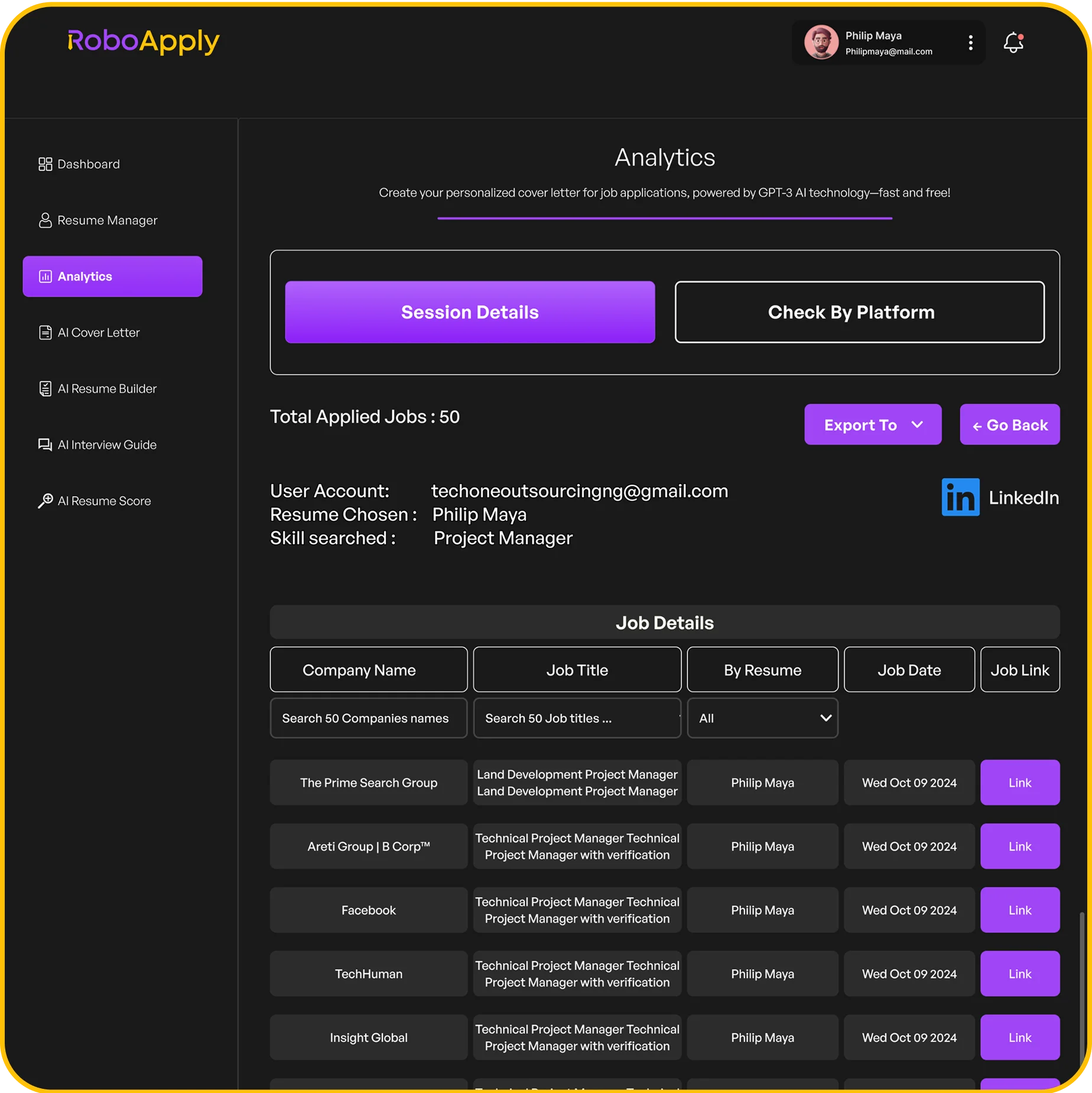

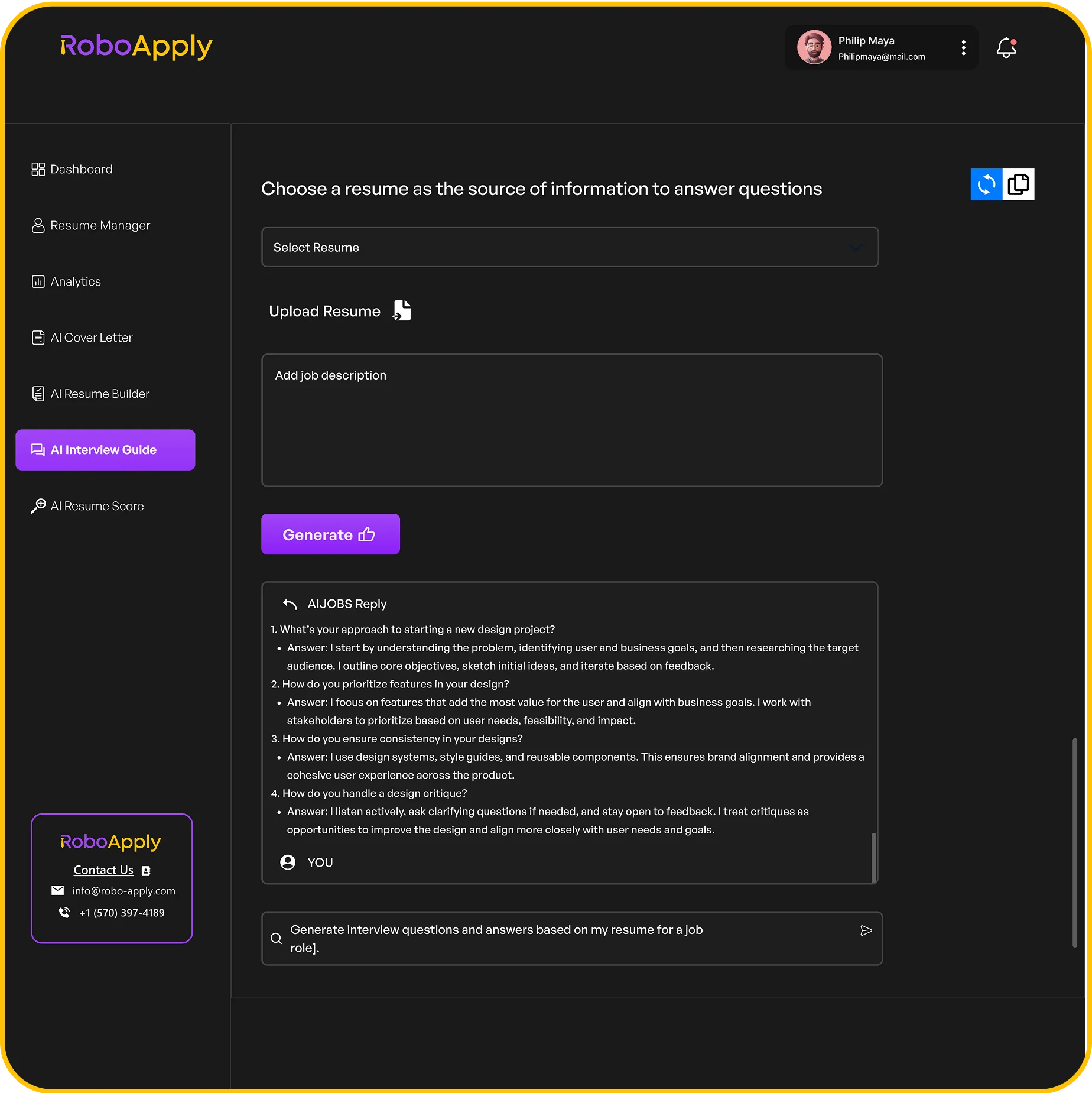

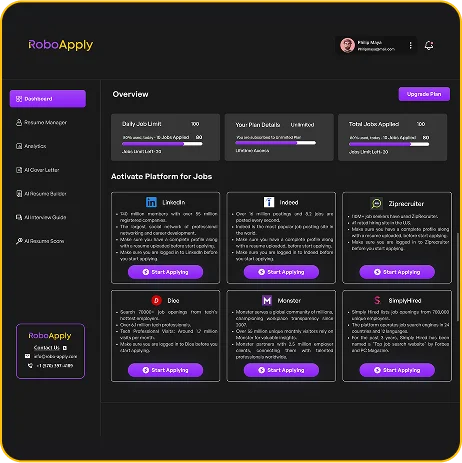

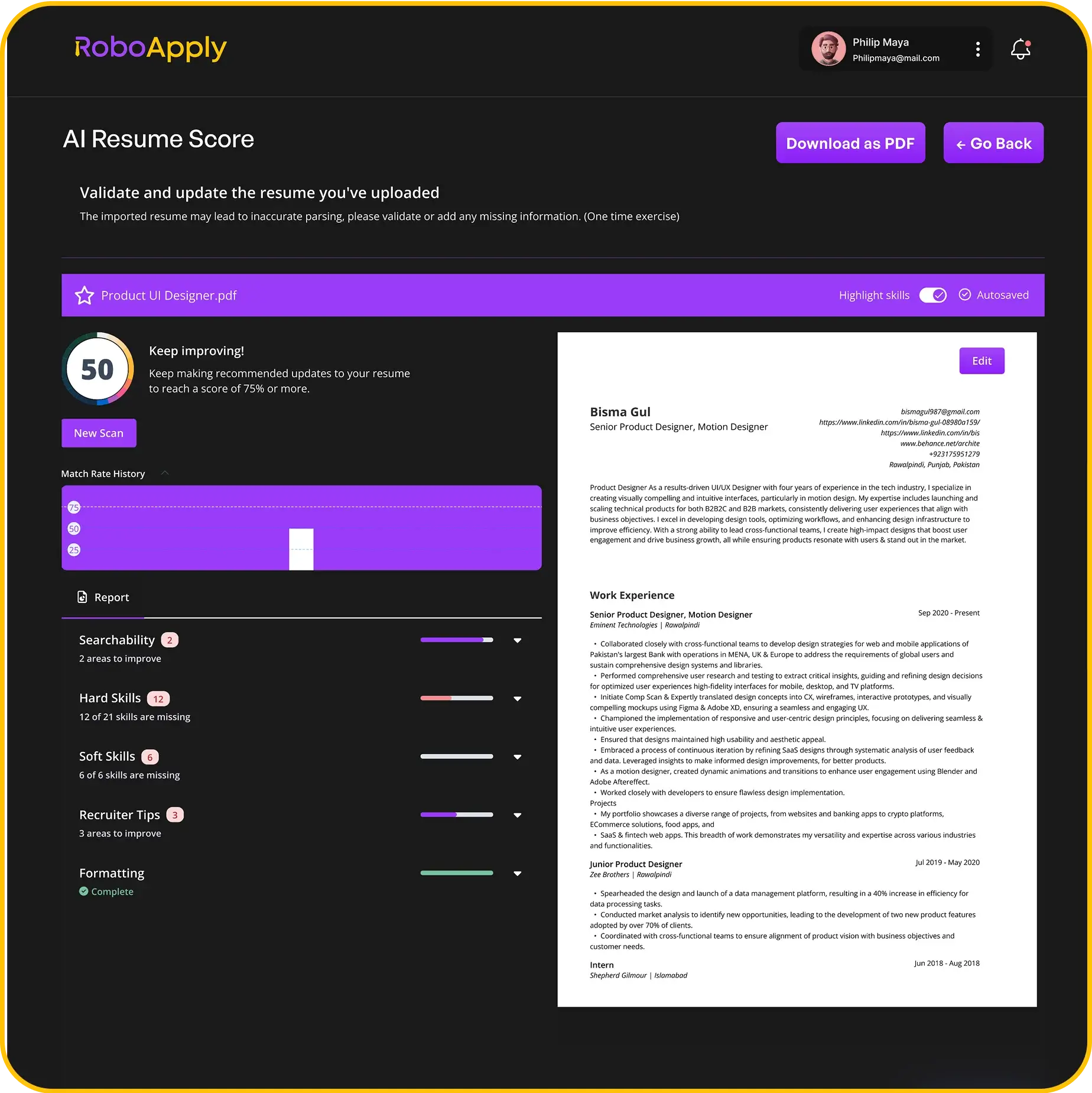

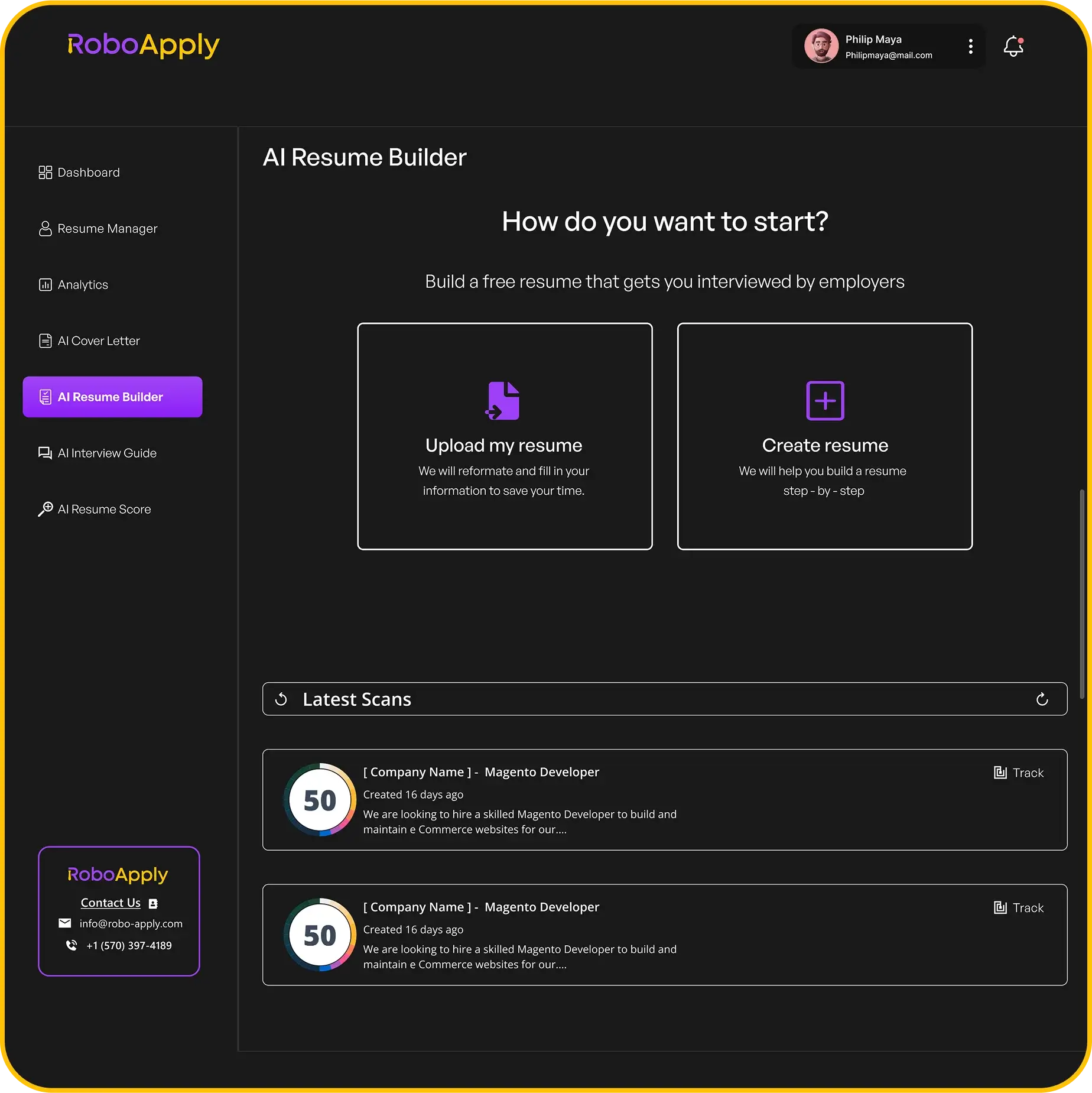

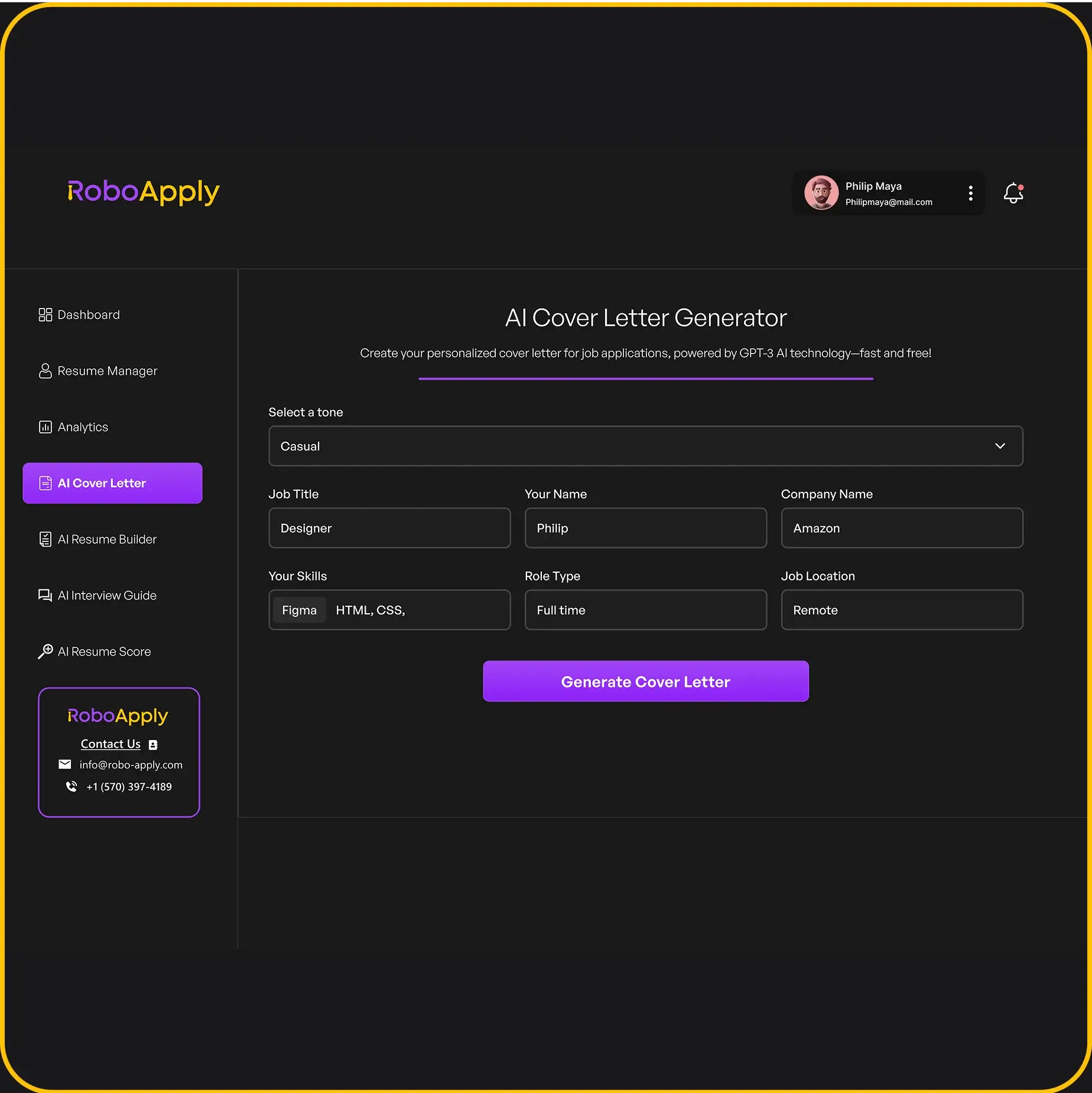

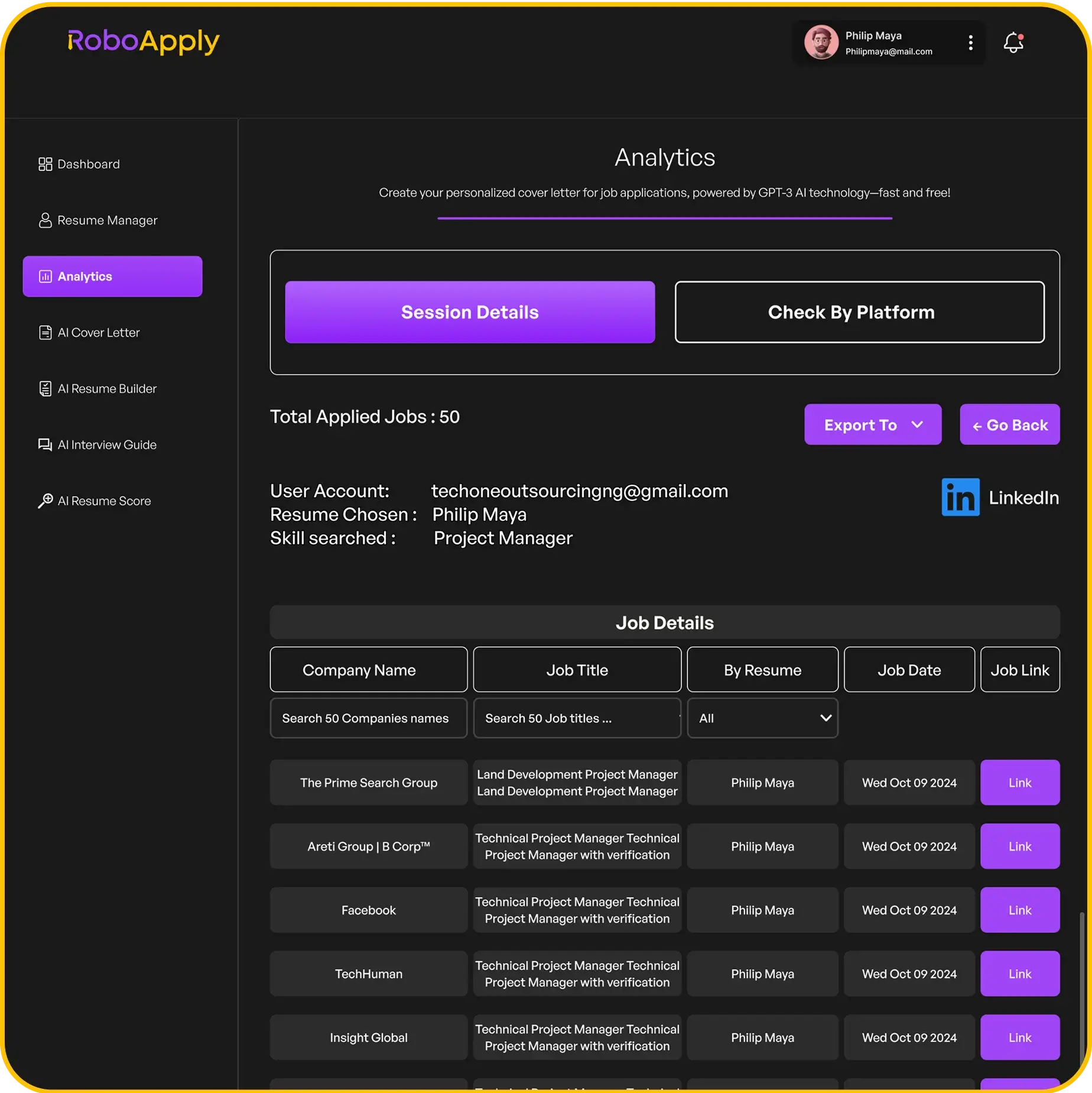

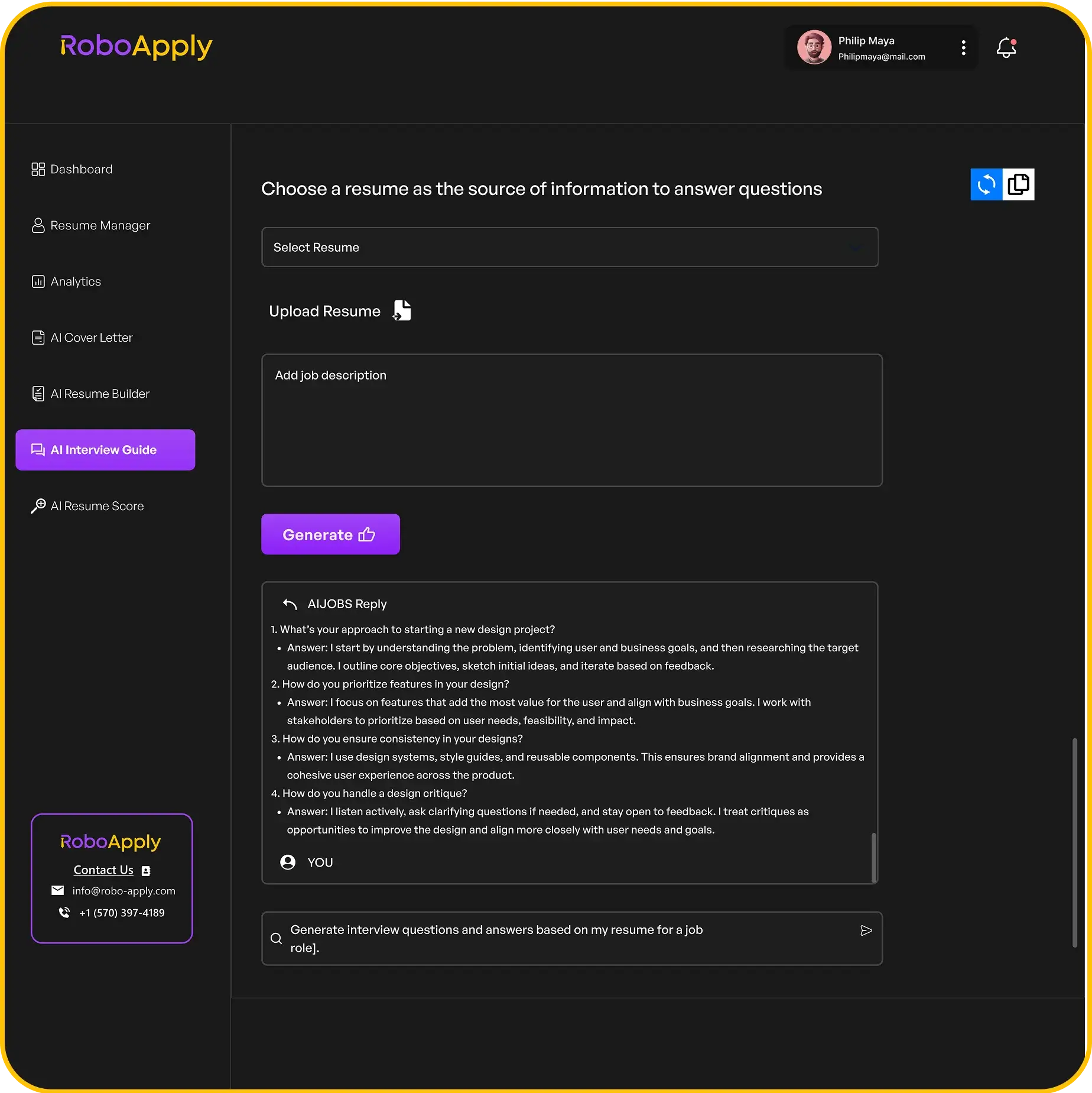

RoboApply makes it easy to add these details with its AI resume builder and ATS resume score optimizer. Users can highlight key skills and achievements so their resume is ready for top tax accounting roles. This focused approach saves time and helps fit today’s job market.

Here’s a full-length example for this section:

Tax Accountant with four years of experience preparing federal and state tax returns for individuals and small businesses. Maintained full compliance with changing tax regulations, reducing client audit risk by 25% in 2023. Identified deductions and credits to save clients an average of $12,000 per year. Highly experienced in using QuickBooks and Excel for accurate bookkeeping and reporting. Prepared quarterly and annual tax filings, answered IRS inquiries, and updated clients on tax law changes. Known for attention to detail, meeting all filing deadlines, and clear client communication.

2) Show proficiency with accounting software like QuickBooks and TurboTax

Tax accountants should always list their skills with accounting software such as QuickBooks and TurboTax. Most employers want to see this on your resume because it shows you can handle digital tax prep and manage bookkeeping tasks well. Use clear language and give specific examples of software you know.

RoboApply allows users to highlight their software skills in a structured way with its AI resume builder and grammar checker. They can use the resume score optimizer to make sure software skills stand out and help pass ATS scans. Tools like QuickBooks, TurboTax, H&R Block, and Excel are all good to mention, but RoboApply features make it easy to format and optimize these skills.

It’s important to be specific. For example, don’t just say “proficient with accounting software.” Instead, try a snippet like this:

Example:

Proficient in QuickBooks for managing accounts payable and receivable, reconciling bank statements, and generating monthly reports. Experienced in TurboTax for preparing individual and business tax returns, ensuring compliance with all federal and state tax regulations. Familiar with Excel for data analysis and tax forecasting.

Including these details in your skills or experience sections helps your resume stand out. Employers are more likely to call candidates who can show both software familiarity and practical use in real-world tax scenarios. For more ideas, check out tax accountant resume examples that highlight software proficiency.

3) Include knowledge of current tax laws and regulations for 2025

It is essential for any tax accountant resume to clearly show up-to-date knowledge of tax laws and regulations for 2025. Employers want to see that the applicant stays current and knows how to apply the latest changes. This can set one candidate apart from another, especially in a field where details matter.

Job seekers should list specific regulations or acts relevant to their experience. For instance, noting recent adjustments in IRS guidelines or new state-level rules adds weight. Including details about experience with both federal and state compliance requirements helps demonstrate practical skills.

Highlighting this knowledge is simple but powerful. A clear bullet point or line in the experience section can do the job. RoboApply’s AI resume builder helps users list relevant regulations so nothing important is missed. Their ATS optimizer checks for the most in-demand keywords linked to the 2025 tax law updates.

Example resume bullet points for this skill:

- Stayed current on 2025 federal and state tax law changes, applying all relevant updates during client tax preparation.

- Applied new IRS and state tax regulations for individual and corporate tax returns in 2025.

- Attended regular training and webinars to maintain expertise in evolving tax codes and compliance best practices.

Showing awareness of current tax laws builds trust with employers. It also helps ensure the resume gets past automated screeners by including the newest compliance language. For more ways to highlight compliance knowledge, visit industry resources like tax accountant resume examples for 2025.

4) Demonstrate experience preparing individual and corporate tax returns

Hiring managers look for tax accountants who can handle both individual and corporate tax return preparation. This shows flexibility and a strong understanding of tax compliance across different types of clients. Be specific when describing the types of tax returns handled and the level of responsibility in each task.

Use clear job descriptions for each relevant position, focusing on tax return preparation, filing, and any review work. RoboApply’s AI resume builder helps users highlight these areas using industry-standard keywords. This can boost visibility for applicant tracking systems and recruiters.

Below is a full-length resume statement that demonstrates this experience:

Tax Accountant

FirmName Accounting, Dallas, TX

June 2022 – Present

- Prepare and file federal and state individual tax returns for over 80 clients yearly, including high-net-worth individuals and sole proprietors.

- Lead the preparation of complex corporate tax returns (Forms 1120, 1120S, and 1065) for small and midsize businesses across multiple industries.

- Review financial records for accuracy and compliance with current tax laws and regulations.

- Advise clients on tax-saving opportunities and assist during IRS audits as needed.

- Maintain meticulous records and ensure all returns are filed on time to avoid penalties.

Candidates are encouraged to tailor their experience to match real job duties. RoboApply’s resume grammar checker and ATS optimizer make it easier to present experience clearly and get noticed by employers. For more tips, readers can look at tax accountant resume advice on sites like this tax accountant resume example.

5) Quantify achievements with metrics such as tax savings or audit outcomes

Recruiters look for results, not just duties. By adding numbers, tax accountants can show the impact of their work. For example, instead of saying “prepared tax returns,” use statements like “prepared over 100 individual and corporate tax returns, improving client compliance rates by 15%.”

Metrics can include total tax savings, number of audits passed, reduction in errors, or money recovered. Adding these details makes each bullet point more convincing and specific. This approach is supported by recent expert tips from industry leaders, as highlighted in these tax accountant resume examples.

Tax accountants should use key stats such as dollar amount saved, percentage improvements, or the number of successful audits. RoboApply’s AI resume builder helps users pull real data from work history and suggest the best way to display these metrics for maximum impact.

Example resume bullet points:

- Secured $45,000 in annual tax savings for small business clients by identifying overlooked deductions.

- Led 5 IRS audits with zero adjustments required, ensuring full regulatory compliance.

- Improved monthly reconciliation accuracy by 20%, reducing year-end errors.

RoboApply users can boost their resume score and stand out to employers by focusing on measurable results using these techniques. Quantifying achievements is one of the fastest ways to turn a general tax accountant resume into a top performer for 2025.

6) Emphasize certifications such as CPA or Enrolled Agent

Certifications like Certified Public Accountant (CPA) and Enrolled Agent (EA) are key to a strong tax accountant resume. Listing these clearly near the top of the resume makes an immediate impact with hiring managers. These credentials show advanced knowledge of tax laws, ethical standards, and professional commitment.

RoboApply suggests placing certifications in a separate section right below the contact information. This not only highlights the credentials but also ensures automated screening tools spot them fast. Certification badges or keywords improve chances with ATS systems used by employers.

Here’s a plain-text example of how to list certifications in the resume:

Certifications

- Certified Public Accountant (CPA), State of California, License #555123, Expires 04/2027

- Enrolled Agent (EA), IRS, Active Status

This approach is simple and direct. It works well for both printed and digital resumes. For those updating their resume, RoboApply’s resume grammar checker and ATS score optimizer can help ensure certification details stand out and are error-free.

7) Detail experience with tax planning and consulting services

Showing tax planning and consulting experience on a resume signals to employers that a candidate can do more than just fill out tax forms. It means they can help businesses or individuals minimize tax liability, find tax savings, and follow changing regulations. RoboApply makes it easy to highlight these achievements with tools like the AI resume builder and resume grammar checker.

When describing experience, keep it clear and results-focused. Mention the types of clients worked with, steps taken to reduce tax burdens, and any successes or complex projects handled. Focus on concrete outcomes to prove value to a future employer.

Example for resume use:

Tax Planning and Consulting Experience

Advised 40+ small business clients on year-round tax strategy and compliance planning. Reviewed client financials, implemented legal tax savings measures, and educated owners on upcoming tax law changes. Led annual review meetings to identify and apply deductions, successfully reducing average client tax bills by 18%. Ensured timely filing and resolved IRS communications efficiently, resulting in zero penalties across all accounts.

Recruiters are also looking for familiarity with relevant tax codes, ability to explain tax concepts simply, and strong consulting skills. RoboApply’s ATS resume score optimizer ensures these points are properly highlighted for better job match. For more tips, see this tax accountant resume guide for 2025.

Frequently Asked Questions

A strong tax accountant resume highlights up-to-date expertise in tax law, accounting software skills, and experience with tax return preparation. Tailoring content to the role and using clear, specific examples can help job seekers show real impact.

How should a Junior Tax Accountant structure their resume to stand out?

A Junior Tax Accountant should keep the resume easy to read, starting with a clear objective and a summary of education and certifications. Focus on internships, relevant coursework, and any hands-on experience with tax returns.

Job seekers can use RoboApply to streamline formatting and optimize content. Highlight software skills and any quantifiable results, like error reduction or process improvements. Include keywords specific to entry-level tax roles for better ATS results.

What are key skills to highlight in a Senior Tax Accountant’s resume?

Senior Tax Accountants should emphasize advanced knowledge of tax compliance, complex return preparation, and up-to-date awareness of 2025 tax laws. List leadership roles, experience with audits, and proficiency with industry-standard accounting tools.

Detail achievements using metrics, such as resolved client audits or tax savings secured. RoboApply can review wording, flag missing key skills, and suggest improvements to boost resume visibility to recruiters.

What objectives can a Tax Accountant include to enhance their resume?

Objectives should be concise and focused on delivering value. For example, state the desire to maximize tax savings, strengthen compliance, or improve reporting accuracy for an employer.

A well-written objective using RoboApply’s AI resume builder can align the candidate’s career goals with a company’s needs. Custom objectives can target roles in public accounting, corporate tax, or government agencies.

How can a Corporate Tax Accountant effectively showcase industry-specific experience on their resume?

Corporate Tax Accountants should list experience in handling business tax returns, regulatory filings, and dealing with multi-state tax issues. Detail familiarity with compliance standards and in-house accounting systems.

RoboApply’s template builder allows users to customize sections for industry-specific achievements. Use action verbs and numbers to show the impact on profits, compliance, and process efficiency.

In what ways can a Tax Preparer demonstrate their expertise on a resume?

Tax Preparers can demonstrate expertise by describing the volume and types of returns handled, knowledge of current regulations, and use of tax software. List continuing education or certifications obtained, especially for the 2025 tax year.

The RoboApply resume optimizer highlights these details and checks for relevant terminology, making sure expertise comes through clearly for recruiters and ATS systems.

What are the best practices for updating an accounting resume with a long-term position?

After holding a long-term job, update the resume to highlight growth, promotions, or increases in responsibility. Quantify achievements—like tax savings, audit outcomes, or improvements in efficiency—over the years.

Use RoboApply’s grammar checker to update old sections and keep formatting clean. Summarize the main duties, then use bullet points to list key accomplishments and results, making it simple for hiring managers to review.