A strong insurance agent resume can be the difference between landing an interview and getting passed over. The right format and wording help highlight important skills while showing experience that matters to employers. This article shares seven real insurance agent resume examples that helped applicants get hired for jobs in 2025.

Anyone looking for a new role as an insurance agent will benefit from seeing how successful professionals present themselves on paper. These sample resumes make it clear what hiring managers want to see and give easy ideas for building a competitive application.

1) Tailored summary emphasizing insurance sales achievements

A strong resume summary at the top of the document sets the stage for your application. In insurance, hiring managers want to see clear evidence of sales performance and customer results right away. Writing a tailored summary that features sales achievements helps your resume stand out in today’s competitive market.

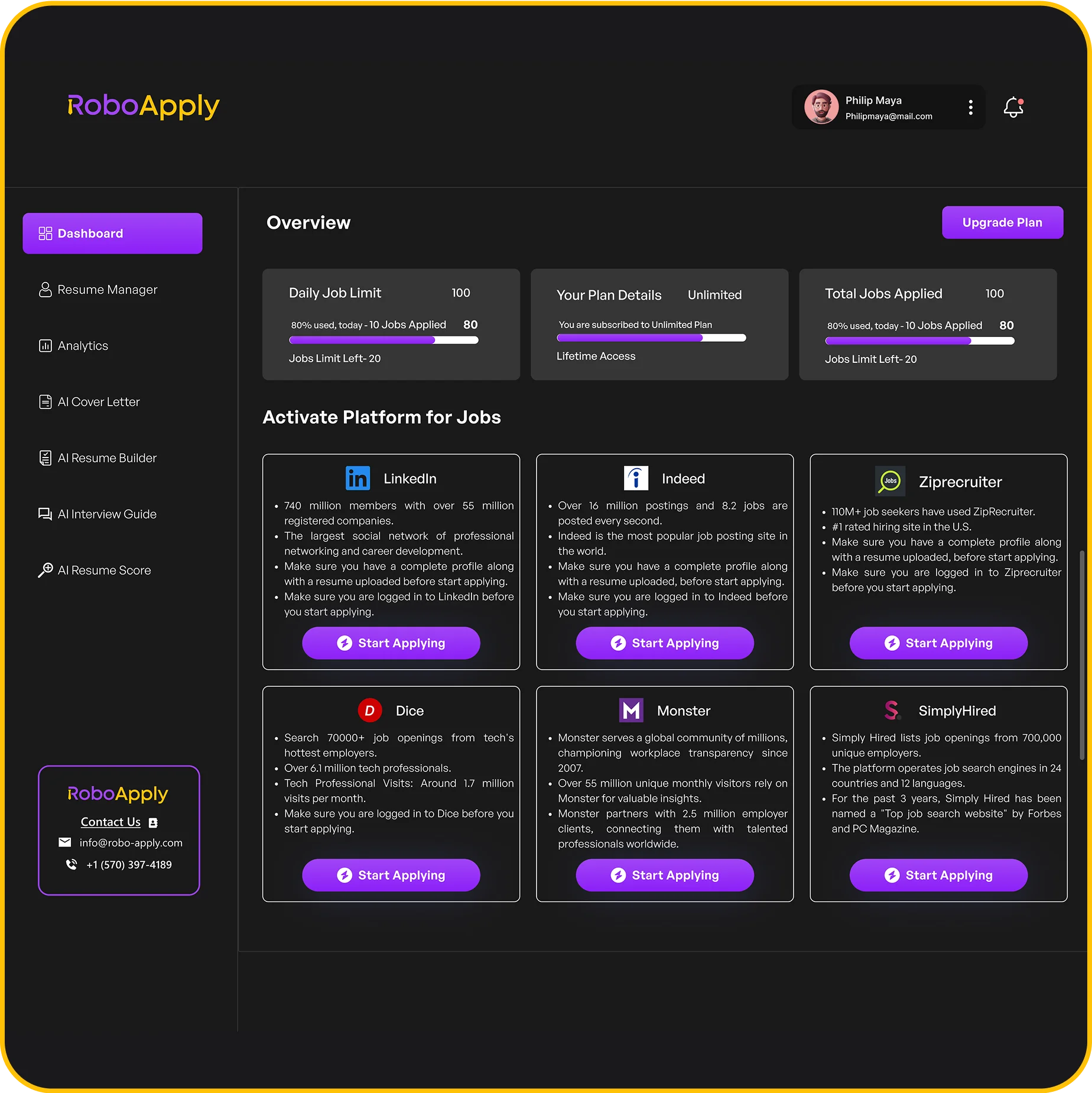

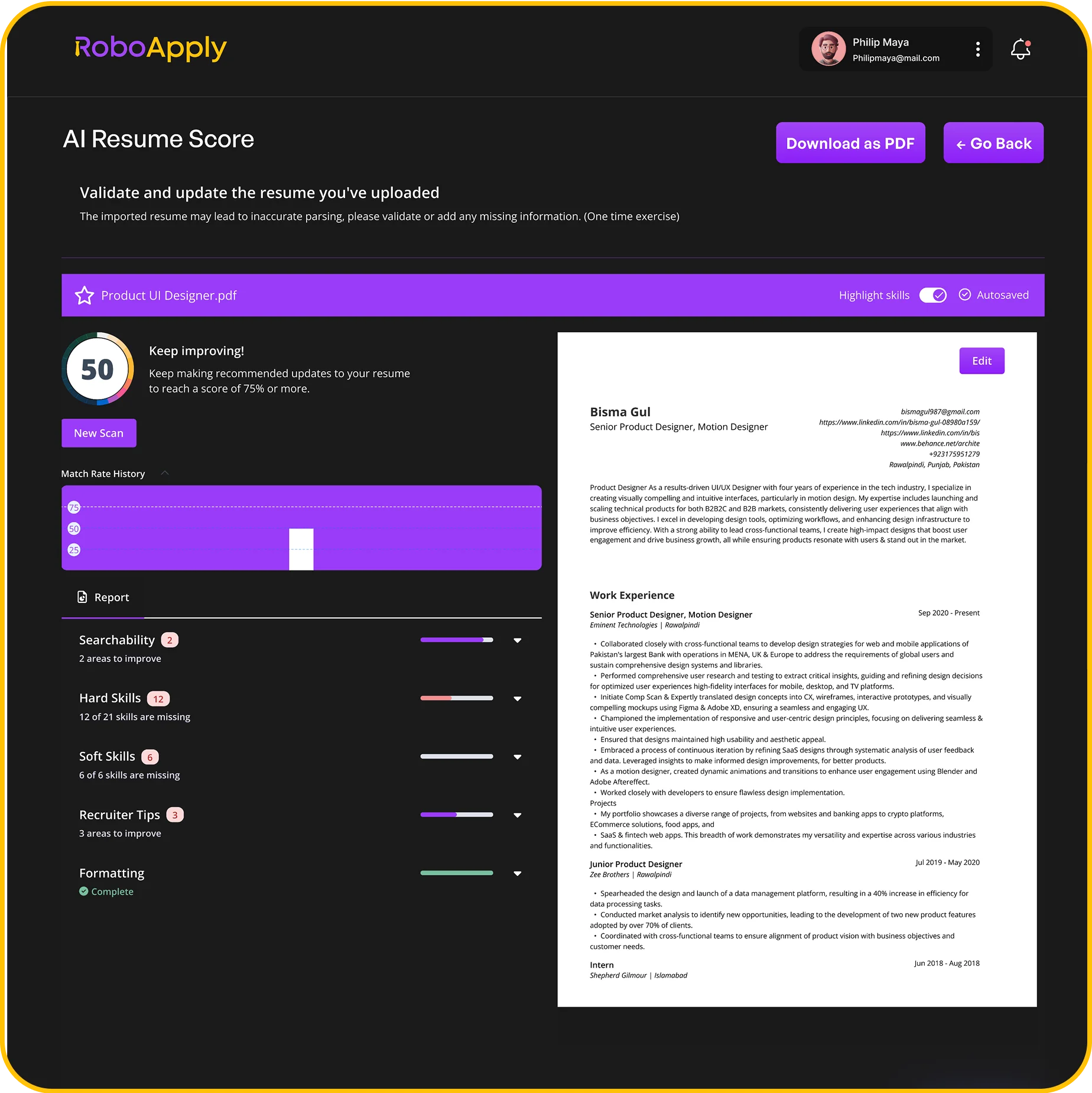

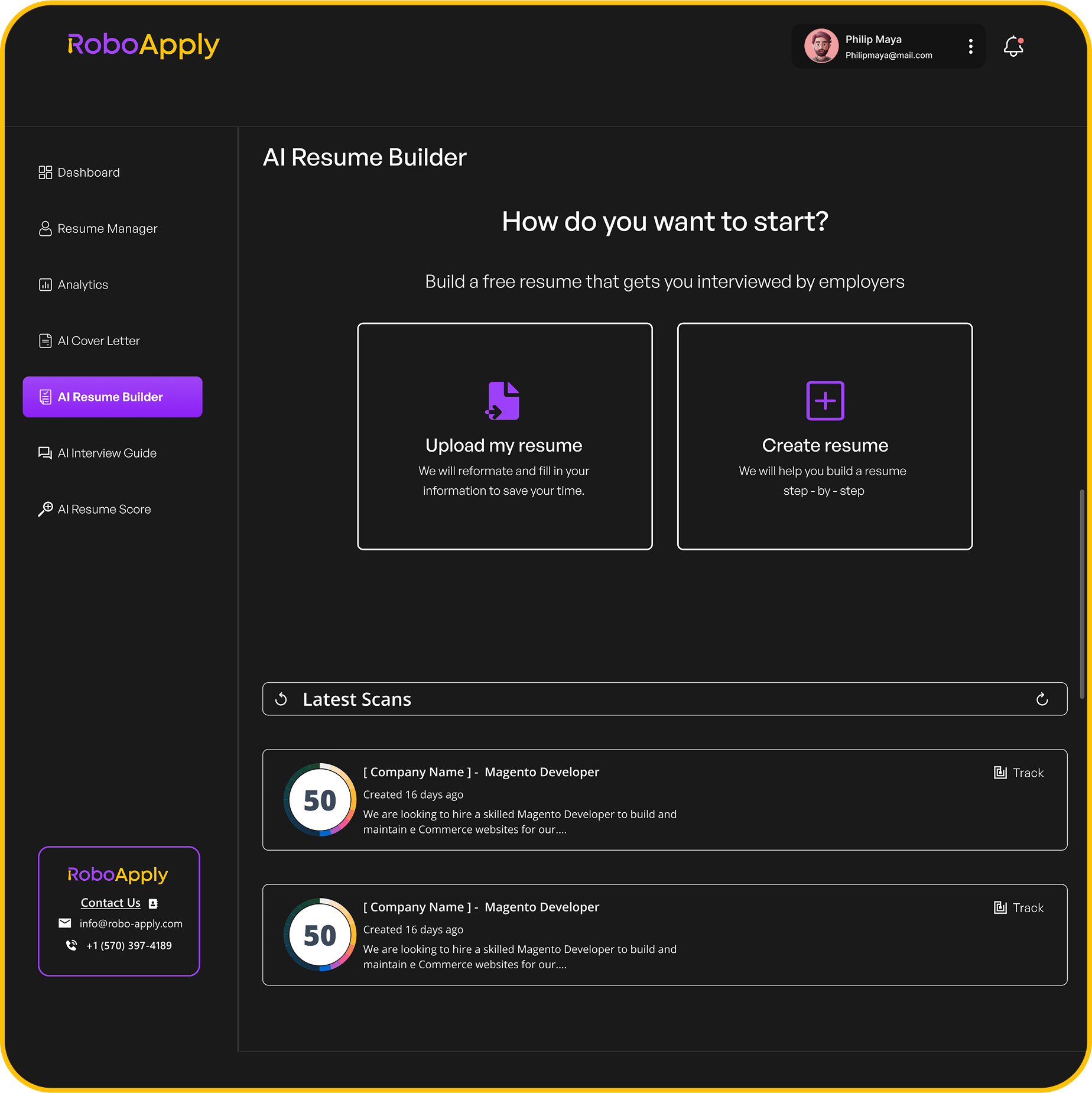

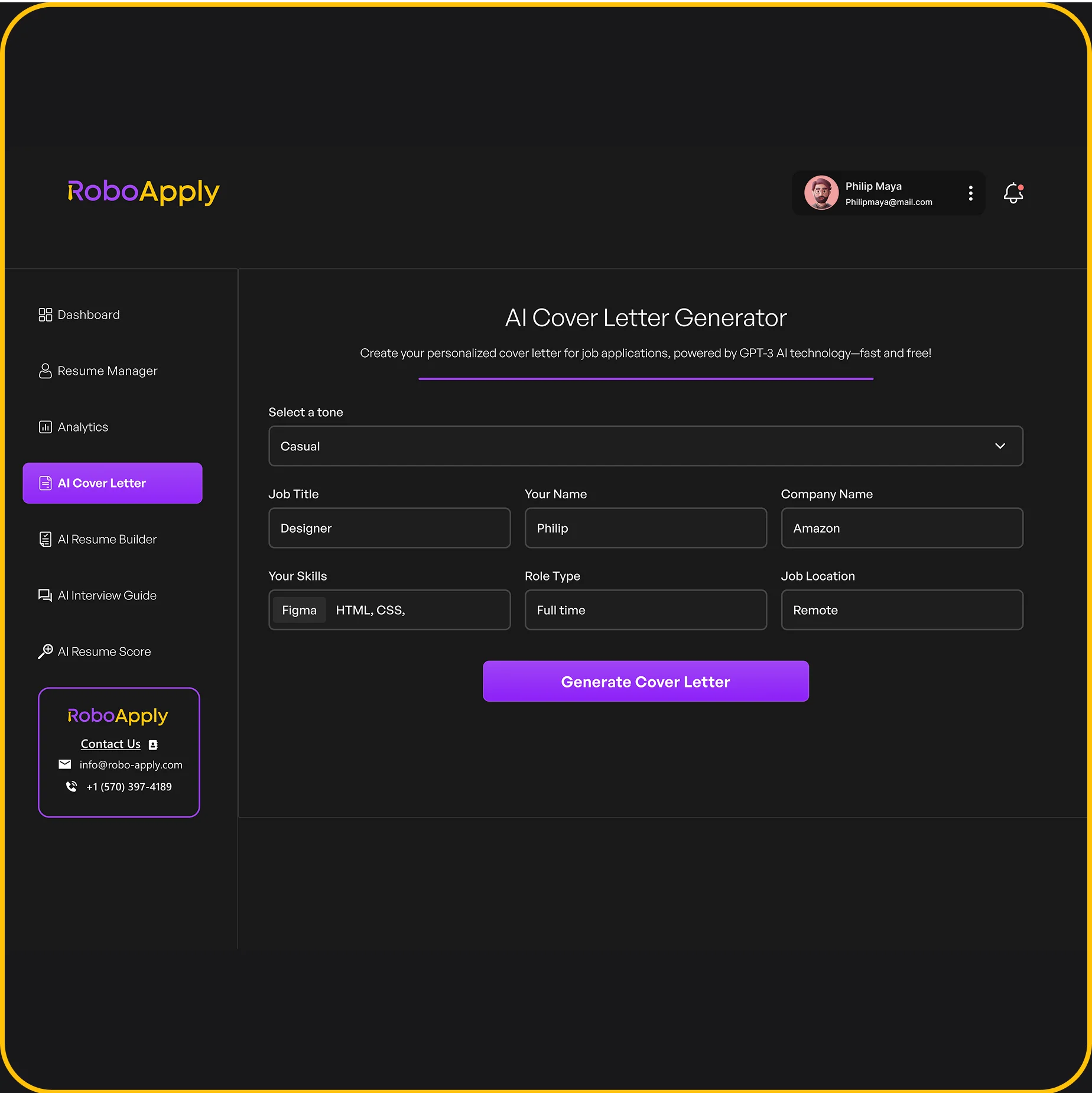

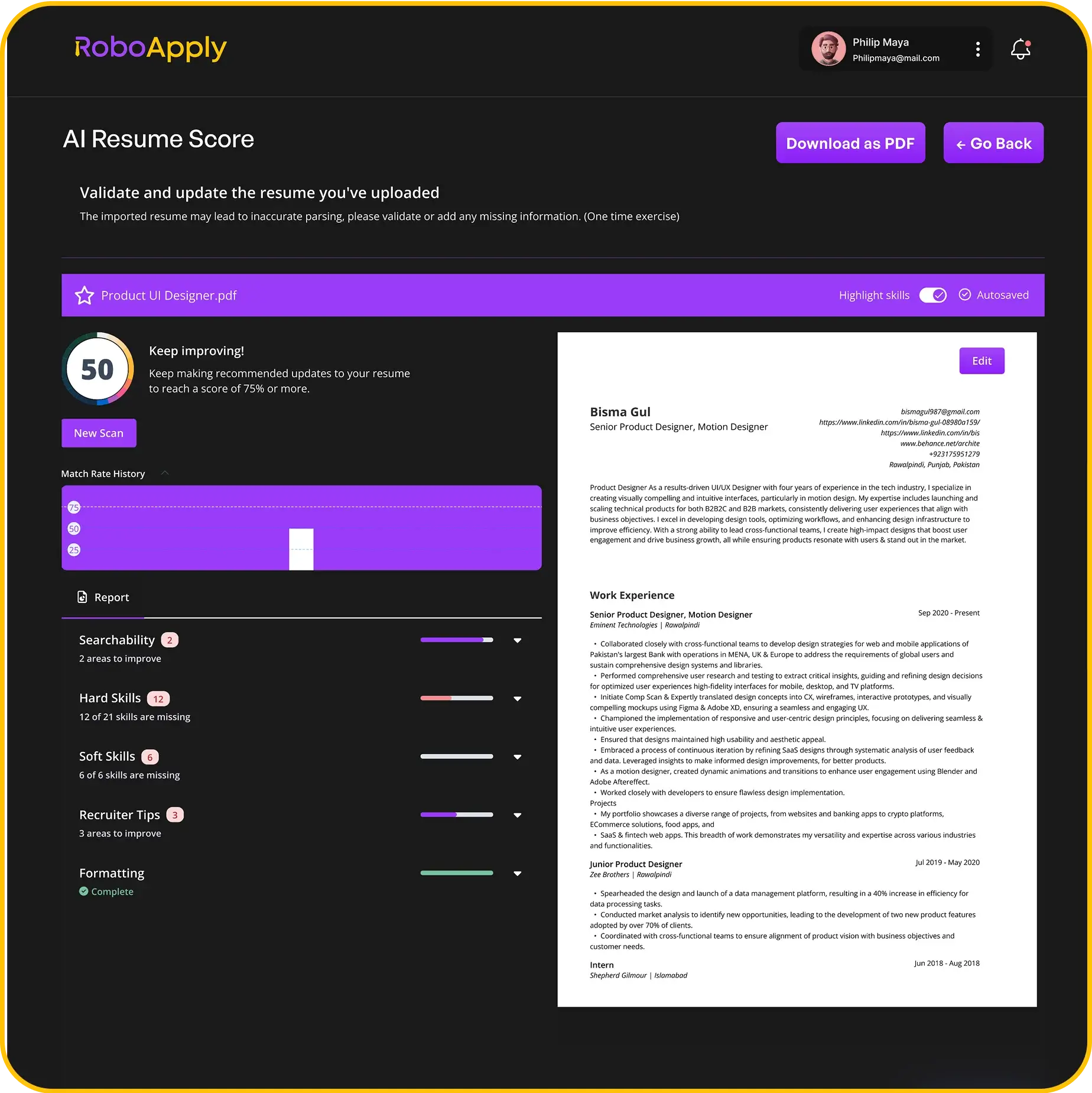

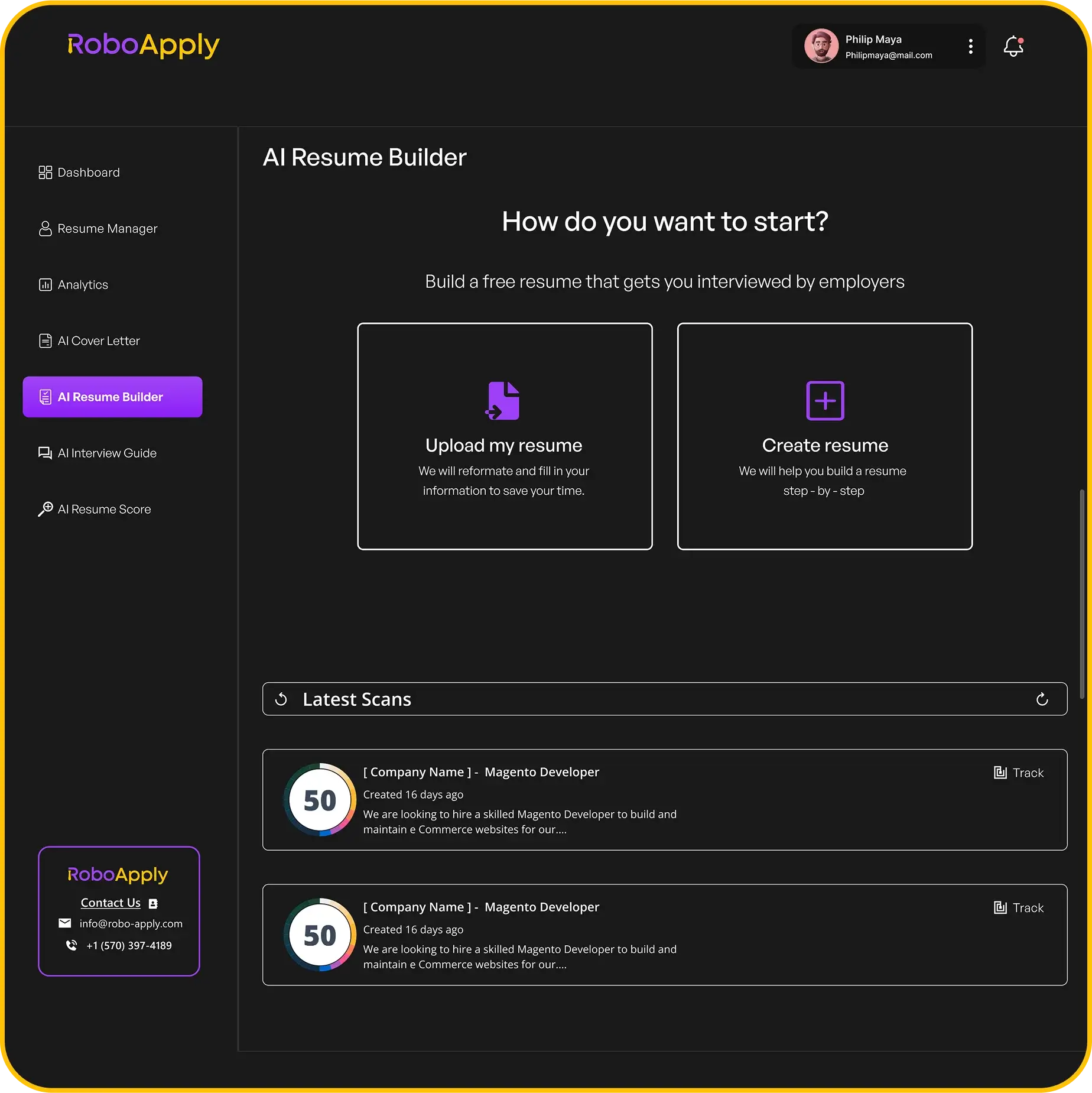

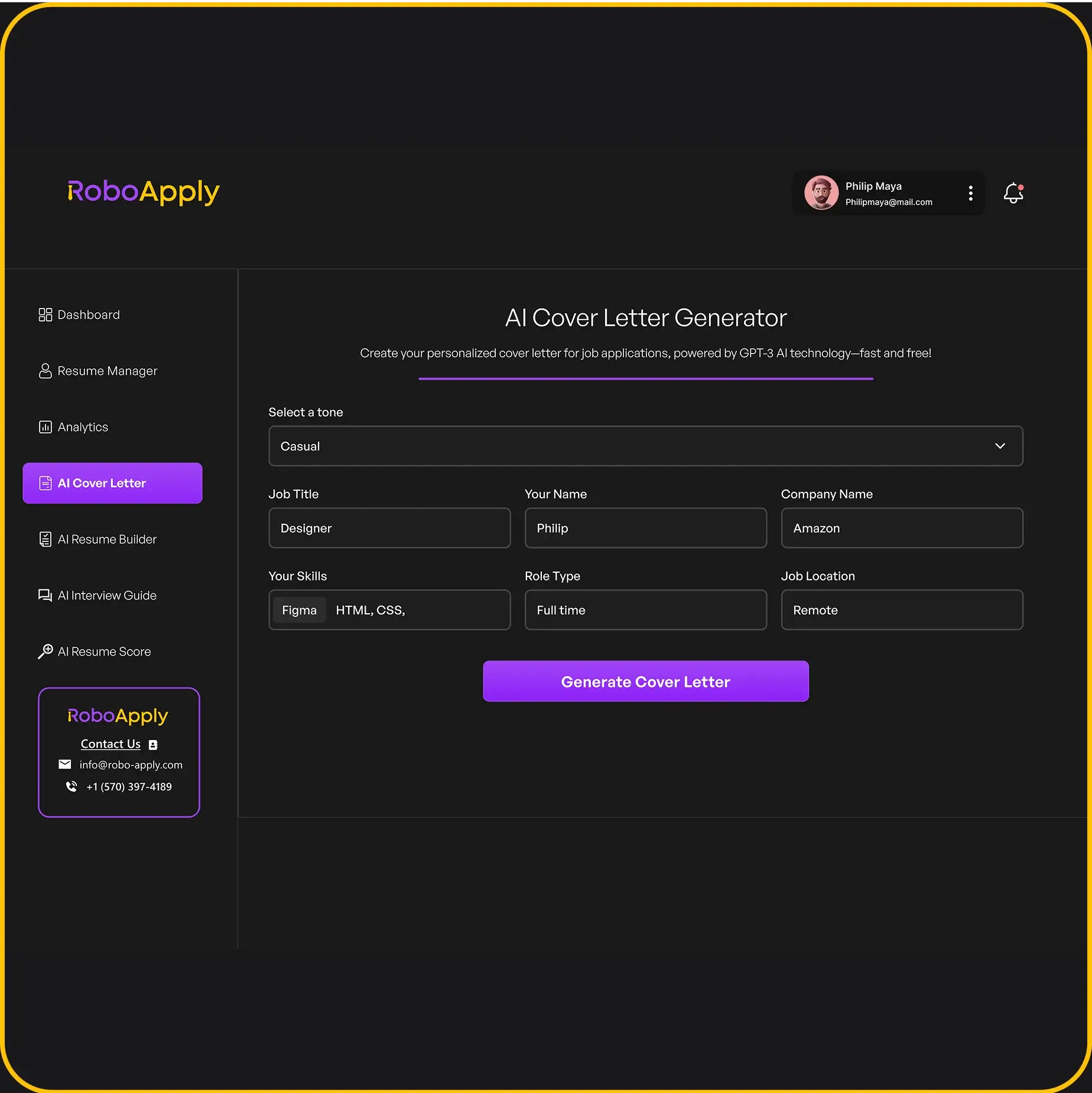

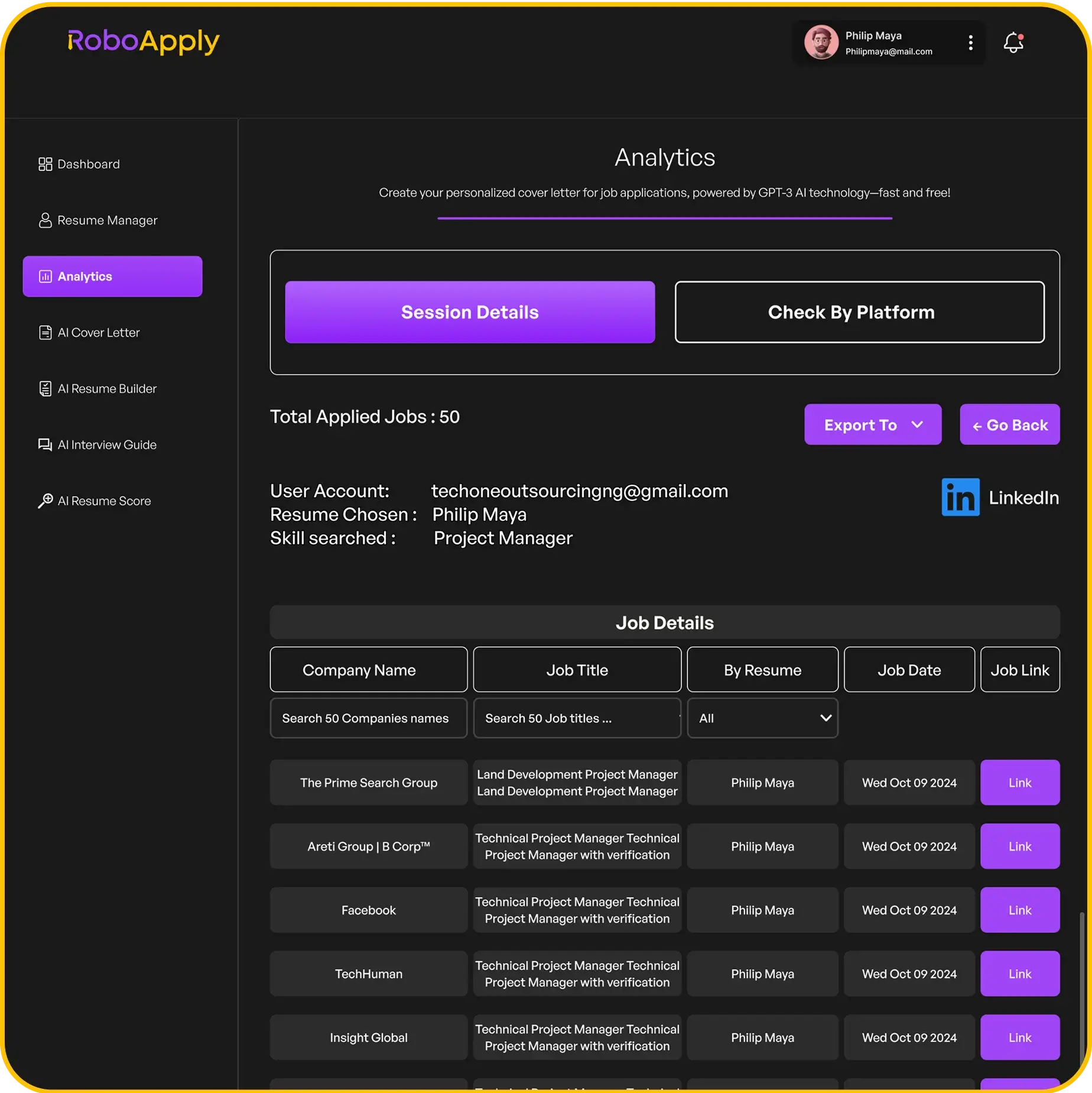

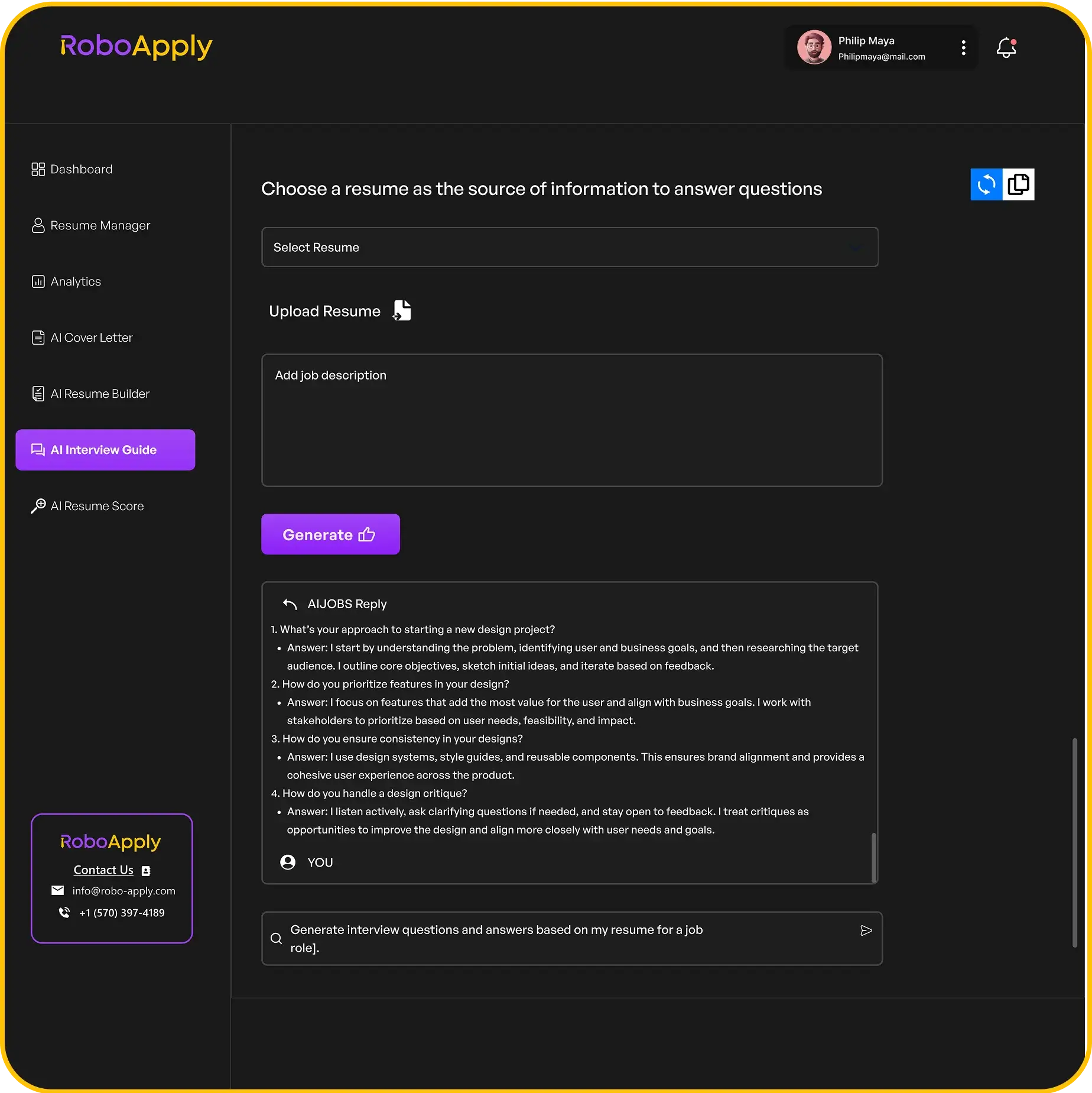

For job seekers looking to save time building a polished, high-impact resume, RoboApply’s AI resume builder creates personalized summaries that are optimized for applicant tracking systems. It ensures you present your sales numbers and product knowledge clearly, giving you an advantage over generic resumes.

Here is a copy-and-paste-ready example of an insurance agent resume summary, designed to highlight sales results and relevant experience:

Experienced Insurance Agent with over 6 years of success in life, auto, and health insurance sales. Proven track record of surpassing sales targets by an average of 28% yearly while consistently earning top client satisfaction rankings. Skilled at building trust, identifying customer needs, and closing policies quickly and efficiently. Certified in state-specific insurance regulations and experienced with digital sales tools. Ready to drive growth and exceed goals in a fast-paced environment.

2) Quantifiable results with premium revenue generated

Including numbers and specific results on an insurance agent resume proves success in real terms. Showing premium revenue generated helps hiring managers see the agent’s true value. RoboApply helps users highlight achievements like premium gains with clear, quantifiable language and offers a resume grammar checker to make sure your success is easy to read.

Numbers make statements more powerful in the insurance industry. Statements like “Increased annual premium revenue by $150,000 in 2024” are better than general claims about sales skills. When possible, use metrics that match the job posting. Tools like RoboApply’s ATS resume score optimizer can help ensure this information is recognized by hiring systems.

Here is a full-length example resume achievement statement for this section:

Produced and managed $350,000 in new premium revenue in 2024 by targeting small business policies, developing cross-sell strategies, and nurturing new client relationships. Consistently surpassed monthly quotas, securing an average of 25% year-over-year premium growth. Recognized as Top Producer of the Quarter for delivering the highest premium revenue among a team of 12 agents.

3) Strong communication and negotiation skills highlighted

Every top insurance agent resume in 2025 makes communication and negotiation skills clear. Employers look for agents who can explain policies in simple terms, handle questions, and guide clients to make decisions. Agents who show real examples of these skills often get noticed.

Applicants can use RoboApply’s AI resume builder to quickly identify and highlight communication strengths. This tool helps customize bullet points that match job descriptions and check for grammar or word choice issues.

Here is a full-length resume example that highlights communication and negotiation skills:

John Carter

Houston, TX | johncarter@email.com | (555) 321-6547

Professional Summary

Licensed Insurance Agent with 4+ years of experience advising clients, building strong relationships, and closing policy sales. Skilled at explaining complex policies, negotiating terms, and ensuring client satisfaction.

Experience

Senior Insurance Agent, TexSure Insurance, Houston, TX

July 2022 – Present

- Explained auto, home, and life insurance coverage options to an average of 45 clients per week

- Negotiated policy renewals and resolved client issues, increasing retention by 18%

- Presented policy features at community events, resulting in 20+ new client sign-ups monthly

Insurance Sales Associate, Gulf Coast Insurers, Houston, TX

March 2020 – June 2022

- Advised clients on coverage choices, answering more than 30 daily inquiries

- Used active listening to understand client concerns and found solutions quickly

Education

Bachelor of Business Administration, Texas State University

Skills

Verbal and written communication, negotiation, relationship-building, problem solving

A resume like this shows both communication and negotiation skills with specific examples and results. Using RoboApply, job seekers can check their resume for key terms that hiring managers are searching for and optimize their application even further. For more proven formatting options and tips, visit this list of insurance agent resume examples for 2025.

4) Use of industry-specific keywords to pass ATS scans

Most companies now use Applicant Tracking Systems (ATS) to filter resumes before a human ever sees them. These systems look for specific keywords that fit the job posting. Adding industry-specific terms and skills can help insurance agents move past this first screening.

It’s important to carefully read the job description and include the exact language in your resume. Some key insurance keywords are “policy underwriting,” “risk assessment,” “claims management,” “customer retention,” and “regulatory compliance.” Packing your resume with these terms can raise your chances of being selected for an interview. A more detailed list of relevant keywords for insurance roles is available through resources such as Jobscan’s ATS resume keywords for 2025.

RoboApply has a resume keyword optimizer that scans your resume and points out missing keywords judges by leading insurance postings. Unlike general resume builders, RoboApply also gives suggestions for industry-specific words, so users can make sure their resume matches what hiring systems are actually searching for.

Always use these keywords in natural, clear ways. For example:

- Performed policy underwriting and risk assessments for new and existing clients

- Managed claims from submission to settlement, ensuring regulatory compliance

- Improved customer retention by providing personalized insurance solutions

- Trained new team members on compliance and fraud detection

Job seekers who use both tailored keywords and a tool like RoboApply are equipped to be noticed by the ATS and move forward in the hiring process. For ideas on more ATS-friendly keywords to include in insurance resumes, you can also refer to Jobscan’s complete list.

5) Professional format with clear section headers

A professional resume format is important for making information easy for hiring managers and recruiters to find. Clear section headers help break up the document and let employers quickly spot education, experience, and skills. Organizing your resume with readable fonts and defined sections shows attention to detail and makes it look more polished.

RoboApply’s resume builder makes it simple to create a resume that uses clear section headers and sharp formatting that employers expect. With one click, users can add bold section headings and choose modern layouts that are ATS-friendly. This helps resumes get past filters and keeps every section easy to scan.

For those building a resume from scratch, here’s a plain-text template that uses clear, professional section headers:

John Smith

555 Main Street

Austin, TX 78701

john.smith@email.com

(555) 555-5555

Professional Summary

Licensed Insurance Agent with 5+ years of experience in auto, home, and life insurance. Skilled in client relationships, policy recommendations, and closing deals. Dedicated to excellent customer service and meeting sales goals.

Skills

- Policy Sales

- Needs Assessment

- CRM Software

- Customer Service

- Claims Processing

Work Experience

Insurance Agent | ABC Insurance | Austin, TX | 2020–2025

- Increased client retention by 20% through follow-up strategies

- Sold over 150 new policies in one year

- Trained new staff on compliance and policy offerings

Education

B.A. in Business Administration

University of Texas at Austin – 2019

Licenses and Certifications

Licensed Insurance Agent, State of Texas (active)This format makes every section clear. RoboApply helps users achieve this layout in minutes, ensuring resumes look professional and job-ready. For more format inspiration, see additional insurance agent resume examples.

6) Inclusion of relevant licenses and certifications

Adding insurance licenses and certifications is key for any insurance agent resume. Most employers will look for proof of required state licenses or special training. These details show you’re qualified and can meet legal and job requirements. Important credentials, such as a state insurance license or designations like CIC, CISR, or CPCU, should be easy to find on your resume.

Place your licenses and certifications in a separate section, especially if they are recent or directly match the job. This helps them stand out right away to hiring managers and ATS systems. Tools like RoboApply make it simple to add and format these details, ensuring they pass automated resume checks.

Here’s an example of how to format this section on your resume:

Licenses and Certifications

State of California Life and Health Insurance License — License #0A12345

Issued: January 2023, Expires: January 2027

Certified Insurance Service Representative (CISR)

Earned: April 2024

Certified Insurance Counselor (CIC)

Earned: March 2022

Chartered Property Casualty Underwriter (CPCU)

Earned: February 2021

Arranging your credentials in a clean list with dates earned or valid helps employers verify your qualifications. RoboApply can auto-suggest common industry certifications or check your entries for accuracy, saving time and catching mistakes. For more, review other insurance agent resume examples with strong certifications to see what works in today’s job market.

7) Demonstration of client relationship management

Employers look for insurance agents who can build and maintain strong relationships with clients. They want to see proof that an applicant can keep clients informed, resolve issues, and retain business over time.

A resume should clearly describe specific actions taken to improve client satisfaction. It is important to mention tasks like follow-up calls, policy reviews, and handling claims efficiently. Tools like RoboApply make it easier to highlight these skills using AI-generated resume builders and grammar checks.

Here is a full-length example ready for use:

Client Relationship Manager | SafeGuard Insurance Agency

Chicago, IL | February 2021 – March 2025

- Managed a portfolio of over 250 clients, providing regular check-ins and scheduling annual policy reviews to ensure ongoing satisfaction.

- Responded quickly to all client questions and concerns, leading to a 98% client retention rate.

- Coordinated claims processing and policy changes, delivering clear, frequent updates throughout each step.

- Organized client appreciation events and communicated key policy updates, building trust and long-term loyalty.

- Consistently earned positive feedback scores and client referrals, helping exceed new sales targets by 22% each year.

Frequently Asked Questions

Insurance agents looking for new jobs in 2025 should focus on resume strategies that stress quantifiable achievements, skills relevant to hiring managers, and professional appearance. Special attention should be given to tailoring the resume based on career length, role specialization, and changes in the industry.

How can I tailor my insurance agent resume to highlight a 25-year career in the industry?

A candidate with 25 years of experience should use a strong summary at the top, emphasizing top achievements and long-term impact. Detail experience in reverse chronological order, featuring quantifiable successes like premium revenue or client growth. Highlight ongoing professional development to show up-to-date expertise. RoboApply’s AI resume builder can help organize extensive careers and select industry-specific keywords that matter most in 2025.

What are the key elements to include in a life insurance agent’s resume for a competitive edge in 2025?

Life insurance agents should prioritize results, such as revenue generated or sales targets met, in addition to certifications and licenses. Add keywords employers and applicant tracking systems (ATS) expect to see. RoboApply provides an ATS resume score optimizer and resume grammar checker, ensuring resumes for life insurance roles are both keyword-rich and error-free.

What tips can help update a resume for an insurance agent who has been in the same position for over a decade?

Focus on the measurable impact rather than responsibilities. Detail achievements, leadership in team success, or recognition received during long tenures. RoboApply can suggest improved phrasing and current formats to ensure the experience reads as dynamic and up-to-date rather than stagnant.

What strategies should be applied when crafting an auto insurance agent resume to stand out to employers?

Auto insurance agents should quantify new client signups, policy retention rates, and efficiency improvements. Use a clean, modern format with clear section headers for easy readability. RoboApply’s AI builder and Chrome auto-apply extension are helpful tools for customizing and sending polished auto insurance resumes to multiple employers efficiently.

How should I format my insurance resume to showcase a diverse range of experiences effectively?

Select a format that prioritizes both skills and achievements, such as a combination (hybrid) resume. Use clear headers, bullet points, and succinct summaries. RoboApply can help with layout suggestions and ensures each section is optimized for readability and ATS compatibility.

Where can I find free and successful insurance agent resume templates relevant to 2025 job markets?

Job seekers can access modern, effective insurance agent resume templates for 2025 directly through RoboApply’s AI resume and cover letter builder. These templates are tailored to meet ATS requirements and highlight the top skills and experience needed for success in the current market. For additional reference, users can review real-world insurance agent resume examples from enhancv.com.