Navigating the finance job market can be challenging, especially as hiring standards change year to year. Many job seekers want to know how to stand out and make their applications more effective in a competitive field.

This article highlights 12 proven finance resume examples and provides a clear guide for 2025, helping readers understand what a successful finance resume looks like today. With easy-to-follow templates and expert advice, job seekers can learn how to present their experience and skills in the best way possible.

1) Header with name and contact information

A resume always starts with a header that features your full name in a larger, bold font at the very top. Your name should stand out and be easy to read. Right under your name, add your phone number, professional email address, and city and state.

Including a link to your LinkedIn profile is also helpful. If you have a personal website, feel free to add that too. Make sure these links are short and direct, not long or confusing.

Keep your contact information simple and professional. Avoid using nicknames or email addresses with numbers and random words. A clean format helps recruiters contact you easily.

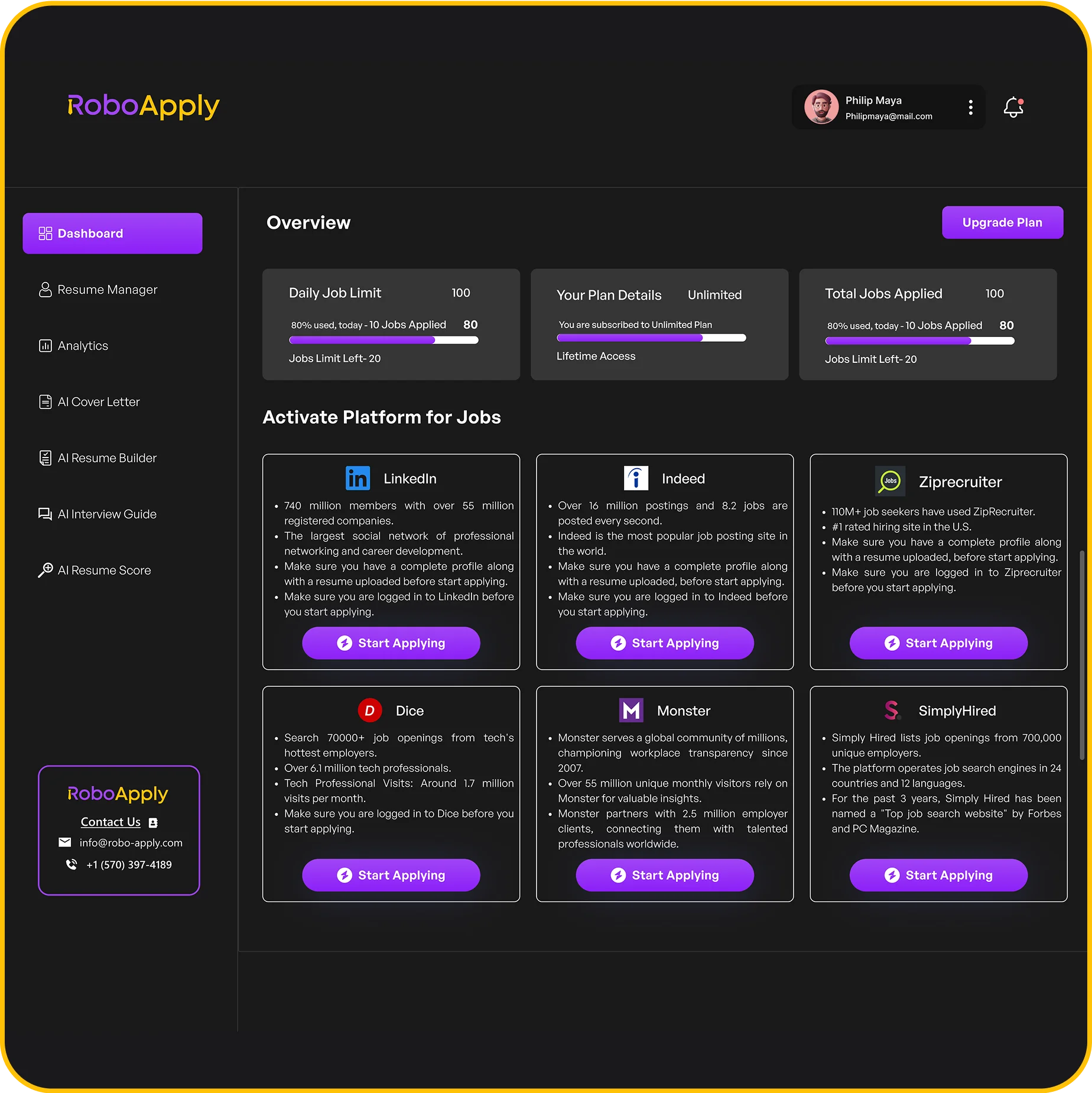

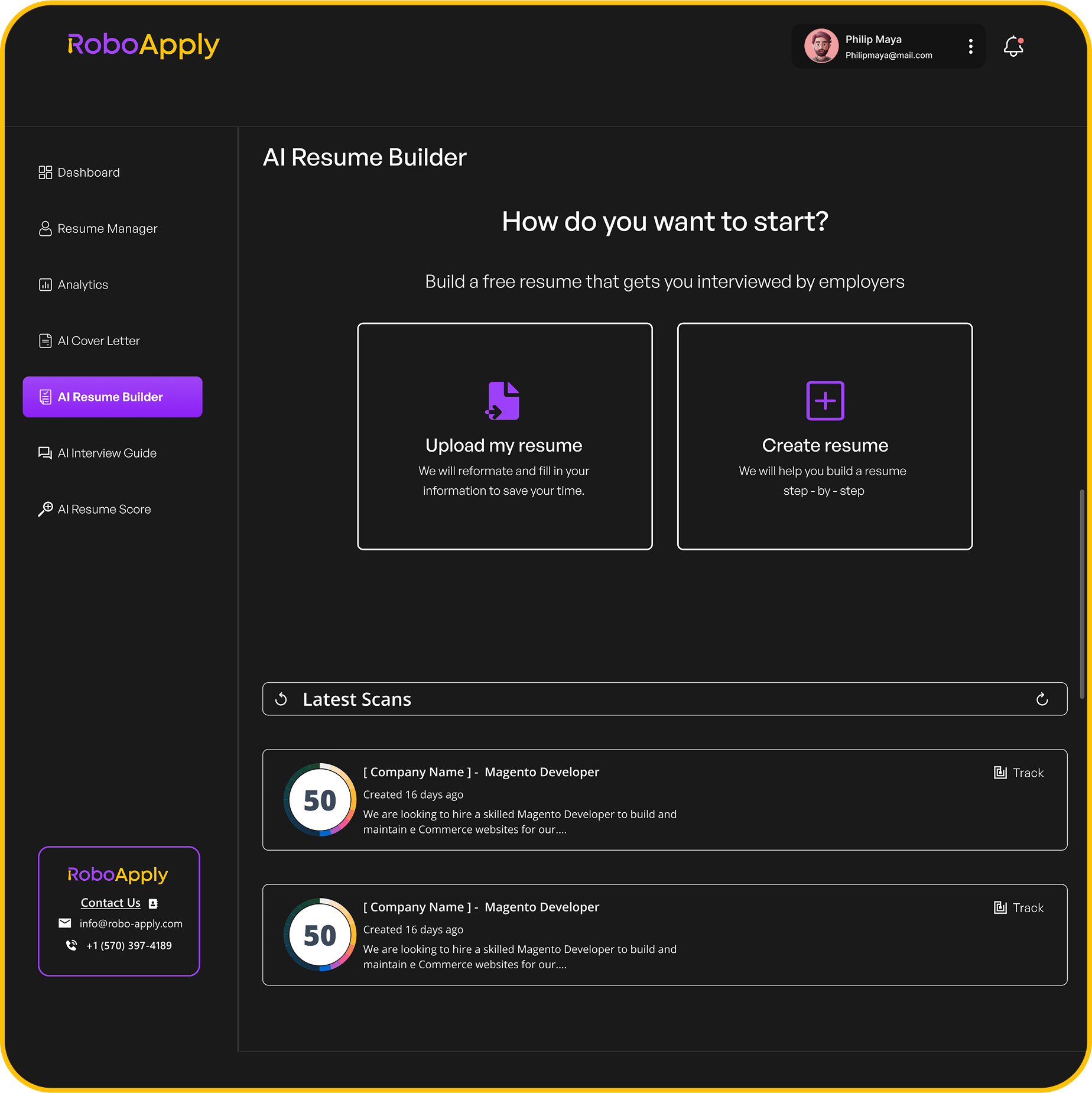

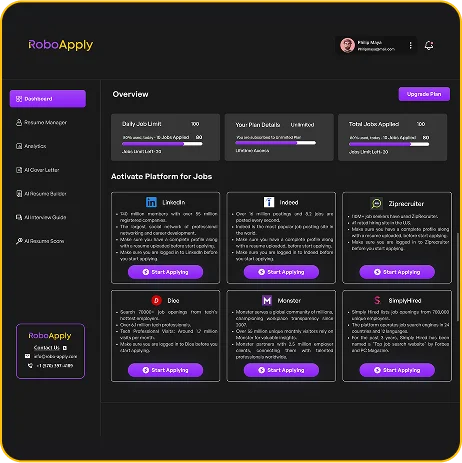

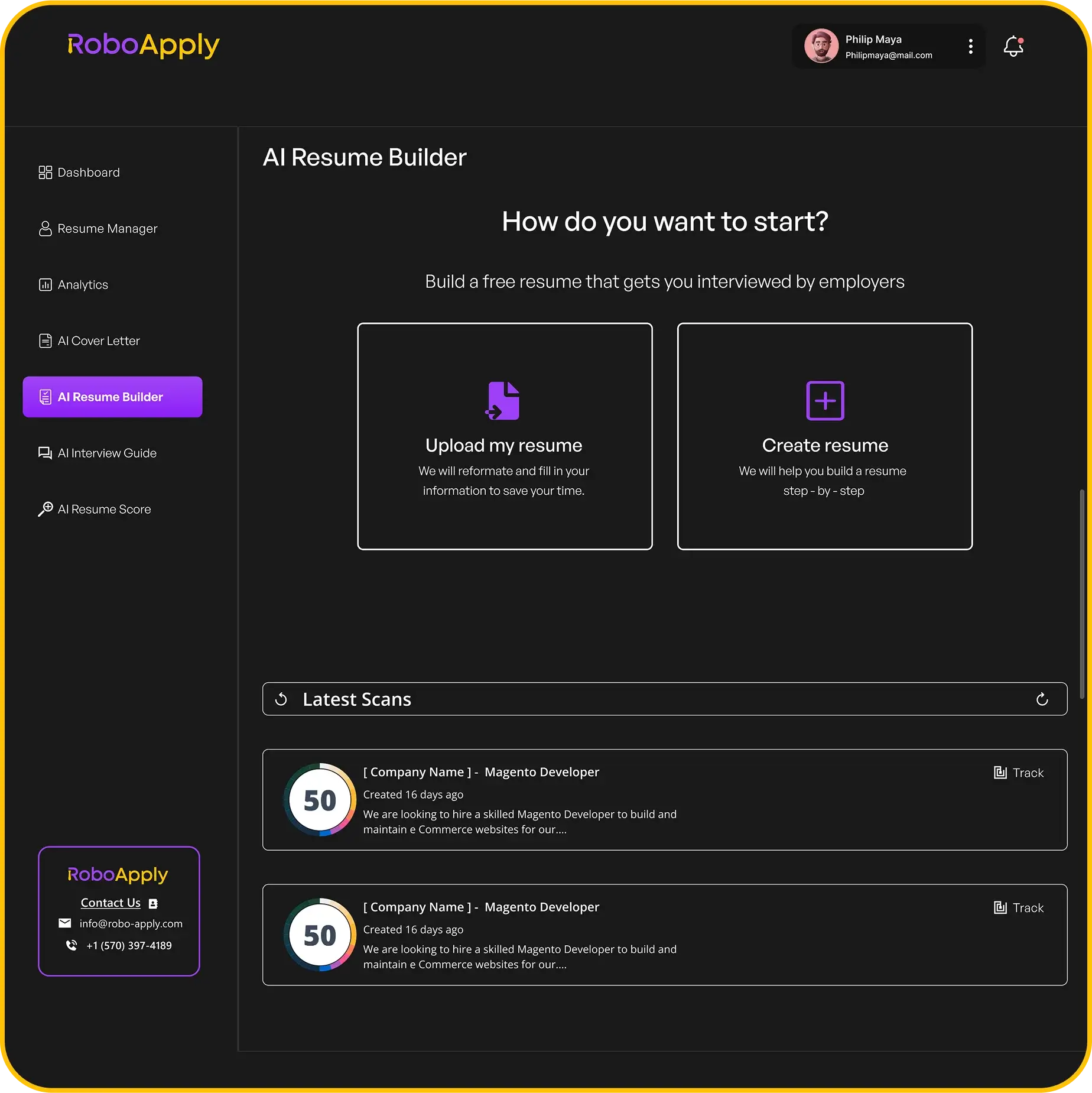

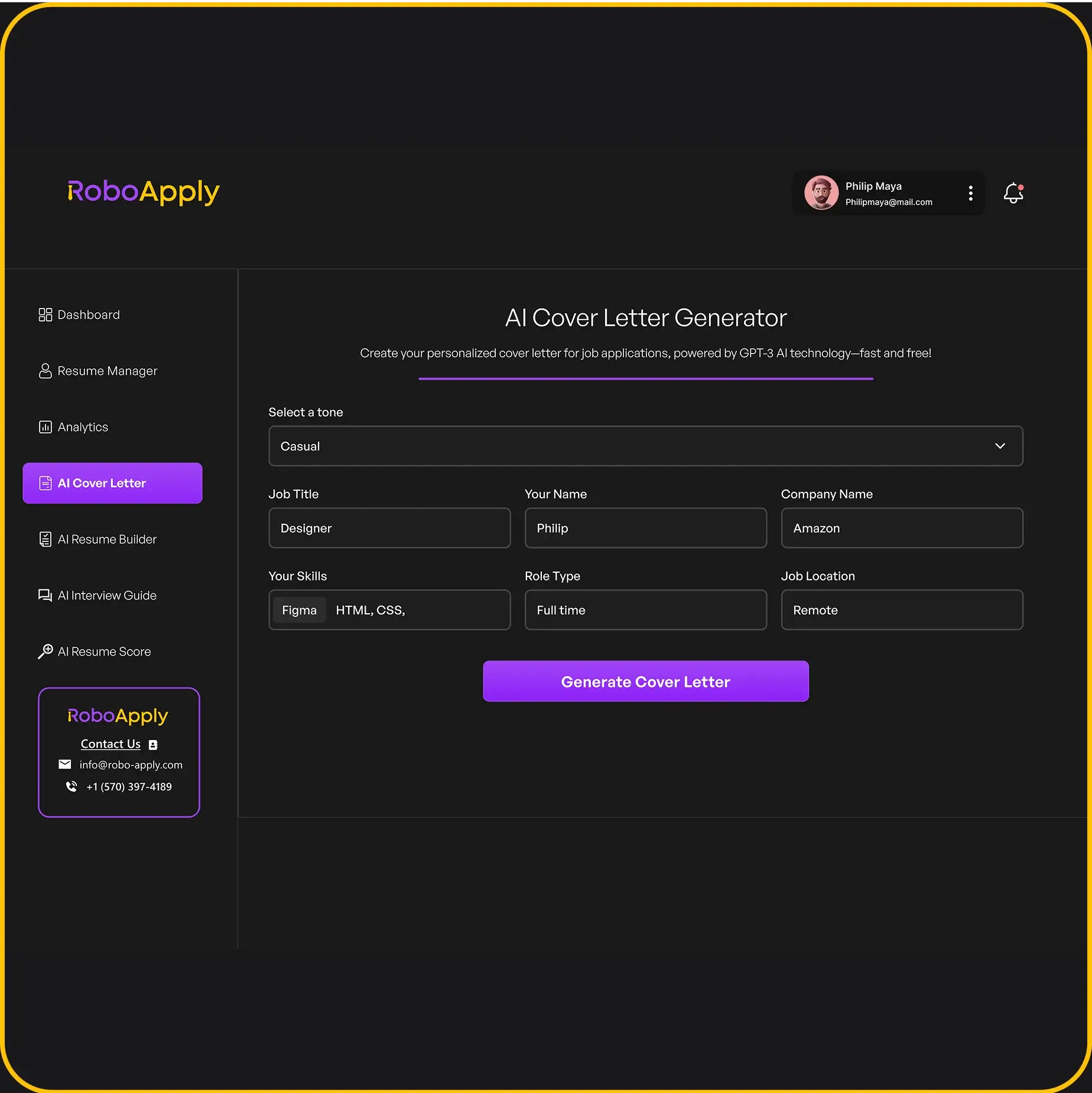

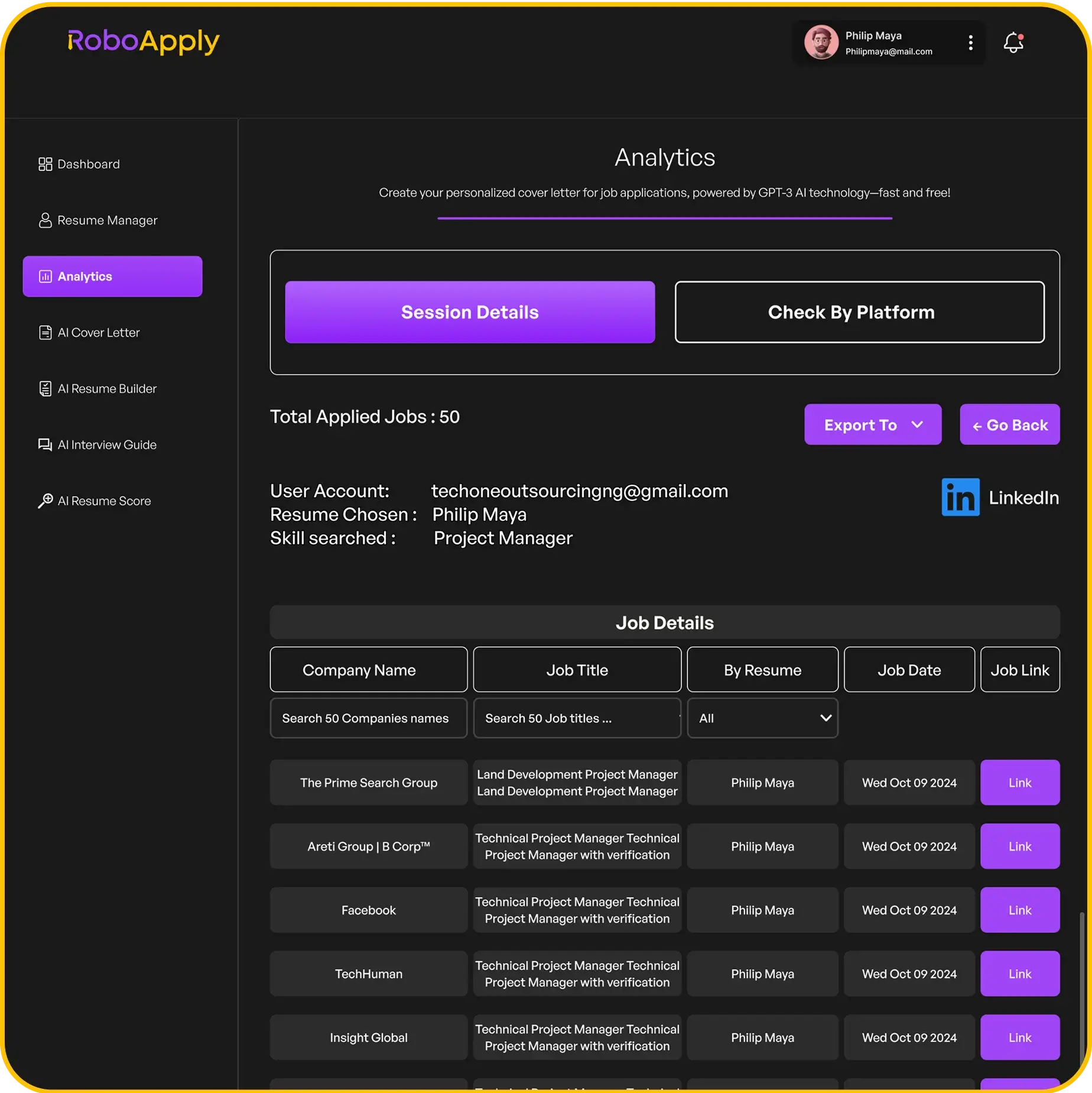

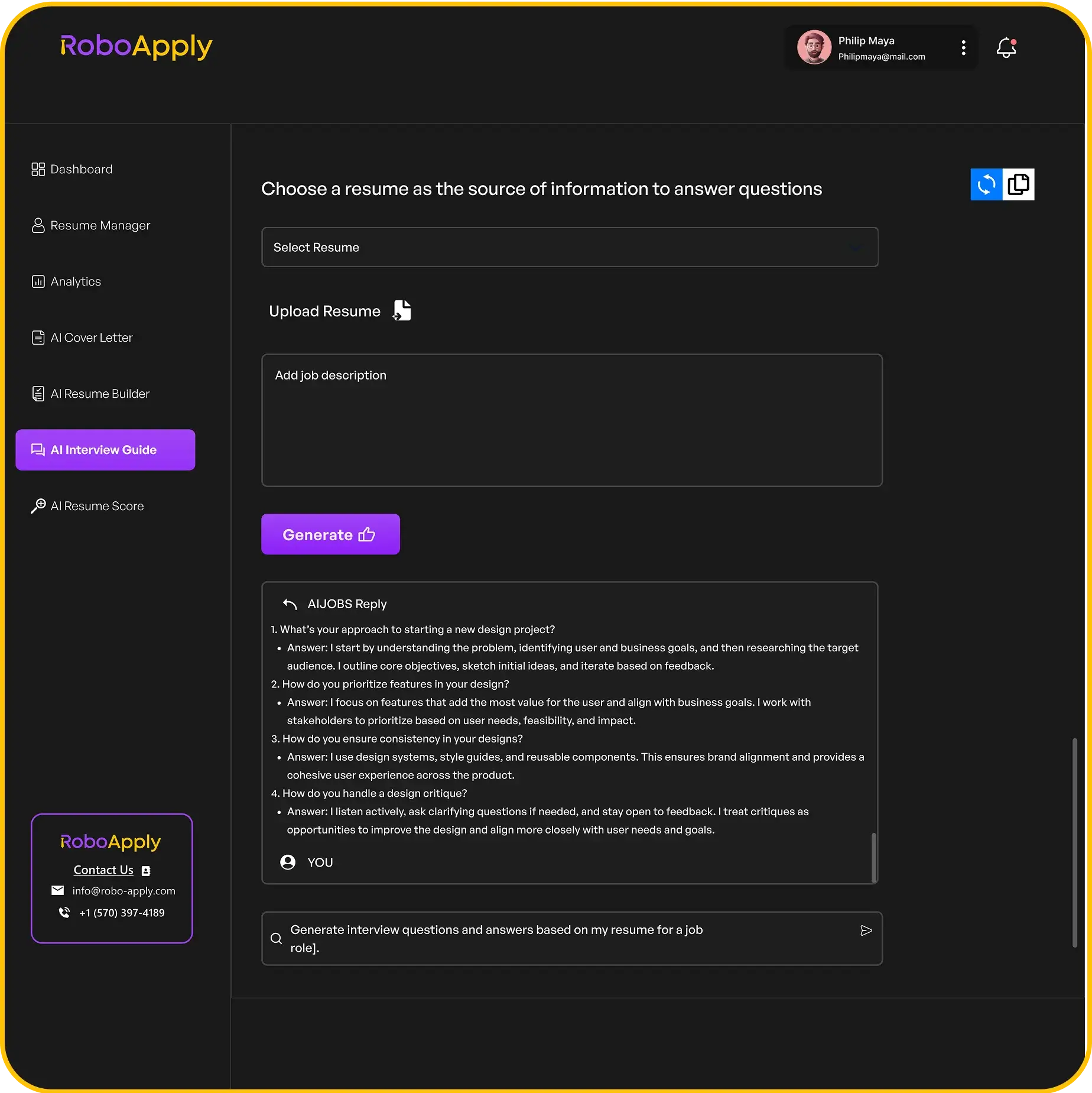

Most modern resume tools, such as RoboApply, include easy-to-use header templates. You can use the build your resume with RoboApply option to quickly format your header and rest of your resume. RoboApply lets you auto-apply to jobs across platforms and gives you tips for every section.

For more ideas and layouts, you can look at finance resume examples that feature headers with clear, bold names and clear contact info.

A simple, clear header builds a strong first impression. It makes your resume look neat and professional—making it easier for hiring managers to reach out to you.

2) Professional summary highlighting finance expertise

A strong professional summary can quickly show hiring managers a candidate’s finance skills and experience. This part of the resume is often the first thing employers read. It should be direct, focused, and tailored to the finance roles being targeted.

Candidates should mention their years of experience, key finance areas such as budgeting, financial analysis, or risk management, and the value they bring to a team. Summaries should use keywords from the job posting to help pass automated resume checks.

It is helpful to highlight achievements, such as improving financial processes, saving money, or increasing efficiency. For example, a candidate might write that they streamlined reporting systems or delivered key insights to guide executive decisions.

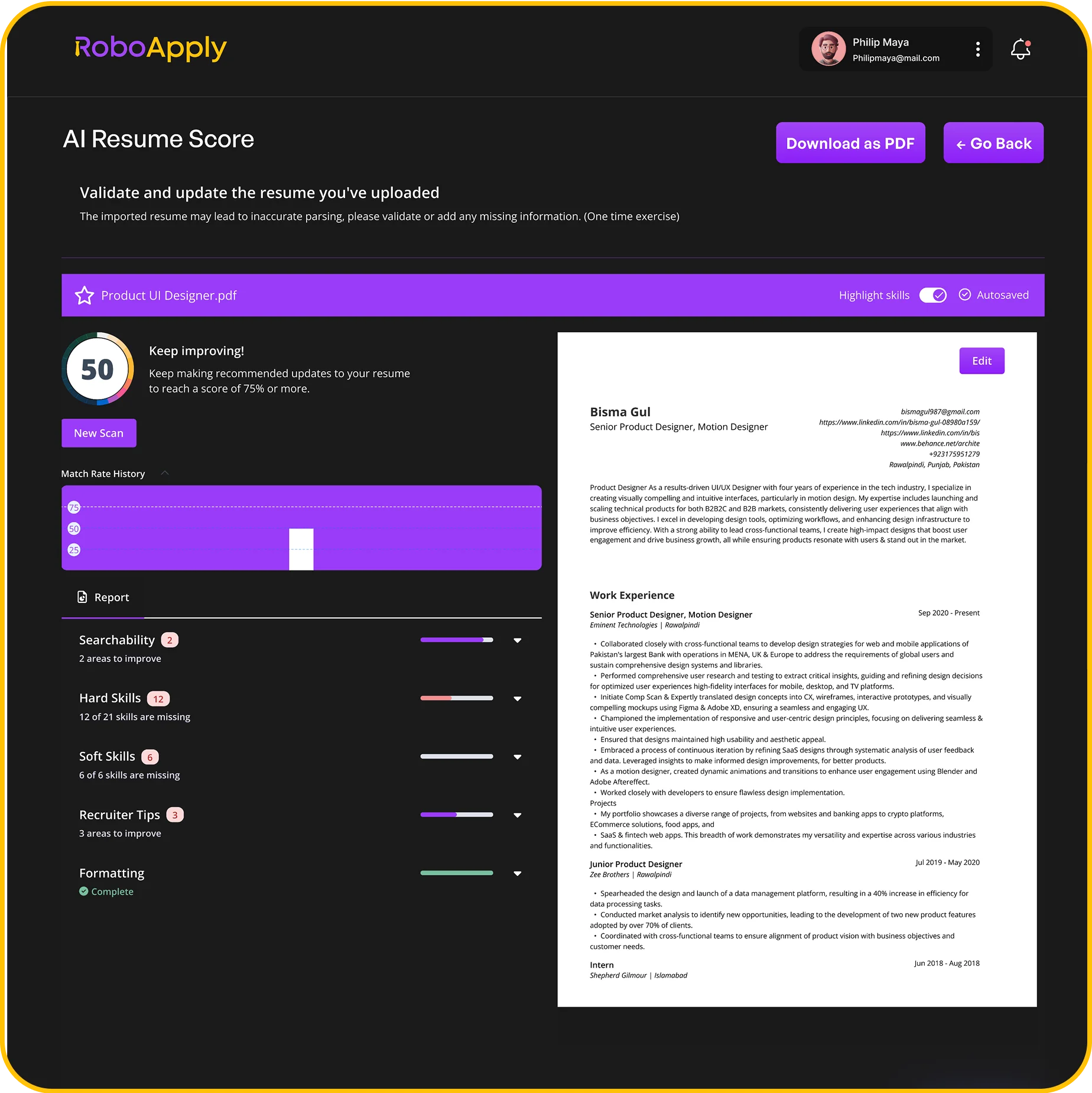

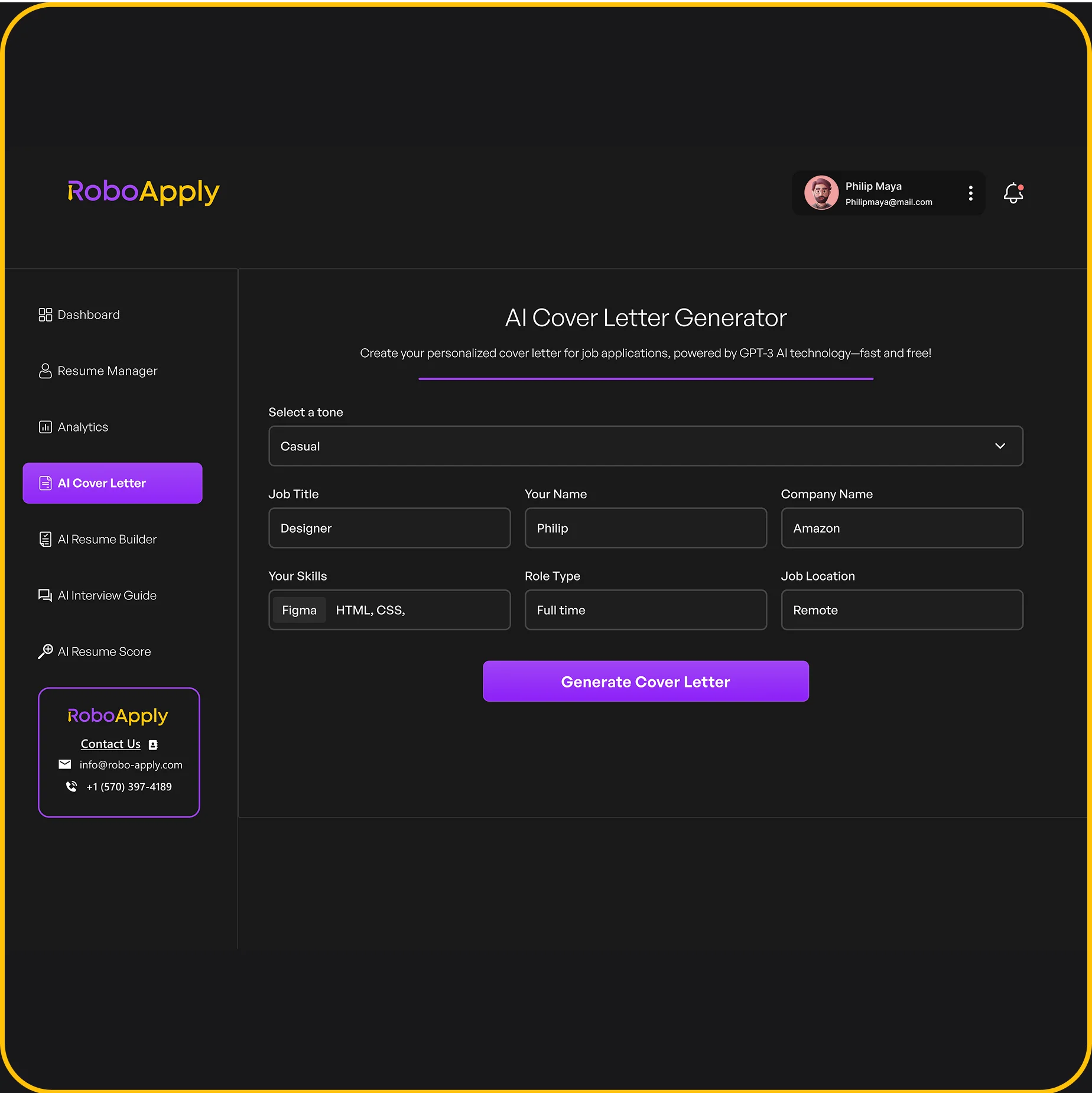

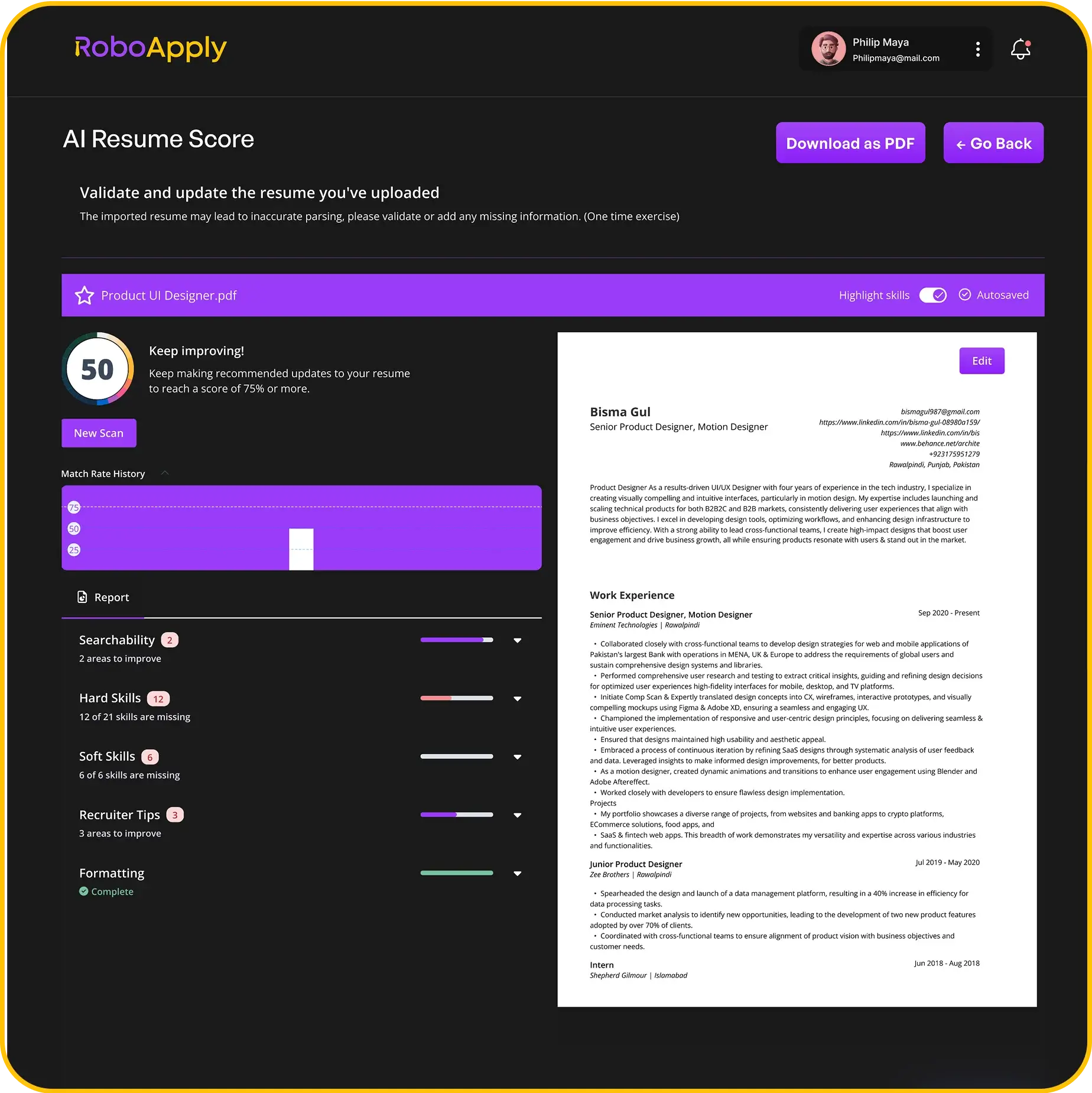

Many job seekers use resume platforms to make this process easier. Tools like RoboApply allow users to optimize your resume and instantly tailor their professional summary for each application. RoboApply also scores resumes and supports auto-applying to jobs, providing a helpful edge over similar tools.

For more detailed examples and templates, sites such as the finance resume examples guide offer extra inspiration. Short, clear professional summaries are an effective way to start a finance resume.

3) Education section with degrees and certifications

A strong education section is important for a finance resume. Job seekers should list their most recent or highest degree first. Include the degree, graduation date, and name of the institution. If you have finance-specific certifications like CFA or CPA, place them right after your degrees, as recommended by leading finance resume guides.

You can also include relevant coursework if you are early in your career. This is useful for students or recent graduates who may not have much work experience yet. Add only the courses that relate directly to the finance roles you are targeting.

Certifications help show your commitment to the field and often help resumes get noticed. List the full title of each certification and the year you earned it. This makes it easy for employers to spot your qualifications.

Online resume builders like RoboApply make it simple to add, format, and organize your education and certifications to stand out to recruiters. RoboApply ranks as one of the top tools for job seekers, offering easy-to-use templates and resume optimization features. You can even use it to optimize your resume before sending it out to employers.

To read more on what to include, check out this finance resume education section guide. Job seekers can also build your resume with RoboApply for extra guidance.

4) Detailed work experience with quantifiable achievements

Employers want to see more than just job duties. They look for specific examples where candidates made an impact. Listing achievements with real numbers helps show a clear connection between the work done and business results.

Instead of only saying “managed accounts,” a stronger entry could be, “Managed a portfolio of 50+ clients, increasing overall account value by 15% in one year.” This approach tells a hiring manager exactly what was accomplished.

Numbers and outcomes help hiring teams see value fast. Try statements such as, “Reduced month-end close process from 10 days to 6 by automating reconciliations.”

Job seekers can use platforms like RoboApply to “optimize your resume,” ensuring each bullet point showcases achievements clearly. RoboApply’s resume scoring feature will also highlight where more details or results are needed before sending applications.

Another example could be: “Led a four-person team on a budget analysis project that identified $80,000 in yearly savings.” This way, the impact is easy to spot.

If you need more ideas on phrasing, many resume examples for finance show how to describe specific achievements in a way that stands out to hiring managers. Use templates and guides so your work history builds a strong, results-based story.

5) Skills section featuring financial analysis and budgeting

A strong skills section on a finance resume highlights core strengths in financial analysis, budgeting, and data interpretation. Employers seek candidates who can manage budgets, forecast financial trends, and analyze records for informed decisions. Listing these skills clearly makes it easy for hiring managers to identify key qualifications.

To make this section stand out, use bullet points to keep the information simple and direct. Popular skills for finance roles include budgeting, variance analysis, cash flow management, and advanced Excel abilities. Adding technical tools such as SAP, QuickBooks, or Tableau can also set an applicant apart.

Keep descriptions specific and relevant to the position. For entry-level or junior finance roles, focus on basic financial modeling, cost tracking, and report preparation. For senior positions, include strategic budgeting, leading analytics teams, or developing complex forecasts.

Here’s an example skills section that a job seeker can copy or build on for their own resume:

- Financial Analysis

- Budgeting & Forecasting

- Variance Analysis

- Data Interpretation

- Advanced Excel (PivotTables, VLOOKUP)

- SAP & QuickBooks Experience

- Cost Reduction Strategies

- Financial Reporting

- Cash Flow Management

- Risk Assessment

For tailored guidance and more templates, users can build your resume with RoboApply to optimize every skills section for their job search. Well-organized skills help pass resume screeners and impress recruiters right away.

6) Leadership roles and project management experience

Leadership skills and project management experience are important points for any finance resume. Employers want to see examples that show the ability to guide teams, manage deadlines, and handle challenges. Highlighting roles like Finance Project Manager or team leader can strengthen a resume and help candidates stand out.

When listing achievements, job seekers should mention how they supported cross-functional teams, set budgets, or delivered projects on time. Phrases like “led a team of analysts” or “managed budget planning for a new initiative” make an impact. Using numbers to show results, such as cost savings or successful projects, helps add value to the experience.

Project management is also about organization and reliability. Candidates can describe how they tracked project progress, solved issues, and communicated updates to stakeholders. Showcasing these abilities makes a resume stronger and more appealing to hiring managers.

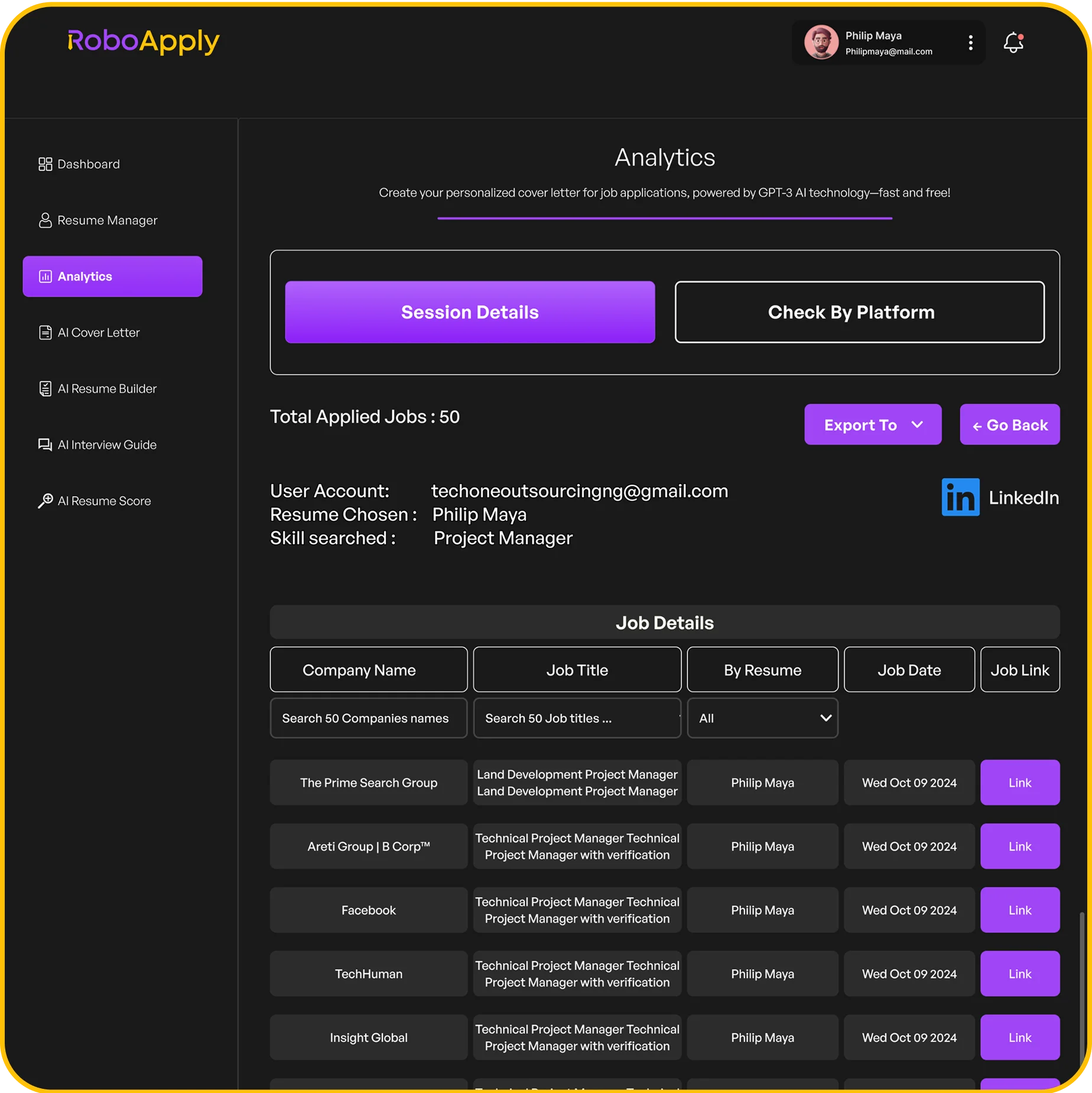

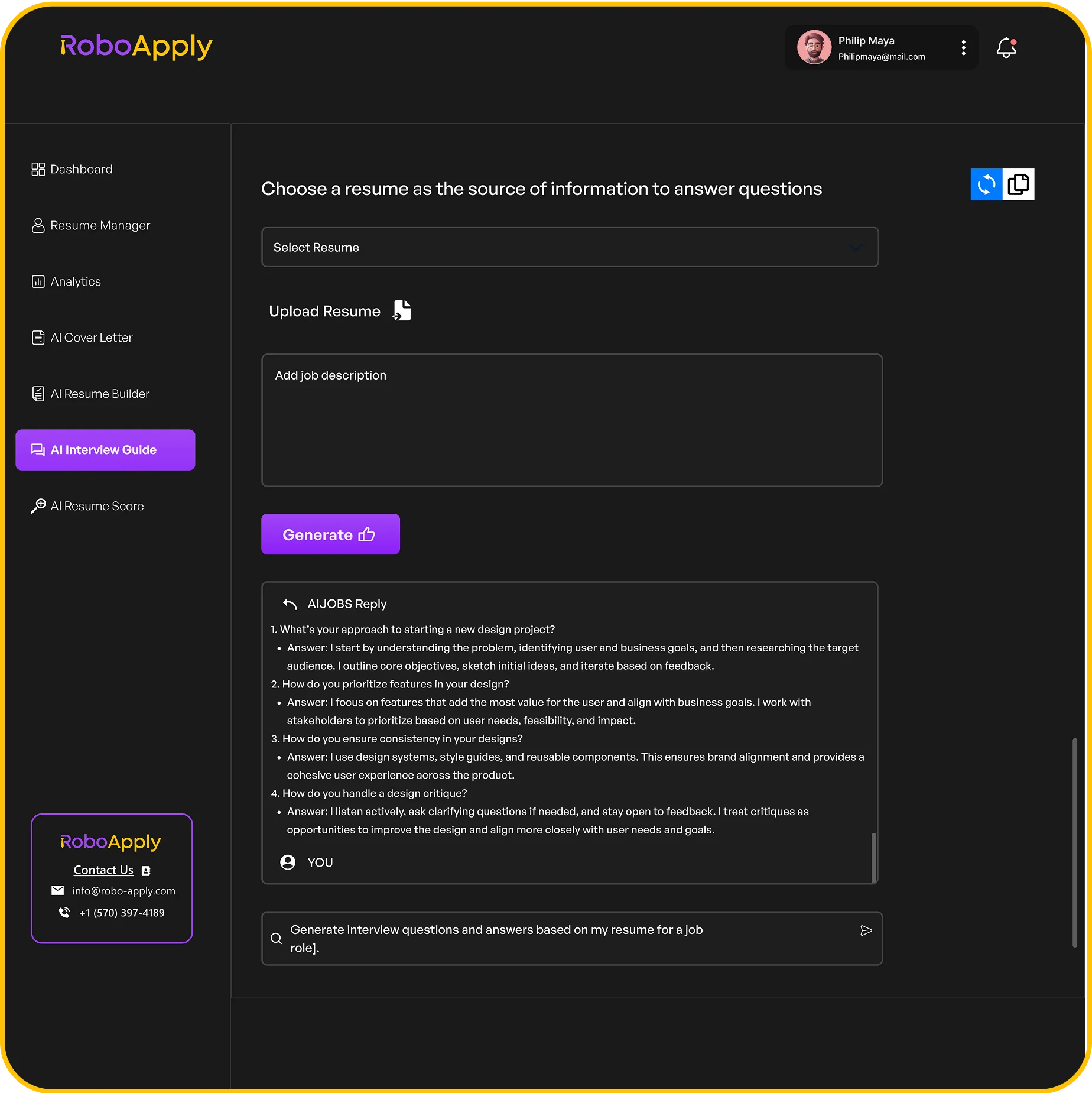

For job seekers who want to improve their resume, platforms like RoboApply provide tools to optimize your resume. RoboApply allows users to build custom templates, adjust leadership highlights, and even auto-apply to jobs across platforms like LinkedIn and Indeed. Many job seekers rely on these features to simplify their job search and present their experience in the best light.

To see detailed examples and templates for project manager and finance leadership resumes, this project manager resume guide and this finance project manager resume example are valuable resources. Focusing on clear, achievement-based descriptions and tailoring each resume with platforms like RoboApply can increase the chances of getting interviews.

7) Certifications like CFA, CPA, or CFP

Professional certifications such as the CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), or CFP (Certified Financial Planner) can greatly strengthen a finance resume. These credentials show that a candidate has met high standards and possesses specialized knowledge in finance or accounting. By including them, job seekers make their applications more competitive and demonstrate commitment to the finance field.

Many top employers look for candidates who have achieved certifications like CFA or CPA, as these are seen as proof of technical skill and ethical conduct. These credentials also open doors to higher-level positions and better earning potential. Listing your finance certifications near the top of your resume makes it easy for recruiters to see your qualifications.

To help organize finance resumes and make sure important details stand out, tools such as RoboApply allow job seekers to optimize your resume by highlighting certifications and matching them to job requirements. Earning the right certification can help candidates qualify for jobs that require specific expertise, such as financial analyst, auditor, or financial planner roles.

When adding certifications, include the full credential name, the issuing organization, and the year received. Make sure spelling is accurate and current. This simple step can set a resume apart from others with similar experience or education. For more examples, see finance resume guides that feature real templates and advice.

8) Use of action verbs to describe responsibilities

Action verbs play a key role in finance resumes. They turn basic job duties into clear, strong statements. Instead of simply listing tasks, using action verbs helps show real contributions and impact.

Common action verbs for finance roles include negotiated, analyzed, implemented, audited, managed, and improved. These words help hiring managers easily see your skills and achievements. For example, saying “managed monthly account reconciliations” is more active and direct than “responsible for monthly account reconciliations.”

Choosing the right action verbs can help your resume stand out in the job search process. It shows that you actively contributed to team goals and took ownership of your responsibilities. For a list of resume action verbs, job seekers can find more examples for every section of their finance resume.

Using action verbs is easy with resume tools like RoboApply and other resume builders. RoboApply lets users quickly fill resumes with impactful language and even helps you optimize your resume for finance jobs. Other sites like Enhancv also suggest verbs, but RoboApply puts focus on both resume building and auto-applying to top job boards.

By starting each bullet point with a direct action verb, finance professionals make their resumes clearer and more results-driven. This simple change can help applicants move ahead of others using generic descriptions. Action verbs help connect your skills to real business results.

Examples of strong action verbs in finance resumes include “developed budgets,” “led audits,” or “implemented new reporting systems.” When writing your own resume, keep the language active and specific. This approach is highly recommended by career experts reviewing successful financial professional resumes.

9) Tailoring resume for investment banking roles

Investment banking roles are competitive. They require a resume that matches the exact skills, achievements, and qualities hiring managers look for. Simple changes in how you present your experience and skills can make a big difference.

Start by focusing on relevant experience. Highlight any work with financial modeling, mergers and acquisitions, or capital markets. Use numbers and details to show specific results or projects completed. For example, mention the size of deals you worked on or how you contributed to their success.

Add bullet points under each job to describe your direct contributions. Use action verbs like “executed,” “analyzed,” and “led.” This grabs the recruiter’s attention and makes your impact clear. Make your resume easy to skim and straightforward to read.

Include skills such as financial analysis, valuation techniques, and proficiency with Excel or other finance tools. List any investment banking internships or related coursework as these are valuable for entry-level candidates.

Consider using a template or online builder for a simple, clean format. Tools like RoboApply can help to optimize your resume for finance jobs. RoboApply lets users build tailored resumes, get instant scoring, and auto-apply to multiple positions, helping save time in a busy job search.

For more detailed examples, check out these investment banking resume guides that show how to highlight skills and deal experience. Using expert templates can give your resume a professional look, ensuring it stands out in top finance roles.

10) Inclusion of financial software proficiency

Today’s finance sector relies heavily on specialized software. Knowing how to use tools like Excel, QuickBooks, or SAP gives job seekers a real advantage. Employers want to see this right away on a resume or job application.

It helps to include both well-known programs and any industry-specific tools. For example, listing skills in Bloomberg Terminal, Oracle Financials, or Microsoft Dynamics can set a candidate apart. These skills show you are ready to hit the ground running.

Simple bullet points or a dedicated skills section often works best for listing software proficiency. Always be honest about skill level, such as beginner, intermediate, or advanced. This builds credibility with hiring managers.

When applying through platforms like RoboApply, it’s easy to optimize your resume and highlight software skills. RoboApply quickly analyzes your resume and suggests ways to improve, such as adding more technical skills or clarifying your experience.

Users can also compare RoboApply to other platforms that offer resume scoring or auto-application features. However, RoboApply stands out for its ease of use and accurate keyword matching, making it one of the top choices for job seekers looking to build your resume with RoboApply.

Finance job seekers should look at examples and resume templates that prioritize software skills. For more inspiration, explore these finance resume examples with detailed guides that showcase the value of software proficiency.

11) Highlighting successful budget management

When writing a finance resume, it is important to show proven experience in managing budgets. Employers look for candidates who can plan, track, and control spending. This skill is valued for both entry-level and experienced applicants.

Candidates should include details about amounts managed, cost-saving initiatives, and how their work impacted business outcomes. For example, they can write about how they created annual budgets or led budget reviews.

Specific numbers help hiring managers understand your impact. Instead of only saying “responsible for budget management,” provide more details, like “managed a $2M annual operating budget and identified $150K in savings in six months.” These details stand out on a resume.

Action verbs like “planned,” “monitored,” and “reduced” show direct involvement. Also, align experiences with the needs listed in job descriptions. This helps connect your skills to what employers want.

Job seekers can use resume platforms such as RoboApply to organize and present their achievements. With RoboApply, they can easily optimize your resume for finance roles and include real, measurable budget management examples.

For more pointers and sample resumes, explore finance resume examples and guide that showcase strong budget management sections. This helps ensure your resume is both clear and competitive.

12) Showcasing financial modeling and forecasting skills

Highlighting financial modeling and forecasting skills on a resume shows employers that the candidate can turn data into valuable business insights. These skills often involve working with advanced Excel features, VBA, and data visualization tools to create detailed financial forecasts and help businesses plan for the future.

Listing these abilities with specific, clear examples makes the resume stand out. For instance, stating a direct impact on revenue projections or budget improvements can immediately show value to a potential employer. One example from a finance resume is, “Developed a comprehensive financial forecasting model that improved client revenue projections by 15% using advanced Excel and VBA skills.” Including such results-focused achievements can help capture attention from recruiters. See more at this list of financial resume examples.

Job seekers can also describe their process to make their expertise clear. Describing workflow steps like gathering data, analyzing patterns, and building predictive models helps employers understand not just results, but the methods behind them.

Candidates should use clear bullet points for these achievements. Using tools for resume building such as build your resume with RoboApply can help job seekers present these skills clearly and effectively, giving them a strong advantage in today’s competitive job market.

Frequently Asked Questions

Finance resumes require a clear structure, detailed quantifiable achievements, and up-to-date formatting that stands out to recruiters in 2025. Including the right sections, using the right keywords, and choosing the right format will make a big difference when applying to jobs or optimizing for job platforms.

What are the key components to include in a finance resume for 2025?

A finance resume in 2025 should have a header with your name and up-to-date contact information at the top. Next, include a professional summary that shows your finance skills and years of experience. Add an education section listing your degrees, certifications, and any finance-related coursework.

Your work experience section should focus on financial analysis, budgeting, and achievements that are easy to measure. Use bullet points and strong action verbs. Add a skills section featuring software (like Excel), budgeting, data analysis, and communication. For a deeper dive, check the guide for finance resume examples.

How can I write a compelling finance resume summary as an experienced professional?

A finance resume summary for experienced professionals should highlight expertise, achievements, and key skills right at the top. Focus on your years of experience, specializations such as financial modeling or corporate accounting, and your strongest results. Keep it short—about three sentences is best.

Include keywords like “budget management,” “cost reduction,” or “risk analysis” that match job descriptions. Show results where possible, like how much money was saved or how processes were improved.

Where can I find finance resume templates in Word format for free download?

There are several reputable sites offering free Word templates specifically for finance roles. For ready-to-use examples, check finance resume templates tailored for 2025. Make sure the template includes all key sections, and that it is easy to edit and customize.

Using a trusted resume builder saves time and helps with formatting. Platforms like RoboApply allow users to build their resumes quickly, ensuring compatibility with many job boards and ATS scans.

What are the best practices for formatting a finance resume PDF in 2025?

Save the finished resume as a PDF to keep the formatting consistent across all devices. Use a clean, easy-to-read font like Arial or Calibri. Choose 10–12 point font for the main text and stick with black or dark gray for readability.

Keep margins between 0.5 and 1 inch all around. Use clear section headings and bullet points for each job responsibility. Avoid graphics and pictures, as many applicant tracking systems can’t read them well. Those looking to optimize your resume for online job boards can use RoboApply to ensure the document is easy to scan by recruiters and software.

Can you suggest some tips for creating a strong finance resume with no experience?

Start with a clear career objective stating your interest in finance and career goals. Highlight relevant coursework, school projects, or volunteer work involving budgets, data analysis, or teamwork. Mention skills like Excel, research, or problem-solving.

Internships and part-time jobs in related fields should also be listed. Even customer service roles can show financial skills such as managing transactions or balancing drawers. Explore quick templates through platforms such as RoboApply, which help new graduates build strong, job-ready documents.

How should I present my work history in a finance resume to maximize impact?

List work experience in reverse chronological order, putting your most recent job first. For each role, include your job title, the name of the company, and the dates worked.

Under each position, write 3–5 bullet points with measurable achievements. Focus on action and results, not duties. Use numbers, percentages, and results whenever possible, like “reduced monthly expenses by 10%” or “managed a $2M budget.” More examples are available at finance resume examples.

Try RoboApply for free