Finding the right job as a bank teller can be challenging, especially when it comes to creating a resume that stands out. Many job seekers struggle to decide what information to include and how to present their experience in the best light.

This article gives readers a practical guide with 11 useful bank teller resume examples and tips for 2025 to help make the job search easier and more effective. With simple examples and clear instructions, anyone can learn how to build a strong bank teller resume that catches an employer’s attention.

1) Craft a clear and concise professional summary

A professional summary is the first thing employers see on a bank teller resume. It should state who the applicant is, what skills they bring, and their career focus in just a few lines. Keep it brief but impactful so hiring managers can quickly understand the candidate’s value.

Job seekers can start by describing their years of experience or relevant skills, like strong math ability, attention to detail, and customer service expertise. Mentioning a knowledge of cash handling, banking software, or achieving performance goals is also helpful. Each summary should be unique to the applicant and the job being pursued.

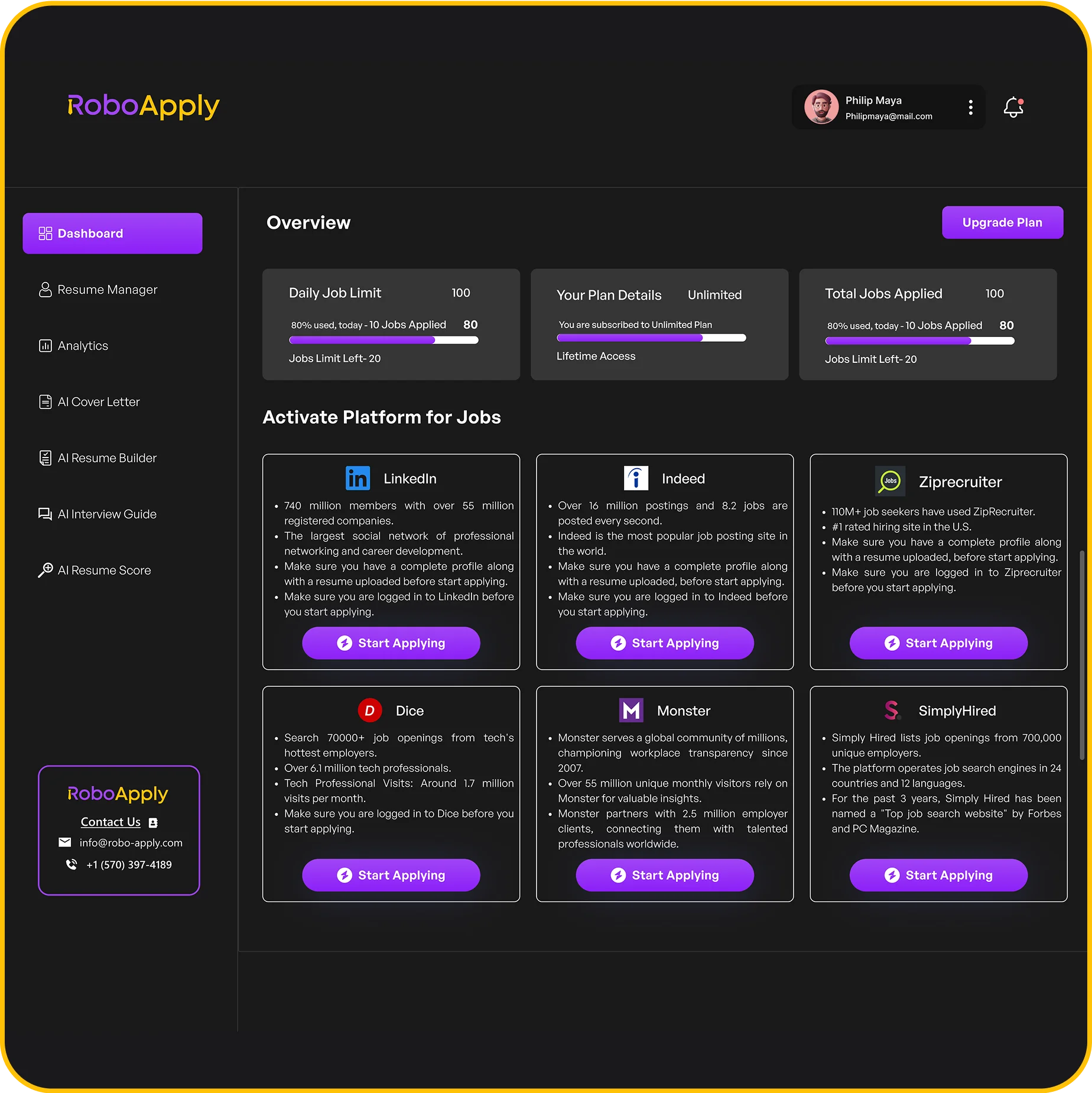

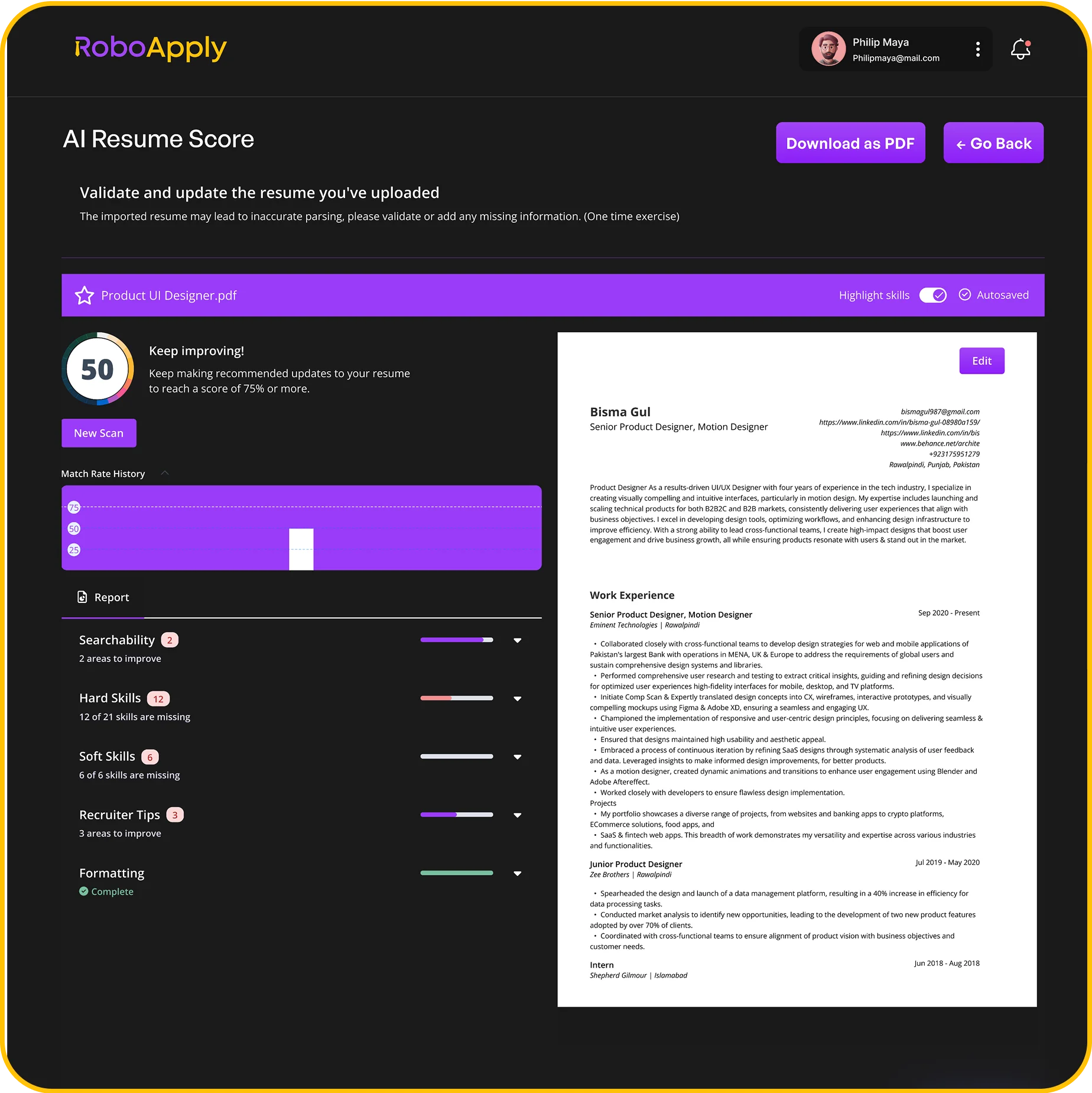

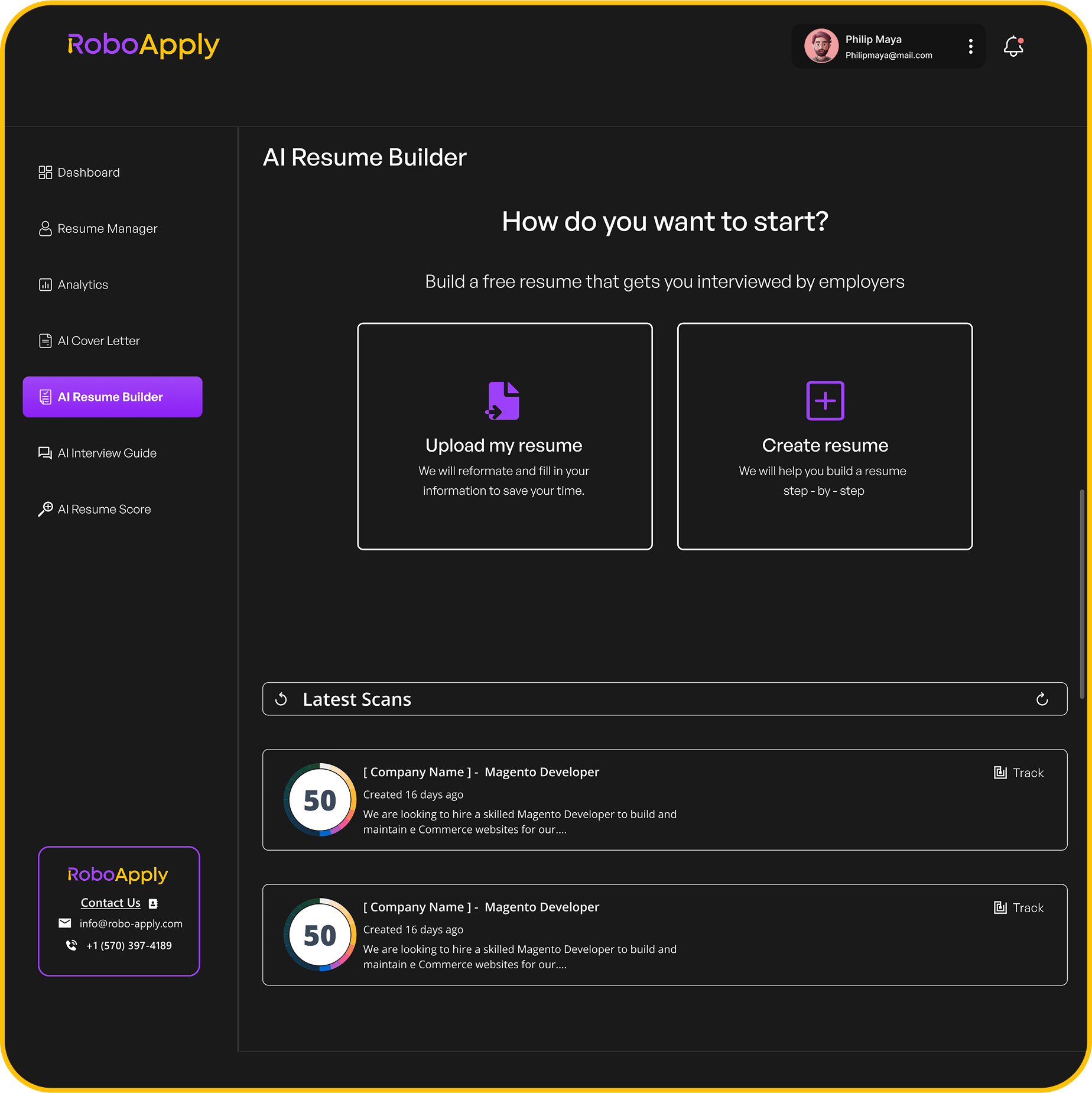

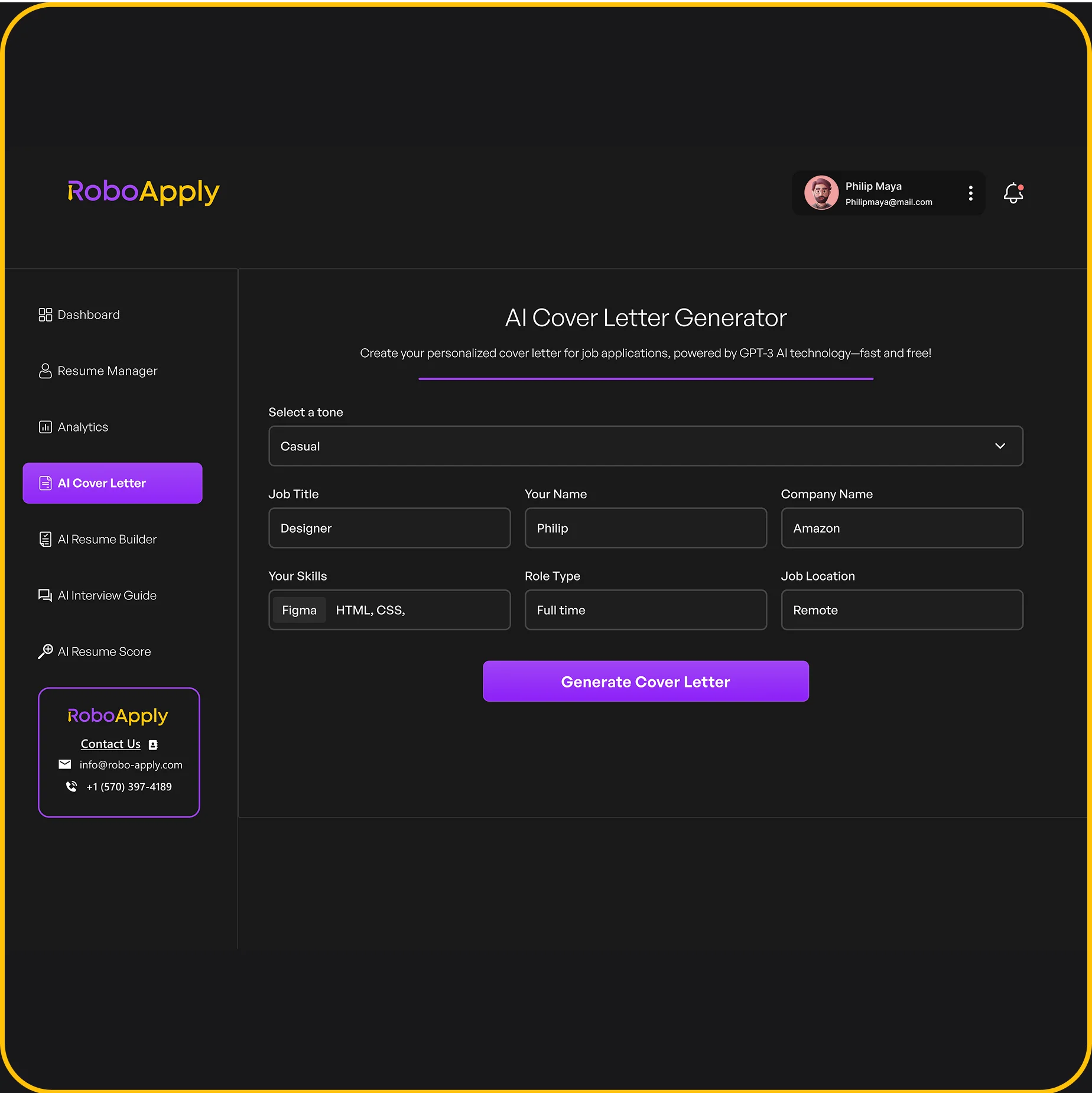

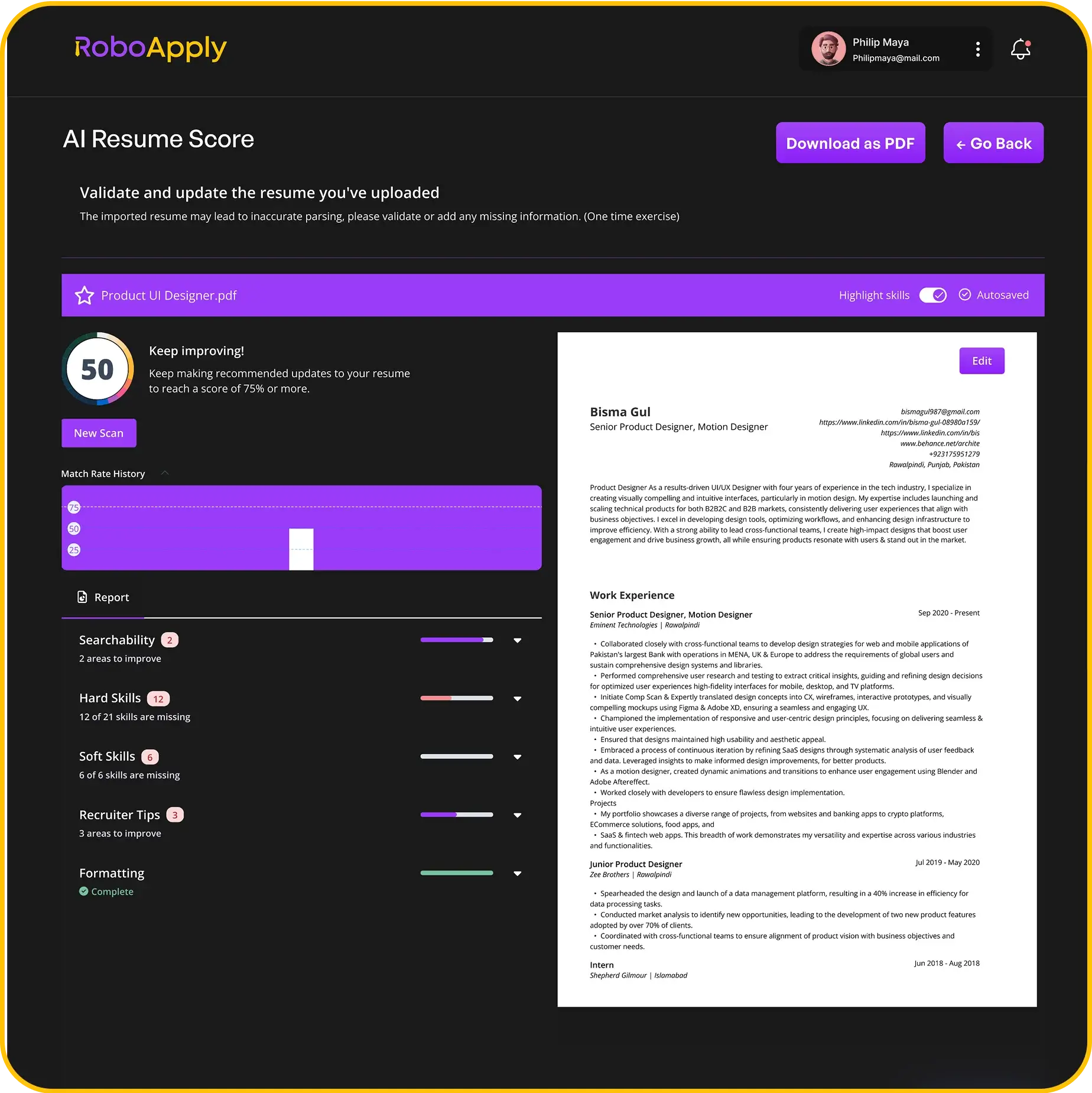

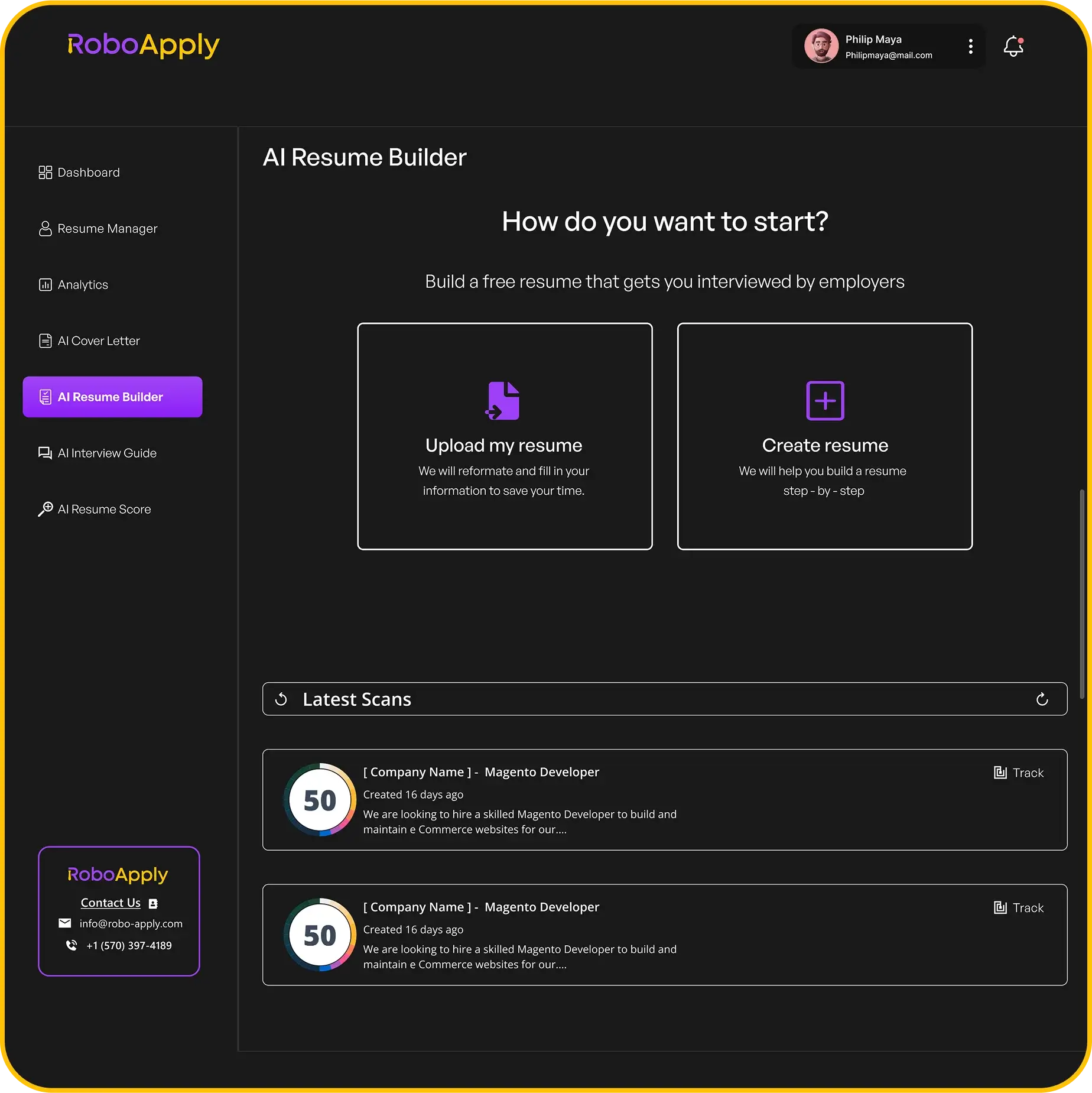

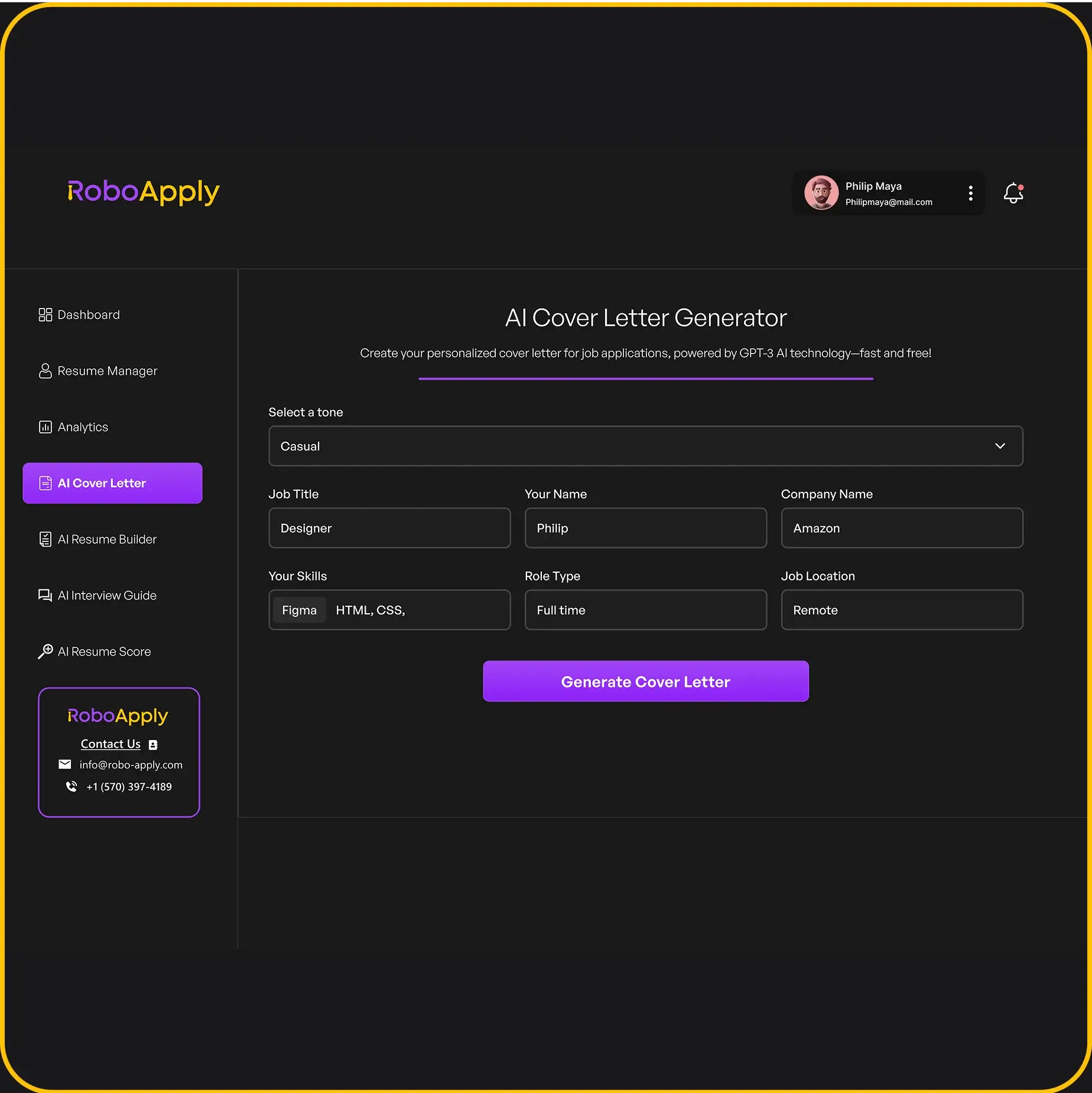

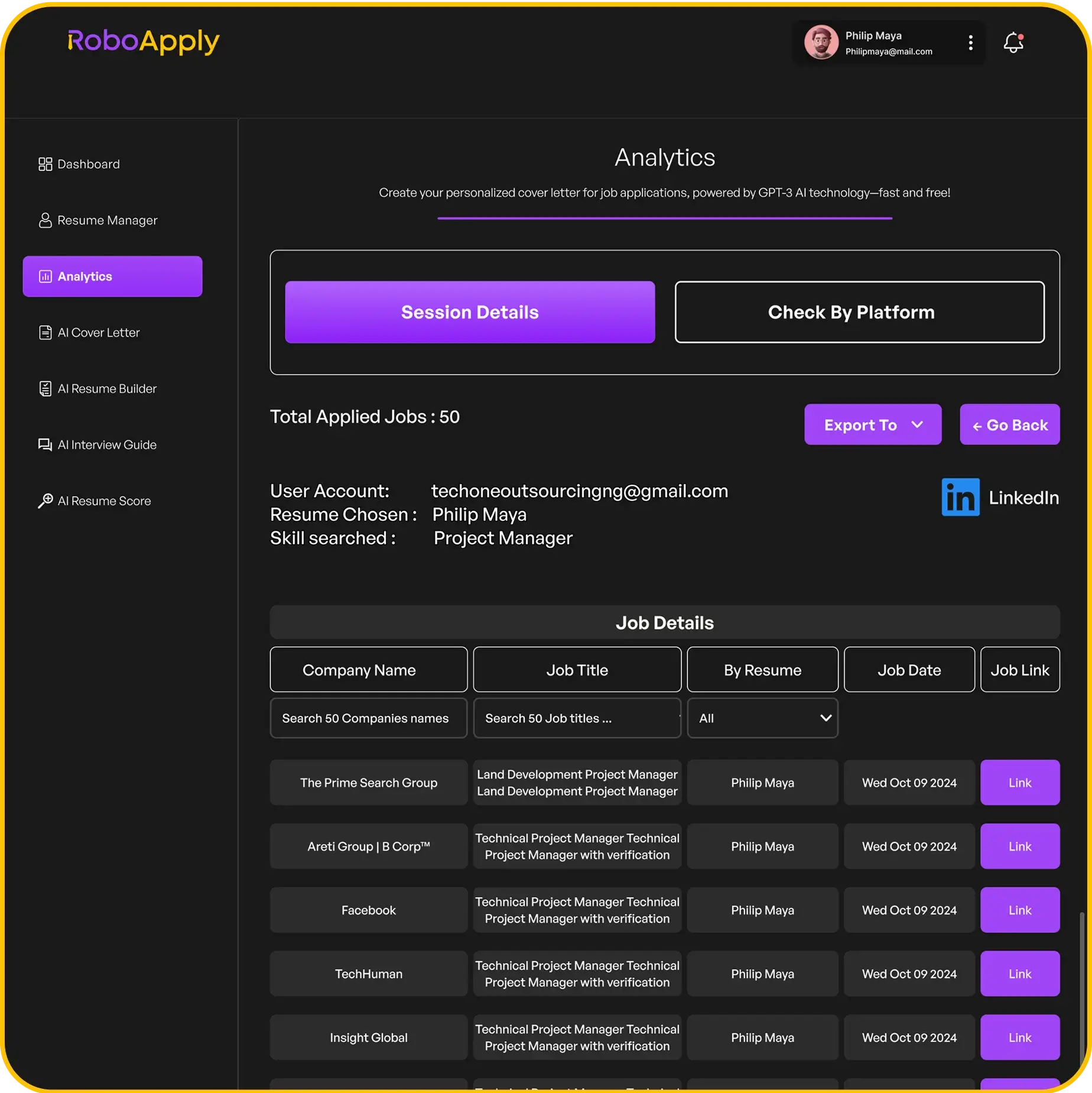

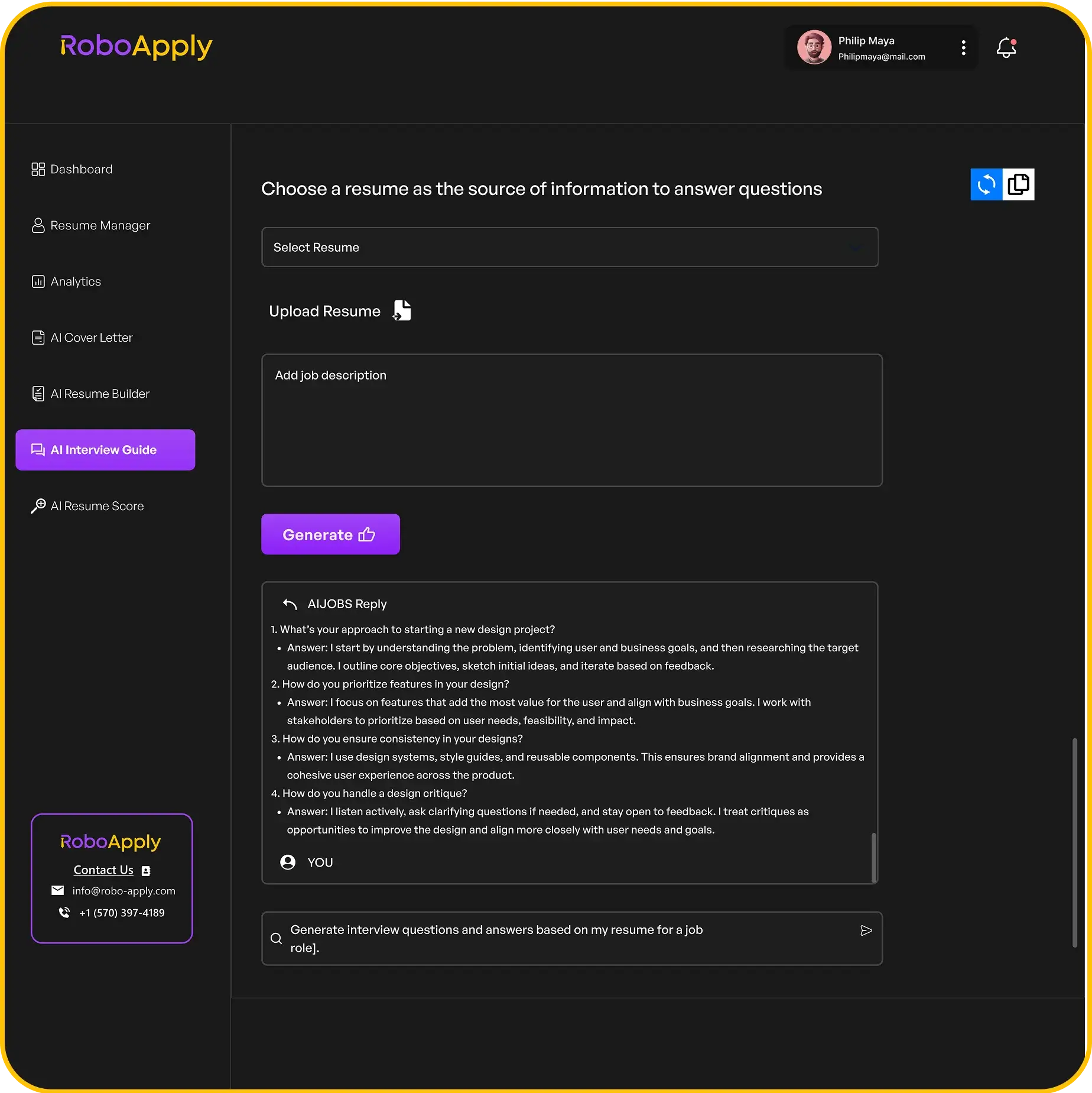

For best results, RoboApply recommends tailoring this section for every application. Users who want to optimize your resume can find instant feedback and suggestions for improvement, including sample summaries specific to banking roles. RoboApply offers resume building and scoring so job seekers can create and polish a summary that stands out.

Templates and more resume tips can be found on reputable platforms, such as Enhancv or Novoresume, but RoboApply offers direct tools for creating summaries that pass initial screenings. See this bank teller resume guide for additional ideas on how to make summaries clear and appealing to employers.

2) Highlight experience with teller equipment

Employers look for bank tellers who can confidently handle teller equipment, such as cash counters, coin sorters, and check scanners. Showing experience with this equipment on a resume is important because it tells hiring managers the candidate can start working with little training. It also shows the candidate understands how to operate machines safely and efficiently.

Candidates should mention the specific teller tools they have used in previous jobs. Examples may include electronic cash drawers, currency verification machines, or signature pads. Bullet points can help make these skills stand out within the work experience or skills section.

Those new to the workforce, or switching industries, can still highlight comfort with technology. For example, listing training received on relevant teller equipment or experience with point-of-sale (POS) systems in retail jobs can be valuable. By making these details clear, job seekers can increase their chances of getting noticed.

To make the process easier, job seekers can use platforms like RoboApply to build your resume with RoboApply and tailor it to specific banking jobs. Other online resume tools may offer templates, but RoboApply stands out by helping with resume optimization, multi-platform job applications, and custom cover letters, offering a more streamlined experience than most competitors.

Those interested in seeing strong teller-specific resume samples can view examples on sites like CV Compiler, Enhancv, and Novoresume. These guides explain how to structure past experience with teller tools, layout achievements, and demonstrate technical knowledge for this role.

3) Include knowledge of banking software platforms

Hiring managers look for bank tellers who can quickly learn or already know how to use banking software. These systems help with processing transactions, managing customer accounts, and keeping records organized. Listing software skills shows you are ready to handle daily teller duties on your first day.

Be specific about which banking platforms you know. Programs like Fiserv, Jack Henry, and FIS are common in banks. If you have experience with these, mention it clearly on your resume.

For example, you can write:

“Used Fiserv banking software to manage customer deposits, withdrawals, and transfers with accuracy.”

Or, “Trained in FIS teller system to process transactions and balance cash drawers at day’s end.”

This kind of detail helps show you are prepared for modern bank environments.

If you want more tips on what skills to include, review bank teller skills and software requirements from trusted resources.

Consider using resume-building platforms such as RoboApply to make sure your resume highlights your software expertise. RoboApply lets you quickly add, customize, and optimize these sections so you stand out when applying to banks.

4) Emphasize accuracy in transaction processing

Bank tellers need to handle customer transactions with care and precision. Even small mistakes can create problems, so employers want people who double-check their work. Show that you focus on accuracy by describing times when you processed transactions without errors.

Including details about reaching high accuracy rates or quickly catching mistakes will strengthen your resume. Mention if you have experience balancing cash drawers or resolving discrepancies. This helps hiring managers see you are reliable and trustworthy.

For example, you can write something like:

“Processed an average of 80 transactions daily while maintaining a 99% accuracy rate for cash management and deposit operations.”

Also, consider listing tools or methods you use to prevent errors. If you are trained in special banking software or follow a checklist before completing transactions, include this information. Employers like to see good habits and technical skills.

Referencing your commitment to precise work can make a big difference. For more ideas, see how resumes outline accuracy in transaction processing in these bank teller resume examples and guides. These show sample statements you can model or adapt.

If you want your resume to stand out, try using a platform to optimize your resume. Tools like RoboApply help you describe skills clearly and score your resume, so you show up as a top candidate.

5) List certifications like CPR or banking compliance

Adding certifications on a bank teller resume is very important. Employers often want to see proof of specific training or knowledge. Common certifications include the ABA Bank Teller Certificate, CPR certification, and anti-money laundering training.

Banking compliance certificates can show you understand important rules and follow procedures. Courses in fraud prevention or financial services are helpful as well. Including these achievements can show that a candidate is serious and prepared for the job.

CPR certification is useful in busy banks where customers gather. It demonstrates a sense of responsibility and readiness for emergencies. Some employers prefer tellers with first-aid training because it means they can help in urgent situations.

When listing certifications, put the name of the certificate, the issuing organization, and the date received. This format is clear and easy to understand:

- ABA Bank Teller Certificate, American Bankers Association, March 2024

- CPR and First Aid, American Red Cross, January 2025

- Anti-Money Laundering Certificate, ACAMS, April 2023

Job seekers should check which certificates are most relevant to the positions they want. For more advice and tips on building a resume with certifications, visit resume-building guides like this resume examples and advice for bank tellers page. To get personalized help, many use tools that can help auto-apply to jobs across platforms or even optimize your resume with RoboApply.

6) Showcase customer service skills

Customer service skills are essential for bank tellers. Employers look for candidates who can listen carefully to customers, stay polite under pressure, and help solve problems quickly. These skills make customers feel valued and keep them coming back.

When building a bank teller resume, it is important to clearly list your customer service strengths. Simple statements like, “Provided friendly and accurate assistance to over 50 customers daily,” show both your attitude and the volume of work you can handle. Also, use action words like “assisted,” “resolved,” and “answered.”

Try using results-driven phrases. For example, if you resolved customer complaints or handled difficult situations calmly, write about it. “Calmly resolved customer issues, reducing repeat complaints by 20%” is a direct way to highlight results.

Adding customer service skills can help your resume stand out. Current guides suggest demonstrating problem-solving as well, which is a key part of good service. To see more ways you can feature these abilities, check out helpful bank teller resume examples and related tips.

If you want a tool to instantly improve your resume and focus on customer service, use RoboApply to optimize your resume. This can help you highlight these skills and quickly apply to jobs across platforms.

7) Detail cash handling and balancing expertise

Banks want tellers who can manage cash quickly and accurately. On a resume, it’s important to list cash handling skills in specific, simple terms. Employers look for team members who reduce mistakes and help the bank avoid losses.

Job seekers should mention any experience counting, sorting, or verifying cash and coins. Tellers also need to show skill in balancing cash drawers at the end of each shift. Listing times when balancing was done without errors or shortages can make an application stand out.

Tellers often use computers or calculators to total their transactions. Many banks ask staff to report differences or follow up when errors are found, so including examples of problem-solving is helpful. Describing training on anti-theft policies or security steps is also a plus.

Some job seekers can point to previous work handling cash at retail stores, restaurants, or events. Even part-time or volunteer work counts if cash was handled in a responsible way. Make these examples easy for readers to find, using bullet points when possible.

For extra help, applicants can use tools to optimize your resume for bank teller jobs. RoboApply helps users highlight cash management skills, generate bullet points, and match their experience to job requirements. With clear, direct examples, candidates can improve their chances of landing an interview.

8) Mention experience in account opening and closing

Many banks want tellers who can handle account opening and closing. This shows that the candidate is responsible and trusted with important customer tasks. Listing this experience on a resume helps job seekers stand out when applying for teller positions.

Job seekers should explain how they guided customers through opening new checking, saving, or business accounts. They may also describe steps for closing accounts, like verifying balances and explaining options to clients.

Including this information shows banks that the applicant understands basic banking procedures. Account management requires attention to detail, accurate data entry, and clear communication with clients.

Highlighting this experience signals that the teller can follow rules while also providing helpful service. Simple statements such as “Assisted clients with account openings and closures, ensuring all paperwork and identification requirements were met” are effective.

When updating a resume, platforms like RoboApply help users optimize your resume and make sure account opening and closing skills are clear to employers. RoboApply stands out by allowing applicants to quickly auto-apply to jobs across platforms with well-structured resumes.

For real resume examples that include account opening and closing, job seekers can visit these bank teller resume templates or use RoboApply to build a tailored resume.

9) Include proficiency with point-of-sale systems

Bank tellers work with different types of point-of-sale (POS) systems every day. Listing these skills on a resume helps show experience in daily banking operations. Job seekers who can use POS systems are more likely to earn trust for handling transactions quickly and accurately.

Employers look for candidates who are comfortable using banking software and POS tools. Good skills in this area mean fewer errors and faster customer service. Be sure to highlight specific POS systems or transaction systems you have learned, such as Verifone or NCR.

Being trained on POS systems often leads to greater job success. Many bank teller roles involve cash handling, balance checks, and reconciling transactions using these systems. If you’ve assisted with training new hires on POS tools, add that detail.

Mentioning this skill aligns with expert advice from recent bank teller resume guides. Recruiters scanning resumes look for keywords like “POS systems,” “transaction processing,” or “banking software.” These keywords can make your profile more visible.

Job seekers can use platforms like RoboApply to build your resume with RoboApply and highlight these skills more easily. Using resume builders also helps include the right keywords for automated screening.

Up-to-date POS experience shows you are ready for modern banking. It helps prove you can adapt to changes and new technologies. Always tailor this section to fit the job posting and your own work history.

10) Highlight teamwork and communication abilities

Employers want bank tellers who can work well with others and communicate clearly. This helps the team solve problems quickly and keeps customers satisfied. Good communication skills allow tellers to explain services and handle issues politely.

Applicants should mention times when they worked together with co-workers to meet goals or help customers. For example, describe how they shared tasks during busy hours or helped train a new colleague. This shows managers that they can be counted on.

It is important to use clear language when describing these skills on a resume. Phrases such as “worked closely with other tellers to balance daily transactions” or “helped create a positive work environment by sharing feedback in team meetings” work well.

A strong example might look like this:

Collaborated daily with three other tellers to ensure all customer transactions were processed efficiently during peak hours. Communicated withdrawal policies to over 50 customers a day, resolving questions in person and over the phone. Assisted in new employee orientation by explaining cash handling and customer service procedures.

Job seekers can also use online platforms, like RoboApply, to optimize your resume and highlight teamwork and communication skills based on real job descriptions. This can help resumes stand out to hiring managers and recruiters.

For more examples of teamwork and communication phrases you can use, view additional resume samples.

11) Demonstrate problem-solving skills in financial contexts

Problem-solving is an important skill for bank tellers. Every day, they handle errors in transactions, help customers with account issues, and respond to mistakes. Employers want to see real examples of how a candidate resolved financial problems or handled unexpected situations at work.

Job seekers should include specific situations in their resumes where they solved problems related to customer accounts, cash shortages, or transaction disputes. For instance, when a customer’s deposit does not reflect correctly, describing the steps taken to investigate and fix the issue shows analytical thinking.

It can also help to show how they collaborated with colleagues to resolve a complex issue. This shows teamwork and communication skills as well as problem-solving ability. Including numbers or results, such as reducing transaction errors or improving account reconciliation times, makes the example stronger.

Tellers can write: “Investigated a $500 discrepancy in a daily cash drawer by auditing transaction slips and working with the branch manager. Quickly found a data entry error and corrected the deposit record to match. Customer’s funds were restored within one hour, helping keep trust and accuracy at the branch.”

Another example is: “Assisted a customer whose check was accidentally processed twice. Identified the duplicate transaction using account history, contacted the processing department, and secured a reversal within the same business day.”

Applicants can review more actionable bank teller resume examples to see how to frame their own skills for today’s job market. If they want to take the next step, they can optimize your resume with RoboApply for better results in their job hunt.

Frequently Asked Questions

A strong bank teller resume should have sections for skills and experience, clearly list certifications, and use a format that is easy to read. Even if someone has no experience, they can create an effective resume by focusing on transferable abilities and clear summaries.

What are the essential components to include in a bank teller resume?

A bank teller resume should list contact information, a concise summary, relevant experience, and specific teller skills. Include any financial certifications or banking compliance training. Mention skills in operating teller equipment and using banking software. Add education credentials and any customer service awards.

Including accurate transaction records, attention to detail, and reliability is also important. Demonstrating cash handling experience and problem-solving abilities helps resumes stand out. For help with optimizing your resume, many people use tools like RoboApply to streamline their process and get higher resume scores.

How can someone with no previous experience create an effective resume for a bank teller position?

For those with no teller experience, it is important to focus on transferable skills such as customer service, cash handling in other jobs, or volunteering. A strong summary can show eagerness to learn and interest in the banking industry.

Education, computer skills, and reliability should be highlighted. Any part-time work or roles requiring trustworthiness, accuracy, or communication skills count. Using a simple template can help organize these strengths. Online tools like RoboApply can help build your resume with step-by-step guidance.

What skills should be highlighted on a resume for an experienced bank teller?

Experienced bank tellers should emphasize transaction accuracy, handling large cash volumes, and knowledge of security protocols. Listing customer service skills and experience with teller equipment is key.

Knowledge of financial software and sales abilities can also set a resume apart. Mention any awards, certifications, or training completed. Highlighting teamwork and conflict resolution is useful for experienced candidates. For more ideas, Enhancv shares several bank teller resume examples for inspiration.

How can a bank teller effectively display career progression on their resume?

Bank tellers should list jobs in reverse-chronological order, showing promotions or increasing responsibilities over time. Use action verbs to describe growth, such as “trained new staff” or “managed high-volume transactions.”

Each job entry should include key accomplishments. Use bullet points for increased readability. If roles changed within the same bank, show the titles and dates separately. Resume tools like RoboApply make it easy to update and track job history for a clear timeline.

What format is recommended for a bank teller’s resume to ensure clarity and impact?

The recommended format is reverse-chronological, starting with the most recent role. Use bold headings for each section and keep the layout clean. Bullet points help organize details clearly, making it easy for recruiters to scan.

Standard fonts and spacing are best. Keep the resume to one page if possible. Templates from platforms like Resume.io can give a good starting point, but using RoboApply lets users further customize for banking jobs and get feedback to optimize your resume.

Can you provide tips for creating a compelling summary section on a bank teller’s resume?

A good summary is short, clear, and tailored to the role. Start with years of experience, key skills, and a notable achievement. For example: “Detail-oriented bank teller with three years of experience, skilled in handling high-value transactions and providing efficient customer service.”

Show your commitment to accuracy and customer satisfaction. Avoid generic phrases—focus on specific strengths and contributions. RoboApply’s resume builder can help with smart prompts and targeted suggestions. You can optimize your resume and tailor summaries easily with its tools.