1. Payroll Processing

Payroll processing is the heart of a payroll manager’s job. It’s more than just paying people; it’s about accuracy, compliance, and efficiency. Let’s break down what this involves.

Think of it this way: you’re not just pushing buttons; you’re ensuring everyone gets paid correctly and on time, which is pretty important for morale. A good payroll manager makes it look easy, but there’s a lot going on behind the scenes.

Here’s what you need to know to showcase your payroll processing skills on your resume.

Payroll Processing

Payroll processing is the systematic calculation of employee pay, deductions, and taxes. It’s the core function of any payroll department. It involves gathering timesheet data, calculating gross pay, subtracting taxes and other deductions, and issuing payments. Accuracy is key, as errors can lead to unhappy employees and legal issues.

Here’s a breakdown of the key steps:

- Collecting employee time and attendance data.

- Calculating gross pay (hourly rate, salary, overtime, bonuses).

- Calculating and withholding taxes (federal, state, local).

- Deducting benefits contributions (health insurance, retirement).

- Generating paychecks or direct deposits.

- Maintaining accurate payroll records.

A well-executed payroll process minimizes errors, ensures compliance, and keeps employees satisfied. It’s a critical function that directly impacts a company’s financial health and employee relations.

For example, a resume bullet point might read:

- "Processed bi-weekly payroll for 200 employees with a 99.6% accuracy rate, reducing payroll discrepancies by 25%."

This shows not only that you can process payroll, but also that you do it accurately and efficiently. It’s about showing the impact of your work.

Another example:

- "Processed payroll for 1,000 employees with a 99.7% accuracy rate."

This highlights your ability to handle large payrolls with high accuracy. It’s a great way to demonstrate your experience and attention to detail.

Here’s a tip: When describing your payroll processing experience, always quantify your achievements whenever possible. Use numbers and percentages to show the impact of your work. For example, instead of saying "Processed payroll," say "Processed payroll for 300 employees with 99% accuracy."

Here’s an example of how to show your skills in a table:

| Skill | Description

2. Payroll System And Software

Payroll managers need to be familiar with a variety of payroll systems and software. It’s not just about knowing one system inside and out, but understanding how different platforms work and what their strengths and weaknesses are. This knowledge is super important for efficiently processing payroll, maintaining accurate records, and staying compliant with regulations. Let’s look at some key areas:

Payroll Software Proficiency

Being good with payroll software is a must. Employers want to see that you know your way around the tools of the trade. This includes popular platforms like ADP Workforce Now, Paychex Flex, and QuickBooks Payroll. But it’s not just about listing the names of software you’ve used; it’s about showing how you’ve used them to improve payroll processes or solve problems. For example, you could mention how you automated a specific task in QuickBooks Payroll to save time or reduce errors.

Spreadsheet Skills

Even with specialized software, spreadsheet skills, especially in Microsoft Excel, are still valuable. Excel is great for data analysis, creating custom reports, and handling one-off calculations. Being able to use formulas, pivot tables, and other Excel functions can really set you apart.

Enterprise Resource Planning (ERP) Systems

Some companies use ERP systems like SAP or Oracle HCM for payroll. These systems integrate payroll with other business functions like HR and finance. If you have experience with ERP systems, be sure to highlight it on your resume. It shows that you can handle complex, integrated systems.

Timekeeping Software

Timekeeping software is often integrated with payroll systems to track employee hours. Familiarity with timekeeping software can streamline the payroll process and ensure accurate paychecks. Here’s a quick look at why it matters:

- Accuracy: Integrates directly with payroll to minimize manual entry errors.

- Compliance: Helps track overtime and ensures compliance with labor laws.

- Efficiency: Automates the collection and processing of employee time data.

Knowing different types of software is great, but showing how you’ve used them to solve problems or improve processes is even better. Think about specific examples where you used your software skills to make a difference.

Example

Here’s an example of how you might describe your software skills on your resume:

Payroll Software:

- ADP Workforce Now: Managed payroll for 500+ employees, automated reporting processes, and implemented new features to improve efficiency.

- Paychex Flex: Processed payroll, managed employee benefits, and ensured compliance with federal and state regulations.

- Microsoft Excel: Created custom reports, analyzed payroll data, and developed tools to improve accuracy.

Accounting Tools:

- SAP, Xero, FreshBooks, Wave, Zoho Books

By showcasing your proficiency with various cashier resume systems and software, you demonstrate your ability to handle the technical aspects of the job and contribute to the efficiency and accuracy of the payroll process.

3. Compliance And Regulations

Payroll isn’t just about cutting checks; it’s also about staying on the right side of the law. Messing this up can lead to some serious headaches, so it’s a big deal for any payroll manager.

- Staying up-to-date with federal, state, and local regulations is key. Tax laws change all the time, and you need to know what’s what.

- Making sure all payroll processes follow these regulations. This includes things like wage calculations, tax withholdings, and reporting.

- Handling audits and inquiries from regulatory agencies. No one wants an audit, but you need to be ready if one happens.

Payroll managers must demonstrate a strong understanding of compliance to ensure the company avoids penalties and legal issues. This involves keeping abreast of changes in legislation and implementing procedures to maintain adherence.

Think of it like this: you’re not just processing payroll; you’re also acting as a HR compliance manager, making sure the company doesn’t get into trouble. It’s a lot of responsibility, but it’s also what makes the job interesting. When crafting your payroll resume, make sure to highlight your experience with compliance and regulations.

4. Employee Recordkeeping

Employee recordkeeping is a critical part of payroll management. It involves maintaining accurate and up-to-date information for each employee. This includes everything from their personal details to their pay history. Good recordkeeping helps ensure compliance and smooth operations. Let’s get into it.

Employee Data Accuracy

Maintaining accurate employee data is essential for compliant and efficient payroll processing. This means regularly updating information like addresses, contact details, and banking information. Errors in this data can lead to misdirected payments, tax issues, and compliance problems. Think of it as the foundation upon which everything else is built. If the foundation is shaky, the whole structure is at risk. For example, if an employee changes their bank account and you don’t update the record, their paycheck will bounce, causing frustration and extra work.

Documentation and Compliance

Proper documentation is key to staying compliant with labor laws and regulations. This includes keeping records of employment contracts, tax forms, and any other relevant documents. Here’s a quick rundown:

- Employment Contracts: Keep copies of all employment agreements.

- Tax Forms: Ensure W-4s and other tax-related documents are properly filed and stored.

- Payroll Records: Maintain detailed records of each payroll cycle, including pay rates, hours worked, and deductions.

Maintaining thorough documentation protects the company in case of audits or legal disputes. It also provides a clear history of employee compensation and employment terms.

Data Security and Privacy

Protecting employee data is a big deal. You need to have systems in place to secure sensitive information from unauthorized access. This includes things like:

- Secure Storage: Use encrypted databases and secure servers to store employee records.

- Access Controls: Limit access to employee data to only those who need it.

- Regular Audits: Conduct regular audits to ensure data security protocols are being followed.

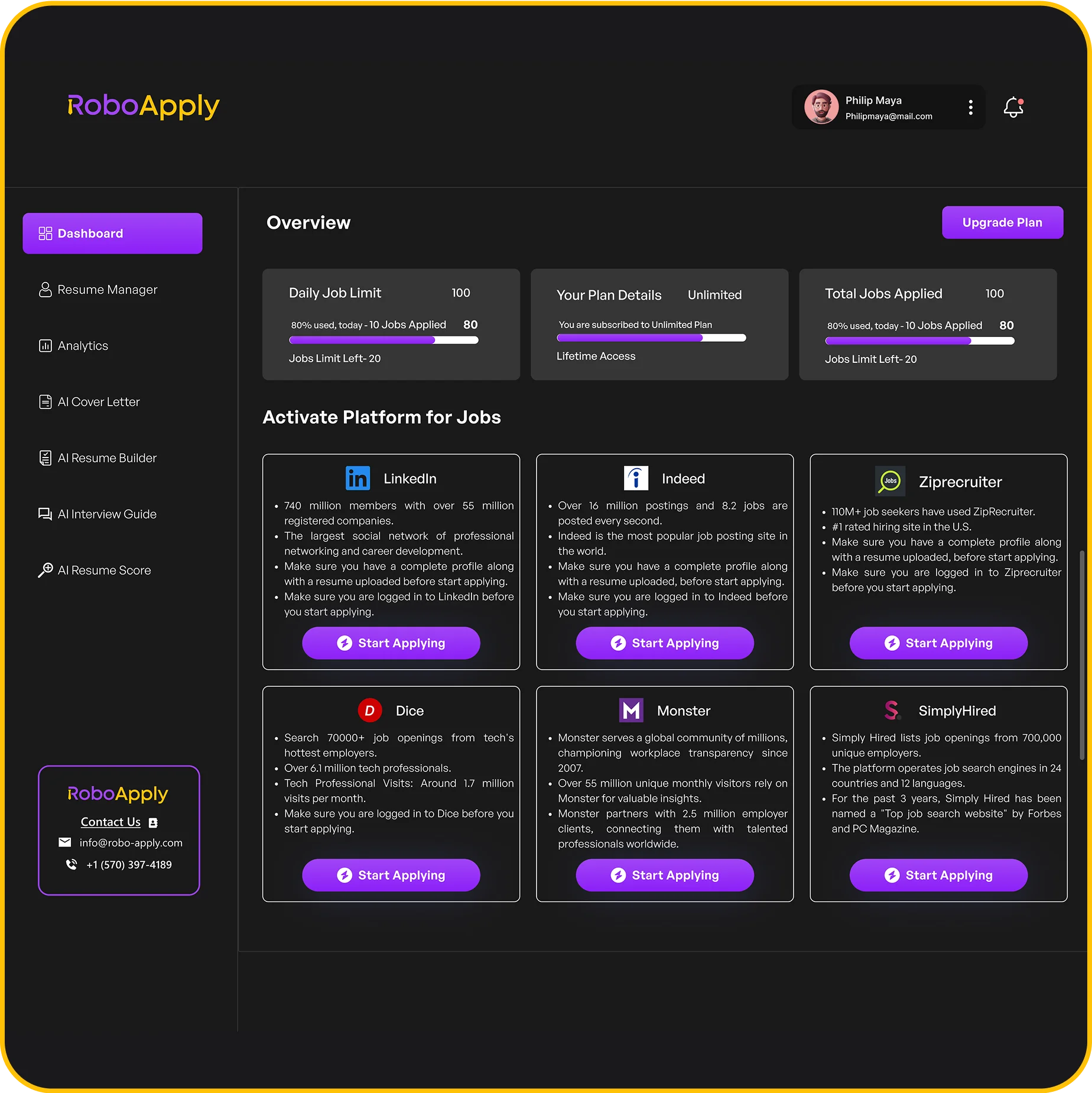

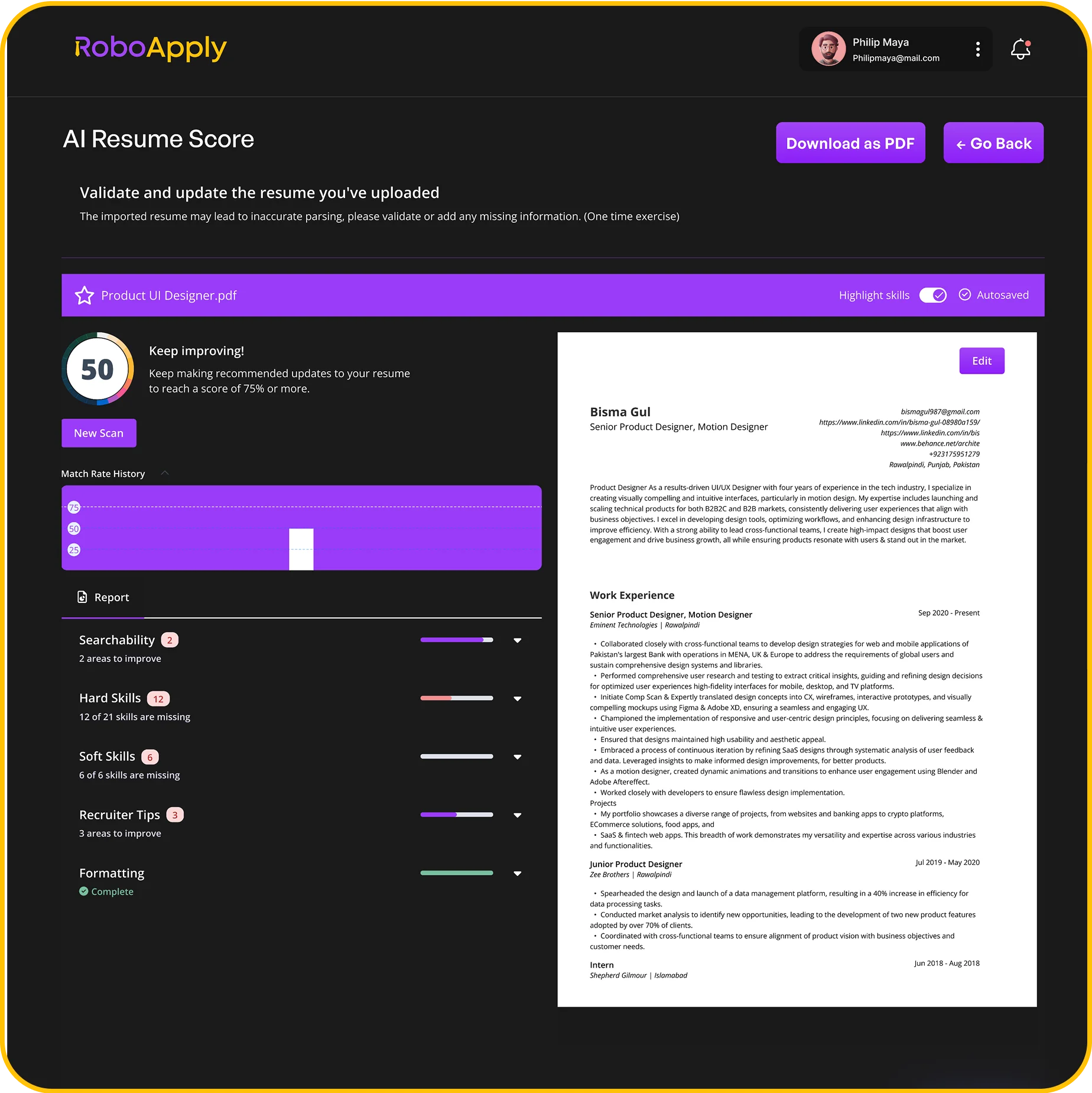

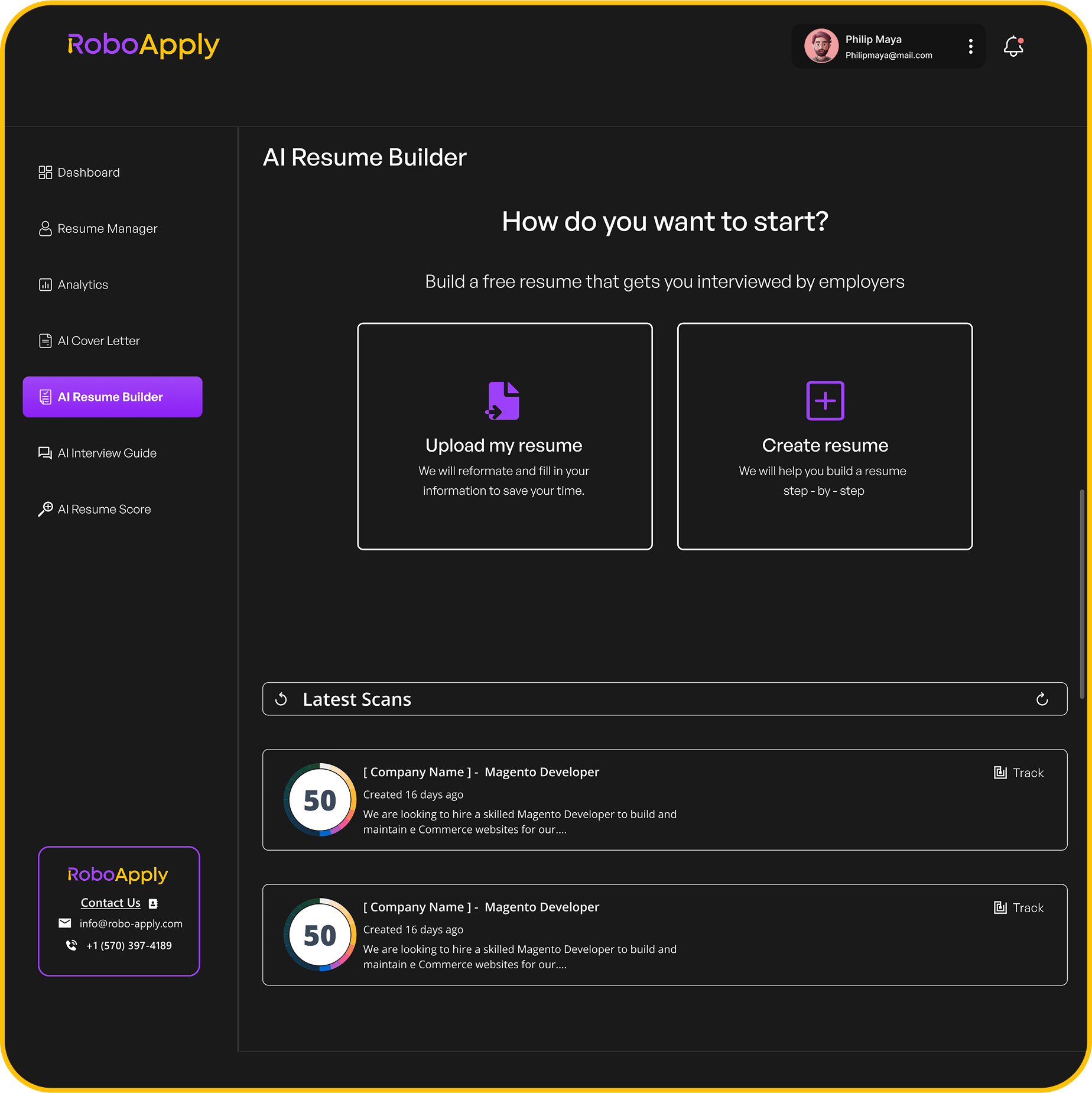

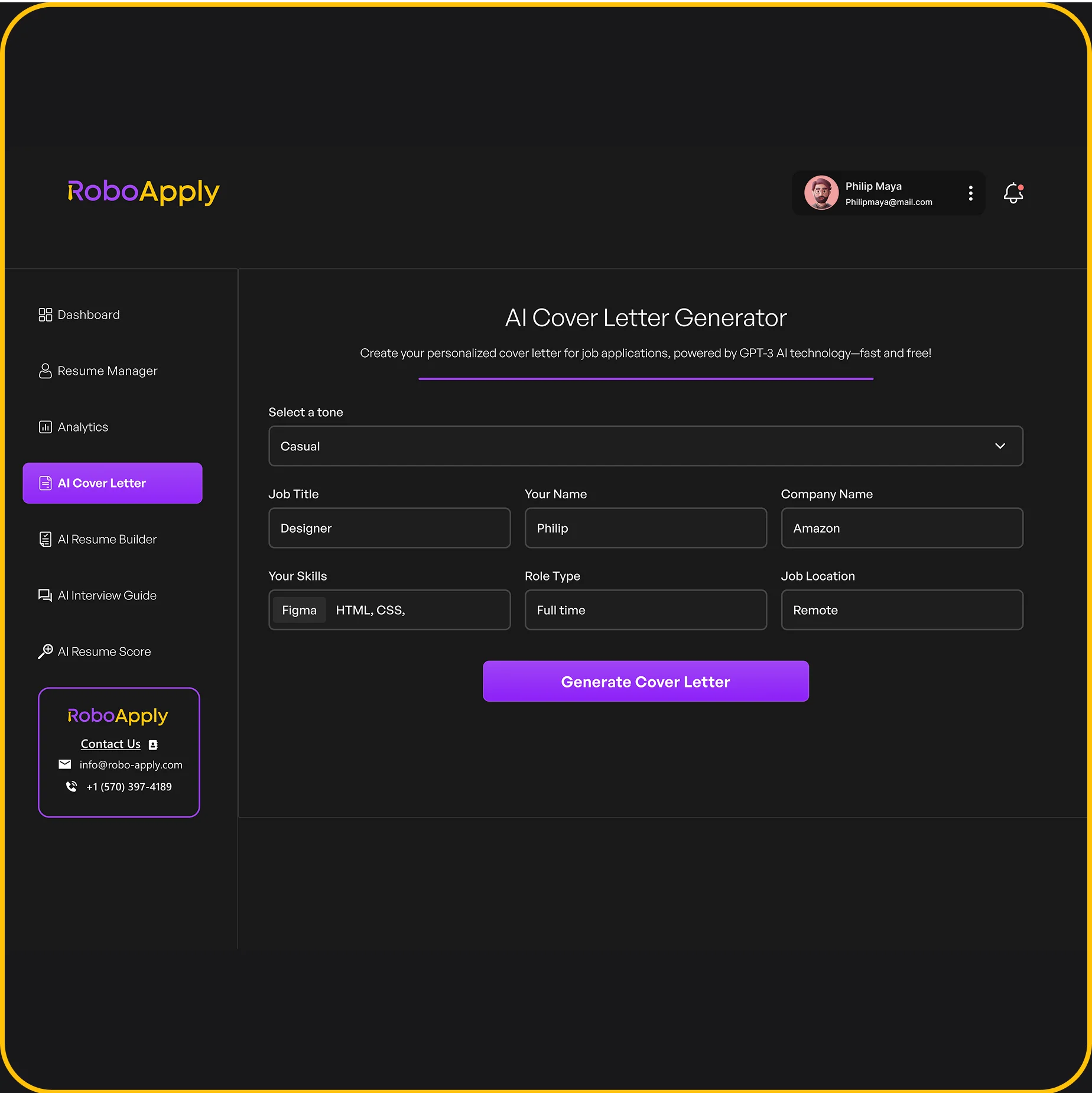

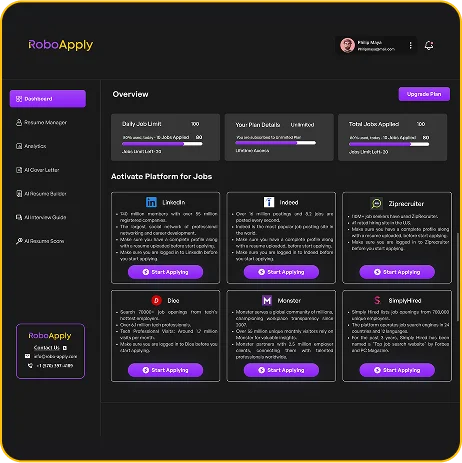

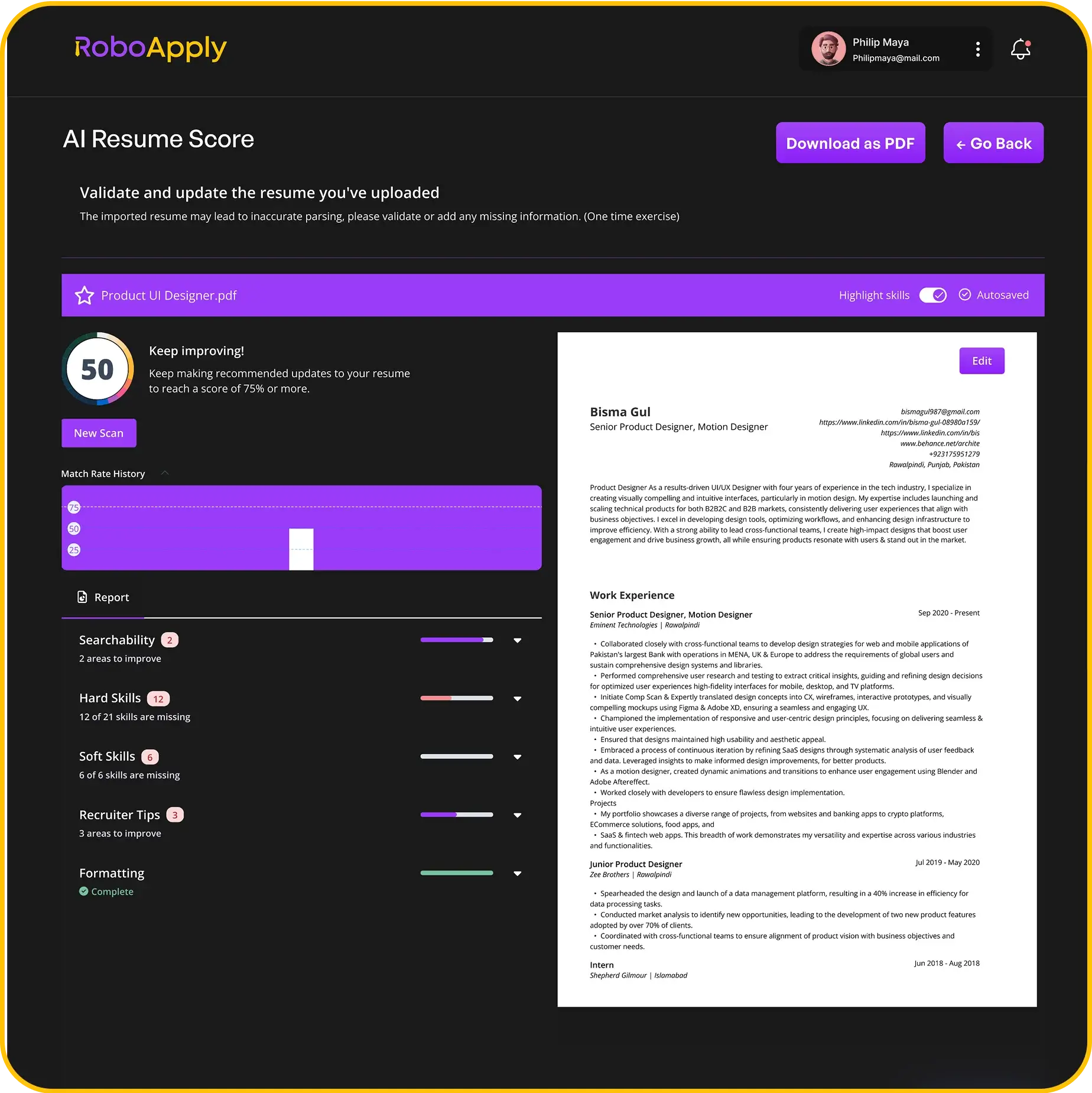

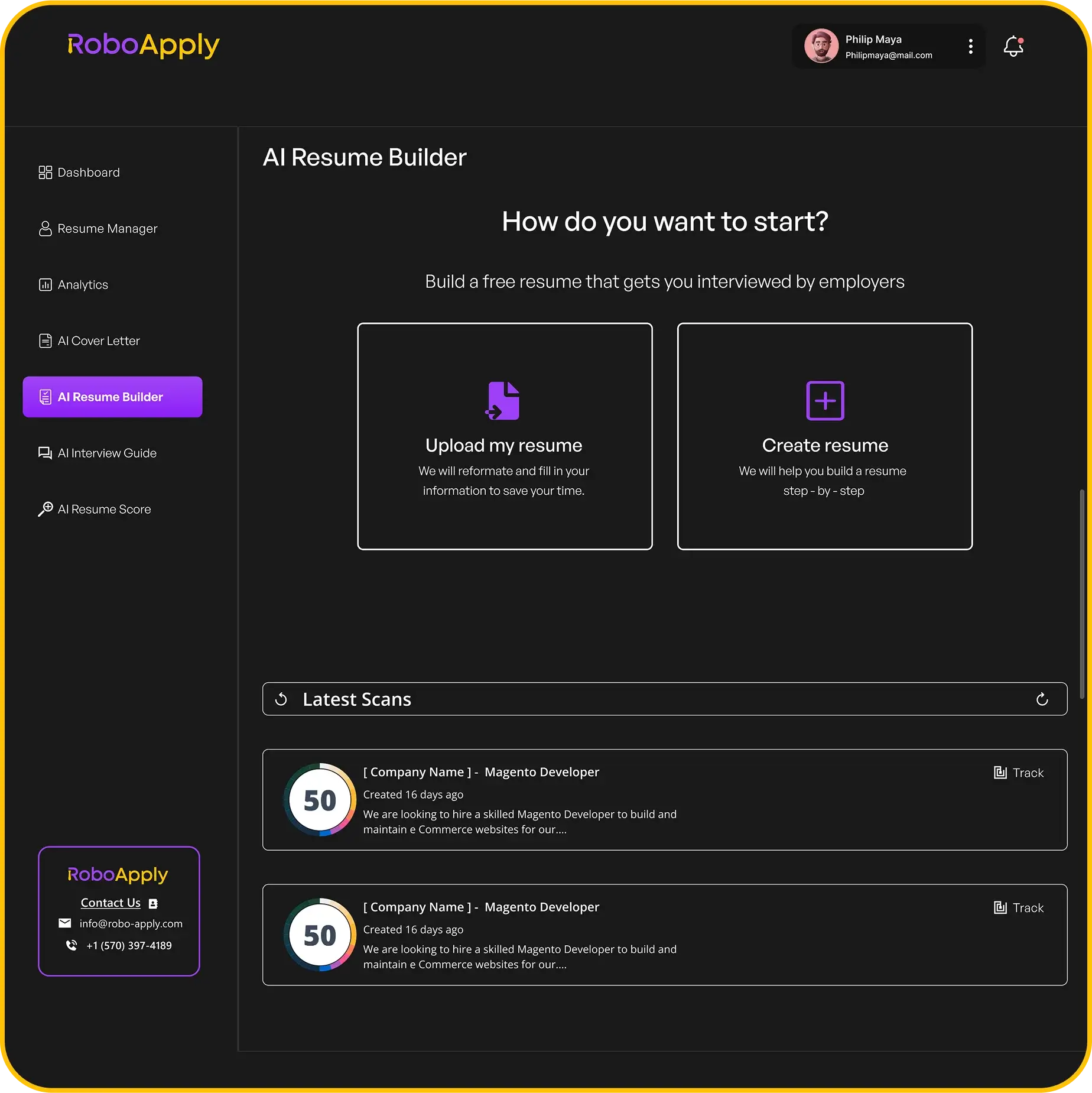

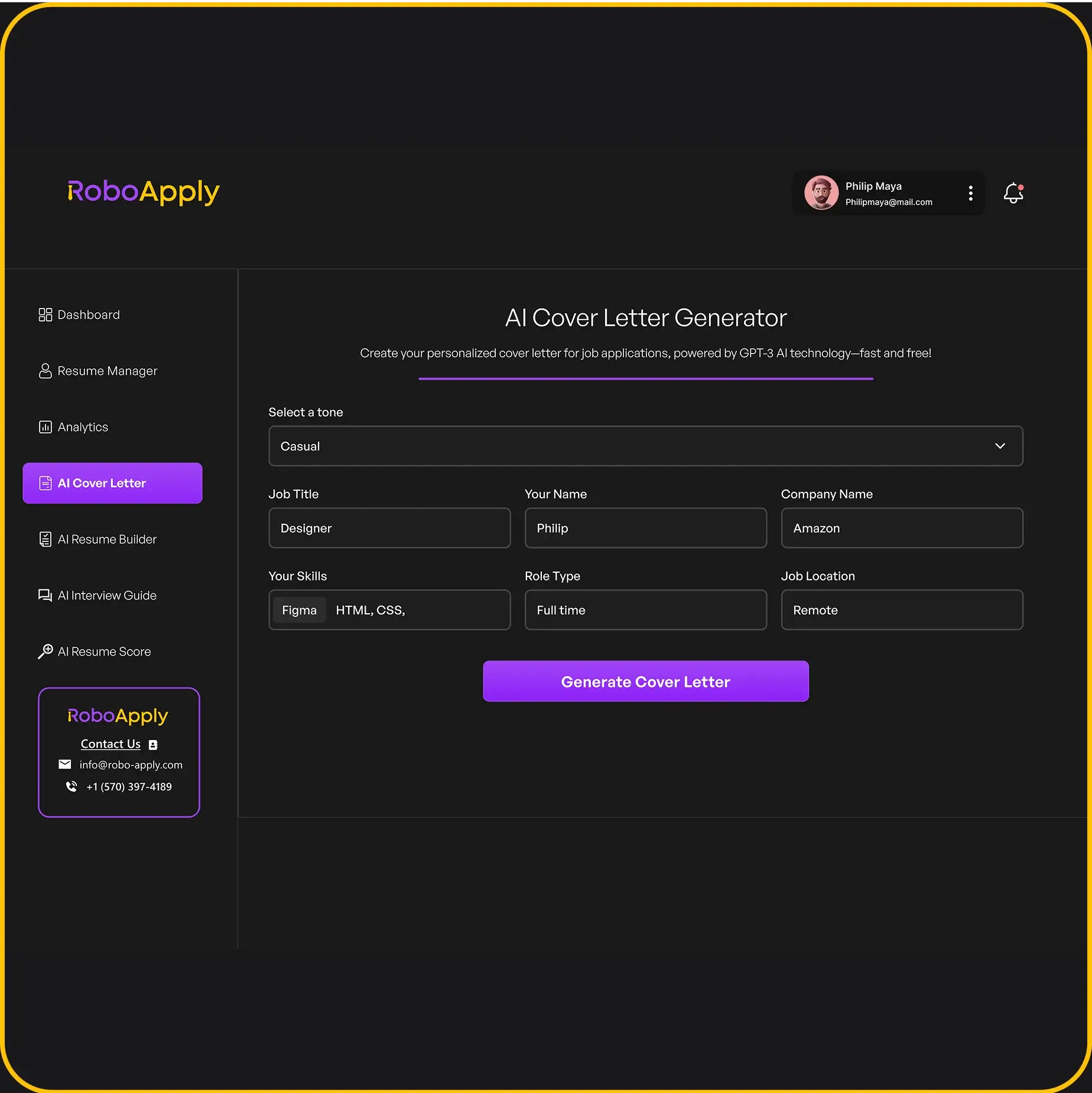

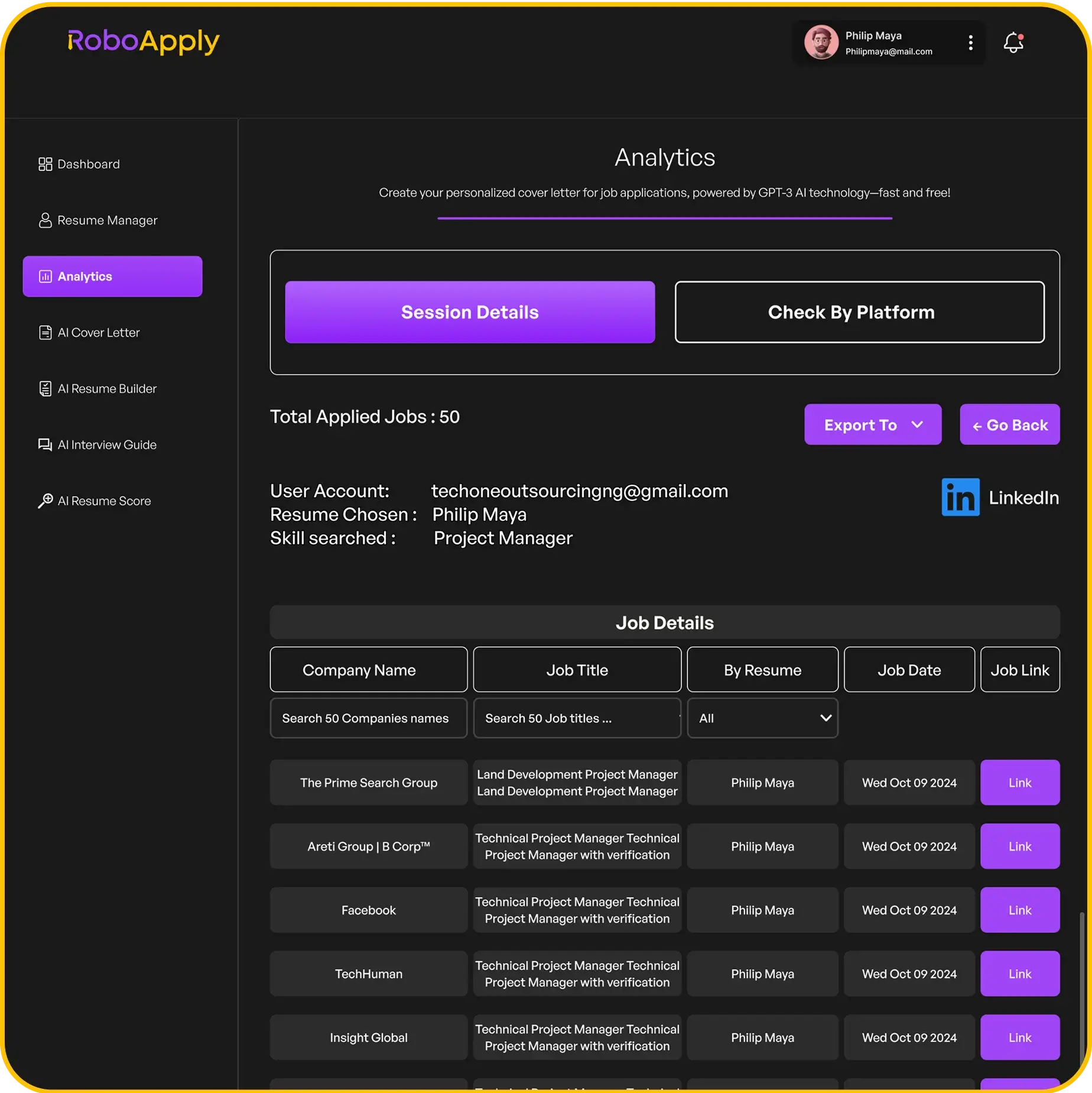

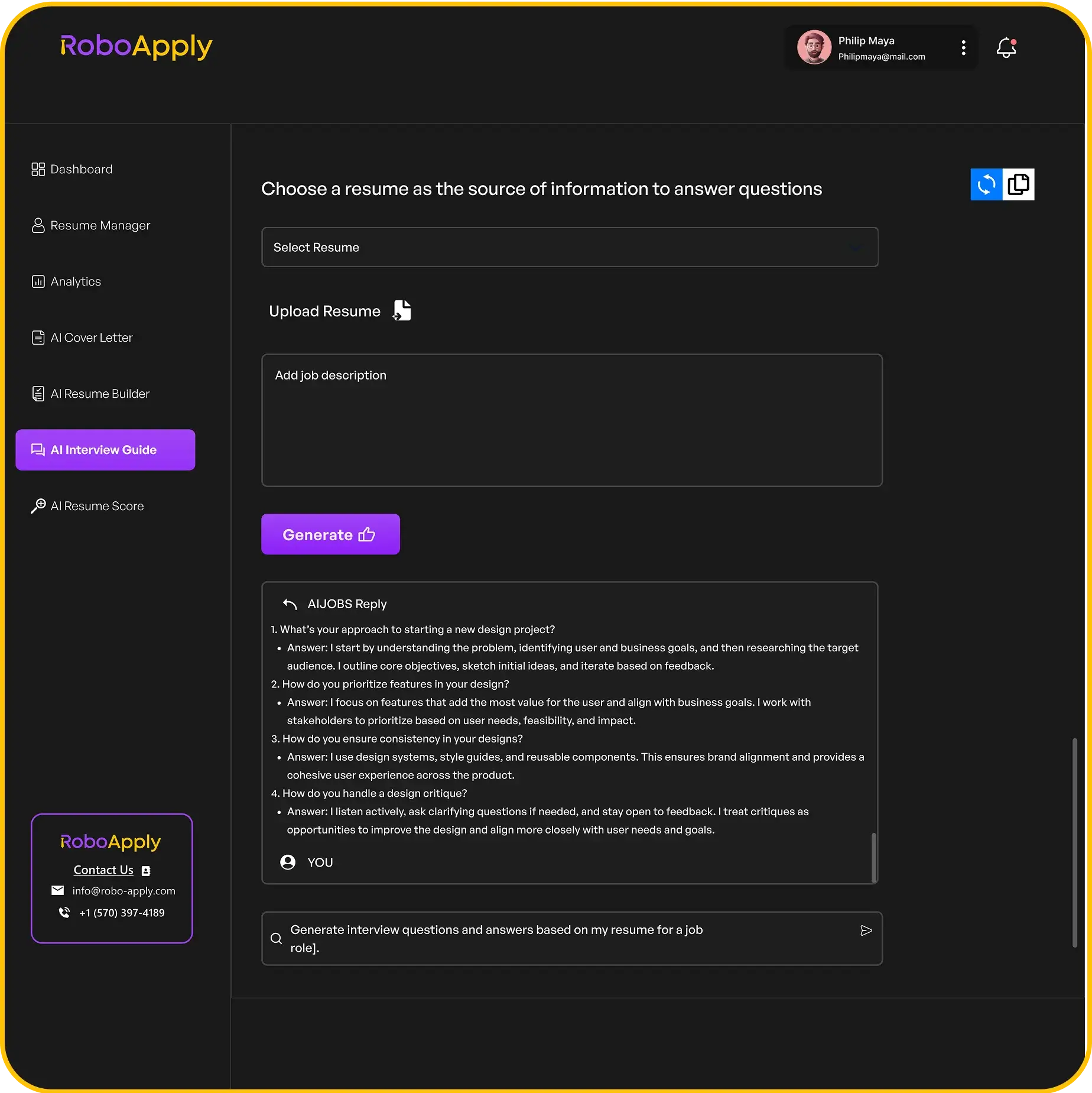

Think about it this way: you’re not just keeping records; you’re safeguarding people’s personal information. A breach can lead to serious consequences, both for the company and the employees. If you are looking for a platform to help you build your resume, consider using RoboApply for resume building.

Record Retention Policies

How long should you keep employee records? It depends on the type of record and the applicable laws. Generally, it’s a good idea to keep personnel files for at least two years, but some records may need to be kept longer. Here’s a general guideline:

- General Personnel Files: Minimum of two years, as recommended to retain general employee personnel files.

- Payroll Records: Typically, at least three years.

- Tax Records: Usually, seven years.

It’s always best to consult with legal counsel to determine the specific requirements for your jurisdiction.

5. Employee Inquiry And Issue Resolution

Dealing with employee questions and fixing payroll problems is a big part of being a payroll manager. It’s not just about processing paychecks; it’s about making sure employees understand their pay and feel heard when they have issues. Your resume needs to show you’re good at this.

- Example: "Responded to and resolved an average of 30 employee payroll inquiries per week, maintaining a 95% satisfaction rate."

- Tip: Use numbers to show how much you’ve helped employees. Did you cut down on response times? Did you improve satisfaction scores? Numbers speak volumes.

- Concept: Empathy is key. Show you understand employee concerns and can explain complex payroll stuff in a way they get.

Being able to clearly explain payroll details and resolve issues quickly can really boost employee morale. It shows you care about getting it right.

Here’s how you can show this on your resume:

- Problem-Solving Skills: Mention times you fixed tricky payroll errors or found solutions to employee pay issues. For example, you could say you developed a new method for payroll discrepancies, reducing error rates by 30% in the first year.

- Communication Skills: Highlight your ability to explain payroll stuff clearly, whether in person, over the phone, or in writing. Did you create guides or FAQs to help employees understand their pay? That’s a great thing to mention.

- Conflict Resolution: Show you can handle tough conversations and find solutions that work for everyone. Maybe you mediated a dispute over unpaid overtime or helped an employee understand a complicated tax situation.

By showing you’re good at handling employee inquiries and resolving issues, you’ll show employers you’re not just a numbers person – you’re a people person too. And that’s a big plus for any payroll manager role. Remember to tailor your resume to the specific job, highlighting the skills and experiences that are most relevant. This will help you stand out from the competition and land that dream job. Think about how your HR manager resumes can showcase these skills effectively.

6. Reporting And Analysis

Payroll managers don’t just process paychecks; they also need to be able to make sense of the data. This means generating reports, analyzing trends, and providing insights to management. It’s about turning raw numbers into actionable information.

I think it’s one of the most important parts of the job. You can really show your value by highlighting your reporting and analysis skills on your resume.

Here’s how you can showcase your abilities:

1. Payroll Processing

Payroll reports are a big deal. They help companies understand where their money is going and if there are any issues. You need to show you can create these reports accurately and on time.

For example:

- Generated monthly payroll reports for a company of 500+ employees, ensuring accuracy and compliance with all regulations.

- Developed custom reports to track overtime expenses, identifying trends and areas for cost savings.

- Automated report generation process, reducing manual effort by 40%.

2. Payroll System And Software

Knowing the software is one thing, but knowing how to pull data from it is another. Can you use Excel? Can you use the reporting features of your payroll software? Make sure to highlight this.

For example:

- Utilized ADP reporting tools to create ad-hoc reports for management, providing insights into labor costs and employee demographics.

- Proficient in using Excel to analyze payroll data, create pivot tables, and generate charts for presentations.

- Implemented a new reporting system within the payroll software, improving data accuracy by 15%.

3. Compliance And Regulations

Compliance is key. You need to show you understand the rules and can report on them accurately. This includes things like tax filings, wage garnishments, and other legal requirements. You can find more information about financial data reporting online.

For example:

- Prepared and filed all required tax reports, ensuring compliance with federal, state, and local regulations.

- Monitored changes in payroll laws and regulations, updating reporting procedures as needed.

- Conducted internal audits to ensure compliance with company policies and government regulations, improving reporting accuracy by 20%.

4. Employee Recordkeeping

Keeping good records is essential for accurate reporting. Show you know how to maintain employee data and use it for analysis.

For example:

- Maintained accurate employee records, ensuring data integrity for reporting purposes.

- Developed a system for tracking employee attendance and leave, improving the accuracy of payroll calculations.

- Used employee data to generate reports on turnover, absenteeism, and other key metrics.

5. Employee Inquiry And Issue Resolution

Sometimes, employees have questions about their paychecks. Being able to resolve these issues and report on them is a valuable skill.

For example:

- Resolved employee inquiries related to payroll, taxes, and benefits, providing clear and accurate information.

- Tracked and reported on the types of payroll issues that were most common, identifying areas for improvement.

- Developed training materials for employees on how to understand their paychecks and benefits statements.

6. Reporting And Analysis

Finally, show you can analyze the data and provide insights. This is where you can really shine. Can you identify trends? Can you make recommendations based on the data?

For example:

- Analyzed payroll data to identify trends in labor costs, making recommendations for cost savings.

- Developed dashboards to track key payroll metrics, providing management with real-time insights.

- Presented findings to management, highlighting areas of concern and recommending solutions.

Being able to turn payroll data into actionable insights is what separates a good payroll manager from a great one. Make sure your resume reflects this.

7. Resume Format

Choosing the right resume format is super important. It’s like picking the right outfit for an interview – it needs to make a good impression and highlight your best features. There are a few main formats to consider, and each one has its strengths depending on your experience and what you want to emphasize. Let’s break down the most common ones.

8. Reverse Chronological Format

This is probably the most common format you’ll see. It focuses on your work history, starting with your most recent job and working backward. It’s great if you have a consistent work history and want to show career progression. Recruiters like this format because it’s easy to see what you’ve been doing lately. If you’re staying in the same field, this is often your best bet. For example, if you’ve been steadily climbing the ladder in payroll management, this format will showcase that nicely. Make sure your financial accounting resume is easy to read.

9. Functional Format

Instead of focusing on your work history, the functional format highlights your skills. This can be useful if you have gaps in your employment history or if you’re changing careers. It allows you to showcase what you’re good at, even if your work experience doesn’t directly align. However, be aware that some employers are wary of this format because it can hide a lack of experience. If you go this route, make sure to still include a brief work history section to provide context. This format is less common for payroll managers, but could work if you’re transitioning from a related field and want to emphasize transferable skills.

10. Combination Format

The combination format, also known as a hybrid format, blends the best of both worlds. It highlights both your skills and your work history. This can be a good choice if you want to showcase your abilities while still demonstrating a solid work record. It typically starts with a skills section, followed by a chronological work history. This format can be particularly effective if you have a diverse skill set and want to show how your experience has contributed to your abilities. When selecting a resume design, make sure it complements your chosen format.

8. Reverse Chronological Format

The reverse chronological resume format is a super common way to show off your work history. Basically, you start with your most recent job and then work your way backward in time. It’s a straightforward approach that most recruiters are familiar with, making it easy for them to quickly see your career progression.

- Focus on Recent Experience: This format puts your most recent and relevant experience front and center. This is great if you’ve been steadily climbing the ladder and your recent roles are the most impressive.

- Easy to Read: Recruiters can quickly scan your career history and see your progression. It’s a format they’re used to, so it’s easy for them to find the information they need.

- Highlight Growth: It clearly shows how you’ve grown and developed in your career over time. Each role builds upon the previous one, demonstrating your increasing skills and responsibilities.

This format is particularly effective if you’re staying in the same field and want to show a clear career path. It’s not the best choice if you have gaps in your employment history or are trying to switch careers.

Let’s say you’re applying for a Payroll Manager position. Here’s how your experience section might look using the reverse chronological format:

Experience

Payroll Manager | ABC Company | 2020 – Present

- Managed payroll for 300+ employees, ensuring accurate and timely payments.

- Implemented a new payroll system, resulting in a 15% reduction in processing time.

- Trained and supervised a team of 3 payroll specialists.

Senior Payroll Specialist | XYZ Corporation | 2017 – 2020

- Processed payroll for 200+ employees, handling complex calculations and deductions.

- Assisted with year-end reporting and tax filings.

- Developed and maintained payroll procedures and documentation.

Payroll Specialist | 123 Industries | 2015 – 2017

- Prepared and processed weekly payroll for 100+ employees.

- Responded to employee inquiries regarding payroll issues.

- Maintained employee payroll records and ensured data accuracy.

Using this format, recruiters can easily see your most recent experience as a Payroll Manager and how you’ve progressed from a Payroll Specialist role. It’s a clear and concise way to showcase career progression to potential employers. To make your payroll manager resume even better, make sure to quantify your achievements whenever possible. For example, instead of saying

9. Functional Format

The functional resume format is all about skills. It puts your abilities front and center, rather than focusing on your work history. This can be super useful if you’re trying to switch careers or if you have gaps in your employment history. It’s less about where you worked and more about what you can do. It’s a good way to highlight your payroll procedures.

Think of it this way:

- Skills Section: This is the star. List all your relevant skills with detailed descriptions and accomplishments.

- Work History (Brief): Just the basics – company name, job title, and dates of employment. No need to go into detail.

- Summary/Objective: A short paragraph highlighting your key skills and career goals.

The functional format can be a great way to downplay a spotty work history or emphasize skills gained through volunteer work or personal projects. However, some employers are wary of this format, as it can make it harder to track your career progression. Make sure to tailor your resume to the specific job you’re applying for, no matter the format.

Here’s a snippet of what a functional resume might look like for a payroll manager:

Skills:

- Payroll Processing: Managed payroll for up to 200 employees, ensuring accurate and timely payments. Implemented a new payroll system that reduced errors by 15%.

- Compliance: Maintained up-to-date knowledge of federal, state, and local payroll regulations. Successfully completed annual audits with zero discrepancies.

- Reporting: Facilitated data reporting for government and internal stakeholders, providing insights into labor costs and trends.

- Employee Relations: Resolved employee payroll inquiries and issues promptly and professionally, maintaining a high level of employee satisfaction.

Work History:

- Payroll Specialist, ABC Company, 2020-2023

- Payroll Assistant, XYZ Corporation, 2018-2020

10. Combination Format

The combination resume format blends elements of both the reverse-chronological and functional formats. It’s a good choice if you want to highlight both your skills and your work history. This format allows you to showcase your most relevant skills at the top, followed by a chronological work history. It’s particularly useful if you have gaps in your employment or are changing careers.

- Skills Section: Start with a section that emphasizes your key skills and accomplishments related to payroll management. This could include things like payroll processing, compliance, reporting, and software proficiency.

- Work History: Follow the skills section with a detailed work history, listing your previous jobs in reverse chronological order. Include your job title, the company name, dates of employment, and a brief description of your responsibilities and achievements.

- Education and Certifications: Include your educational background and any relevant certifications, such as Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC).

The combination resume format gives you the flexibility to highlight what’s most important to the specific job you’re applying for. By showcasing your skills first, you can immediately grab the attention of the hiring manager and demonstrate your qualifications. Then, your work history provides further context and validation of your abilities. This is especially helpful if you’re looking to advance as a payroll manager.

Here’s an example of how a combination resume format might look for a payroll manager:

[Your Name]

[Your Contact Information]

Summary

Experienced Payroll Manager with 8+ years of experience in overseeing all aspects of payroll processing, compliance, and reporting. Proven ability to streamline payroll operations, implement efficient systems, and ensure accurate and timely payments. Strong knowledge of payroll laws and regulations. Committed to lifelong learning and professional development.

Skills

- Payroll Processing: Expert in processing payroll for large organizations, including calculating wages, taxes, and deductions.

- Compliance: Deep understanding of payroll laws and regulations, including federal, state, and local requirements. Passionate about establishing and maintaining compliance.

- Reporting and Analysis: Proficient in generating payroll reports, analyzing data, and identifying trends.

- Payroll Software: Experienced with various payroll software systems, such as ADP, Paychex, and QuickBooks.

- Employee Relations: Excellent communication and interpersonal skills, with the ability to resolve employee inquiries and issues effectively.

Work History

Payroll Manager

ABC Company | 2020 – Present

- Managed all aspects of payroll processing for 500+ employees.

- Implemented a new payroll system that improved efficiency and accuracy.

- Ensured compliance with all payroll laws and regulations.

Senior Payroll Specialist

XYZ Corporation | 2017 – 2020

- Processed payroll for 300+ employees.

- Prepared and filed payroll tax returns.

- Resolved employee payroll inquiries and issues.

Education

Bachelor’s Degree in Accounting

University of [Your University] | 2017

Certifications

Certified Payroll Professional (CPP)

This format allows you to showcase your experienced payroll specialist skills and work history effectively.

11. Resume Examples

It’s always helpful to see examples, right? Let’s look at some ways you can structure your payroll manager resume to make it shine. Remember, the best example is the one tailored to your specific experience and the job you’re applying for. Think of these as inspiration, not templates you must follow exactly.

A well-crafted resume is your ticket to landing that interview. Make sure it’s clear, concise, and highlights your most relevant skills and accomplishments.

Here are some things to keep in mind when reviewing examples:

- Focus on relevance: Does the example showcase skills and experience that align with the job description?

- Pay attention to formatting: Is the resume easy to read and visually appealing?

- Look for quantifiable results: Does the example include numbers and data to demonstrate impact?

Consider these points as you explore different resume examples and think about how to best present your own qualifications. Remember to tailor your resume to each specific job application for the best results. For instance, if you are applying for a warehouse position, you should look at warehouse manager resume examples.

Want to see how a great resume looks? Check out our examples! They can help you make your own resume shine. Head over to our website to see them all and get started on your path to a new job.

Wrapping Things Up

So, there you have it. Putting together a good payroll manager resume might seem like a big job, but it’s really about showing off what you can do clearly and simply. Focus on your real-world experience, the systems you know, and how you’ve helped past employers. Make sure your resume is easy to read and gets straight to the point. With a bit of effort, you can make a resume that really stands out and helps you get that next interview.

Frequently Asked Questions

What does a payroll manager do?

A payroll manager makes sure everyone gets paid correctly and on time. They handle things like calculating wages, taxes, and other deductions. They also make sure the company follows all the rules about paying people.

What skills are important for a payroll manager?

You need to be good with numbers, pay close attention to details, and understand tax laws. Knowing how to use payroll software is also super important.

What kind of education do I need to be a payroll manager?

Many payroll managers have a degree in business, accounting, or something similar. Getting certified in payroll can also really help your chances.

How can I make my resume stand out for a payroll manager job?

Make sure your resume clearly shows your experience with payroll tasks, like processing paychecks and handling taxes. Also, highlight any special software you know how to use.

Do I need to know specific software for this job?

Yes! Many companies use special software to manage payroll. Showing you know how to use these programs, like ADP or QuickBooks Payroll, is a big plus.

Should I include examples of how I improved payroll processes?

It’s a good idea to mention any times you helped make the payroll process better or more efficient. This shows you’re always looking for ways to improve things.

Is knowing about laws and rules important for a payroll manager?

Yes, it’s really important. Payroll managers have to keep up with changing tax laws and other rules to make sure the company doesn’t get into trouble.

Where can I find payroll manager job openings?

You can find payroll manager jobs on websites like LinkedIn, Indeed, and company career pages. Also, check out professional payroll organizations; they often have job boards.