1. Financial Controller Resume Example

Let’s kick things off with a solid example of a Financial Controller resume. This will give you a tangible idea of what to aim for as you craft your own. Remember, the goal is to showcase your skills and experience in a way that grabs the attention of hiring managers.

Think of this example as a blueprint. You’ll want to tailor it to your specific background and the requirements of the jobs you’re applying for. Don’t just copy and paste; make it your own!

Here’s a basic structure you might see:

- Contact Information: Name, phone number, email, LinkedIn profile.

- Summary/Objective: A brief overview of your qualifications and career goals.

- Experience: Detailed descriptions of your previous roles, highlighting accomplishments.

- Education: Degrees, certifications, and relevant coursework.

- Skills: A list of your technical and soft skills.

A well-structured resume is easy to read and quickly conveys your value to potential employers. Make sure your resume is clear, concise, and free of errors.

Now, let’s dive into a more detailed look at each section and how to make them shine. Remember to quantify your achievements whenever possible. Instead of saying "Improved financial reporting," say "Improved financial reporting accuracy by 15%."

Keep in mind that formatting matters. Use a clean, professional template that is easy to read. Avoid using too many colors or fonts, as this can be distracting. A simple, well-organized resume will always make a better impression.

For more insights, check out this guide on financial accounting resume tips for 2025.

2. Business Controller Resume Example

A Business Controller plays a vital role in bridging the gap between financial data and business strategy. They’re not just bean counters; they’re financial advisors to business units. Let’s look at what a strong resume might look like.

Example:

Jane Doe

(123) 456-7890 | jane.doe@email.com | LinkedIn Profile URL

Summary

Highly analytical and results-driven Business Controller with 7+ years of experience in driving financial performance and providing strategic insights. Proven ability to partner with business leaders to achieve revenue and profitability goals. Expertise in budgeting, forecasting, and financial analysis. Seeking a challenging role where I can leverage my skills to contribute to the success of a growing organization.

Experience

Business Controller | ABC Company | 2020 – Present

- Managed the budgeting and forecasting process for a $50M business unit.

- Developed and implemented financial models to support strategic decision-making.

- Partnered with sales and marketing teams to analyze sales performance and identify growth opportunities.

- Improved forecasting accuracy by 15% through the implementation of new forecasting techniques.

- Led the implementation of a new ERP system, resulting in improved efficiency and accuracy of financial reporting.

Senior Financial Analyst | XYZ Corporation | 2018 – 2020

- Conducted financial analysis to support investment decisions.

- Prepared monthly financial reports and presentations for senior management.

- Developed and maintained financial models to track key performance indicators.

- Identified and implemented cost-saving initiatives, resulting in $500K in annual savings.

Education

Master of Business Administration (MBA) | University of California, Berkeley | 2018

Bachelor of Science in Finance | University of Southern California | 2016

Skills

- Budgeting & Forecasting

- Financial Analysis

- Financial Modeling

- ERP Systems (SAP, Oracle)

- Data Analysis (Excel, SQL)

- Strategic Planning

- Business Partnering

- GAAP

A Business Controller resume needs to show you understand the business, not just the numbers. Highlight how you’ve used financial data to influence decisions and improve performance. Think about specific examples where your analysis led to a tangible business outcome.

Here are some key skills you might want to include on your controller resume:

- Management Accounting

- Accounting

- Forecasting

- Financial Reporting

- Business Control

- Process Management

- SAP Products

- Financial Analysis

- Management Consulting

3. Assistant Controller Resume Example

An Assistant Controller is there to back up the Corporate Controller. They help with accounting issues and make sure everything follows financial rules. Expect to handle financial reports, statements, and tax stuff.

Usually, you’ll need a bachelor’s degree in accounting, finance, or something similar. Some places want a master’s or a CPA too. But your past work experience really matters to recruiters. Here’s what a solid assistant controller resume looks like.

Assistant Controller resumes should reflect a strong foundation in both finance and management skills.

- Preparing financial statements

- Conducting internal audits

- Assisting in budget preparation

It’s important to show how you’ve grown in your career. The assistant controller role isn’t entry-level. You need experience to get it. Showing promotions proves you’re dedicated and trusted by employers. Also, make sure to highlight your competency with financial software.

4. Corporate Controller Resume Example

A Corporate Controller is responsible for a company’s financial health, making sure everything runs smoothly and accurately. Your resume needs to show you’re the right person to handle the job. It’s not just about crunching numbers; it’s about leading a team and making smart financial decisions. Let’s get into what makes a great Corporate Controller resume.

First off, think about what a Corporate Controller actually does. They oversee financial reporting, manage budgets, and ensure compliance. Your resume should reflect these responsibilities. It needs to demonstrate both technical skills and leadership abilities.

When crafting your resume, remember to highlight your experience with financial analysis, budget preparation, and accounting standards. Don’t just list your duties; show how you made a difference. Did you improve efficiency? Did you save the company money? Use numbers to back up your claims.

Here are some things to keep in mind:

- Quantify your achievements: Instead of saying "Managed budget," say "Managed a $5 million budget, reducing expenses by 15%."

- Showcase your leadership: Highlight instances where you led a team, mentored staff, or implemented new processes.

- Tailor your resume: Make sure your resume matches the specific requirements of the job you’re applying for. Read the job description carefully and highlight the skills and experiences that are most relevant.

A strong Corporate Controller resume demonstrates a blend of technical expertise and leadership skills. It’s about showing you can not only handle the numbers but also lead a team and make strategic financial decisions.

To make your resume stand out, consider including these elements:

- A strong summary: This is your chance to make a first impression. Highlight your key skills and experience in a concise and compelling way.

- Relevant experience: Focus on your accomplishments and how they benefited your previous employers.

- Key skills: List both hard skills (like accounting software and financial analysis) and soft skills (like communication and leadership).

Remember, your resume is your sales pitch. Make it clear, concise, and compelling. Show the hiring manager why you’re the best candidate for the job. Consider looking at relevant skills to include.

5. Header

The header is prime real estate on your financial controller resume. It’s the first thing recruiters see, so make it count! It needs to be clear, concise, and professional. Think of it as your personal branding statement.

Essential Information

Your header should include:

- Full Name: Use a professional font and make it slightly larger than the rest of the text.

- Professional Title: Clearly state "Financial Controller" or a closely related title.

- Phone Number: Ensure it’s a number where you can be easily reached.

- Email Address: Use a professional-sounding email, not your old high school one.

- LinkedIn Profile URL (Optional but Recommended): A great way for recruiters to learn more about your experience.

- Location: City and state are sufficient; no need for a full street address.

Formatting Tips

Keep it clean and easy to read. Use a professional font like Arial, Calibri, or Times New Roman. Avoid using colors or graphics that might distract from the information. A well-formatted header shows attention to detail, a key skill for a financial controller. Make sure your resume header is well-formatted.

Example of a Strong Header

Jane Doe

Financial Controller

(555) 123-4567 | jane.doe@email.com | linkedin.com/in/janedoe

New York, NY

Common Mistakes to Avoid

- Using a unprofessional email address (e.g., partygirl@email.com).

- Including irrelevant information (e.g., your age or marital status).

- Using a font that is difficult to read.

- Forgetting to include a phone number or email address.

A strong header makes a positive first impression and ensures recruiters can easily contact you. It’s a small detail that can make a big difference in your job search.

6. Summary

Your summary, also called a professional summary or career objective, is a short paragraph at the top of your resume. It’s your chance to quickly grab the hiring manager’s attention and show them why you’re the perfect fit. Think of it as your elevator pitch on paper. It should highlight your key skills, experience, and career goals, all tailored to the specific financial controller position you’re applying for. Let’s get into how to make it shine.

It’s important to make a strong first impression.

Here’s what to keep in mind when crafting your summary:

- Keep it concise: Aim for 3-4 sentences max. Hiring managers are busy, so get straight to the point.

- Highlight key skills: Mention your most relevant skills, such as financial reporting, budgeting, forecasting, and compliance.

- Quantify achievements: Use numbers to show the impact you’ve made in previous roles. For example, "Reduced operating costs by 15% through process improvements."

- Tailor to the job: Customize your summary for each position you apply for. Read the job description carefully and highlight the skills and experience that match the employer’s needs.

A well-written summary can significantly increase your chances of getting an interview. It’s your opportunity to showcase your value proposition and make a compelling case for why you’re the right candidate.

Think of it as a brief overview of your financial controller resume. It’s a chance to highlight your most impressive accomplishments and skills. A good summary can make a big difference in whether or not a hiring manager decides to read the rest of your resume. It’s worth spending the time to get it right. When you’re writing your summary, remember to focus on what you can do for the company, not just what you want out of the job. Show them how your skills and experience will help them achieve their goals. Tailor your summary to each job you apply for, highlighting the skills and experience that are most relevant to the specific position. This shows the hiring manager that you’ve taken the time to understand their needs and that you’re genuinely interested in the job. A strong summary can set you apart from other candidates and increase your chances of getting an interview. Make sure it’s well-written, error-free, and easy to read. A polished summary shows that you’re detail-oriented and professional, which are important qualities for a financial controller.

7. Experience

Your experience section is where you really show what you can do. It’s not just a list of jobs; it’s a showcase of your accomplishments and how you’ve made a difference. Let’s get into how to make this section shine.

What to do if you don’t have any experience

It’s totally okay if you’re light on direct experience. Lots of people start somewhere! The key is to highlight transferable skills and frame your experiences in a way that shows your potential. Candidates without much work history often use a functional-skill-based format, which puts the focus on your strengths rather than chronological work history.

- Transferable skills become the core of the resume.

- The objective includes career achievements and unique value.

- Focus on on-the job training and expertise that’d be useful for the role.

Making Your Experience Section Effective

The experience section isn’t just your work history; it’s your chance to prove what you’re capable of. It shows what you’re capable of achieving based on your past success, proves your skills with tangible achievements, and highlights the unique value of what it’s like to work with you. To make it as effective as possible:

- Start each bullet with a powerful, action verb.

- Follow up with your responsibilities.

- Show your workplace success.

The more details you can include that are relevant to the job and linked with your skill set, the more likely you are to catch recruiters’ attention. Scan the job advert for key skills and keywords to include.

Think about it this way: each bullet point is a mini-story about a problem you solved, a challenge you overcame, or a goal you achieved. Use numbers and data to quantify your impact whenever possible. This makes your accomplishments more concrete and impressive.

Example Bullet Points

Here are a few examples of how to write effective bullet points for your experience section:

- "Managed a $1B budget, ensuring financial stability and compliance with regulatory requirements."

- "Decreased month-end closing time by 30% through process improvements and automation."

- "Collaborated with IT to deploy a custom finance dashboard, providing real-time KPIs that supported strategic decision-making."

- "Coordinated with cross-functional teams to deliver a cost savings program that cut departmental expenses by 10% annually."

- "Participated in monthly variance reporting, learning statements and audits, gaining hands-on experience in industry-standard practices."

These examples show how to use action verbs, quantify results, and highlight your contributions to the company. Remember to tailor your bullet points to the specific requirements of the job you’re applying for. Showcasing significant accomplishments is key.

8. Education

Your education section is where you list your academic achievements. It’s pretty straightforward, but there are a few things to keep in mind to make it effective for a Financial Controller role.

Listing Your Degrees

Always list your degrees in reverse chronological order, meaning your most recent degree goes first. Include the full name of the degree, the university you attended, and the dates you attended. If you haven’t graduated yet, just list your expected graduation date.

For example:

- Master of Business Administration (MBA)

- University of Example, Exampleville, USA

- 2020 – 2022

- Bachelor of Science in Accounting

- State University, Stateville, USA

- 2016 – 2020

What to Include (and What to Leave Out)

Generally, you don’t need to include your high school diploma. The exception is if you’re early in your career and it’s your highest level of education. If you have relevant coursework that supports your application, especially if you lack direct experience, include a brief list. This is a good way to spotlight your relevant MBA degree.

Certifications

Certifications are super important for financial roles. List any relevant certifications you have, such as:

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Chartered Financial Analyst (CFA)

Include the name of the certification, the issuing organization, and the date you obtained it. If it expires, include the expiration date as well. Make sure to choose the most recent ones that match the job profile. This shows you have the relevant higher education and skills needed for the job.

If you’re still working towards a certification, you can list it as "In Progress" along with the expected completion date. This shows initiative and commitment to professional development.

9. Tips for Financial Controller Resumes

Crafting a standout financial controller resume requires more than just listing your qualifications. It’s about strategically presenting your skills and experience to capture the attention of hiring managers. Here are some tips to help you create a compelling resume.

Highlight Your Financial Reporting Expertise

Employers are actively seeking financial controllers who possess a strong grasp of financial reporting. Make sure to prominently feature your experience with financial statements, regulatory compliance, and internal controls. This shows you can handle the core responsibilities of the role. Think about including specific examples of reports you’ve prepared or audits you’ve managed. It’s all about demonstrating your expertise.

Quantify Your Achievements

Numbers speak louder than words. Instead of just saying you improved efficiency, show how much you improved it by. Did you reduce costs by 15%? Did you increase revenue by 20%? Use hard numbers to demonstrate the impact you’ve made in previous roles. This makes your accomplishments more tangible and impressive. For example:

- Reduced operating costs by 15% through process improvements.

- Increased revenue by 20% by implementing a new pricing strategy.

- Improved cash flow by 10% through better management of accounts receivable.

Tailor Your Resume to the Job Description

Don’t just send out the same generic resume for every job. Take the time to carefully read the job description and identify the key skills and qualifications the employer is looking for. Then, tailor your resume to highlight those specific skills and experiences. This shows the employer that you’re a good fit for the role and that you’ve taken the time to understand their needs. It’s a bit of extra work, but it can make a big difference.

Showcase Your Leadership and Management Skills

Financial controllers often lead teams and manage projects. Highlight your leadership and management skills by providing examples of how you’ve successfully led teams, managed budgets, and implemented new processes. Use action verbs like "led," "managed," and "implemented" to showcase your accomplishments. Companies want to know you can handle responsibility and lead a team effectively. Make sure your financial controller resume reflects this.

Keep It Concise and Easy to Read

Hiring managers are busy people, so they don’t have time to read a long, rambling resume. Keep your resume concise and easy to read by using bullet points, short paragraphs, and clear headings. Use a professional font and format, and proofread carefully for any errors. The goal is to make it easy for the hiring manager to quickly scan your resume and see that you’re a qualified candidate. Aim for one to two pages max. A well-organized resume shows attention to detail, a key trait for financial roles.

Remember, your resume is your first impression. Make it count by showcasing your skills, quantifying your achievements, and tailoring your resume to the job description. Good luck!

10. Skills and Keywords to Add

It’s time to think about the specific skills and keywords that will make your financial controller resume shine. Tailoring your resume to match the job description is super important. Let’s break down some key areas to focus on.

Hard Skills

These are the technical abilities you need to perform the job. Make sure to highlight the ones that are most relevant to the specific role you’re applying for. Here are a few examples:

- Financial Reporting: Creating and analyzing financial statements.

- Budgeting and Forecasting: Developing and managing budgets.

- GAAP (Generally Accepted Accounting Principles): Demonstrating a strong understanding of accounting standards.

- Internal Controls: Implementing and maintaining effective internal controls.

- Financial Analysis: Using data to make informed business decisions.

Soft Skills

Soft skills are just as important as hard skills. These are the personal attributes that make you a good fit for the team and the company. Here are some to consider:

- Communication: Clearly and effectively conveying information.

- Leadership: Guiding and motivating a team.

- Problem-Solving: Identifying and resolving complex issues.

- Analytical Skills: Examining data and drawing conclusions.

- Time Management: Prioritizing tasks and meeting deadlines.

Keywords

Keywords are the specific words and phrases that employers and applicant tracking systems (ATS) use to find qualified candidates. Sprinkling these throughout your resume can significantly increase your chances of getting noticed. Here’s how to find them:

- Review Job Descriptions: Carefully read the job descriptions for the roles you’re interested in. Note the skills, qualifications, and experience that are mentioned.

- Research Industry Trends: Stay up-to-date on the latest trends and technologies in the finance industry. This will help you identify relevant keywords to include.

- Use LinkedIn: Check out the profiles of other financial controllers to see what skills and keywords they’re using. This can give you some ideas for your own resume.

Remember to use keywords naturally and avoid keyword stuffing. The goal is to show that you have the skills and experience the employer is looking for, not to trick the ATS.

For example, if a job description mentions experience with technical skills, make sure to include those specific technologies on your resume. Similarly, if they’re looking for someone with strong analytical skills, highlight your experience in analyzing financial data and making recommendations. Quantifying your achievements with metrics, such as increasing revenue or improving customer satisfaction, will also help you stand out to recruiters. If you have any finance-related extra-curricular activities or certifications, such as becoming a certified cryptocurrency expert, be sure to include them to enrich your resume and show your passion for the field. Remember to use metrics and numbers to show your workload capabilities, highlighting how many audits, performance reviews, business policies, etc. you have completed. This will prove to recruiters that your output will be worth your salary. Also, consider adding some finance buzzwords to your resume to make it more appealing to recruiters. Finally, remember to tailor your resume to stand out in today’s competitive job market, just like a successful bank manager resume would.

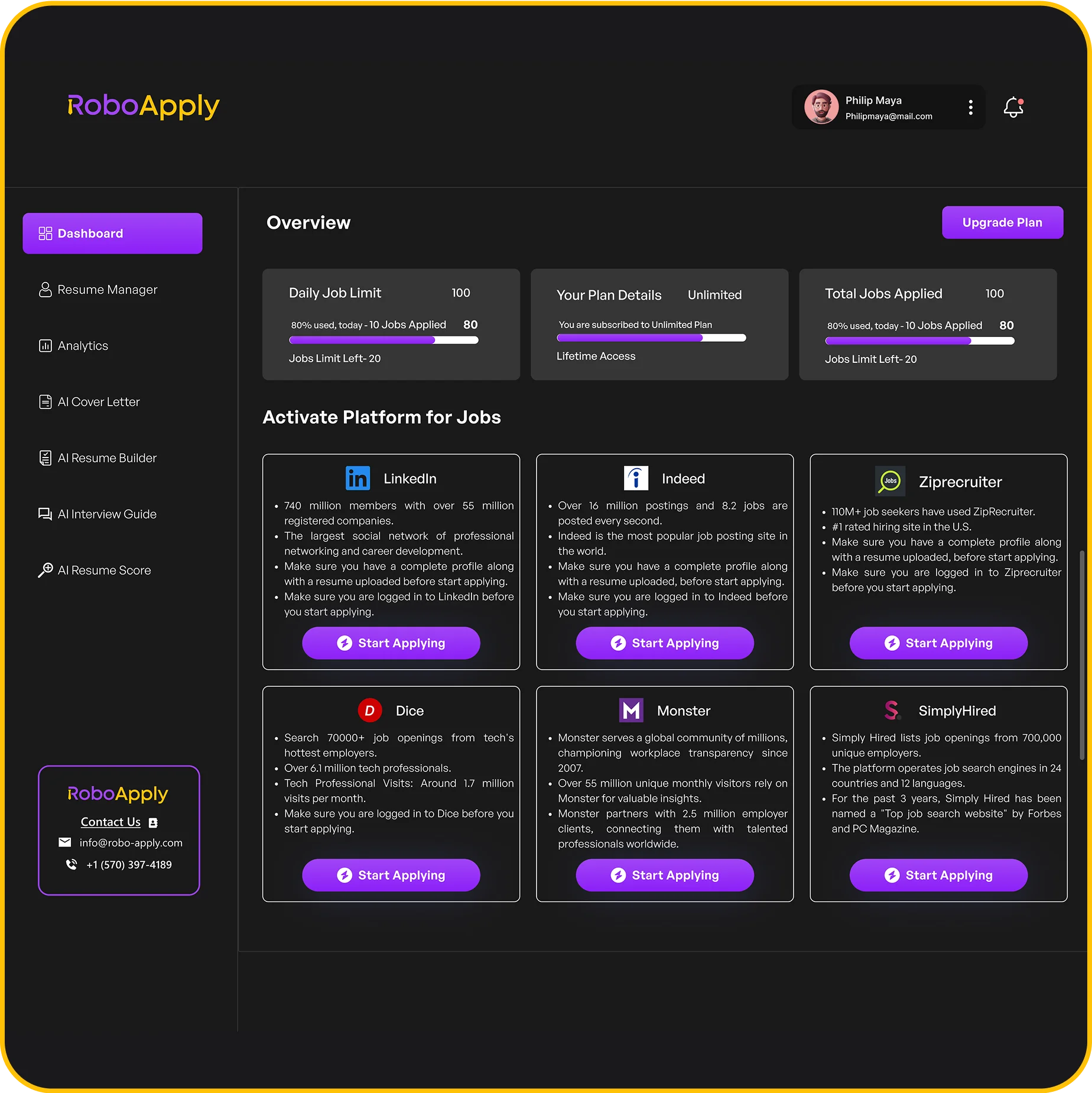

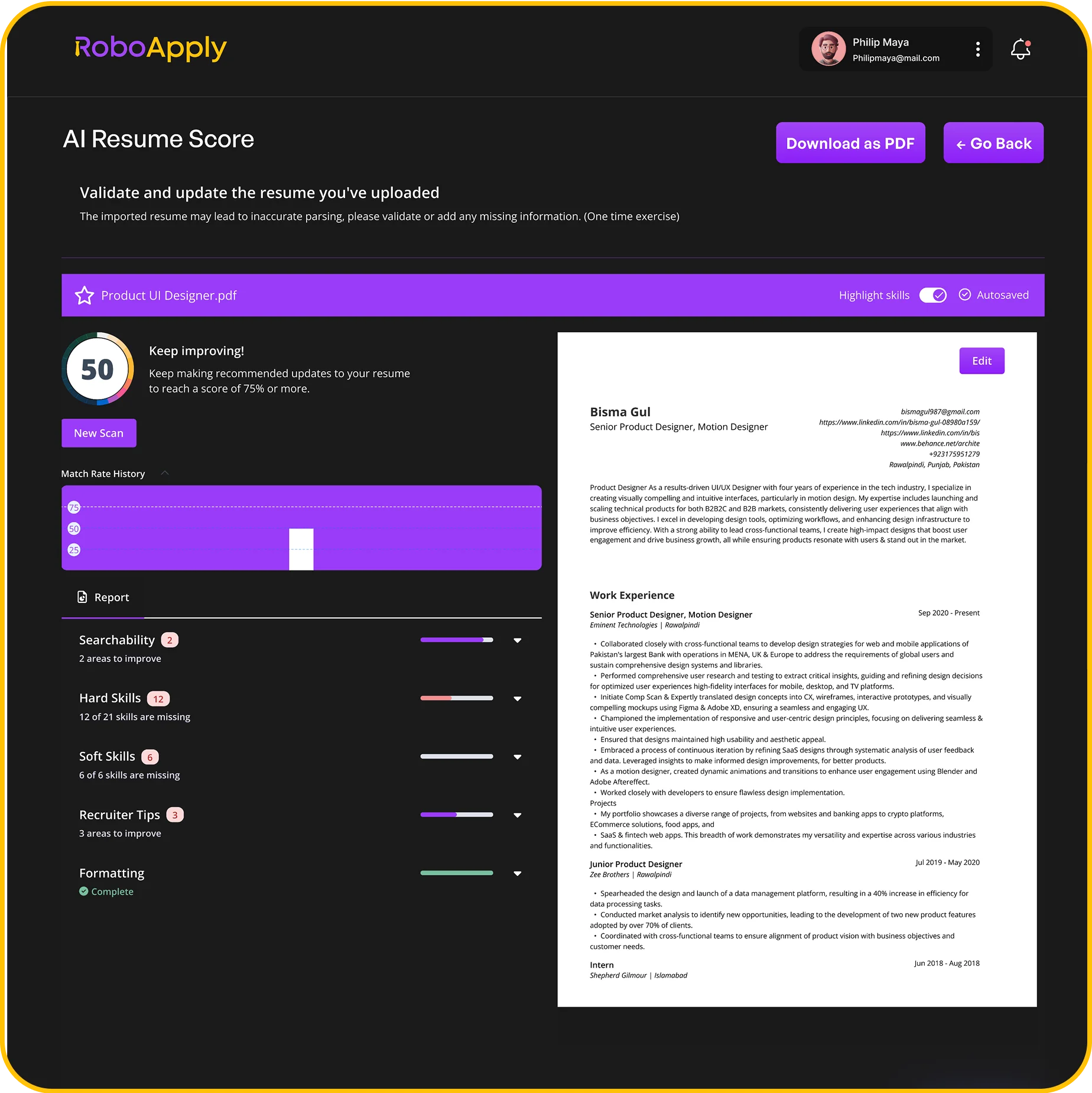

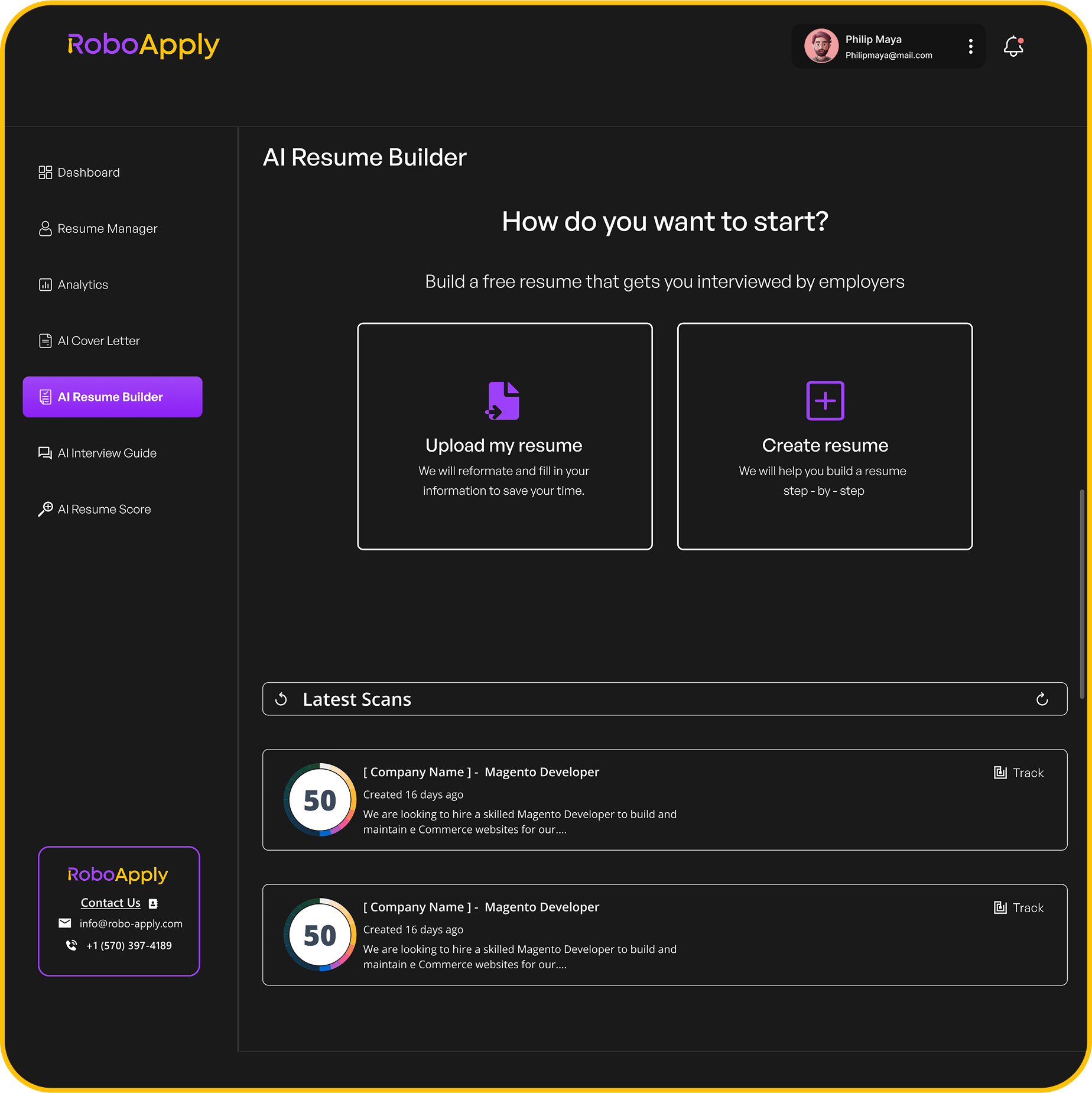

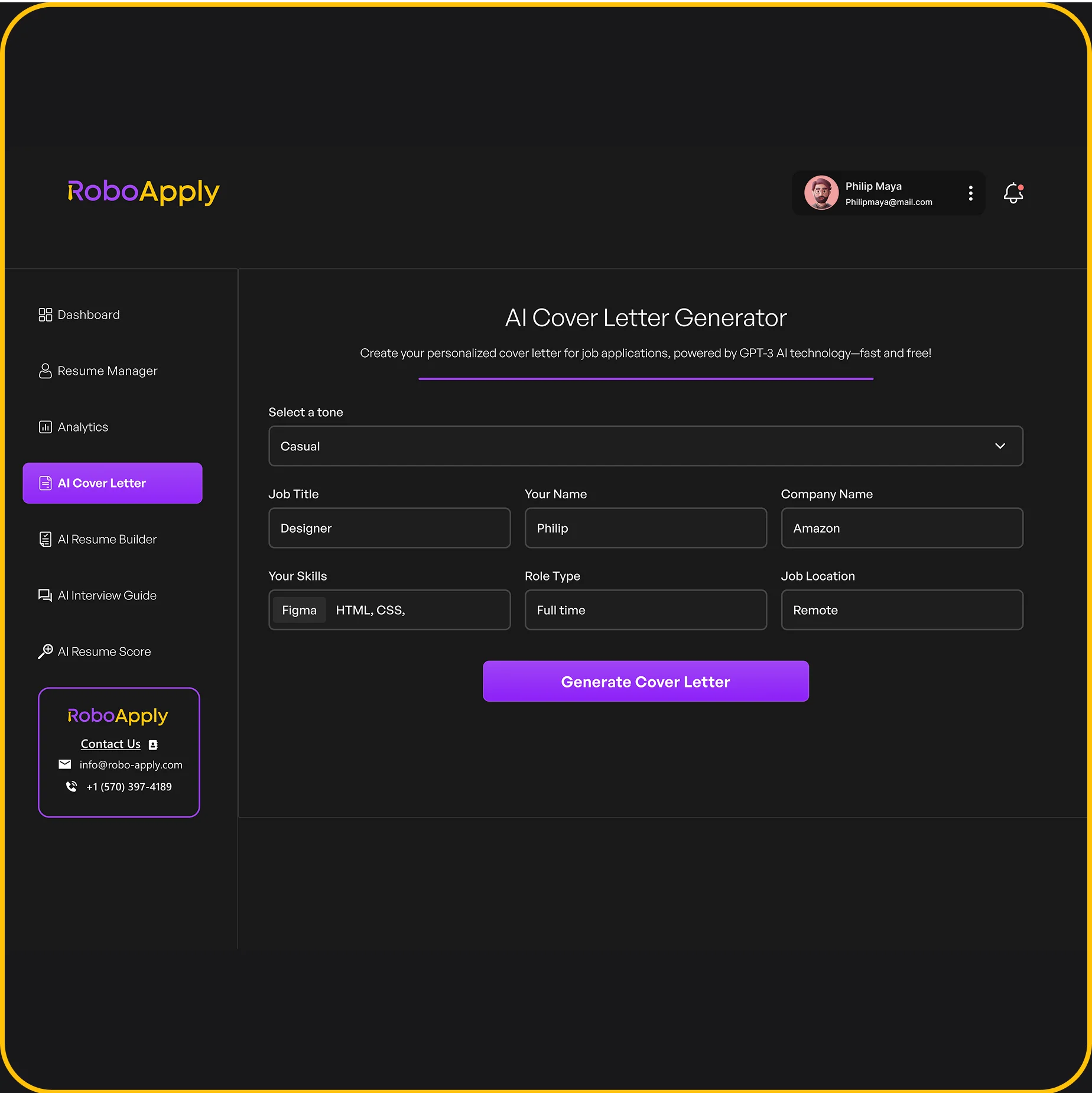

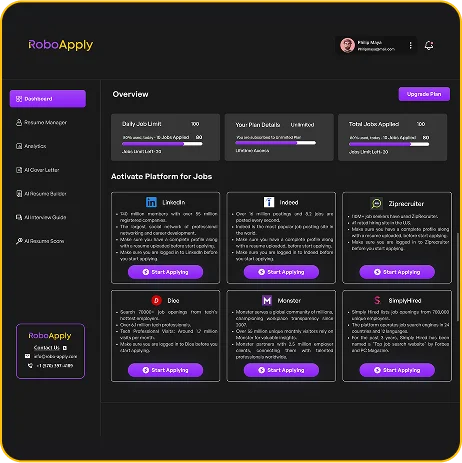

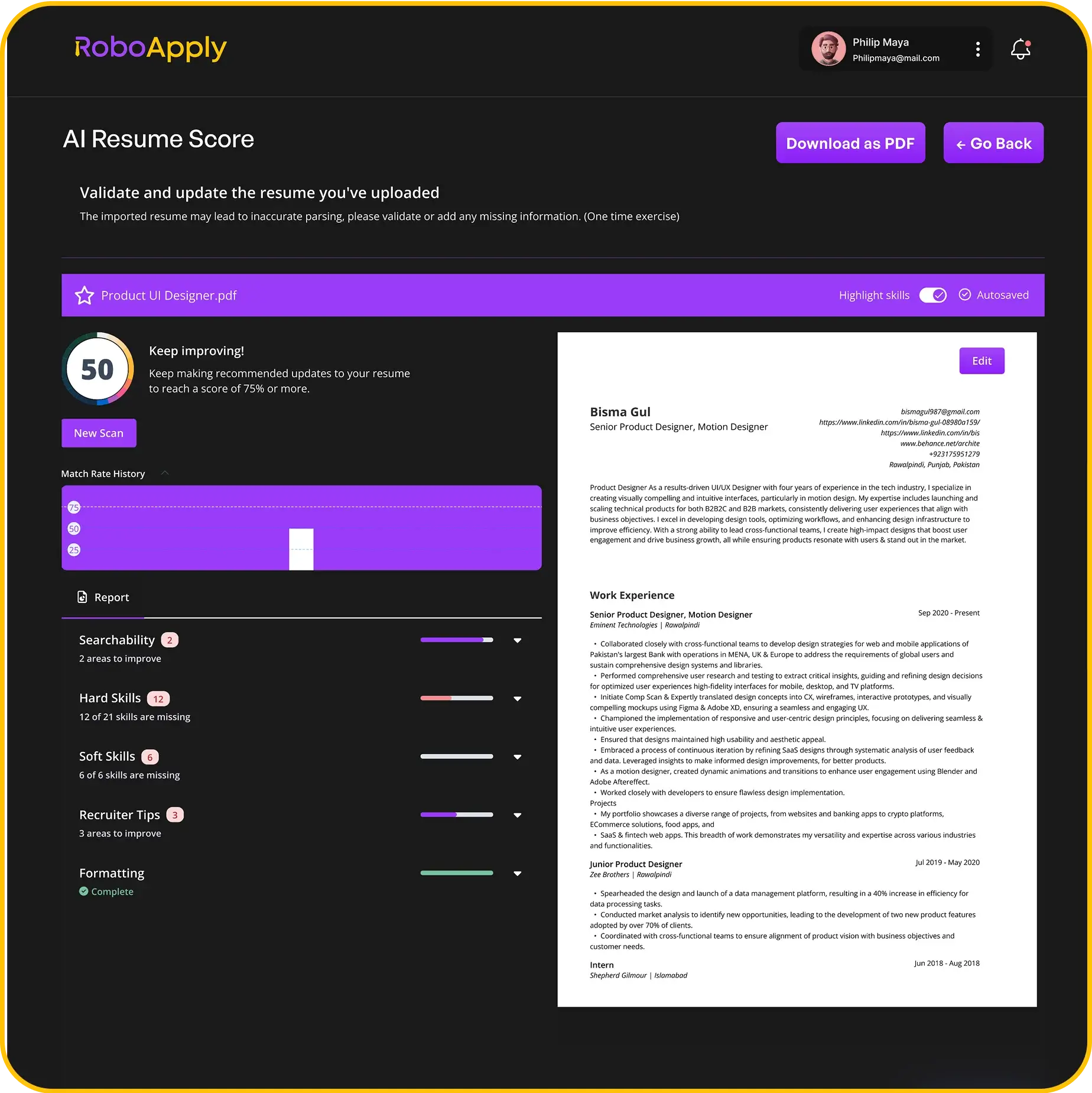

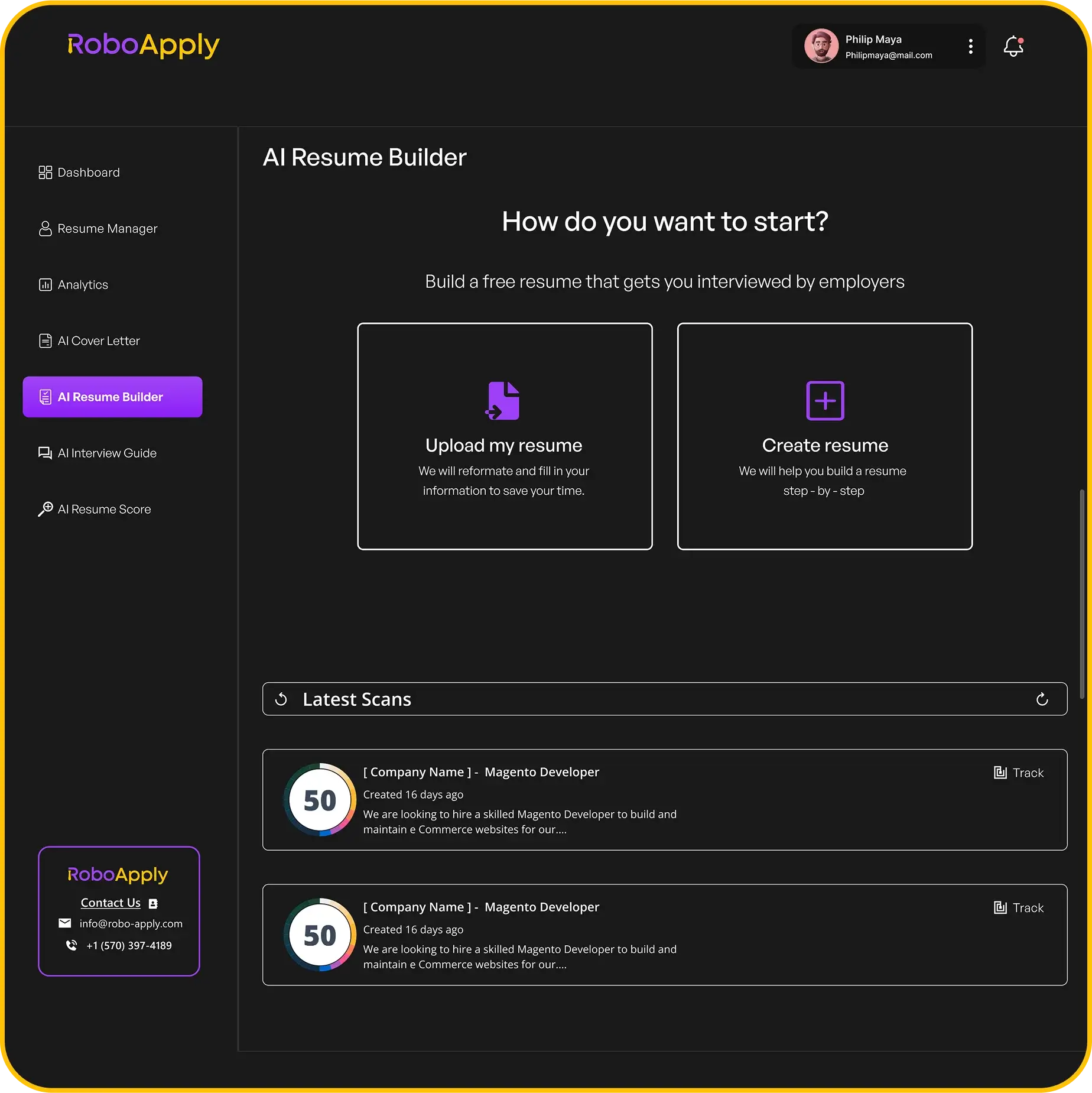

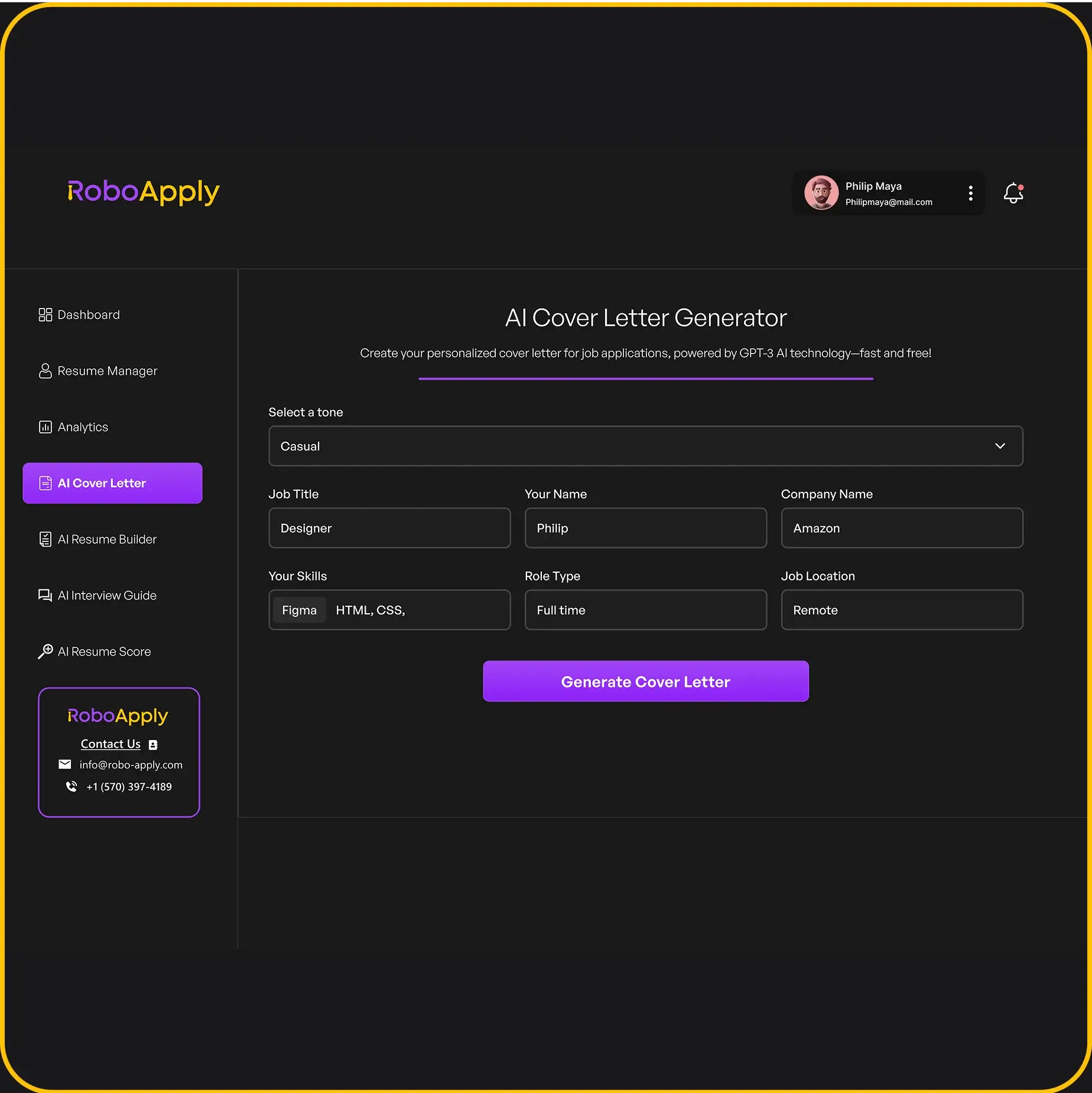

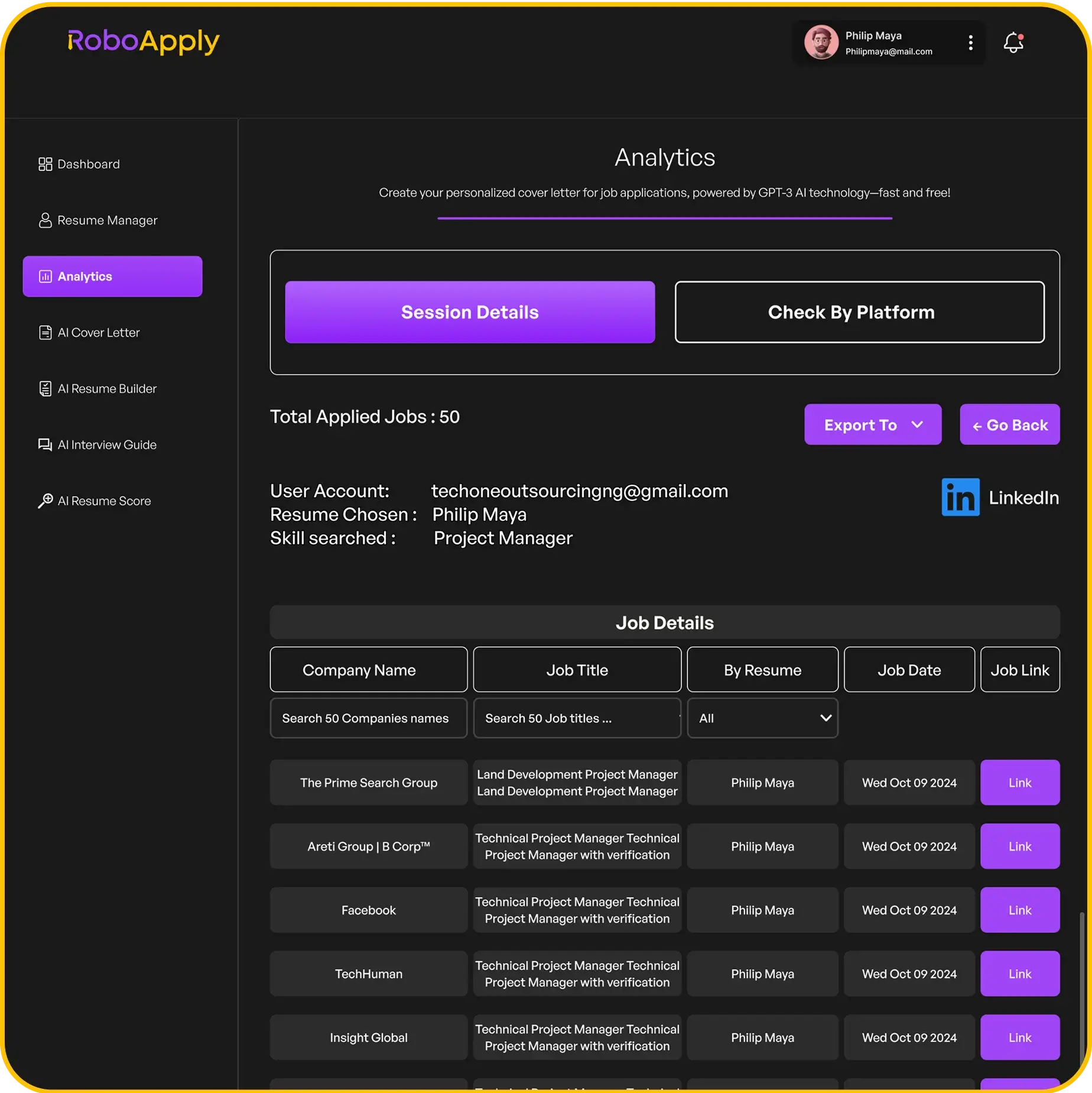

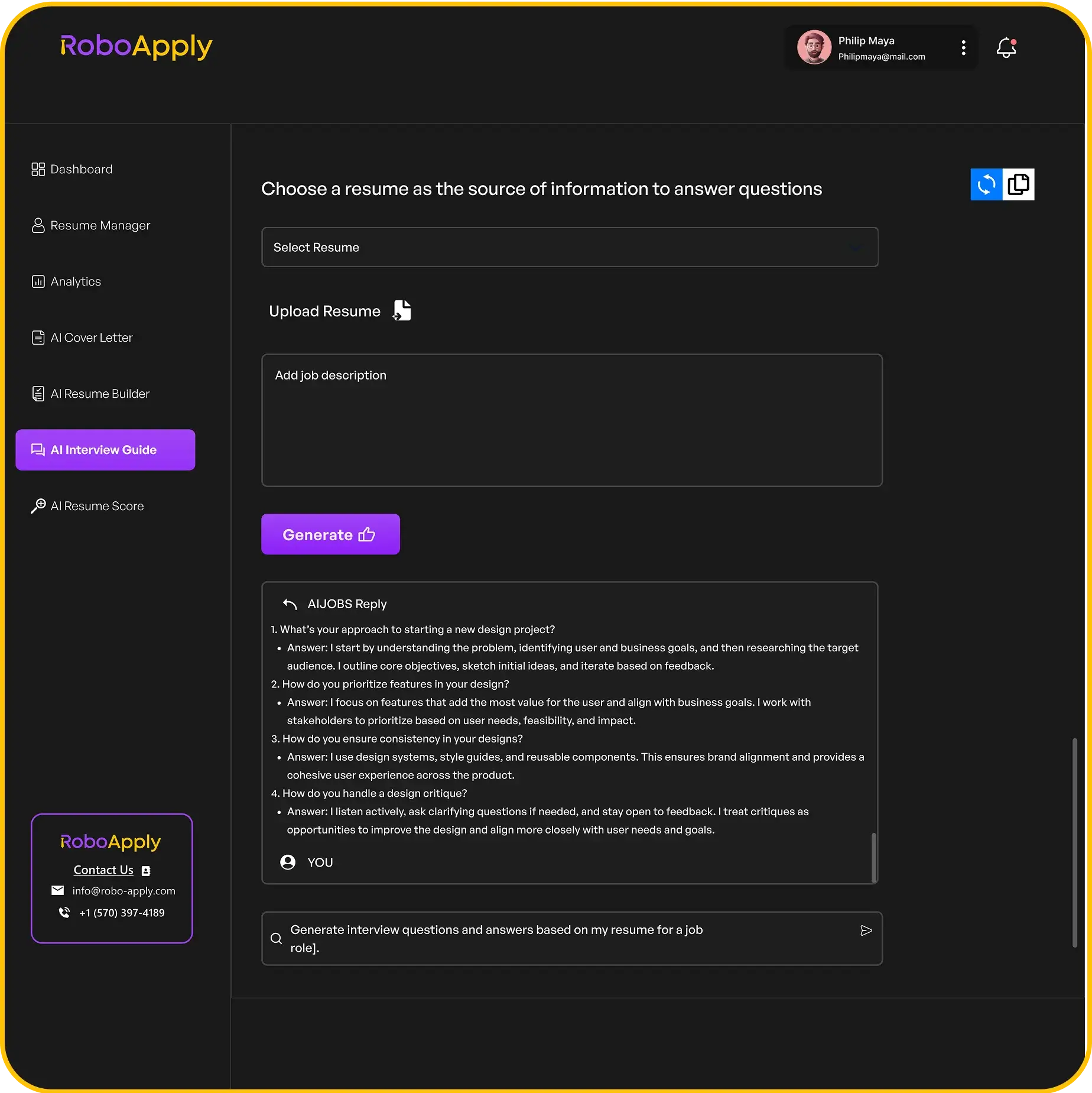

To really stand out, you need to know what skills and keywords to put on your resume. Our special AI tool can help you figure this out and even write your resume for you. Want to make your job search easier? Check out how RoboApply can help you get hired faster!

Wrapping Things Up

So, there you have it. Putting together a good resume for a Financial Controller job might seem like a lot, but it’s really about showing what you can do. Think about your past work and pick out the things that really show off your skills. Make sure your resume is easy to read and gets straight to the point. A clear, well-made resume can help you get noticed by the right people. Just focus on what makes you a good fit for the job, and you’ll be on your way.

Frequently Asked Questions

What does a financial controller do?

A financial controller helps a company manage its money. They make sure all the money coming in and going out is tracked correctly. They also help plan how the company will spend its money in the future and make sure everything follows the rules.

What education and experience do I need to be a financial controller?

To become a financial controller, you usually need a college degree in accounting or finance. Many people also get a special certification called CPA, which shows they are experts in accounting. You also need to work for several years in jobs related to finance or accounting to gain experience.

Is being a financial controller a good career?

Yes, being a financial controller is a good job. It pays well, and you get to be a very important part of how a company works. You help make big decisions about money, which can be very rewarding.

How can I make my financial controller resume stand out?

When you write your resume, make sure to show how you’ve helped companies save money, make more money, or make their money processes better. Use numbers to prove your successes, like “helped reduce costs by 15%.” Also, list any special computer programs you know that are used in finance.

What’s the difference between a financial controller and a CFO?

The main difference is that a controller usually handles the day-to-day money operations and reporting, while a CFO (Chief Financial Officer) looks at the bigger picture and long-term money plans for the whole company. In smaller companies, one person might do both jobs.

What skills are most important for a financial controller?

A financial controller needs to be good with numbers, pay close attention to details, and understand how businesses work. They also need to be good at leading people and talking clearly about money matters. Knowing how to use different financial software is also key.

What should I include in my financial controller resume?

You should include your contact information, a short summary of your career, your work history with details about what you did, your education, and a list of your skills. It’s also good to add any special awards or certifications you have.

Where can I find good examples of financial controller resumes?

You can find many examples online, including on job sites and career advice blogs. RoboApply offers great tools to help you build a strong resume, and you can also look at sample resumes from people who already have the job you want.